Best Altcoins to Buy in March 2025

On this Page:

Contents [show]

Alternative coins, better known as altcoins, cover all cryptocurrencies other than Bitcoin. Altcoins can be split into sub-categories, with popular niches including smart contract infrastructures, meme coins, and decentralized finance (DeFi).

Altcoins are almost always built on existing layer 1 or 2 networks like Ethereum, Solana, BNB Chain, and Base. While altcoins can be a profitable investment, knowing which ones to purchase can be daunting.

This guide explores the best altcoins to buy for long-term gains, covering a wide range of niches and network ecosystems. Learn how to build a profitable altcoin portfolio, what investment strategies to deploy, and where to invest for the safest experience.

| # | Coin | Price | 24h % | Market Cap | Volume | 24h Range |

|---|---|---|---|---|---|---|

| 1 |

|

$1,944.42 | -2.56% | $234,839,115,254 | $12,164,729,687 |

$1,938.90 ― $2,005.82 |

| 2 |

|

$126.53 | -3.73% | $64,722,127,513 | $2,616,733,619 |

$125.48 ― $131.80 |

| 3 |

|

$0.71 | -4.82% | $25,406,769,031 | $867,404,816 |

$0.70 ― $0.75 |

| 4 |

|

$18.51 | -2.94% | $7,664,786,022 | $201,241,899 |

$18.38 ― $19.15 |

| 5 |

|

$0.21 | -3.96% | $363,492,910 | $2,691,853 |

$0.20 ― $0.22 |

Ethereum

ETH#1

$234,839,115,254

$12,164,729,687

$1,938.90 ― $2,005.82

Solana

SOL#2

$64,722,127,513

$2,616,733,619

$125.48 ― $131.80

Cardano

ADA#3

$25,406,769,031

$867,404,816

$0.70 ― $0.75

Avalanche

AVAX#4

$7,664,786,022

$201,241,899

$18.38 ― $19.15

Polygon

MATIC#5

$363,492,910

$2,691,853

$0.20 ― $0.22

Top Altcoins to Buy

Read on to discover the best altcoins to buy in 2025. Altcoin projects with the most attractive long-term potential will now be revealed.

1. Ethereum

Ethereum Price Chart

(ETH)24h change -2.56%

Ethereum (ETH)

$1,944.42 (-2.6%)

$1,938.90 ― $2,005.82

Market Cap: $234,839,115,254

Trading Volume: $12,164,729,687

All Time High: $4,878.26 (-59.9%)

Ethereum isn’t only arguably the best crypto to buy but it’s also the largest by market capitalization. It’s the original pioneer of “smart contracts”, enabling peer-to-peer transactions without needing to trust third parties. Ethereum’s use cases are limitless, with thousands of decentralized applications (dApps) already boasting increased adoption rates.

For example, the Ethereum blockchain hosts decentralized exchanges (DEXs) like Uniswap, SushiSwap, Curve, and Bancor Network. Ethereum also hosts a wide range of DeFi protocols, allowing users to lend, borrow, and stake cryptocurrencies. Examples include Lido, Aabe, Maker, and EigenLayer, projects contributing billions of dollars in Total Value Locked (TVL).

The Ethereum blockchain is also the go-to ecosystem for metaverses, NFT projects, and play-to-earn games. Not to mention stablecoins like USDT, Dai, and USDC. Most projects operating on the Ethereum blockchain have a native crypto, known as “ERC-20” tokens. However, all transaction fees must be covered in ETH, the proprietary asset backing Ethereum.

For instance, consider that tens of thousands of USDT transactions take place daily. Each USDT transaction requires a small amount of ETH, creating demand and revenue for the Ethereum blockchain. While Ethereum does face issues with weak scalability and oftentimes high fees, it remains the overall best altcoin to hold long-term.

Find out more about Ethereum:

2. Solana

Solana Price Chart

(SOL)24h change -3.73%

Solana (SOL)

$126.53 (-3.7%)

$125.48 ― $131.80

Market Cap: $64,722,127,513

Trading Volume: $2,616,733,619

All Time High: $293.31 (-56.7%)

Solana is also one of the best altcoins to buy. Just like Ethereum, Solana specializes in smart contracts. It also handles dApps, although the Solana blockchain has now become synonymous with meme coins. Donald Trump and Javier Milei, the presidents of the US and Argentina respectively, recently launched Solana meme coins themselves.

One of the main attractions for meme coin creators is Solana’s low barrier to entry. Anyone can launch a meme coin, with Solana transaction fees averaging just $0.00064. This makes meme coin trading cost-effective, unlike Ethereum which can be expensive during busy periods. Moreover, Solana boasts considerably higher scalability when compared to Ethereum. Even so, Solana has faced multiple network outages since its inception, so it’s not as reliable or trusted as its Ethereum counterparty. Crucially, however, the long-term future of Solana should revolve around the Web 3.0 era. It’s one of the top-performing blockchains for speed, fees, and high throughout, a perfect combination for DeFi. For example, Raydium, which is built on the Solana blockchain, is now the largest DEX for daily trading volume. Similarly, many Ethereum-based dApps have bridged to Solana for increased efficiency, including Decentraland, Axie Infinity, and Ethereum Name Service. All Solana transactions collect fees in SOL, translating to significant annual revenues.

Find out more about Solana:

3. Cardano

Cardano Price Chart

(ADA)Cardano (ADA)

$0.71 (-4.8%)

$0.70 ― $0.75

Market Cap: $25,406,769,031

Trading Volume: $867,404,816

All Time High: $3.09 (-77.0%)

Some experts argue that Cardano, the so-called “Sleeping Giant”, is the best altcoin to buy for long-term holders. Founded in 2015, Cardano is an established layer-1 blockchain with a native ecosystem token, ADA. Its foundations are built around academic research, with transparent and methodological procedures shaping its development.

Unlike Solana, which prioritizes scalability and fees, Cardano aims for true decentralization and security. It leverages a robust and energy-efficient consensus mechanism called Ouroboros, which is based on the proof-of-stake framework but unique to Cardano. In terms of speeds, Cardano block times average 20 seconds. This is slower than most competing blockchains. Nonetheless, Cardano supports smart contracts and dApps, so long-term holders will be hoping for increased adoption in the Web 3.0 space. However, Cardano is known for its slow development progress, which has hindered its market share. Even so, ADA remains a top altcoin to hold.

Find out more about Cardano:

4. Avalanche

Avalanche Price Chart

(AVAX)Avalanche (AVAX)

$18.51 (-2.9%)

$18.38 ― $19.15

Market Cap: $7,664,786,022

Trading Volume: $201,241,899

All Time High: $144.96 (-87.2%)

Avalanche is another layer-1 blockchain with smart contracts and dApp capabilities. It uses the proof-of-stake mechanism and offers fast and low-cost transactions. Block finality is often reached in just 1-2 seconds, with fees typically costing a few cents. Moreover, Avalanche boasts scalability of up to 6,500 transactions per second.

Avalanche’s blockchain has three sub-networks, X, C, and P-Chain. Each has a specific purpose – asset transfers and custom tokens, smart contracts, and staking validation, respectively. While Avalanche is also suitable for DeFi ecosystems, one of its key markets is decentralized gaming.

