Justin Sun bats for TRON Halving! Impact on TRX’s price will be…

- TRON’s ecosystem is considering a proposal to reduce the rate of TRX emission through halving

- Justin Sun believes that just like Bitcoin, a TRX halving will benefit both validators and the token

Over the past few days, TRON community has widely discussed the idea of a Bitcoin-like halving for TRX. As expected, this discussion has prompted TRON’s founder Justin Sun to make a case for the altcoin’s halving.

According to Sun, TRX is already in a deflationary state of 1% per year, making it the only deflationary asset among major cryptocurrencies. However, as the prices have risen, rewards for block-producing nodes across the network have risen considerably too. Hence, a moderate reduction can be beneficial to the network.

Citing Bitcoin’s path, Sun posited that as Bitcoin’s network grew, block rewards gradually fell. In the early days, higher rewards were necessary for bootstrapping the network. However, as BTC’s price surged, block rewards were lowered, and the halving cycle played a role in Bitcoin’s long-term sustainability.

Therefore, just like Bitcoin, TRON could benefit significantly from reduced block rewards. As such, if daily block rewards are reduced by 1 million TRX, the deflation rate would increase by 50%, reaching 1.5% per year.

Equally, if reduced by 2 million TRX, the deflation rate would rise by 2% annually. This would effectively double the deflation rate with an impact on TRX’s price, one comparable to Bitcoin’s halving.

According to Sun, even if the block reward is reduced, the current incentives for validators are highly attractive and will still keep them in profitable positions.

What would it mean for TRX?

As suggested by TRON’s founder, more deflationary measures would greatly benefit TRX. Therefore, a halving event for it could positively affect the altcoin in various ways. For starters, it would result in market speculation in every halving cycle, driving the altcoin’s demand in the process.

Additionally, lower rewards will result in reduced supply which would lower inflation on TRX’s price. Lower supply results in higher prices, especially if demand remains high or constant.

Based on supply and demand, TRX will benefit extensively on its price charts. As such, TRX could grow and reclaim its ATH and climb to $1.

Latest market conditions

According to AMBCrypto’s analysis, TRX is still facing some strong bearish sentiments. Especially as investors now lack the motivation to open new positions.

Over the past week though, the altcoin gained by 6.08% to trade at $0.235 at press time.

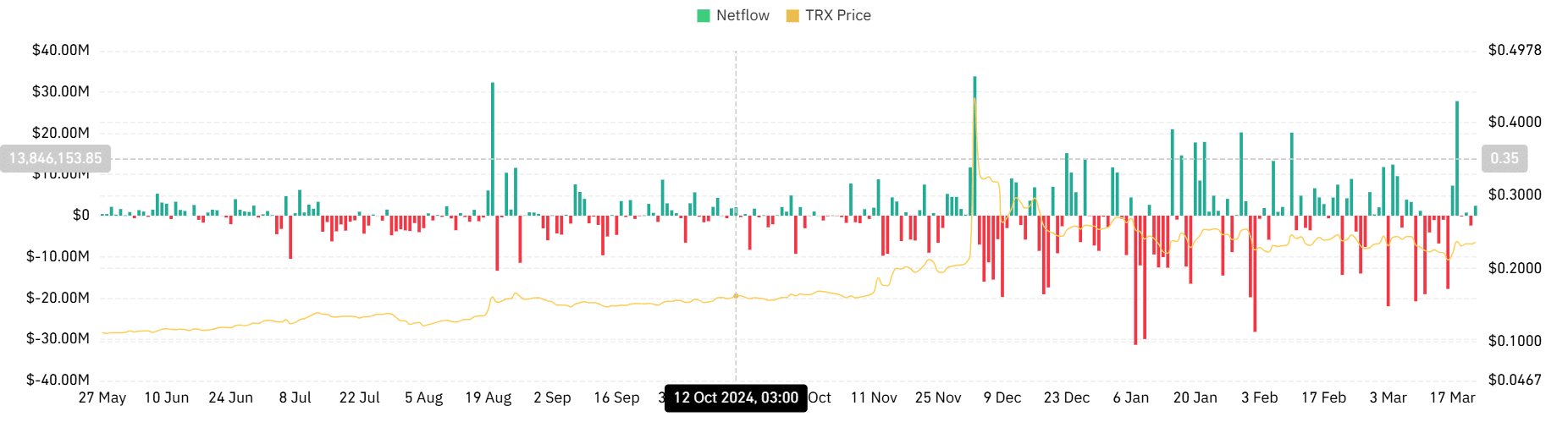

And yet, dspite this price pump, it is still facing significant bearishness. We can see this as the market is being dominated by more sellers. In fact, TRX’s spot outflows turned positive over the past day, hitting $2.39 million. When exchange netflows turns positive, it means that there are more inflows.

