Bitcoin: Are BTC miners holding for a bigger price jump?

- Miners’ stable reserves and strong support suggested that Bitcoin could maintain upward momentum.

- Whale and institutional accumulation, including BlackRock, supported bullish sentiment for Bitcoin.

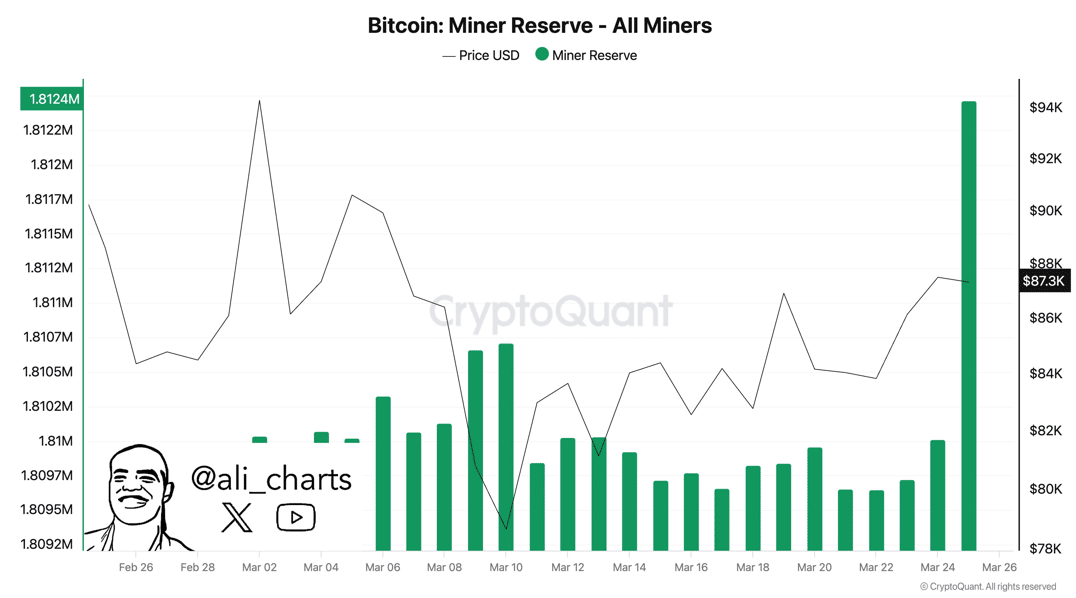

Bitcoin [BTC]’s Miner Reserve has remained stable, with no significant selling activity recorded over the past 24 hours. This indicates that miners are holding onto their Bitcoin, signaling confidence in future price movements.

The stability in miner behavior could suggest that miners are waiting for favorable market conditions to sell at higher prices.

As a result, this steady behavior in the miner reserve is a key indicator to watch for potential shifts in market dynamics.

How does Bitcoin’s price action look?