A wide range of play-to-earn and NFT games already operate on Avalanche, including Metados, Nexus, and Kokodi. Long-term investors will like Avalanche’s staking features, with APYs currently at 7.6%. Unlike Ethereum staking, Avalanche has a low barrier to entry. Minimal hardware demands are required and there’s no slashing penalties.Find out more about Avalanche:

5. Polygon

Polygon Price Chart

(MATIC)Polygon (MATIC)

$0.21 (-4.0%)

$0.20 ― $0.22

Market Cap: $363,492,910

Trading Volume: $2,691,853

All Time High: $2.92 (-92.9%)

Polygon was one of the original layer-2 solutions for the Ethereum network. It solves Ethereum’s sluggish performance metrics with more scalable and cheaper transactions. Polygon functions as a side-chain, with transactions initially verified outside of the Ethereum blockchain.

They’re then batched and settled on Ethereum at a later date, ensuring security while maintaining efficiency. Polygon claims to have theoretical capabilities of 65,000 transactions per second. Fees rarely exceed a few cents, making it a significantly more cost-effective alternative to the main Ethereum blockchain.

Polygon’s growing ecosystem includes the most popular Ethereum-based dApps, including Uniswap, Aave, Chainlink, and USDT. Its native token, POL (formally MATIC), is used to pay network fees. Polygon is one of the few layer-2 networks to have a burning mechanism, with POL tokens frequently removed from the circulating supply. This makes POL one of the best altcoins to buy.Find out more about Polygon:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- 250,000+ Monthly Active Users

Why Buy Altcoins When You Can Buy Bitcoin?

Some investors prefer Bitcoin for its market dominance and true decentralization. Bitcoin is also the most recognized and established crypto asset, with the largest market capitalization and lowest volatility levels. So that begs the question: Why buy altcoins when they’re riskier than Bitcoin? Some of the key reasons include higher upside potentials, innovation beyond peer-to-peer transactions, the ability to diversify, and income-generating capabilities. Let’s take a closer look at why altcoins offer a solid alternative to Bitcoin in 2025.

Higher Upside Potential

First, the best altcoins to buy offer a higher upside potential than Bitcoin. At its core, this is due to the market capitalization of altcoins, with Bitcoin worth significantly more than most projects. For example, at its peak, Bitcoin boasted a market capitalization of over $2 trillion. This valued Bitcoin higher than almost every blue-chip stock on the S&P 500.

Even so, this limits Bitcoin’s price potential, with each market cycle offering more limited returns. Put otherwise, the days of Bitcoin increasing by 2,000% in a 12-month period are long gone. After all, this would require an unprecedented market capitalization increase from $2 trillion to $20 trillion. Now compare this to the top altcoins. Ethereum, for example, reached a market capitalization of over $550 billion in the 2020/21 bull market. That’s about 25% of Bitcoin’s peak valuation, meaning Ethereum has a lot more room for growth.

The growth potential increases as we move down the market capitalization rankings. For instance, Polygon’s all-time high was hit in late 2021, valuing the layer-2 project at about $6 billion. That’s just 1% of Ethereum’s peak market capitalization, allowing Polygon to target significant returns in the coming years. Ultimately, while Bitcoin is the de facto crypto asset, altcoins are attractive for their larger return on investment (ROI) potential.

Innovative Altcoin Projects

Some promising altcoins are behind innovative technologies, offering unique use cases and solutions. This makes them ideal from an investment advice perspective, considering funds are being invested into real utility tokens rather than speculative meme coins. For example, we’ve discussed smart contract platforms like Ethereum, Solana, Cardano, and Avalanche.

These layer-1 blockchains have entire ecosystems, with secondary projects building dApps from a range of niches. For example, Ethereum is home to some of the best DeFi crypto dApps, including borrowing and lending platforms like Aave and Compound. Not to mention DEXs like Uniswap and even metaverses and play-to-earn games. Best of all, these dApp projects have native altcoins, allowing investors to gain exposure at much lower valuations than the leading layer-1 blockchains. For example, Lido DAO (lending), The Graph (blockchain indexing), and The Sandbox (metaverse) all trade with market capitalizations of sub-$1 billion.

Those looking for even bigger growth potential can consider small-cap altcoins with strong fundamentals. These are often up-and-coming projects at the early stage of their development, allowing investors to build exposure at an attractive valuation. Your risk tolerance, however, should be higher when investing in small-cap projects.

Ability to Diversify

Another benefit of investing in altcoins is the ability to diversify. In contrast, investing solely in Bitcoin means you’re over-exposed to a single project. Millions of altcoins exist from a wide range of categories and sub-niches, making diversification seamless. For example, some investors will diversify across the leading layer-1 blockchains like Ethereum, Solana, and BNB.

Layer-2s, side networks that support layer-1 blockchains, also offer a diversification angle. Polygon, Arbitrum, and Optimism are just some examples. Another high-growth investing niche is DeFi. This includes DEXs, lending, staking, and other earning-based ecosystems. Choosing multiple altcoins from the DeFi space ensures a risk-averse approach. An increasing number of investors are also turning to artificial intelligence (AI) and machine learning altcoins, with many producing significant returns in the past 24 months.

Play-to-earn gaming and real-world asset (RWA) tokens are another popular niche with growth investors. Crucially, spreading funds across these altcoin niches allows you to target the broader industry.

Income-Generating Capabilities

Bitcoin – similar to other stores of value like gold and fine art – offers just one growth stream – price appreciation. This means investors can only make money when the Bitcoin price increases. In contrast, the best altcoins to buy also offer income-generating capabilities. This is in addition to long-term price potential.

For example, altcoins backing proof-of-stake blockchains like Ethereum and Solana can be “staked”. Tokens are locked for a minimum time frame, allowing holders to generate passive yields. This is like keeping cash in bank accounts, but tokens are secured by a decentralized smart contract rather than a financial institution.

Staking yields vary considerably based on demand, although they’re typically higher when investing in lower-cap projects. Another way to generate income on altcoins is by providing liquidity to DEXs. This creates a trading pair, with liquidity providers earning a share of any commissions paid. For example, lending equal amounts of Solana and USDC creates the SOL/USD pair on Raydium. You’d earn passive income whenever someone swaps SOL for USDC, and vice versa. Best of all, you still benefit from price appreciation even when altcoins are locked in DeFi ecosystems.

More Suitable for Day-to-Day Transactions

Most altcoins are significantly more suitable for day-to-day transactions when compared to Bitcoin. For example, Bitcoin was previously lauded for its solution as a cross-border payment network. Anyone can send Bitcoin globally in just 10 minutes, with fees often costing a few dollars.

However, not only do altcoins offer faster transactions and lower fees but considerably higher scalability. Bitcoin can handle just 7 transactions per second, while Solana and Avalanche manage thousands. Fees cost a fraction of what the Bitcoin blockchain charges and transactions are settled in seconds.

Latest Crypto News

Key Factors to Consider When Choosing an Altcoin

We’ve established that the altcoin market offers many advantages over Bitcoin. However, the key challenge is knowing which altcoins to buy. According to Coinbase CEO Brian Armstrong, about 1 million new altcoins (mainly meme coins) are being created every week. Only a very small percentage will succeed, with most new launches eventually leaving investors with worthless tokens. Therefore, knowing how to navigate the altcoin markets is crucial. We’ll now discuss the key factors to consider when building an altcoin portfolio.

Market Capitalization and Liquidity

One of the best aspects of the altcoin market is that there’s a project to suit all risk-reward objectives. At one end, you’ve got large-cap altcoins with huge market capitalizations, such as Ethereum, Solana, BNB, and Cardano. These projects are established, having growing ecosystems, and a large number of long-term holders.

In turn, large caps generally benefit from substantial liquidity levels and reduced volatility, making them ideal for more risk-averse investors. The trade-off is that large-cap altcoins also offer a reduced upside potential. They require much higher capital inflows when compared to small caps, limiting the growth potential. This is similar to investing in blue-chip stocks.

