SHIB ETF proposal sparks breakout hopes – Will it ignite a massive rally?

- Unlike Dogecoin ETF, no issuer has applied for a SHIB ETF so far

- Sell-offs on exchanges were low as holders bought the dip in Q1

One of Shiba Inu’s [SHIB] ecosystem executives, Lucie, is in the news today after she made an ETF pitch for the memecoin. Needless to say, this has sparked buzz around a potential price breakout. According to her, SHIB is accessible across several exchanges and isn’t ‘just a meme.’

“Is SHIB good for an ETF? Yes. Will boomers invest in a “doggy coin”? Also yes. Because SHIB isn’t just a meme—it’s decentralized, community-driven, and built to last.”

Will SHIB follow DOGE?

Here, it’s worth noting that apart from Dogecoin [DOGE], no issuer has filed for a spot memecoin ETF with the SEC, at the time of writing. Even so, the markets have high hopes, with there being a 72% chance of approval by the end of 2025 on Polymarket.

As the top pioneers in the memecoin space, it remains to be seen whether a SHIB ETF will follow DOGE ETF.

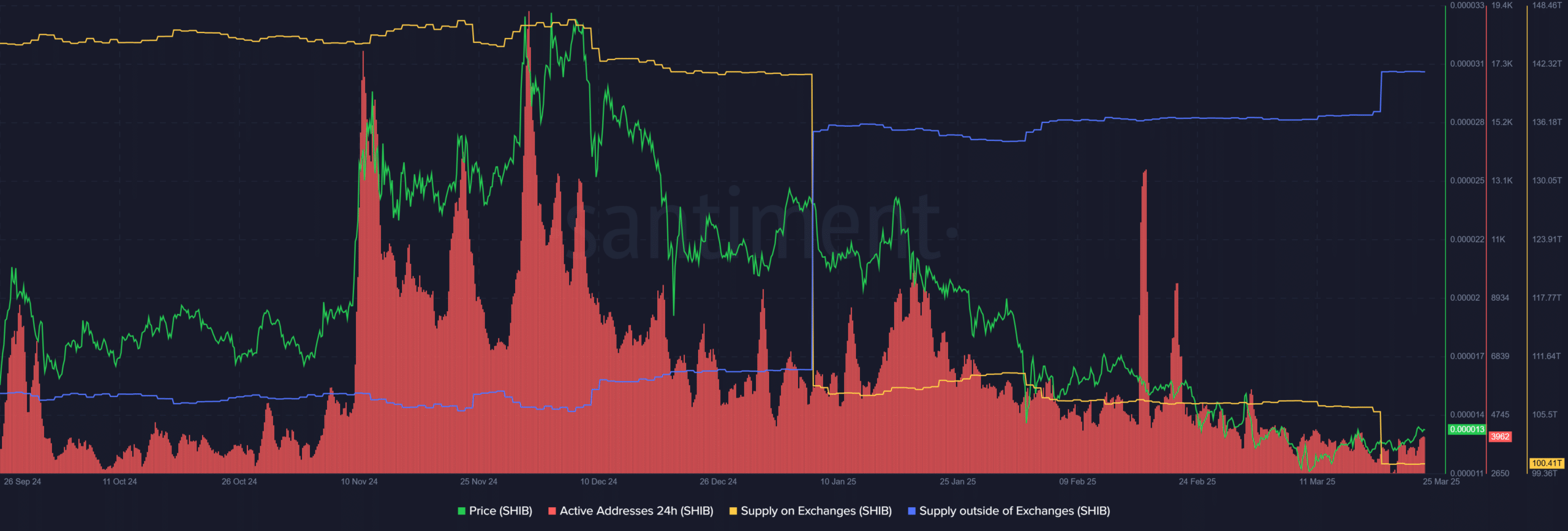

That being said, SHIB may be well primed for a breakout, given low selling pressure and a months-long accumulation spree. The only thing needed is the right catalyst. Notably, sell-offs on exchanges dipped to record lows, as illustrated by the supply on exchanges (yellow line).

Similarly, over 50 trillion SHIB have been moved from exchanges (accumulation) between December and March. Per supply outside exchanges (blue), the figure increased from 855 trillion SHIB to 901 trillion SHIB. Simply put, holders bought the Q1 dip and may be expecting a future rally.

However, network activity declined to quarterly lows of around 4000, compared to nearly 20k seen in December. That hinted at 5x decline in user interest.