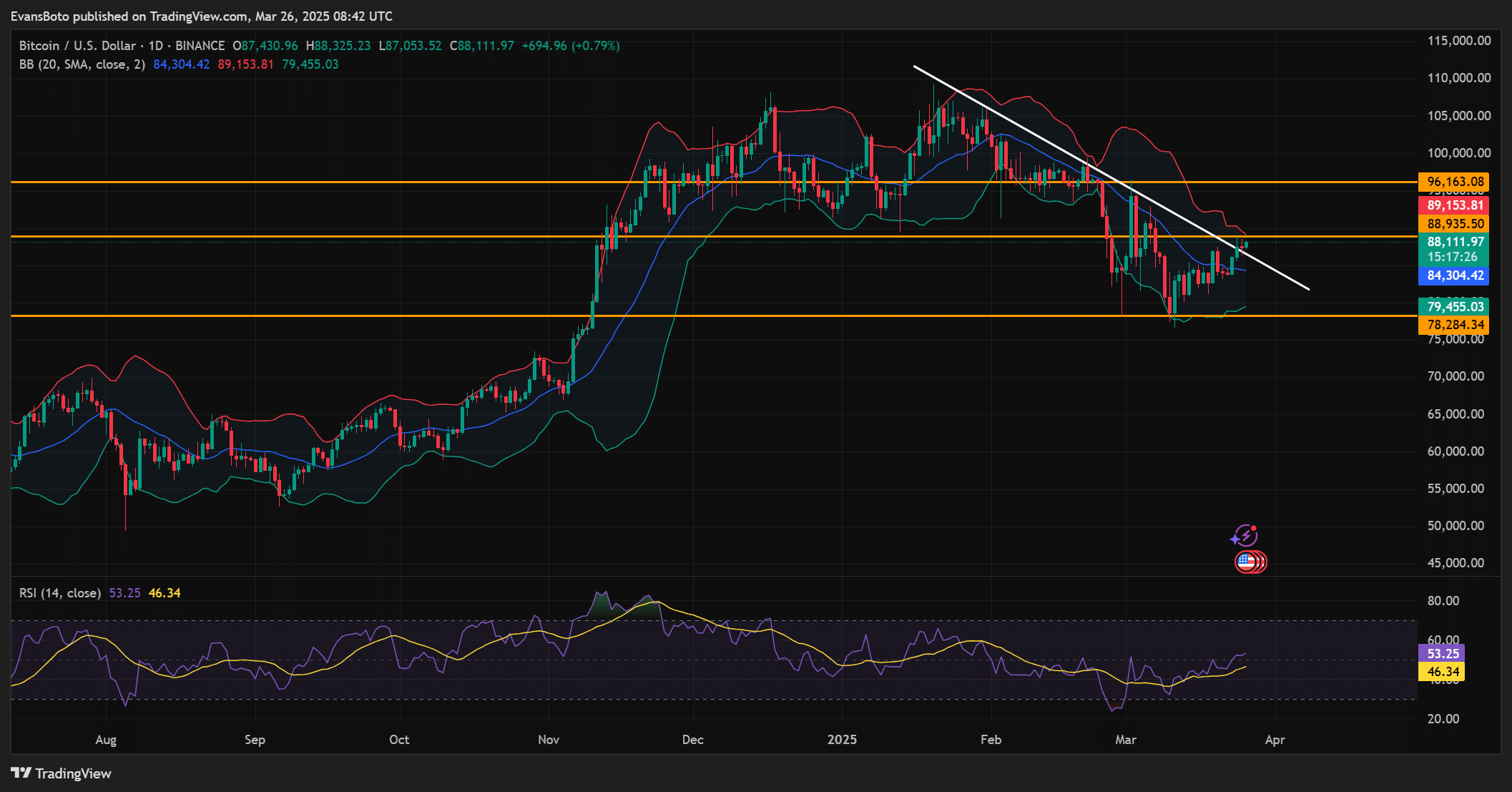

At press time, Bitcoin was trading at $88,020.88, up 1.53% over the past 24 hours.

BTC has recently broken out of a descending trendline and was bouncing off the demand zone. This suggests strong buying interest around these price levels, which could help push Bitcoin higher.

The Bollinger Bands indicated that BTC was nearing the lower range of its bands, suggesting that consolidation is in play or a breakout might be imminent.

Additionally, the RSI reading of 53.25 showed neutral market sentiment, signaling no overbought or oversold conditions at the moment.

What does BTC’s In/Out of the Money distribution tell us?

