Stablecoins at all-time highs – What this signals for crypto’s future

- Stablecoin market cap hits all-time highs, signaling liquidity build-up and potential for a market rally.

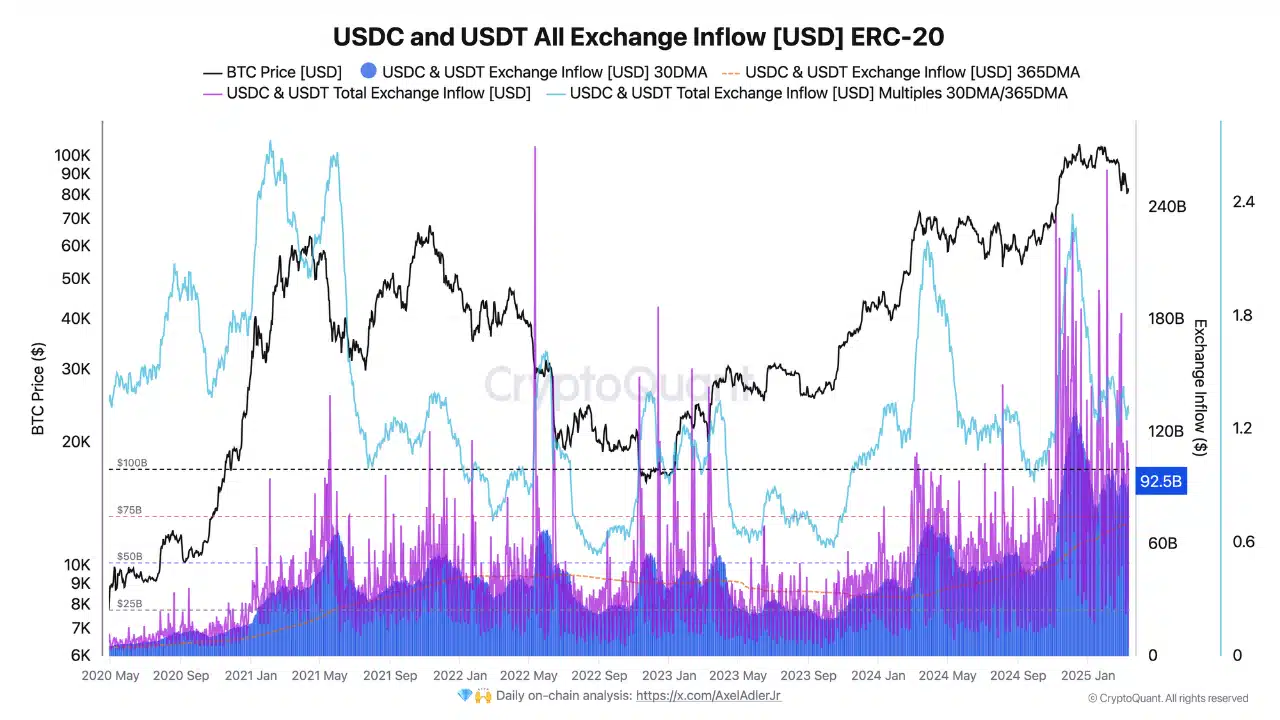

- Strong stablecoin inflows into exchanges suggest investors are positioning for a potential market re-engagement.

Despite recent price pullbacks and market-wide corrections, stablecoin data seems to be telling a different story.

The total market cap of stablecoins has climbed to fresh all-time highs, marking several consecutive months of growth.

More notably, stablecoin inflows into centralized exchanges have remained strong, a classic sign of incoming buy-side pressure. These trends suggest that while the market takes a breather, capital isn’t fleeing — it is in wait.

In an environment clouded by volatility, stablecoins are emerging as the clearest signal of investor conviction.

Far from marking the end of a cycle, current conditions may simply be the pause before a larger upward move.

