Top 5 DeFi Cryptos Set to Soar in March 2025

In March 2025, the cryptocurrency market is seeing a new phase of acceleration, with DeFi (Decentralized Finance) taking the spotlight. Driven by technological innovations, strategic updates, and increased adoption, select projects are standing out prominently.

Which DeFi Cryptos Will Explode in 2025 ?

DeFi, or Decentralized Finance, encompasses all financial applications built on public blockchains. These protocols allow borrowing, lending, trading, or earning returns without intermediaries, ensuring transparency.

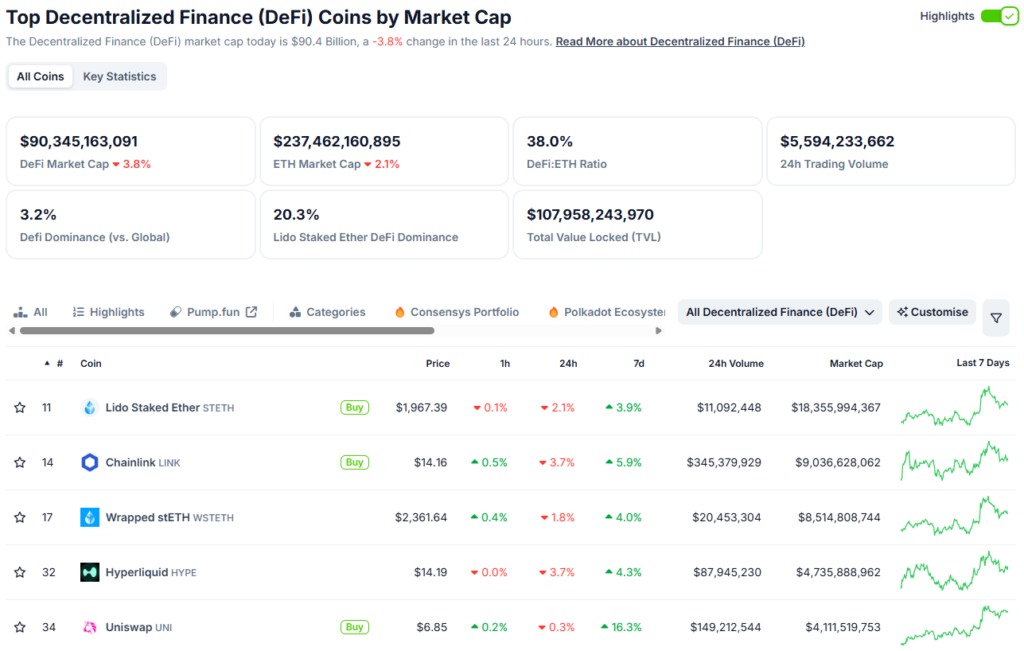

In March 2025, the total market capitalization of the DeFi sector reached $90.3 billion, representing about 3.2% of the global crypto market. The 24-hour trading volume exceeded $5.59 billion, despite a slight -3.8% decrease in the last day.

This vitality demonstrates an ongoing interest from investors in this vertical, which remains one of the pillars of the Web3 ecosystem! We will now introduce you to 5 promising DeFi cryptos that are making waves in 2025.

1. Hyperliquid (HYPE)

Hyperliquid is making waves in early 2025 with a massive AirDrop and continues to attract traders with its ultra-fast perpetual trading platform. This decentralized perpetual trading platform is gaining attention for its fluidity, execution speed, and well-thought-out tokenomics.

- Performance: The HYPE token has surged over 340% since its launch, reaching an all-time high (ATH) at $35 before retracing around $14.

- News: The protocol plans to introduce new derivative products and improve its tokenomics.

- HYPE price forecast: If the volume remains strong, HYPE could target the psychological zone of $40 in the coming months.

2. Aave (AAVE)

A historical DeFi protocol, Aave strengthens itself with the development of Aave v4, bringing new cross-chain functionalities and a revamp of liquidations.

In 2025, Aave continues to dominate the decentralized lending and borrowing market, with over $17 billion of TVL. Recently, the protocol attracted attention with transactions related to Donald Trump and his family, who use the platform to manage funds in stablecoins.

With the rise of Real World Assets (RWA) tokenization on its platform, AAVE could play a key role in democratizing decentralized finance.