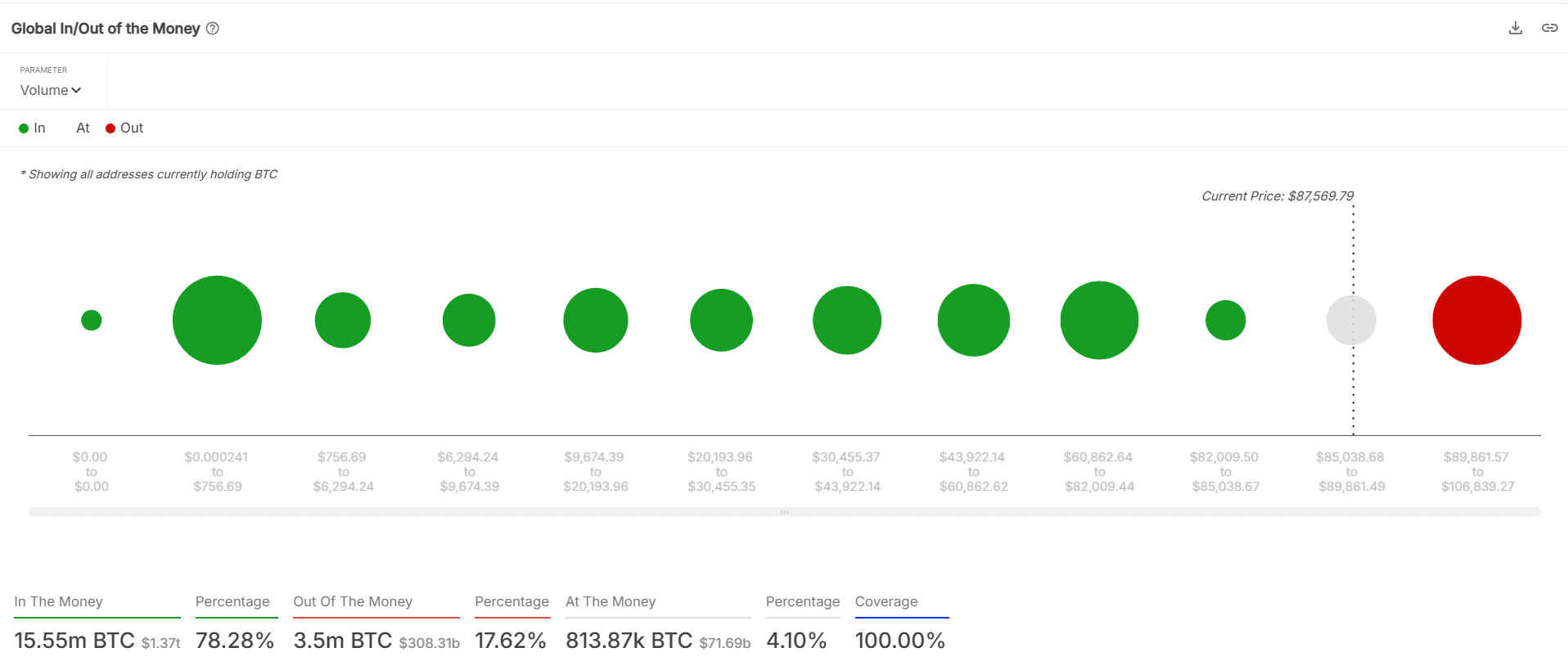

Looking at Bitcoin’s In/Out of the Money chart, the majority of addresses holding BTC are in profit, with 78.28% of addresses “in the money.”

This distribution is important because it signals strong support levels beneath the current price.

Furthermore, it suggests that the market sentiment is generally bullish, as most holders are in profit. The absence of significant losses in BTC holdings could be a sign that the price has enough upward momentum to avoid a significant pullback.

Is Bitcoin’s NUPL proposing a positive trend?

