Technical Analysis for Optimal Entry

As one of the world’s leading cryptocurrency exchanges, Binance has evolved into a vast ecosystem supported by BNB (Binance Coin). This article explores Binance, BNB, and forecasts the future trends of BNB price.

What is BNB Coin?

About Binance

Binance is one of the world’s largest and most influential cryptocurrency exchanges, providing a comprehensive suite of financial services, including spot trading, futures, staking, and DeFi solutions. Founded in 2017 by Changpeng Zhao (CZ), Binance has rapidly evolved into a global powerhouse, offering users a secure and efficient platform for trading digital assets.

Beyond its exchange services, Binance has expanded into a full-fledged blockchain ecosystem, fostering innovation through the BNB Chain network, which supports thousands of decentralized applications (dApps), smart contracts, and DeFi protocols.

BNB: The Native Token of Binance

Binance Coin BNB is the native token of the Binance ecosystem and plays a central role in its operations. Initially launched as an ERC-20 token on Ethereum, BNB later migrated to BNB Chain, Binance’s proprietary blockchain network.

Use Cases of BNB

On Binance Exchange

- Trading Fee Discounts: Users paying with BNB receive a ~25% discount on spot and margin trading fees.

- Base Currency for Trading Pairs: BNB serves as the base currency for numerous trading pairs on Binance.

- Binance Launchpad: Holding BNB allows users to invest in new projects and purchase tokens exclusively with BNB.

- Staking Rewards: Users can stake BNB to earn advantages while contributing to network security.

- Collateral for Lending: BNB can be used as collateral in lending platforms like Venus.

On Binance Chain & Binance Smart Chain (BSC)

- BNB is used as the native gas fee payment for all on-chain transactions.

- BNB also functions as a governance token, allowing holders to participate in on-chain decision-making.

Payments and Real-World Applications

- BNB is accepted as a payment method via Binance Pay and Binance Visa Card.

- Many external merchants and service providers support BNB as a payment option.

BNB in the DeFi Ecosystem

- BNB plays a crucial role in the DeFi ecosystem on BSC, powering various applications such as:

- PancakeSwap (AMM DEX): BNB is a primary asset in liquidity pools.

- Venus Protocol: BNB serves as collateral for borrowing and lending.

- Yield Farming: BNB is widely used in yield aggregator platforms on BSC.

- Binance NFT Marketplace: BNB is the primary currency for transactions.

What is BNB Chain?

- BNB Chain consists of two parallel blockchains:

- BNB Beacon Chain: Handles governance and staking.

- BNB Smart Chain (BSC): Supports smart contracts and is fully compatible with Ethereum.

- BNB Chain stands out due to:

- The Proof of Staked Authority (PoSA) consensus mechanism, produces blocks every 3 seconds.

- Only 21 validators, ensuring high efficiency but lower decentralization than Ethereum.

- Low transaction fees and high throughput (~100 TPS compared to Ethereum’s ~20 TPS).

- Full EVM compatibility, making it easy to migrate Ethereum-based dApps.

BNB Chain Ecosystem

Key Products and Services

- DeFi: PancakeSwap (DEX), Venus (Lending), Alpaca Finance, Beefy Finance (Yield Aggregation).

- NFT and GameFi: Over 300 blockchain gaming projects on BNB Chain, accounting for 50% of the top decentralized games.

- Web3 Applications: dYdX (BSC version), stablecoin BUSD, DAOs, and governance platforms.

Notable Statistics

- In 2021, BSC processed an average of 7 million daily transactions (up from ~350,000 earlier that year).

- All-time high: 14.7 million transactions in a single day (Nov 17, 2021)—10x Ethereum’s volume.

- 1 billion+ cumulative on-chain transactions within just a year of launch.

- Active wallet addresses peaked at over 2 million daily users.