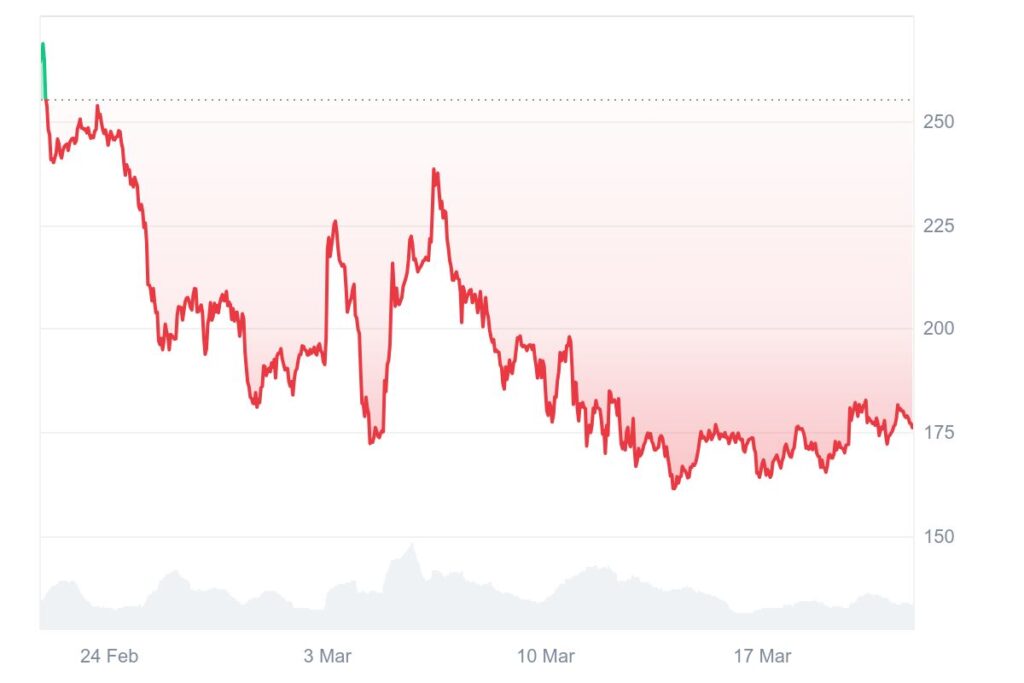

- Performance: -30% in the last month. The token tested $268 before correcting sharply to around $160.

- Support/Resistance levels to watch: Major support at $160 and direct resistance at $200.

- AAVE price forecast for 2025: With the deployment of v4, the interest of the Trump family, the AAVE token could reach $300 to $400 in the coming months.

3. PancakeSwap (CAKE)

PancakeSwap remains one of the most popular DEXs, offering decentralized trading, yield farming, and a launchpad for new projects.

Despite a long bearish phase, the CAKE token rebounded strongly in March with a +45% increase over the week, driven by increased volumes on the BNB Chain.

- News: Introduction of new pairs on its DEX, returning users, and rising volumes.

- CAKE token performance: From $1.61 to $2.80 in the last week.

- Price forecast for 2025: Short-term target: $3.50 if the bullish trend continues. The CAKE token must maintain its key support at $2.20 to confirm this momentum. In the longer term, the $4.10 level may be retested.

4. Raydium (RAY)

Raydium is one of the leading DEXs (Decentralized Exchanges) in the Solana ecosystem. The platform offers deep liquidity and ultra-fast swaps through its integration with the Automated Market Maker (AMM) and Serum’s order book.

Its central role in the Solana DeFi universe makes it a key platform for trading and token liquidity on the blockchain.

In February 2025, Raydium (RAY) plummeted by 60% in the last month, dropping from $4.40 to $1.47. This decline was due to the announcement of Pump.fun, which plans to launch its own Automated Market Maker (AMM) on Solana.

However, a large part of Raydium’s volume comes from Pump.fun tokens, generating significant fees for the platform. This potential competition has worried investors, leading to selling pressure on the RAY token.

But Raydium has regained the spotlight recently with the announcement of LaunchLab, a token issuance platform for Solana, inspired by Pump.Fun. With this announcement, the RAY token surged by +10% over the week, retesting the $2 threshold.

- RAY token performance: -60% in the last month, with the RAY token hovering around $1.70

- Potential: By further integrating into the Solana ecosystem and memecoins, Raydium could play a key role in community launches.

- Price forecast for 2025: If LaunchLab gains popularity, RAY could target $2.50 quickly. In the longer term, it could reach $4 to $5 if the altcoin market resumes a bullish trend.

5. Lido (stETH)

Lido is the leader in liquid staking on Ethereum, allowing users to stake their ETH while maintaining liquidity through stETH.

Unlike traditional staking that locks funds, Lido offers a flexible alternative where users receive stETH in exchange for their staked ETH, usable on various DeFi protocols.

