Bitcoin’s risk level eases, but a short-term breakout remains uncertain – Why?

- Speculators’ risk appetite for BTC improved with bids from long-term holders.

- But bulls could only confirm market edge if they reclaimed $91.5K.

Speculative interest in Bitcoin [BTC] recovered slightly, pushing it to $88K, but a strong, sustained recovery path wasn’t clear yet, at least at press time, per analysts.

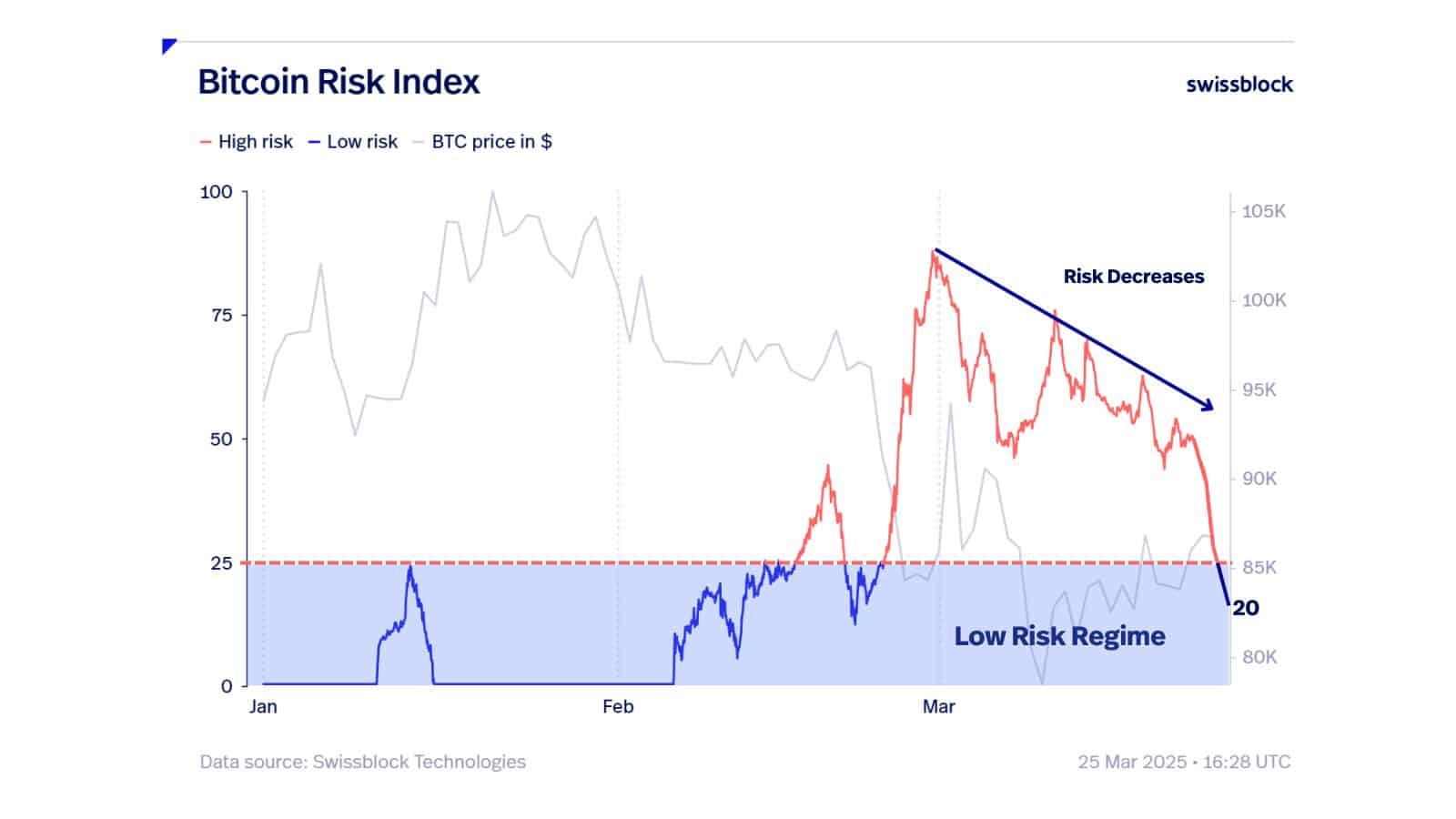

According to Swissblock, an analytics firm by Glassnode founders, risk aversion eased slightly but didn’t guarantee a breakout.