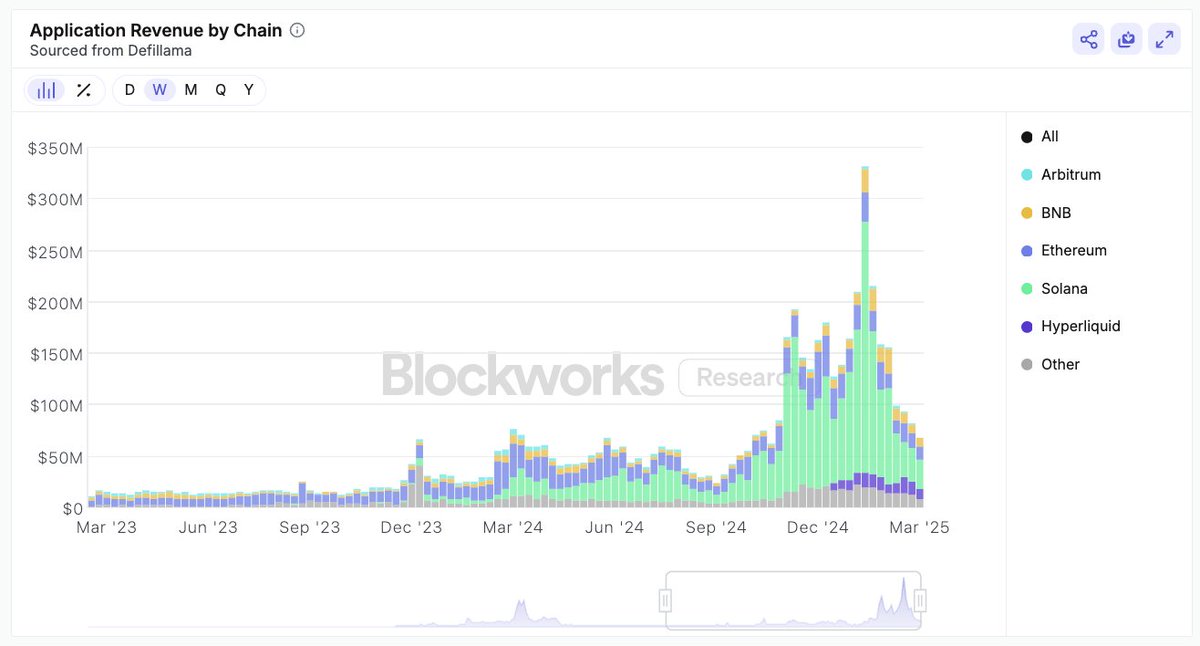

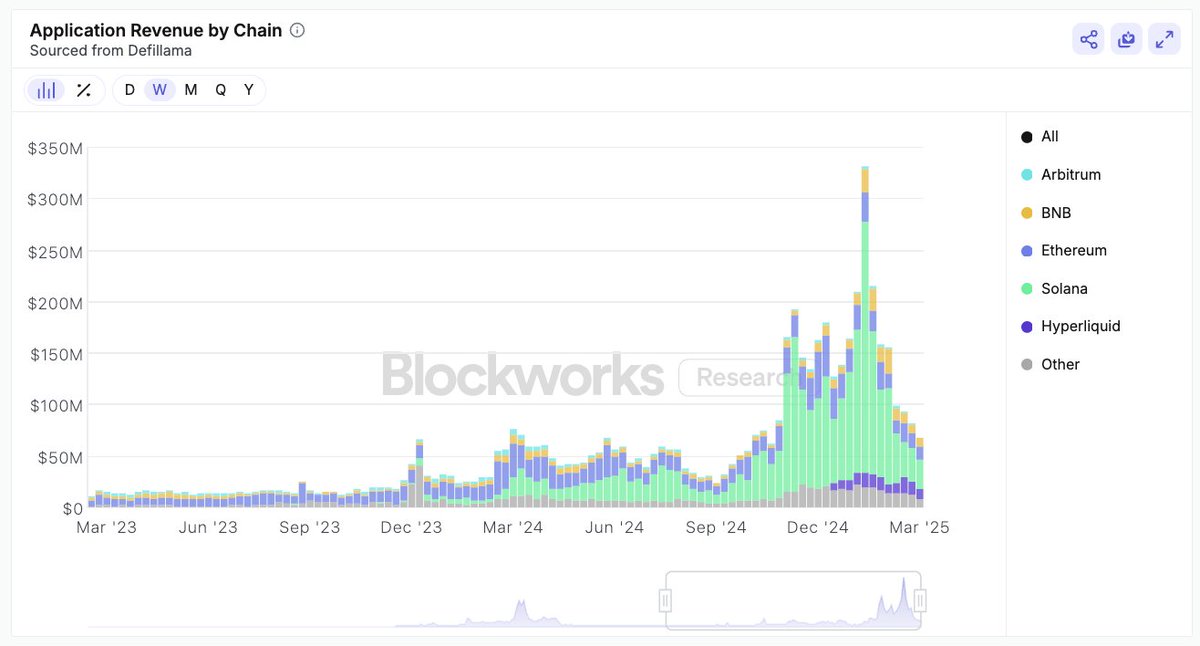

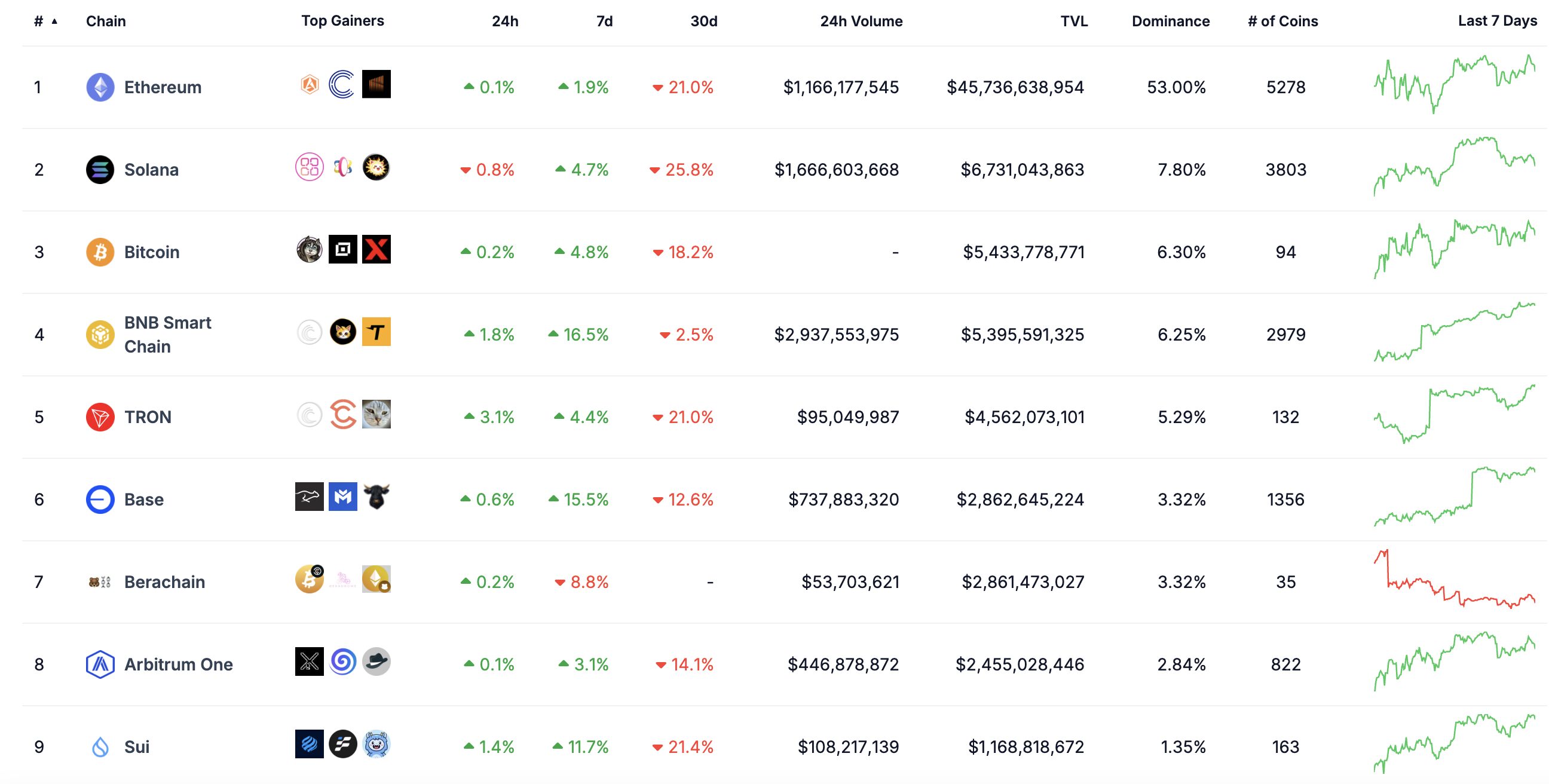

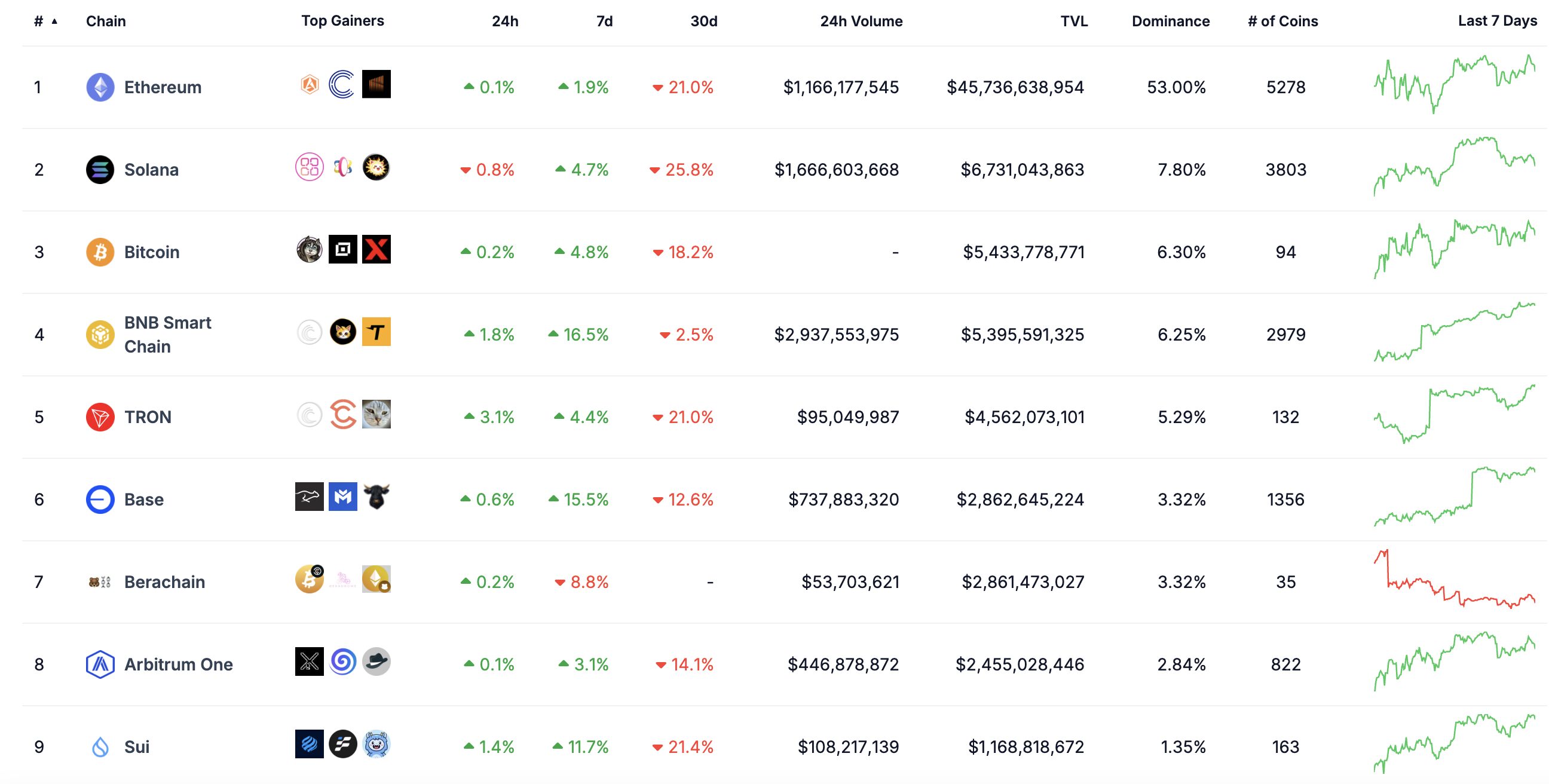

Source: Defillama

Binance CeFi & DeFi Integration

- Users can seamlessly utilize BNB across Binance services, including trading, staking, lending, farming, and NFT purchases.

- Binance is actively integrating real-world payment solutions, partnering with platforms like Travala and ClassicBritishCars, enabling BNB to be used for travel bookings and luxury purchases.