What rising stablecoin market cap means

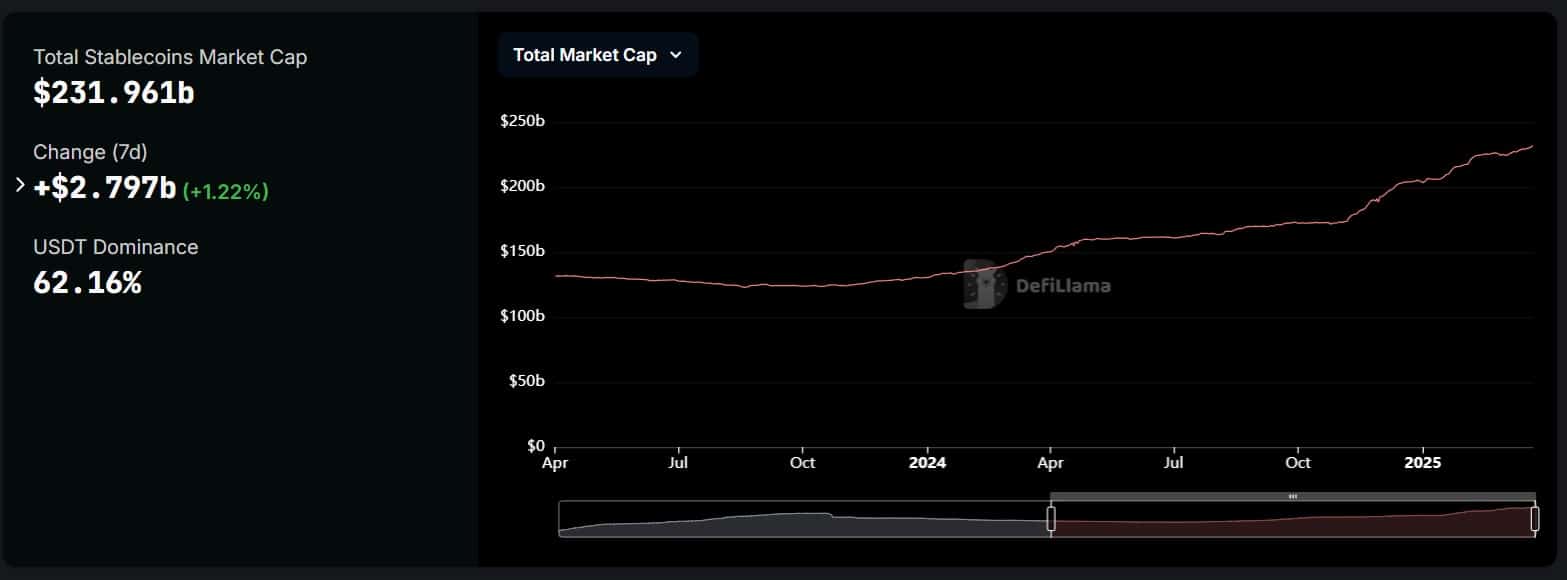

The stablecoin market cap has surged to an all-time high of $231.96 billion, with a $2.8 billion increase in the past week alone, according to DeFiLlama.

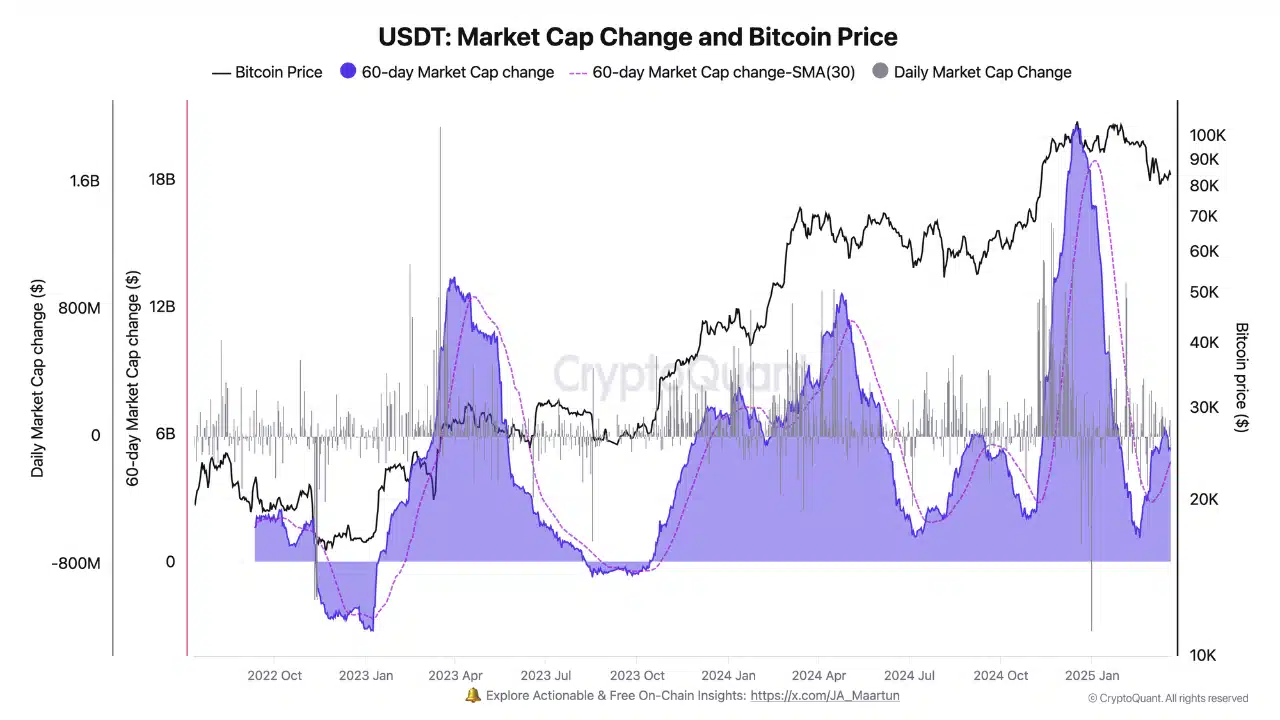

This sustained growth — up over 50% since mid-2023 — indicates a consistent influx of liquidity into the market, often a precursor to bullish momentum.

Historically, prolonged expansions in stablecoin supply have aligned with accumulation phases that precede market rallies.

The current rise is in stark contrast to the sharp outflows seen during the 2022 bear market, when capital fled exchanges.

With USDT maintaining a dominant 62.16% share, the data supports the view that the market remains well-positioned for a continuation of the bull cycle.