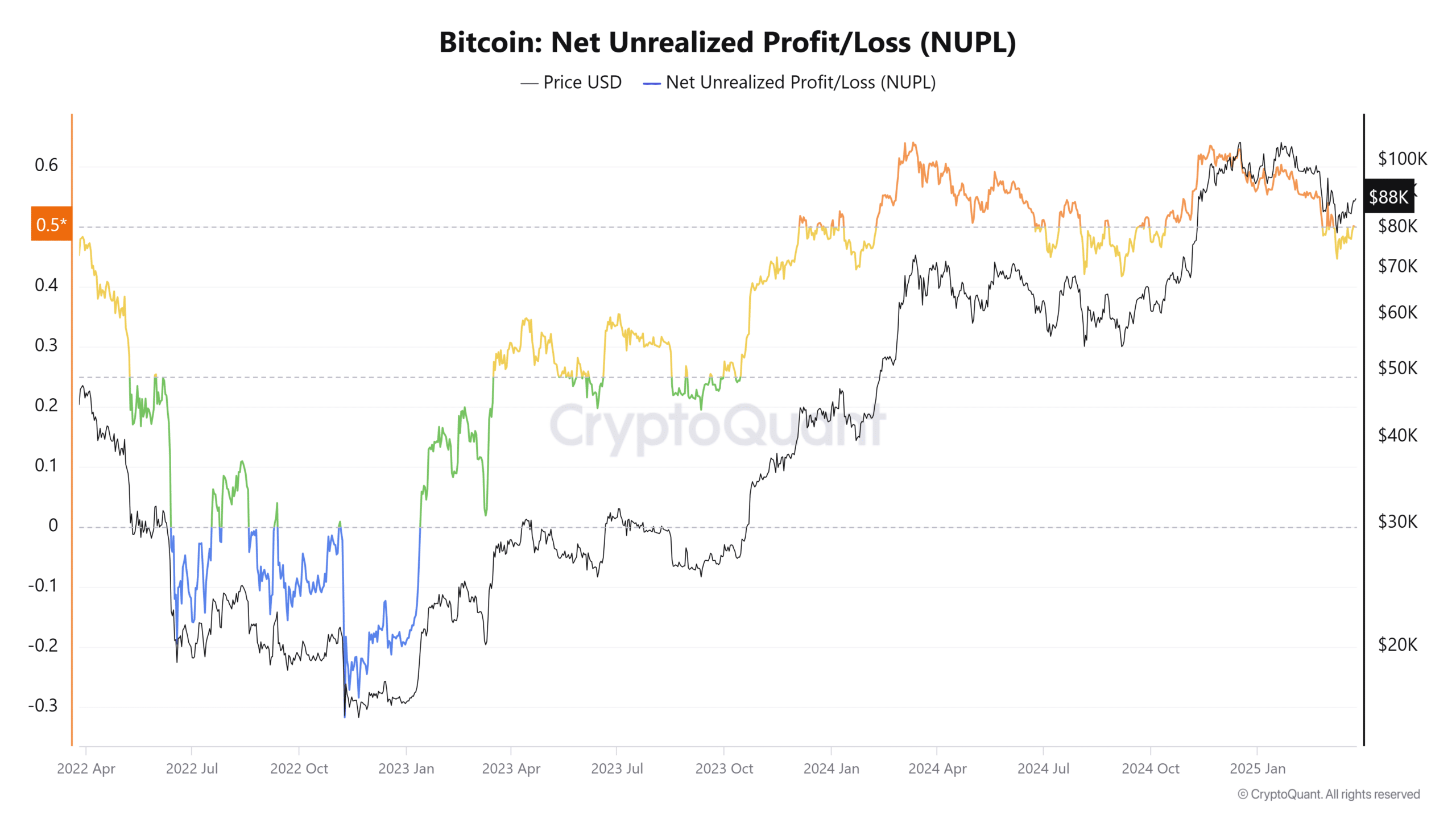

At the time of writing, Bitcoin’s Net Unrealized Profit/Loss (NUPL) stood at 0.501, showing that the market is in a profit zone.

A positive NUPL reflects strong market sentiment, with most Bitcoin holders enjoying unrealized gains.

How are whale and institutional activity influencing BTC’s market?

Bitcoin’s whale activity has been noteworthy, highlighted by the recent transfer of 2,760 BTC. Institutional investors, such as BlackRock, are also accumulating substantial amounts of Bitcoin.

Earlier this year, BlackRock purchased $42 million worth of BTC, reinforcing the prevailing bullish sentiment. Combined with whale movements, this institutional activity indicates that key players are preparing for potential future price surges.

What next for BTC

With stable miner reserves, a positive NUPL, and a breakout from a descending trendline, Bitcoin appears positioned for an upward move.

Institutional accumulation, including BlackRock’s $42 million Bitcoin purchase, alongside notable whale activity, adds fuel to this potential rally.

The coming days will be pivotal in determining whether BTC can sustain its momentum and solidify a stronger bullish trend.