Investors with a higher appetite for risk might prefer altcoins with lower market capitalizations. Sure, these projects are riskier and more volatile, but the upside can be significant. Especially when investing in new crypto releases. For example, consider a newly launched DeFi project with a $150 million market capitalization. This is just a small fraction of the top altcoins. The project could still only be valued at $1.5 billion with a 10x upside. And just $3 billion when increasing by 20x.

- Seasoned altcoin investors will often “weight” their portfolios by the market capitalization.

- For example, 40% could go into Ethereum and Solana

- Another 40% can be spread across other layer-1 blockchains like BNB, Avalanche, and Cardano.

- The remaining 20% could be distributed across smaller-cap altcoins, covering DeFi, blockchain gaming, and AI.

Use Cases and Community

The best altcoins to buy have clear use cases. This means that, unlike the best meme coins, the sole purpose of buying altcoins isn’t short-term speculation. On the contrary, quality altcoins offer specific utility within their ecosystem, unlocking various features and perks.

For example, altcoins backing layer-1 and 2 networks are often required to pay transaction fees. So, dApps operating on the BNB Chain must pay fees in BNB whenever smart contracts are executed. This could include a DEX trade, NFT purchase, or lending agreement. This means demand for BNB can increase exponentially as more people use its ecosystem.

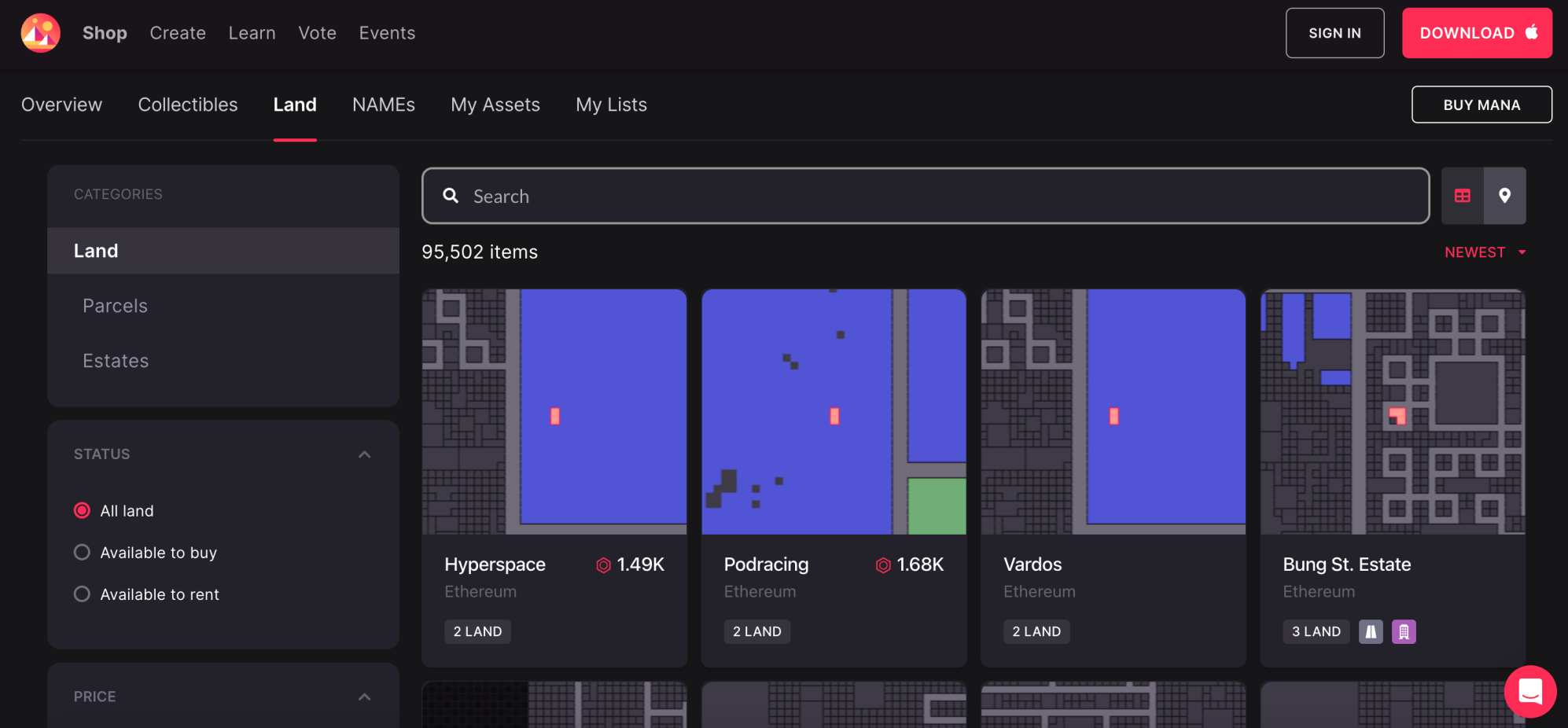

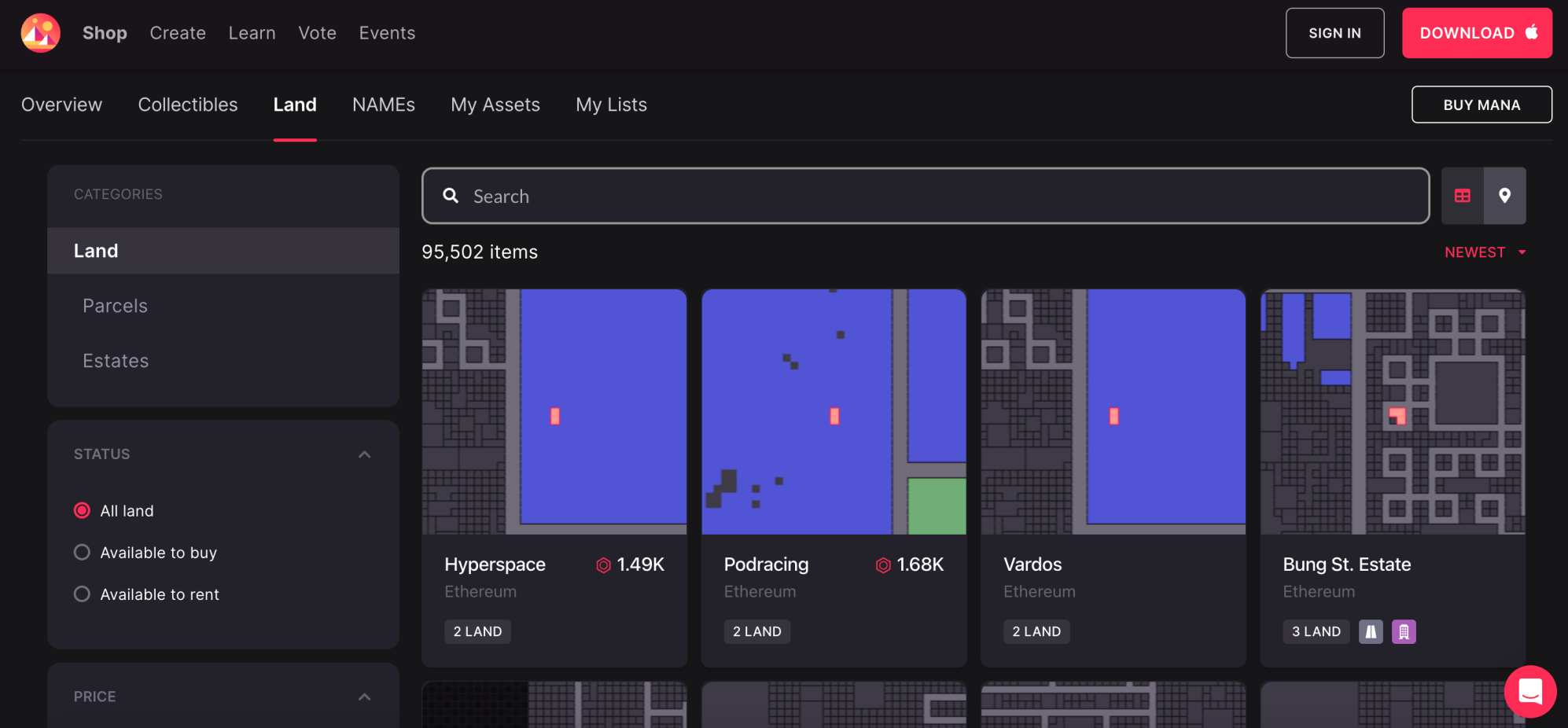

Similarly, MANA is the native altcoin backing Decentraland, a popular metaverse built on the Ethereum blockchain. MANA is used when buying metaverse land and building virtual real estate projects. Importantly, gaining exposure to altcoins with strong utility makes the investment thesis considerably more favorable.