A strong recovery could be at risk if user interest remains low in the short term.

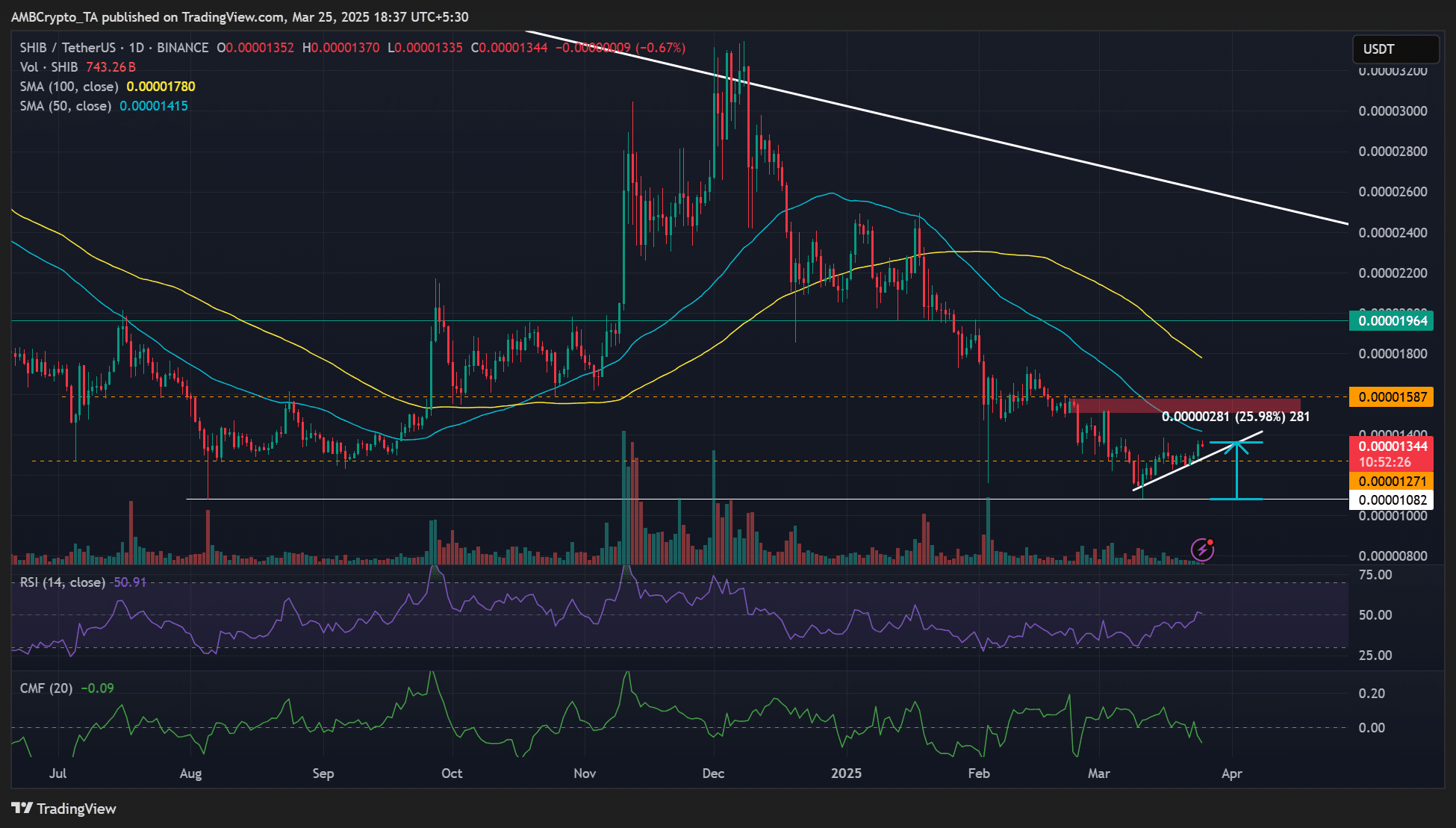

On the price chart, however, SHIB was up 25% from its March 2025 lows at press time. This also coincided with its August 2024 lows.

Right now, SHIB is stuck in a Q3 price range of $0.000012 and $0.000020. Gains of 47% could be feasible if recovery were extended to $0.000020. However, the hurdle of $0.000016 (red zone) has to be cleared first.