MicroStrategy’s Bitcoin Holdings Exceed 500,000 BTC

Michael Saylor announced that Strategy (formerly MicroStrategy) just purchased $584 million worth of Bitcoin, bringing its total holdings to over 500,000 BTC. Bitcoin is up this morning, and MicroStrategy’s purchase helps build market confidence.

However, the firm can only continue these acquisitions through sizable debt obligations. It seems unlikely that Strategy could ever sell off these assets without risking market confidence.

Strategy’s Bitcoin Buys Grow Again

Strategy (formerly Microstrategy) has been on a wild trajectory in the last few weeks. It has been one of the world’s largest Bitcoin holders for months, but the company’s purchase sizes have fluctuated wildly in the last few weeks.

Today, however, Michael Saylor announced that Strategy purchased a huge amount of Bitcoin:

“Strategy has acquired 6,911 BTC for ~$584.1 million at ~$84,529 per bitcoin and has achieved BTC Yield of 7.7% YTD 2025. As of 3/23/2025, Strategy holds 506,137 BTC acquired for ~$33.7 billion at ~$66,608 per bitcoin,” Saylor claimed via social media.

The price of Bitcoin is very uncertain right now, and this has left an outsized impact on Strategy. Last month, the firm began offering STRK, a new perpetual security, to fund massive BTC acquisitions.

Shortly before today’s purchase, he upsized his latest stock offering by over $200 million.

This has reinvigorated the firm’s purchasing strategy but also left it with other serious problems. In essence, Strategy will never be able to sell its Bitcoin without seriously damaging the market.

The company has funded these purchases with massive debt obligations, but it has negative cash inflows. Saylor’s routine acquisitions keep market confidence high, but the community watches carefully for any signs of diminished activity.

Enthusiasts carefully watch for smaller purchases, and they would certainly notice a sale of any size.

That is to say, what happens if Strategy’s unsecured debt goes down if the price of Bitcoin goes down? The community would take a forced liquidation as a very bearish sign.

The company’s tax obligations are another possible source of trouble. For now, at least, the price of Bitcoin is on the mend.

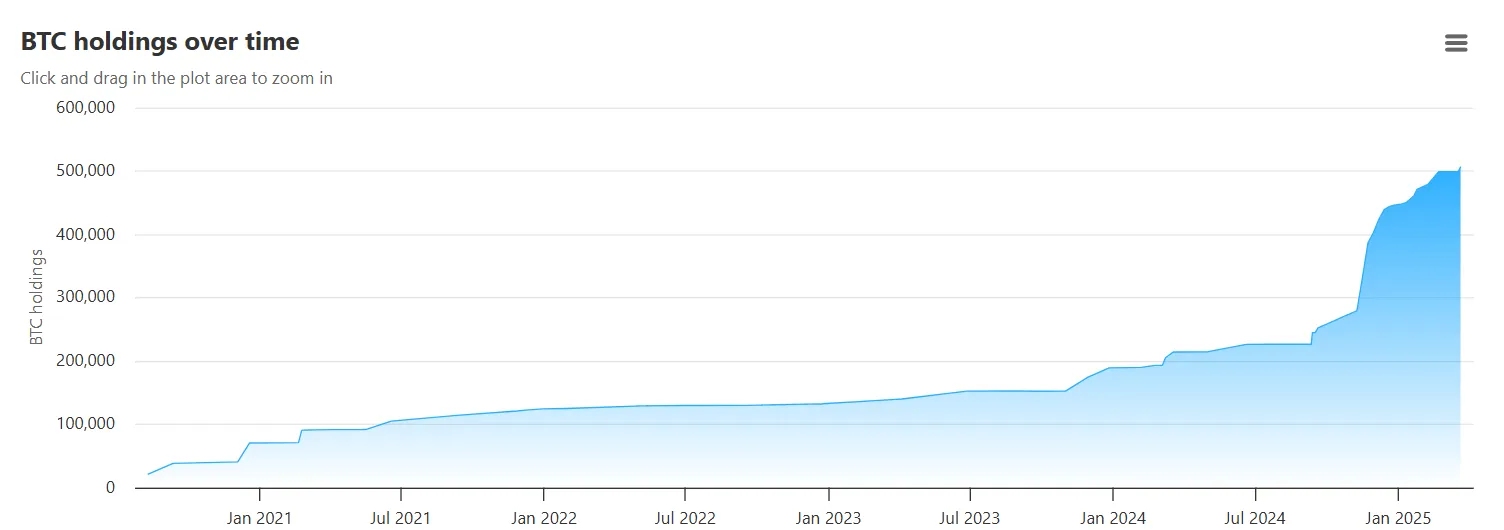

After this acquisition, MicroStrategy holds more than 500,000 Bitcoins. As the following chart shows, the company’s BTC purchase activity significantly intensified since late 2024, even though the asset’s price reached an all-time high during that period.

It’s evident that Saylor will serve as an important guarantor of Bitcoin’s confidence. However, if market conditions spin out of control, Strategy’s massive debt could cause some serious trouble.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.