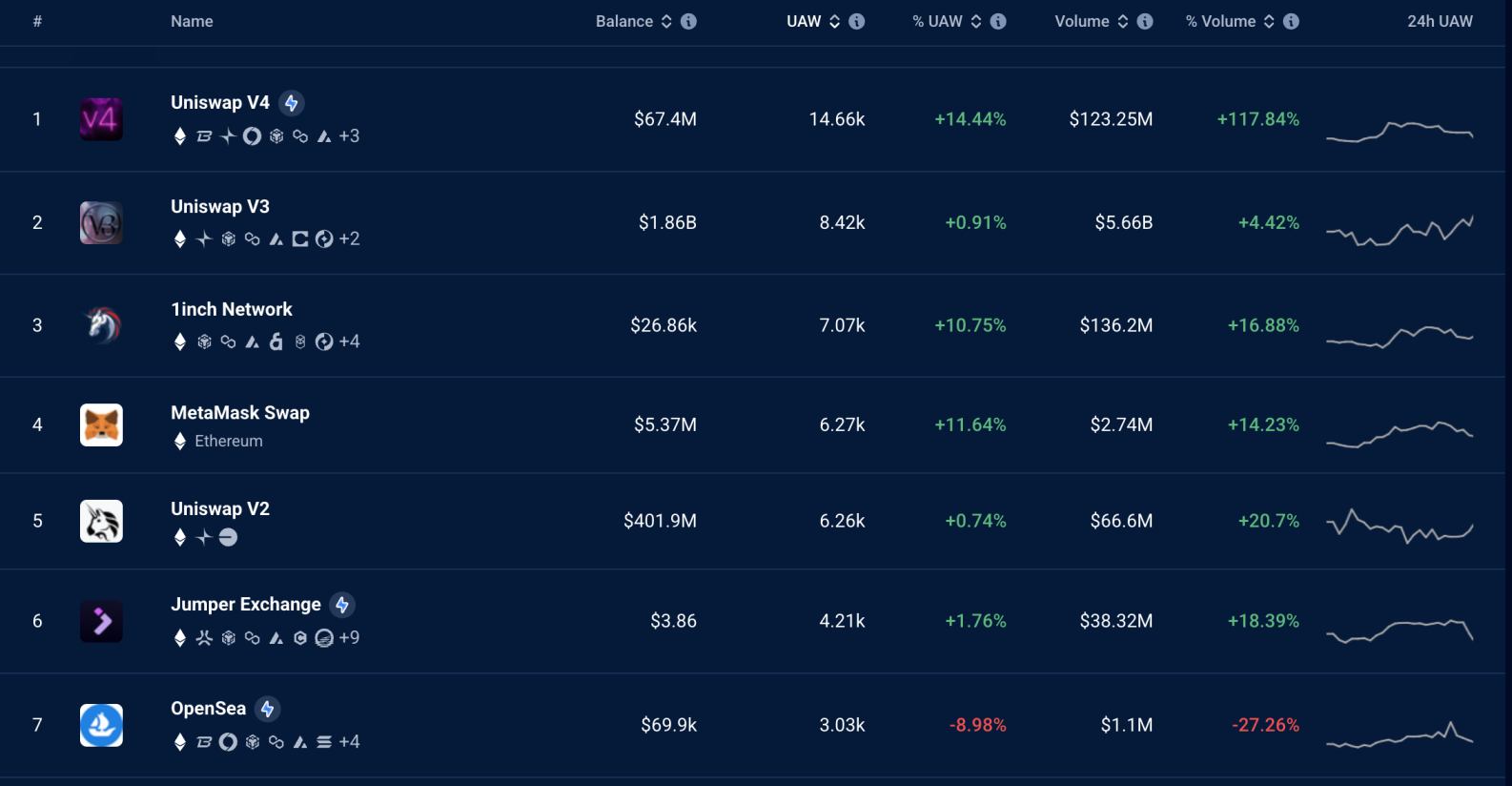

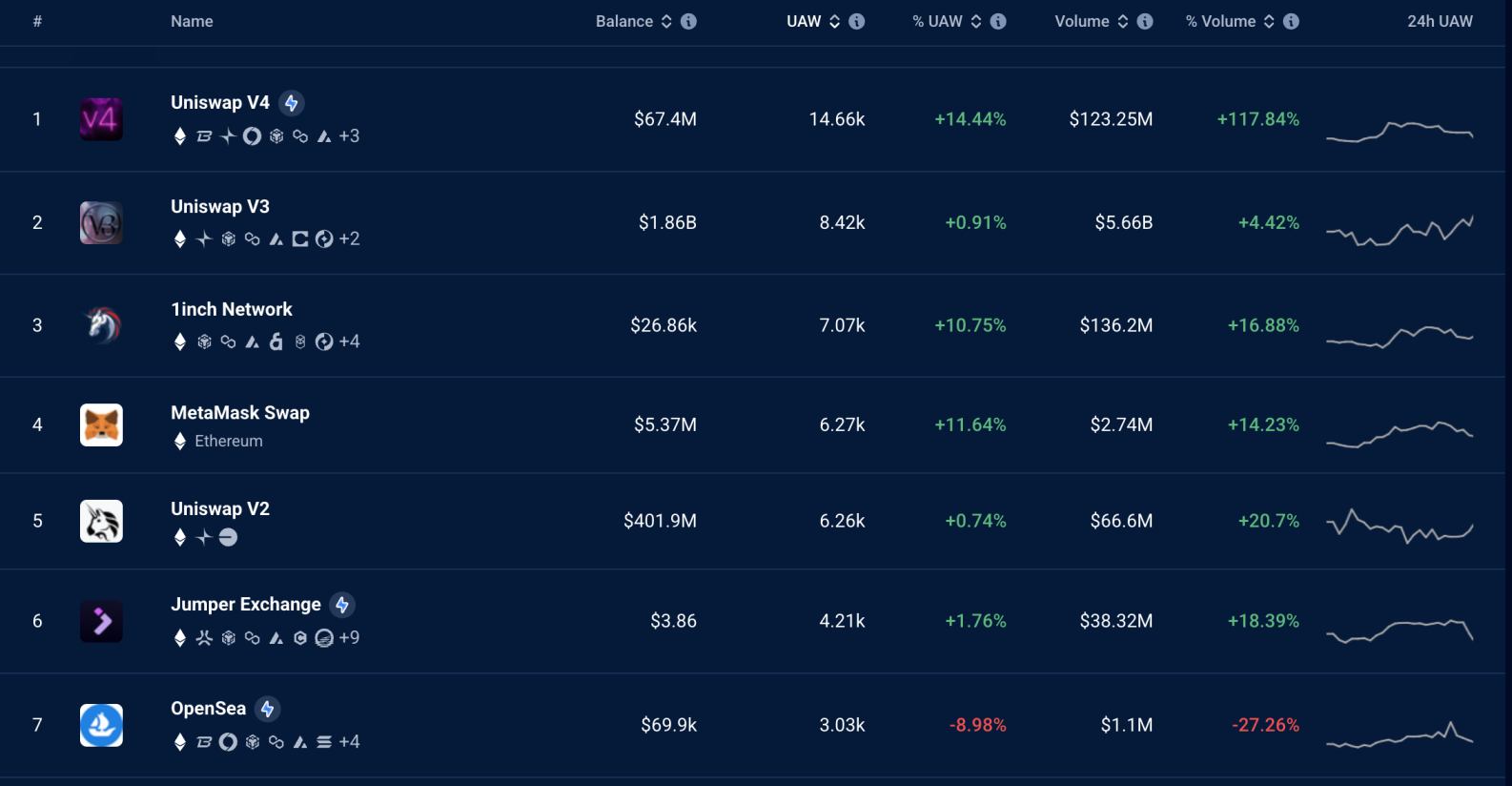

Strong communities are also active adopters of the respective ecosystem. For example, many ETH holders used Ethereum-based dApps, from Uniswap, Aave, and 1inch to OpenSea, 0x Protocol, and SushiSwap. This is crucial for the broader Ethereum ecosystem, considering dApp users pay fees in ETH. We’d suggest spending some time on DappRadar to assess community insights, including daily transactions, users, and TVLs.

Development Team

Investing in altcoins with a strong and proven development team is important. For example, Cardano, while frustrating some investors with its slow roadmap progress, has one of the most respected development teams in the industry. The underlying technology is built with an academic-first ethos, ensuring transparency and robust security.

Ethereum also has one of the strongest development teams, with the Ethereum Foundation working full-time to improve and innovate its ecosystem. Conversely, development teams that consistently miss deadlines or fail to resolve key issues should be avoided. This is no different from avoiding stocks with poorly managed executives.

Tokenomics

Tokenomics should also be considered when choosing the best altcoins to buy. This is the supply and demand dynamics for the respective altcoin token.

These are the most important aspects to explore:

- Maximum Supply: First, check the “maximum” supply, meaning the total number of tokens that can ever exist. Some altcoins, such as Ethereum and Solana, have an unlimited supply. New tokens are frequently issued, meaning these projects have inflationary supplies. This isn’t problematic if new tokens are issued slowly and predictably.

- Total Supply: The “total” supply is the number of tokens that have been created so far. It can be equal to or less than the maximum supply and includes tokens in circulation, locked, and/or held by the founders.

- Circulating Supply: The “circulating” supply is the number of tokens in the public float, meaning trade on exchanges or are held in wallets.

XRP, for example, has a total and maximum supply of 100 billion tokens. This means new XRP tokens can’t be created, so the maximum supply will never exceed 100 billion. However, just 58.1 billion XRP is in the circulating supply. The balance is held by the XRP team, albeit, locked in smart contracts with predictable release schedules. Another important metric from the tokenomics is governance. Some altcoin projects were built with democratic frameworks, with token holders voting on any key decisions.

For example, ADA holders cast votes when Cardano developers have important proposals that will directly impact the ecosystem. Votes are cast on-chain for increased transparency and validity. In contrast, projects like Solana have no governance structure, making them increasingly centralized. Instead, decisions are made by the core team, similar to traditional companies.

Security

Quality altcoin projects are renowned for their security practices. This can, however, depend on whether it’s a primary or secondary altcoin, and what consensus mechanism is used. For example, layer-1 blockchains using the proof-of-work mechanism are considered the most secure.

While this results in slower and less scalable transactions, security is the key priority. Proof-of-work altcoins include Litecoin, Bitcoin Cash, Ethereum Classic, and Monero. Newer altcoin ecosystems prefer the proof-of-stake mechanism. It’s less secure than proof-of-work but offers increased scalability and faster transactions.

Additional research needs to be done when exploring secondary altcoins, such as those built on top of Ethereum or Solana. While these altcoins benefit from the security provided by their parent blockchain, they often have unique underlying smart contracts. Any vulnerabilities with these smart contracts can mean the project is hacked.