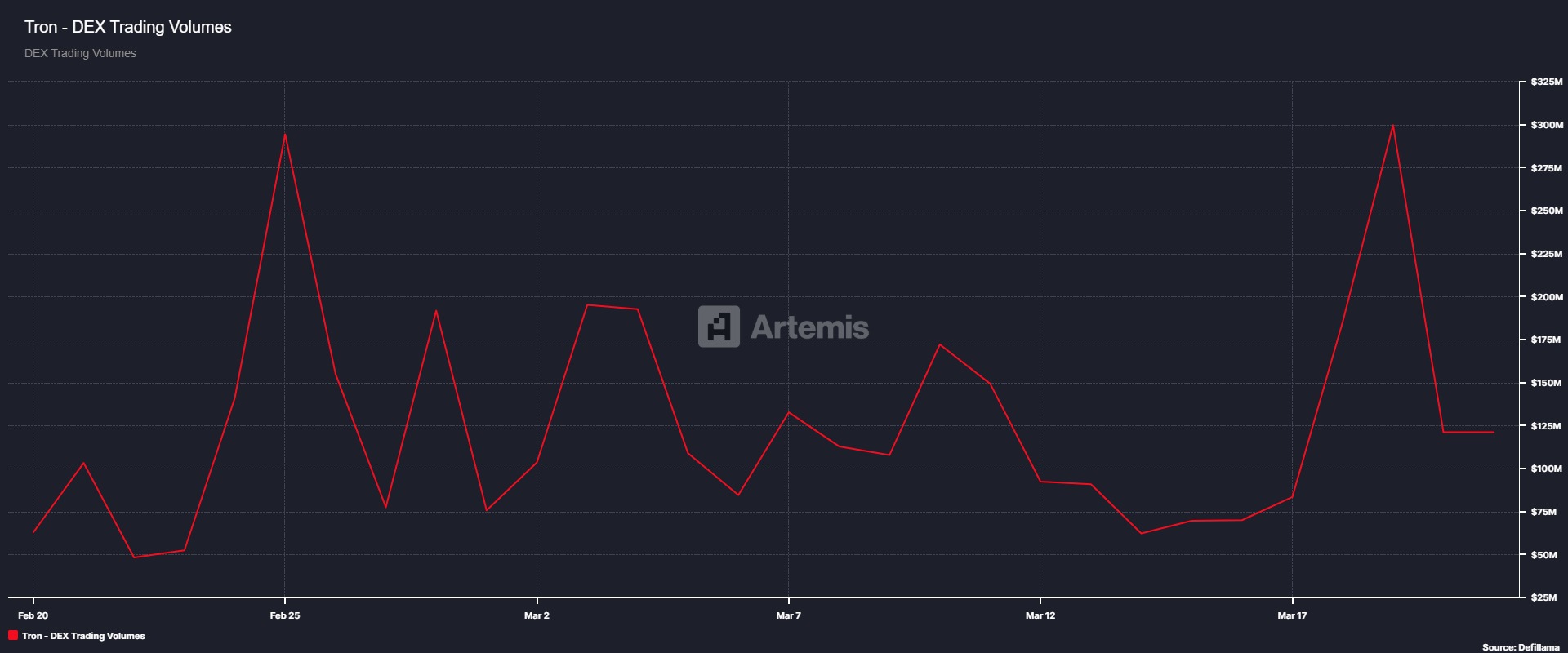

Additionally, TRON’s DEX trading volume declined from $299 million to $121 million. When this falls, it means that the network is seeing a decline in network activity as demand drops.

Hence, there’s less speculation among traders, leading to lower swaps. Historically, a high DEX volume leads to higher prices. For instance, when TRX’s price spiked to $0.38 three days ago, it flashed a figure of $299 million. Thus, a drop means lower prices.

As it stands, there are strong bearish sentiments in the market. If these prevailing sentiments persist, we could see a retracement to $0.22. However, if investors take Justin Sun’s advocacy as a bullish signal, the altcoin can reclaim $0.35.