AVAX price prediction – Could bulls trigger a near-term rebound now?

- Big investors (whales) are buying more AVAX and moving it off exchanges, showing great interest

- Chances of a price recovery depend on market activity and investor demand

Avalanche (AVAX) is under pressure right now, with its price going down on the charts over the last few days. However, even though the altcoin’s price has been dropping, there have been some signs that the market might turn around soon. Needless to say, traders are watching closely to see if AVAX will recover.

At the time of writing, AVAN was priced at $18.71, after falling by 2.13% in the last 24 hours. Over the past week, it has dropped by nearly 10% as more people started selling.

Here, it’s worth noting that the downtrend is still strong right now. And, AVAX is likely to struggle to stay above important price levels.

What does whale activity say?

AVAX’s price has been falling, and one big reason can be recent changes in the Avalanche Foundation. Earlier this month, three board members resigned, making people worry about the project’s future. Even though the team says everything is still on track, investors are unsure.

Additionally, broader market trends are influencing AVAX. Bitcoin (BTC) is staying above $84,000, and if it keeps going up, AVAX might also recover along with other cryptocurrencies.

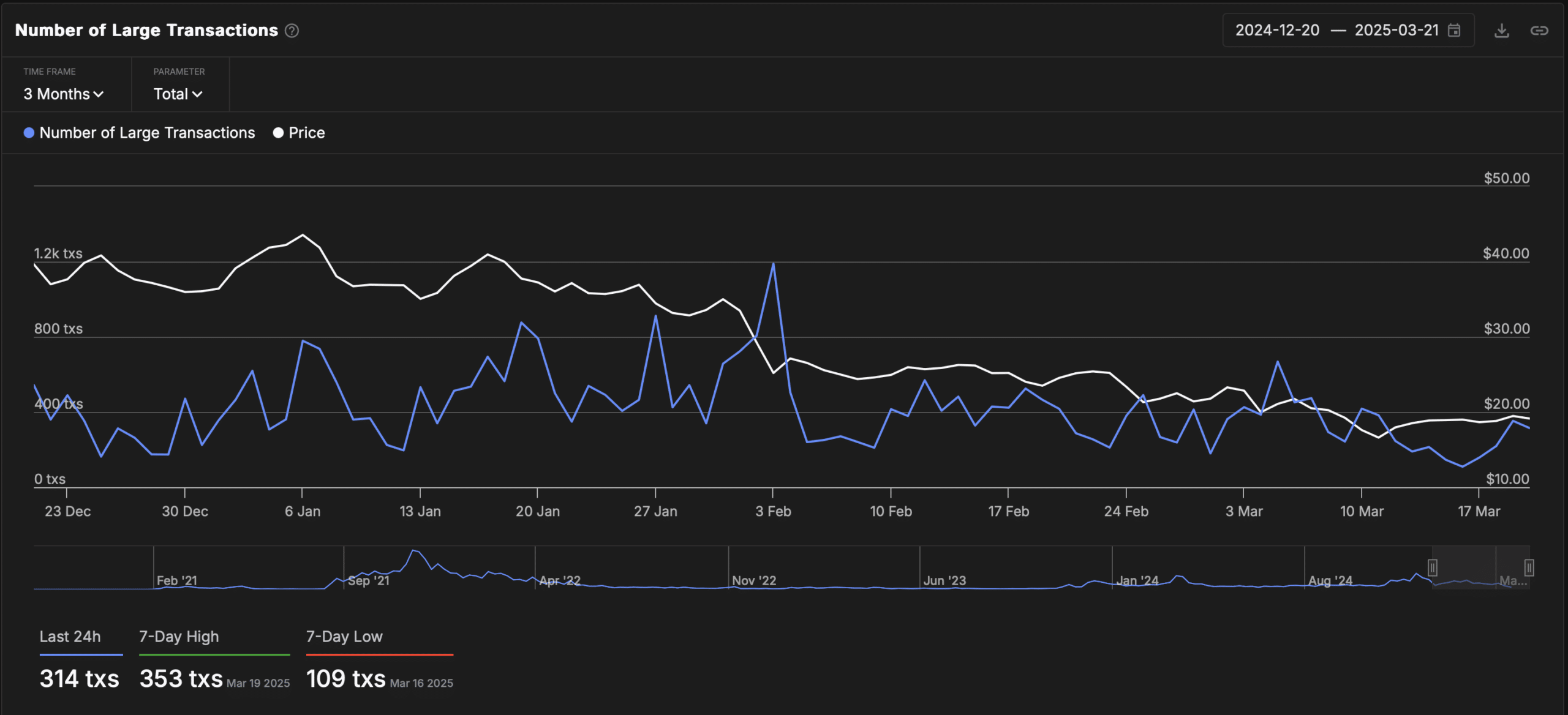

Despite the price drop, however, whale activity revealed that large investors have been actively accumulating AVAX.

In the last 24 hours alone, there were 314 large transactions, with a 7-day high of 353 on 19 March and a 7-day low of 109 on 16 March – Showing a sharp hike in accumulation. This growing buying pressure could signal a price reversal as market sentiment shifts.

AVAX’s volume and Open Interest trend

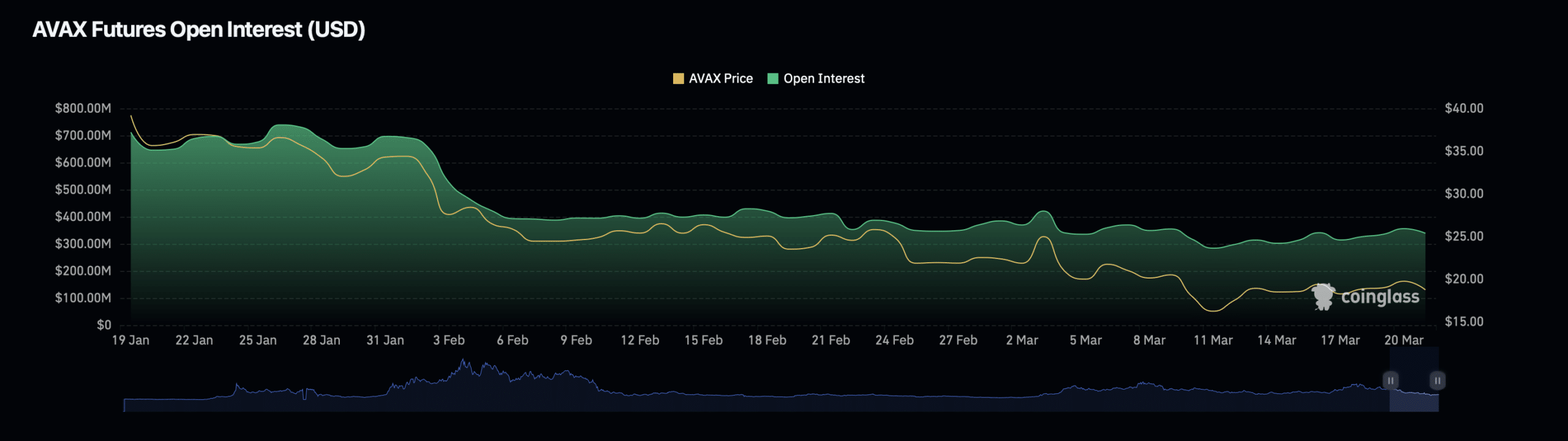

At press time, AVAX’s trading volume was at $213.47M – A 38.92% drop. However, a spike could indicate renewed buying interest.

Meanwhile, Open Interest, which tracks the number of active futures contracts, stood at $341.27 million. However, it has been dropping lately.

This means fewer traders are now opening new positions, which shows they are being cautious about the market. If OI starts increasing along with the price, it could mean more traders are getting involved, and the trend might take a turn for the better.

To put it simply, AVAX is at a crossroads right now. While bearish trends dominate, signs of accumulation and key technical indicators underlined a possible rebound around the corner. If Bitcoin continues its strong performance and AVAX breaks its resistance, a recovery could follow. However, failure to hold support could lead to further losses.