For example, Ronin Bridge, a side-chain for the Axie Infinity play-to-earn game, was hacked in 2022. The hackers got away with over 173,000 ETH and 25 million USDC, valuing the heist at about $615 million. Security hacks not only result in financial loss but reputational damage. Those altcoins might never recover, so security should always be considered before investing.

Major Categories of Altcoins & Their Investment Potential

We mentioned that millions of altcoins exist. Projects can be categorized into different categories, similar to stock market sectors. Each altcoin category offers various risks and potential rewards. with capital flows often moving between different niches for extended periods. Understanding the most important investing categories will help you choose the best altcoins to buy.

Smart Contract Platforms

Smart contract platforms dominate the altcoin space, especially in terms of market capitalization. These projects have proprietary layer-1 blockchains, enabling anyone to build secondary tokens and dApps.

This means smart contract platforms provide the infrastructure for entire ecosystems. Ethereum is the original smart contract platform. Launched in 2015, Ethereum has the biggest dApp ecosystem in the market. It boasts billions of dollars in TVL, allocated across lending protocols, metaverses, DEXs, and more. Ethereum generates revenue when secondary projects transact, with fees payable in ETH.

Dozens of other cryptocurrencies and smart contract platforms have since entered the market, known as so-called “Ethereum Killers”. This includes everything from Solana, BNB Chain, and TRON to Avalanche, Cardano, and EOS. Most competitors offer more efficient smart contract transactions, meaning lower fees, faster settlement times, and higher scalability.

The smart contract category has also made its way to layer-2 networks. These projects support layer-1 blockchains, meaning even more efficient transactions. For example, Optimism, Base, Polygon, Arbitrum, and Blast serve Ethereum-based projects, making them significantly more scalable. With the exception of Base, these layer-2 projects have native altcoins.

The smart contract category has also made its way to layer-2 networks. These projects support layer-1 blockchains, meaning even more efficient transactions. For example, Optimism, Base, Polygon, Arbitrum, and Blast serve Ethereum-based projects, making them significantly more scalable. With the exception of Base, these layer-2 projects have native altcoins.

When choosing potential projects, focusing on real on-chain data is crucial. After all, having the fastest and cheapest smart contract platform is notable. But irrelevant if nobody is using it. Explore how many transactions are being conducted daily, what this amounts to in fees, and whether adoption rates are rising.

Ultimately, smart contract altcoins are considered the most risk-averse investments in the crypto market. They provide the necessary infrastructure, not only for utility projects but also for meme coins. Their business models ensure native ecosystem tokens must be held to transact. For instance, the millions of meme coin projects on Solana all pay transaction fees in SOL.

DeFi (Decentralized Finance) Coins

According to a Fortune Business Insights study, the broader DeFi industry was worth $55.5 billion in 2022. This is projected to grow to over $337 billion by 2030, amounting to a 28.2% compound annual growth rate (CAGR). Therefore, DeFi represents one of the hottest cryptocurrency markets to explore. Now, the best DeFi altcoins provide exposure to unique ecosystems. One of the most popular DeFi niches is DEXs, allowing users to trade altcoins via smart contracts rather than centralized order books. For example, Pancakeswap, the largest DEX on the BNB Chain, has a native altcoin called CAKE. It offers access to staking and yield farming rewards, among other use cases.