“Market risk easing…Now below the 25 threshold, signaling a shift into a low-risk regime. A key step in the bottoming process. Reduces the likelihood of a sharp drop but doesn’t guarantee a breakout.”

Bitcoin breakout prospects

The outlook was confirmed by the Crypto Fear and Greed Index, which increased from an extreme fear of 10 to a neutral level of 47 at the time of writing.

But the firm added that the low-risk regime could attract new demand and liquidity needed for a potential breakout.

In addition, Swissblock stated that the breakout could only be confirmed if BTC reclaimed $90K.

Renowned BTC trader and analyst Cryp Nuevo echoed a similar sentiment. He said,

“Very good reaction from the 1W50EMA, our buy zone and likely bottom of this correction. We’ll be out of the woods once/if we can flip $91.5k which was the previous range lows.”

Despite the caution, investors appeared optimistic, as illustrated by the $420M BTC withdrawn from exchanges in the past week. In fact, on the 24th of March, $220M BTC was moved from exchanges, reiterating an accumulation spree.

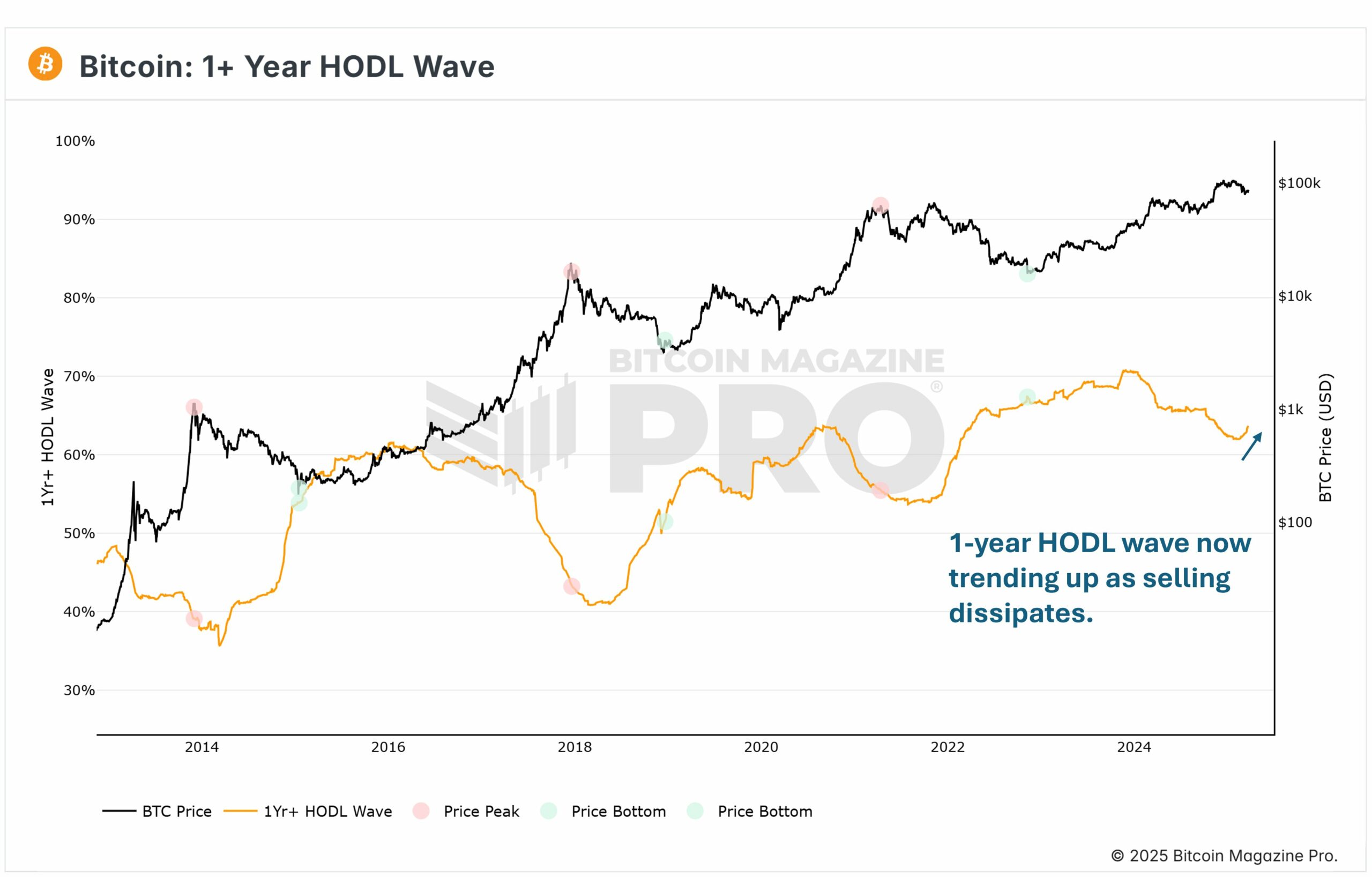

Renewed interest from long-term holders further corroborated the quiet demand, as illustrated by 1-year HODL waves. After selling during the ‘Trump pump,’ analyst Philip Swift noted they were bidding again.

“Long-term BTC holders have stopped selling their BTC around $100k. +1 Year HODL Wave is now trending back up. Expect this to trend down again only once we are comfortably above $100k.”

Per the chart, the +1 year HODL cohort typically bids during market fears and dumps and then sells during price rallies.

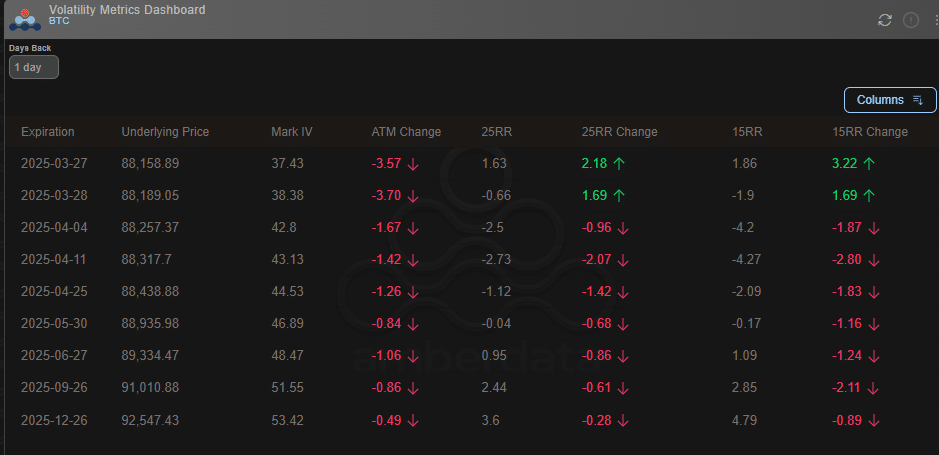

However, the Options market appeared somewhat cautious, as put options traded at a slight premium (there was more demand for downside risk protections).

This was illustrated by 25RR (25-delta risk reversal) for the 28th of March, which has an expiry at -0.66.

Additionally, the early April expiry had a 25RR of -2.5 and -2.73, further reinforcing traders’ caution in the first half of next month.