How Strategy outperformed Bitcoin by 3.3X with 2,115% share gains

- Strategy’s BTC holding crossed 500K and hit 2.4% of the total supply.

- The firm had $15B left for debt issuance and overall $39B capital to be raised per its 21/21 plan.

Strategy (formerly MicroStrategy) became the first public company to cross 500K Bitcoin [BTC] holdings after the latest purchase.

On the 24th of March, Michael Saylor, founder of Strategy, stated that the firm acquired an extra 6,911 BTC worth $584 million.

The firm’s total holdings jumped to 506,137 BTC worth $43.9B, translating to 2.4% of the total BTC supply (21M coins).

To put this in perspective, 492,750 BTC would be mined between now and March 25, 2028, just before the next halving. Simply put, Strategy held more BTC than would ever be mined in the next three years.

MSTR as a Bitcoin beta

Since Strategy’s aggressive BTC approach in 2020, its share, MSTR, has been the largest beneficiary.

Over the past five years, MSTR gained 2,115% while BTC rallied 638%. It outperformed the world’s largest cryptocurrency by 3.3X.

On a month-to-date basis, MSTR was up nearly 25%, while BTC bounced about 1%. The outperformance was very clear, even on a YTD (year-to-date) timeframe.

MSTR was up 12% in 2025, while BTC was down 8%, reinforcing the stock as the ultimate BTC proxy play.

That said, the latest purchase was financed by a recent stock sale (both MSTR and STRK), SEC filing showed.

“The bitcoin purchases (6,911 BTC) were made using proceeds from the Common ATM and the STRK ATM.”

In short, the recent preferred stock sale (STRF) was yet to be deployed. BTC analyst James Van Straten noted that the firm could acquire an extra 7K BTC in the next few days.

For the unfamiliar, this was part of the firm’s 21/21 plan to raise $42B of capital through stock issuance and debt financing for BTC buys.

According to analyst Ragnar, the firm had $15B worth of debt issuance remaining under the plan, with an overall $39B capital left to be raised.

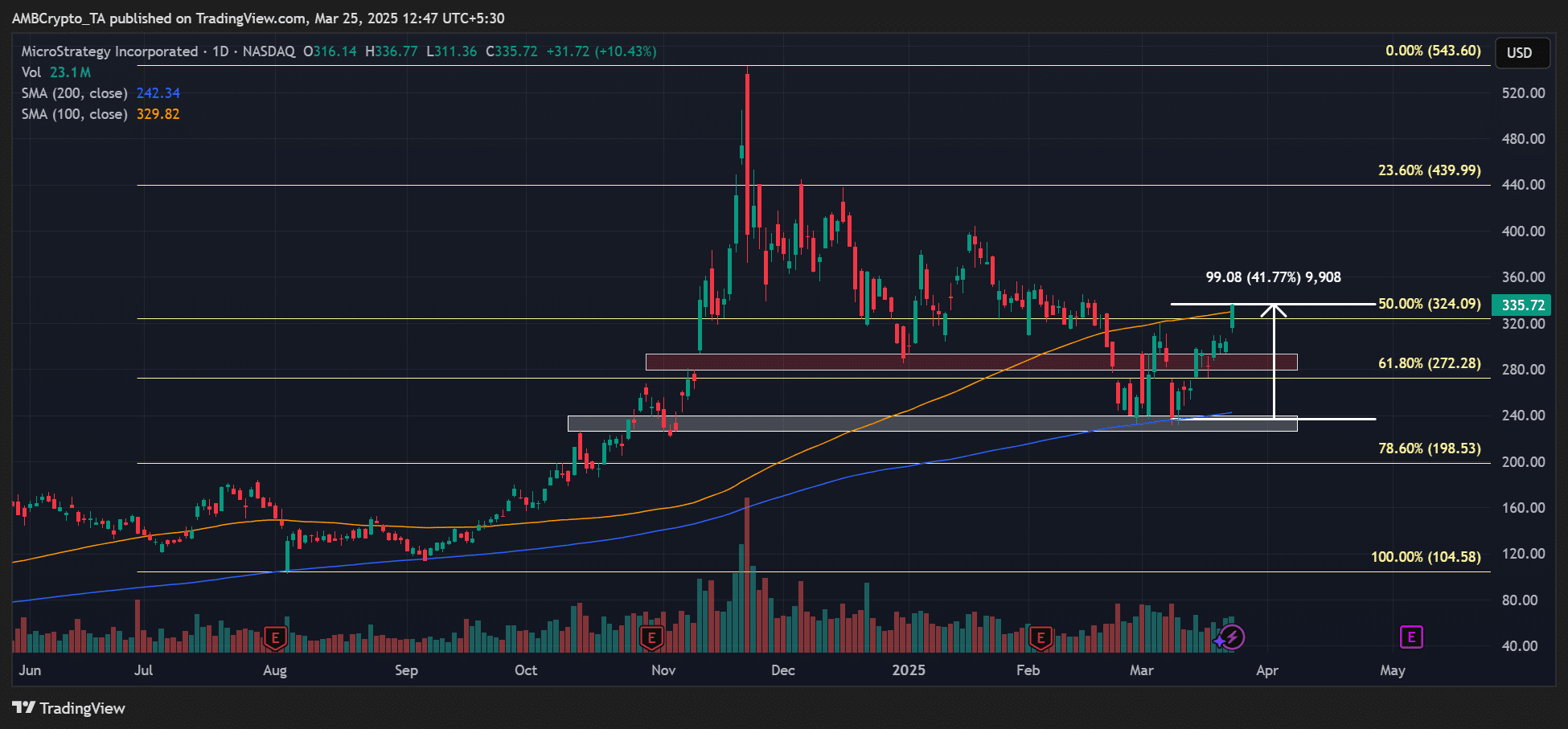

On the price chart, MSTR oscillated between 200DMA (Daily Moving Average) and 100DMA.

The 41% rally seen in the past two weeks tapped the upper range of 100DMA (orange). Whether a breakout would happen remained to be seen.