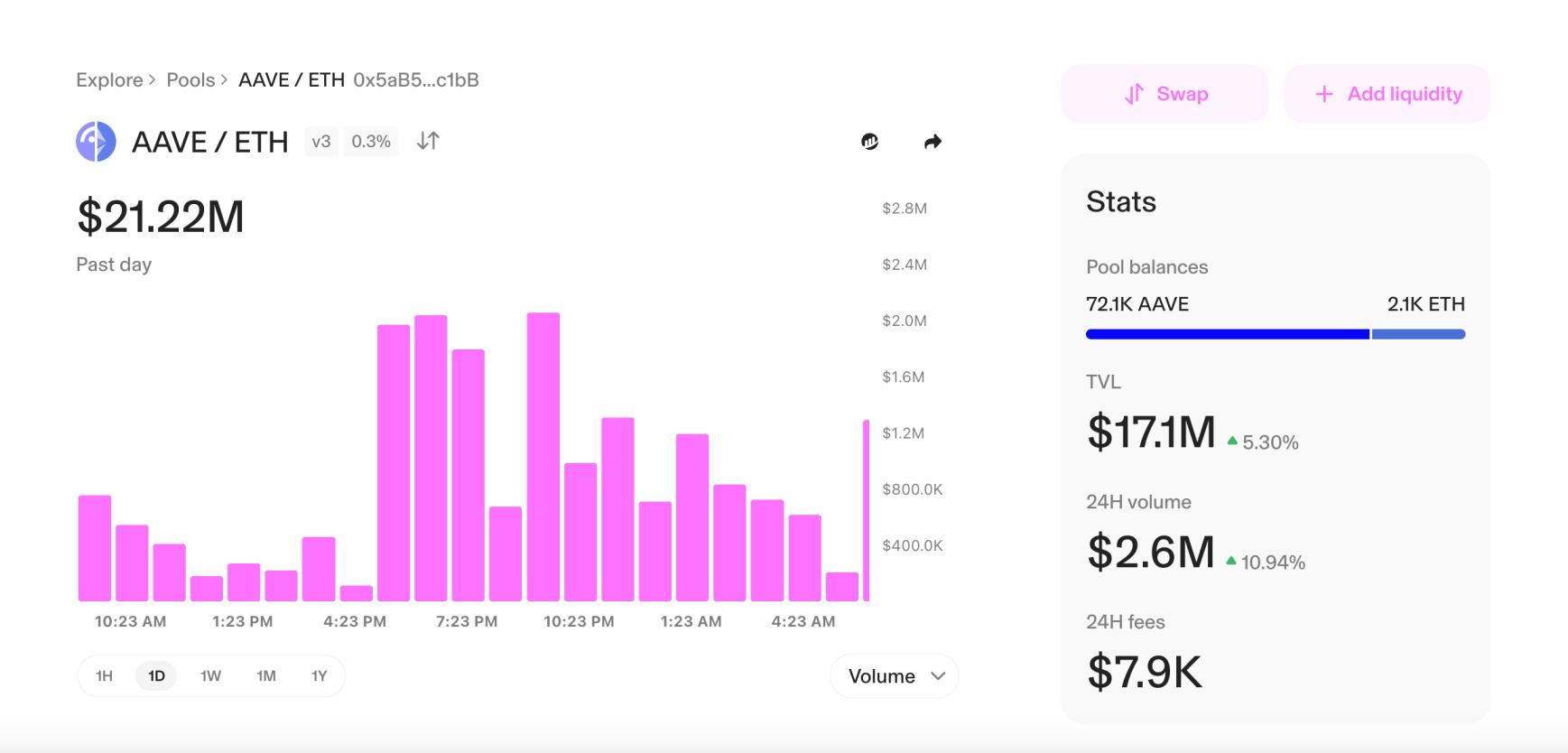

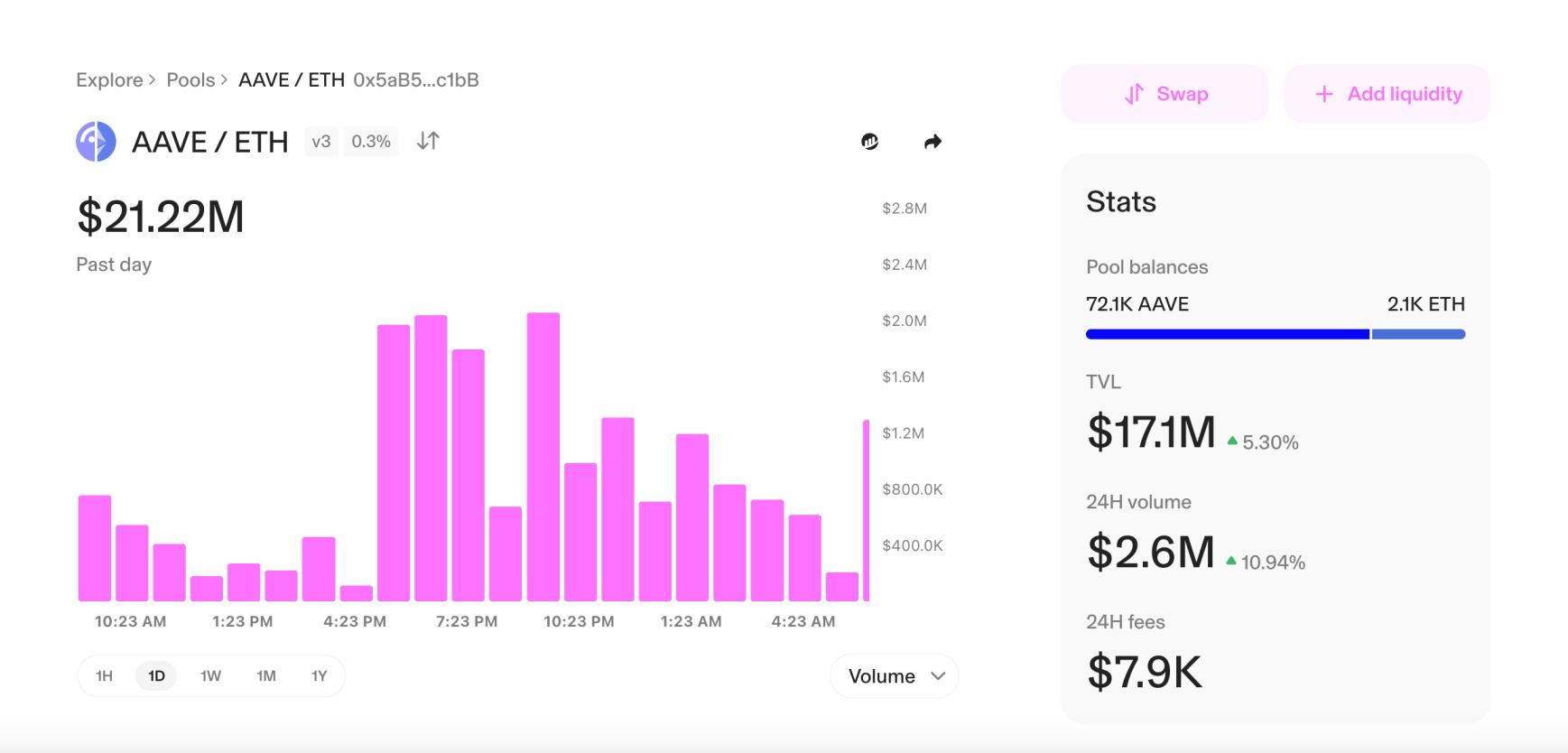

Similarly, Raydium is a popular DEX on Solana. Those holding its native altcoin, RAY, can access upcoming launchpad events, pay commission fees, and earn rewards via liquidity provision. All that said, simply holding DEX altcoins like CAKE and RAY offers exposure to their long-term growth. Put otherwise, DEX altcoins can increase in value as they become more widely used. This is typically measured by trading volumes, the core indicator for DEX revenues.