The platform continues to solidify its position as a leader in liquid staking, with over 30% of ETH staked on Ethereum, thus reinforcing its dominance in the market.

The recent V2 upgrade introduced a key feature: direct ETH withdrawal, offering stakers increased flexibility to access their funds.

- stETH token performance: A 27% decrease in the last month, with a price trading around $1,973.

- News: Lido’s dominance in Ethereum staking surpasses 38%, with a TVL of over $18 billion.

- Price forecast for 2025: With the increasing adoption of liquid staking, stETH could follow the trajectory of ETH and surpass $2,500 in 2025.

Where to Buy DeFi Cryptocurrencies?

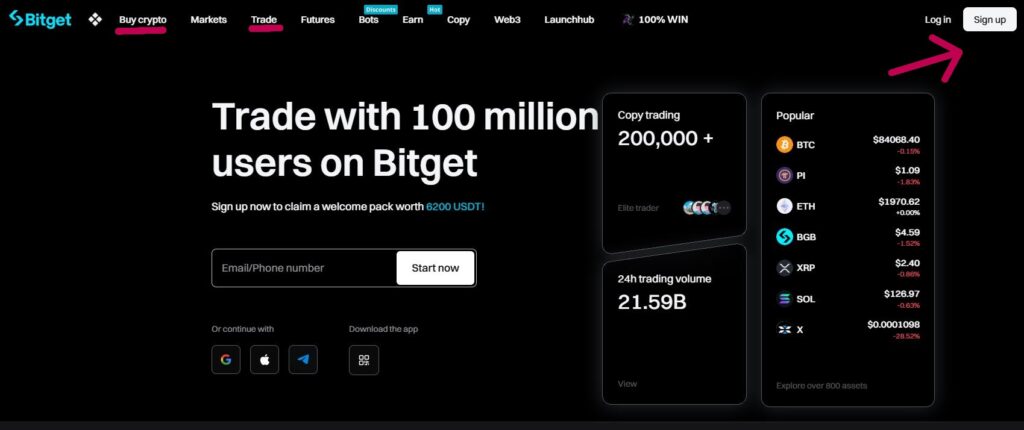

Bitget is a reliable and accessible crypto platform that allows you to easily acquire DeFi cryptocurrencies. With competitive fees, an intuitive interface, and multiple payment options, Bitget stands out as one of the best exchanges to buy and trade assets related to decentralized finance.

Whether you’re a beginner or an experienced investor, buying DeFi tokens can be done in a few steps. Simply create an account, deposit funds in USDT or USDC via credit card or bank transfer, and place an order for the corresponding pair.

Once the transaction is confirmed, your tokens will be available in your Bitget wallet, ready to be traded or securely stored.

How to Buy DeFi Cryptos with Bitget ?

Here are the steps to buy DeFi tokens on the Bitget platform :

- Create an Account: Sign up with an email address and verify your identity (KYC).

- Deposit Funds: Purchase USDT using a credit card (Visa/Mastercard), bank transfer, or Apple Pay/Google Pay.

- Find the Trading Pair: Search for HYPE/USDT, AAVE/USDT, CAKE/USDT, RAY/USDT, or stETH/USDT.

- Place an Order: Choose a market order for an instant purchase or a limit order for a specific price.

- Store Your Tokens: Keep them on Bitget or transfer them to an external wallet for added security

Tip : Dollar-Cost Averaging (DCA) is the recommended strategy for investing in DeFi, helping to reduce stress caused by market volatility.

DeFi remains a key narrative to watch

DeFi Cryptos Gain Strength in 2025 with Key Projects Like Hyperliquid, Aave, PancakeSwap, Raydium, and Lido

The DeFi sector continues to grow in 2025, with innovative projects driving the space forward. The resurgence of activity on the BNB Chain, the rise of Solana, and Ethereum’s dominance in liquid staking confirm that DeFi is stronger than ever.

Beyond our Top 5, several DeFi cryptos are gaining attention in 2025. Jito (JTO) stands out on Solana with its liquid staking solutions, while Ethena (ENA) introduces a synthetic stablecoin backed by the derivatives market. MakerDAO (MKR) remains a leader with DAI, and Jupiter (JUP) solidifies its position in the Solana ecosystem with record-breaking DEX volumes.

These DeFi projects demonstrate increasing maturity, offering solid, useful, and well-integrated solutions. Despite market volatility, DeFi remains a key focus for mid- and long-term investors. Stay informed, choose strong projects, and adapt your investment strategy wisely!

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.