The DeFi category also extends to lending and borrowing platforms, with market leaders including Aave and Compound. Aave, for instance, enables users to earn passive income by lending idle cryptocurrencies. Those loans are secured by collateral, meaning borrowers must deposit cryptocurrencies before receiving funds. For example, depositing $2,000 worth of ETH at a loan-to-value (LTV) of 50% would mean $1,000 can be borrowed. The borrower pays interest on the loan, which is above the APY received by the lender.

While the native altcoin, AAVE, is primarily used for staking and governance, it’s also an investment token. Its value rises and falls based on the success of Aave’s lending and borrowing platform.

Metaverse & Gaming Tokens

Metaverse and gaming are also hot altcoin categories to explore. A good example is Decentraland, which covers both niches. Decentraland is an Ethereum-based metaverse world that enables users to socialize and explore via custom avatars. Decentraland is fully customizable, allowing developers to launch play-to-earn games and virtual experiences.

Moreover, Decentraland allows users to purchase land within its metaverse ecosystem. Land plots are priced based on their size and location, similar to the traditional real estate sector. Crucially, metaverse land is backed by non-fungible tokens (NFTs), ensuring buyers fully own their investments. For example, suppose you buy $5,000 worth of land in Decentraland. The transaction will be facilitated in MANA, the project’s native altcoin. That land plot can then be built upon, such as a house or store.

Everything is backed by an Ethereum NFT, meaning the owner can sell their metaverse land at any time. The value is determined by market forces. Not only that but landowners can also monetize their metaverse investments. For example, users can build a hotel and rent out the rooms, collecting fees in MANA. Now, we should mention that the metaverse niche witnessed significant hype in 2021. Land prices went parabolic, with some metaverse plots selling for millions of dollars.

By extension, metaverse altcoins like MANA exploded in value. However, the metaverse niche has seen a major correction since the 2021 bull market, meaning altcoin and land plot valuations have declined considerably. This could be a benefit for first-time investors, as crypto prices are now a small fraction of their former highs. In addition, play-to-earn games should also be considered when choosing the best altcoins to buy. It’s a legitimate competitor to the traditional gaming sector, which rakes in billions of dollars from in-game sales. This includes anything from weapons to player packs and virtual skins.

However, in-game purchases are only usable within the respective gaming ecosystem. They’re controlled by the developer too, meaning no option for ownership or monetization. This is where play-to-earn games revolutionize the market, with in-game items backed by NFTs. Players can also earn in-game tokens, which are usually tradable on public exchanges.

Knowing which gaming altcoins to buy can be challenging, as the market is highly fragmented. For example, the “safer” play is to invest in gaming ecosystems like Immutable and Gala, which enable developers to launch their own games. However, those looking for the biggest returns might consider direct investments into individual play-to-earn projects. Some of the most popular include Hamster Kombat, Pixels, GMT, and Illuvium.

AI & Infrastructure Altcoins

The broader AI boom has made its way to the blockchain industry. It’s one of the hottest and best-performing altcoin niches to explore right now, especially considering the recent market correction. There are two core areas to focus on in the AI category. First, there are infrastructure and computing power ecosystems. These typically provide the framework for individual AI projects.

For example, NEAR Protocol is a high-performance blockchain designed for the AI era. It supports AI-centric dApps, ensuring significant scalability and carbon-neutral consumption. Not to mention 1-second transaction finality and sub-$0.01 fees. Another example is Render Network, which provides AI projects with decentralized computing power.

This is a major market, considering how rendering power AI initiatives demand. Render uses a peer-to-peer structure, where anyone can contribute spate computational power to the network. AI companies can rent that power, often at a considerably lower fee than traditional rendering providers. Fetch.ai is another AI infrastructure project to keep an eye on. It enables anyone to launch AI agents via a decentralized network, providing end-users with full automation. AI agents can be accessed with FET, the project’s native altcoin.

The second AI category is AI-driven applications, which use the aforementioned infrastructure ecosystems to function. For instance, Ocean Protocol is a decentralized marketplace for data sharing, ensuring privacy and ownership through tokenization The ecosystem is accessed by AI and machine learning models that require data for intelligence building.

Anyone providing data to Ocean Protocol earns fees, paid by those using it. This is unlike traditional web and mobile browsing, where personal data is collected and sold, without any of the proceeds going to the user. In our view, AI will be one of the hottest crypto spaces this year, so exploring suitable altcoins while prices are cheap could be a smart move.

Meme Coins & Community-Driven Projects

We’ve reiterated that the best altcoins to buy have solid use cases and innovative technologies. However, it wouldn’t be wise to discount the meme coin narrative, considering it’s the most popular altcoin category for retail traders. In a nutshell, meme coins are often created as a joke. They pay homage to internet trends, popular memes, and even animals. The original and most valuable meme coin is Dogecoin. However, millions of other meme coins have since been created.

Almost all meme coins have no use cases – they’re purchased solely for speculative reasons. Even so, the upside potential can be substantial when holding a meme coin that blows up. For example, Shiba Inu hit lows of $0.000000000056 when it launched in 2020. Shiba Inu hit an all-time high of $0.00008845 in late 2021. This amounts to gains of almost 158 million percent. At its peak, Shiba Inu had a market capitalization of over $40 billion, briefly replacing Dogecoin as the most valuable meme coin.

So, how do you find the next Shiba Inu when investing in meme coins? The reality is that most meme coins fail, with only a micro-percent of launches achieving success. One strategy is to focus on trending networks, with meme coin flows often moving between different ecosystems. For example, Solana was the go-to ecosystem for meme coins in early 2024.

Multiple meme coins achieved a market capitalization of over a billion dollars, including dogwifhat and Bonk. Base, the layer-2 network backed by Coinbase, has also seen increased flows in recent months. Some experts believe that Base meme coins could go on a parabolic run this year. After all, Coinbase has already listed several Base projects, including Toshi and doginme. That said, meme coin investors should also consider their preferred market capitalization range. This directly impacts the risk and potential rewards.

- For instance, some meme coin traders, known as “Crypto Degens”, like meme coins with ultra-low market capitalizations.

- They’ll often buy meme coins valued at under $1 million.

- The most likely outcome is that the meme coin is either a scam or fails to achieve any traction.

- However, only one low-cap meme coin needs to explode to see substantial gains.

- Consider that a $1 million project would still only be worth $150 million with 150x gains.

- That’s $150,000 for every $1,000 invested.

Conversely, some meme coin investors prefer higher-cap projects with a strong following. The likes of Dogecoin, Shiba Inu, and Pepe not only have multi-billion dollar valuations but millions of unique holders.

Stablecoins & Payment Tokens

Stablecoins contribute a significant market capitalization to the broader altcoin space. Market leaders like USDT and USDC are designed to be pegged to the US dollar. They’re backed by real assets, including US dollars, Treasuries, and even precious metals. Unlike other altcoin categories, this means stablecoins don’t provide financial gain. Instead, they’re always valued at approximately $1, making them a solid choice for hedging. Investors often increase their stablecoin holdings during volatile market periods.

This practice helps protect portfolios from wild pricing swings. Having a stablecoin allocation is also beneficial for capitalizing on new investment opportunities. Investors can immediately purchase their required altcoins without needing to inject additional capital. Stablecoins, particularly USDT, also play a major role on centralized exchanges, especially those operating outside of the US. This is because altcoins are frequently paired with USDT rather than USD.

For example, ETH/USDT is the most traded altcoin market. Stablecoins are also beneficial for cross-border transactions. It takes seconds for stablecoin transfers to reach the receiver, often at a fee of a few cents. This is the case regardless of whether the sender and receiver are based or the value of the transaction.

An increasing number of stablecoins are being launched for other currencies too. For instance, the Base network is home to multiple stablecoin currencies, including EUR, CAD, and CHZ. Stablecoins are also a solid choice when investing in DeFi products. Yields can be earned without volatility risks, meaning the sole focus can be APYs.

- For example, Aave offers APYs of 4.37% and 3.85% on crvUSD and USDT, respectively.

- Borrowers pay interest rates of 6.41% and 5.6%, a comfortable gap to cover potential defaults and ensure profitability. Moreover, borrowers must provide collateral before receiving loaned stablecoins, which will be liquidated if repayment isn’t made.

However, no stablecoins are guaranteed to retain their pegging. This is why regular audits from reputable auditing companies are crucial. This ensures the underlying assets backing the stablecoins actually exist.

Risks & Challenges of Investing in Altcoins

The altcoin markets are a lot riskier than traditional investment spaces. For a start, altcoins are typically more volatile than Bitcoin. Volatility levels increase as the market capitalization decreases. For example, suppose the Bitcoin price declines by 7% in a 24-hour period. Large-cap altcoins like Ethereum and BNB could decline by 10-12%.

Smaller-cap altcoins, especially speculative meme coins, could drop by over 25% in the same period. This is why risk management is crucial when choosing the best altcoins to buy. Stop-loss orders might be considered, ensuring losing trades are automatically cashed out at the stated price. For example, you might want to cap losses at 10%. So, buying ETH at $2,000 would mean a stop-loss order at $1,800 (10% of $2,000). Additionally, altcoin diversification is just as important. Spread funds across a wide range of altcoin categories rather than investing all your capital into one project. You can then diversify further within each category.

For instance, you might consider Aave, Compound, Raydium, and Uniswap from the DeFi niche. And Ocean Protocol, Fetch.ai, and Render Network for exposure to AI. Government regulations should also be considered when assessing altcoin risks and challenges. For example, XRP was embroiled in a legal battle with the SEC for several years. It secured a partial victory in 2023, encouraging US-based exchanges like Coinbase and Kraken to list XRP for spot trading. XRP has now secured a complete victory, with the SEC dropping its appeal. Another major risk when investing in altcoins is scams. Rug pulls, for example, leave investors with worthless tokens.

The founder withdraws liquidity from DEXs without accountability or repercussions. There are also pump and dumps, honeypots, and overhyped projects. Investing based on FOMO (fear of missing out) is strongly discouraged. Instead, focus on altcoins with strong fundamentals and a long-term future. Altcoin investors should also be aware of low trading volumes, which are particularly prevalent when buying small-cap tokens. This can make it difficult to cash out at the “market price”, as even a small sell order could result in a big price decline.

Future Trends in the Altcoin Market

Listed below are some emerging trends and narratives to keep an eye on. This will help you choose the best altcoins to buy for long-term success.

- Interoperability: Over 100 blockchain networks are in existence, each leveraging unique standards, consensus mechanisms, and native altcoins. This is making the blockchain markets increasingly fragmented. “Interoperability” is the solution, allowing competing blockchains to communicate without third-party integrations. Cosmos, for example, has developed the Inter-Blockchain Communication (IBC) protocol. IBC connects multiple networks while retaining decentralization, including Kava, Cronos, and Osmosis.

- Mainstream Financial Support: An increasing number of financial institutions are gaining exposure to digital currencies. While Bitcoin remains the most commonly purchased crypto, other altcoins can also be found in institutional-grade portfolios. For example, tier-one banking giant Standard Chartered has previously invested in XRP. While BlackRock holds ETH via its Ethereum ETFs. Mainstream support also includes collaborations. For instance, Visa has partnered with Solana for blockchain payments, while PayPal has created a stablecoin on Ethereum.

- Bridging the Gap With Traditional Sectors Blockchain and altcoins are also bridging the gap with traditional sectors. For example, Ethereum and Solana now have fully-fledged ETFs on Wall Street, allowing the world’s biggest financial institutions to invest. Real estate is also being revolutionized by altcoins, facilitating fractional ownership for casual investors. The supply chain is another sector, with blockchain providing increased transparency and accuracy for real-time tracking.

- AI Altcoins Could be the Next Niche to Explode: One of the biggest trends in the crypto space is AI projects. Blockchain allows AI to create sea changes in every industry and sector imaginable, from banking and cloud computing to video rendering. It combines high scalability and low fees with decentralization, the perfect combination for data-heavy AI processes.

Best Altcoins to Buy FAQs

What is an altcoin?

Altcoins (alternative coins) covers all cryptocurrencies other than Bitcoin.

How do altcoins differ from Bitcoin?

While Bitcoin is primarily a store of value, many altcoins offer innovative technologies and use cases. This includes DeFi, metaverse worlds, play-to-earn gaming, and layer-2 networks.

What are the best altcoins to buy right now?

According to experts, the best altcoins to buy include Ethereum, Solana, Cardano, Avalanche, and Polygon. Other popular altcoins include BNB, Dogecoin, and XRP.

How do I choose the right altcoin to invest in?

Investors should initially choose their preferred altcoin markets, such as DeFi, AI, RWA, and P2E gaming. Then consider metrics like market capitalization, tokenomics, price performance, and adoption rates.

Are altcoins a good investment?

Altcoins can offer a high upside potential, especially when investing in projects early. However, millions of altcoins now exist, so choosing profitable projects is challenging.

How do DeFi altcoins work?

DeFi altcoins power finance platforms, such as exchanges, lending, borrowing, and staking. While DeFi altcoins can provide governance within the respective ecosystem, they’re typically purchased for financial gain.

What role do altcoins play in the crypto ecosystem?

Altcoins not contribute a significant amount of market capitalization to the crypto ecosystem but also extended use cases, such as DeFi, stablecoins, and AI infrastructure. Altcoins now exist on over 100 different blockchains.

How do market trends affect altcoin prices?

The Bitcoin price directly impacts the broader markets, with altcoins often increasing or decreasing by higher amounts. Traditional economic developments also impact prices, plus specific altcoin hype cycles like meme coins or RWA.

How can I find new altcoins before they explode in value?

One strategy is to invest in initial coin offerings (ICOs) or launchpads, which sell new altcoins before they’re listed on exchanges. You can also explore on-chain trends, such as TVL, wallet movements, and daily transactions.

References

- The case for altcoins and memes as bitcoin, now approaching $100,000, faces a potential correction (CNBC)

- CEO Brian Armstrong says there are 1 million new cryptocurrencies created every week (Business Insider)

- Explainer: Ronin’s $615 million crypto heist (Reuters)

- Decentralized Finance Technology Market Size, Share & COVID-19 Impact Analysis (Fortune Business Insights)

- Virtual real estate plot sells for record $2.4 million (Reuters)

- Shiba Inu Passes Dogecoin as No. 10 Cryptocurrency (Bloomberg)

- Ripple Labs says US SEC ends appeal over crypto oversight (Reuters)

- Three AI-Crypto Firms Agree on Deal to Merge Their Tokens (Bloomberg)

Source link