Source: BSCDaily

BNB Tokenomics

- Ticker: BNB

- Blockchain: Binance Chain & Binance Smart Chain

- Consensus Mechanism: Tendermint

- Total Supply: 145,887,575 BNB

- Max Supply: 200,000,000 BNB

- Circulating Supply: 145,887,575 BNB

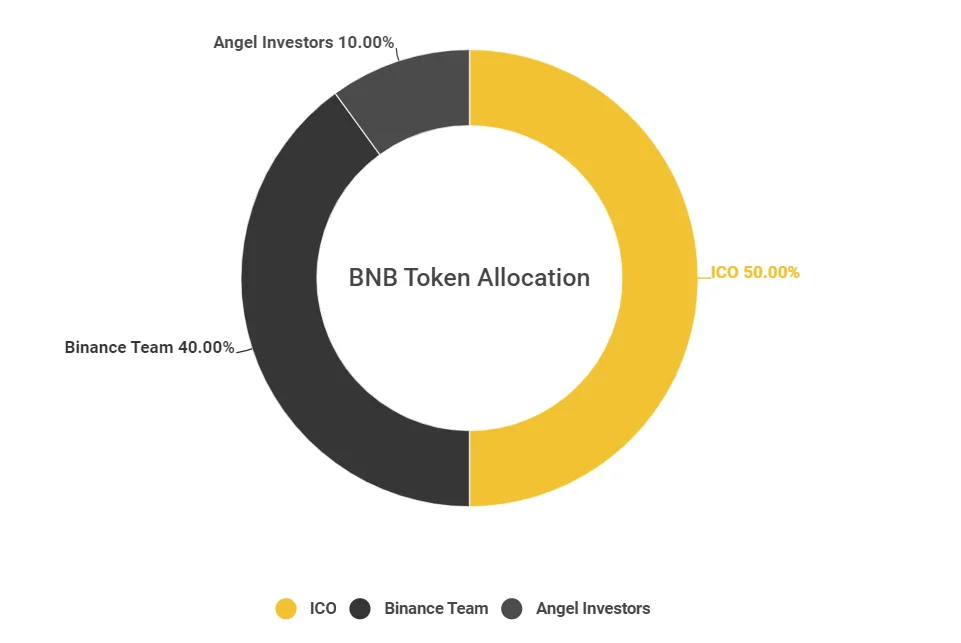

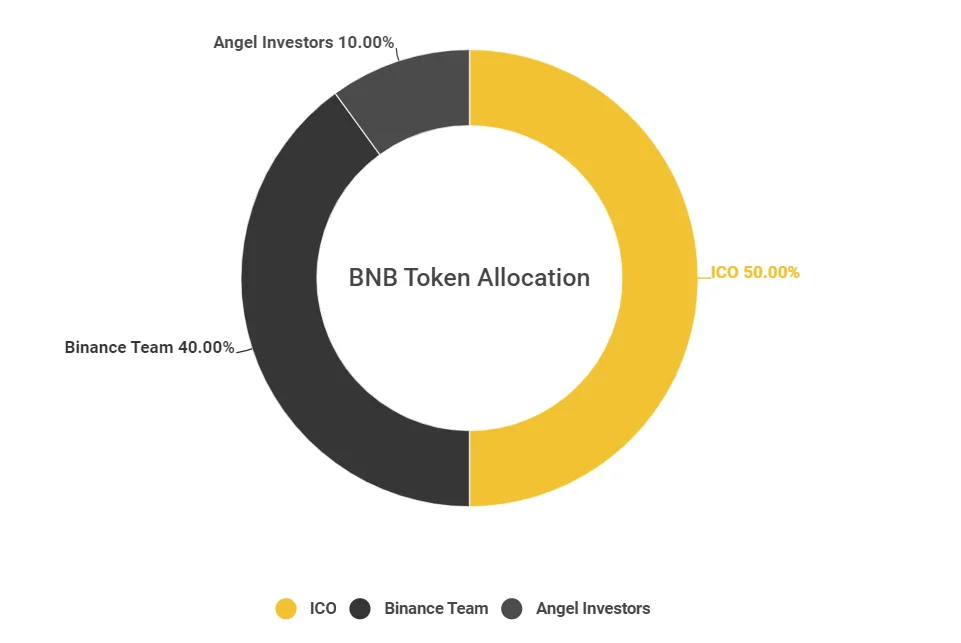

Token Allocation

Initially, BNB had a total supply of 200,000,000, distributed as follows:

- ICO: 50% – 100,000,000 BNB

- Binance Team: 40% – 80,000,000 BNB

- Angel Investors: 10% – 20,000,000 BNB

Source: Binance Blog

A crucial feature of BNB’s tokenomics is its periodic burn mechanism, designed to reduce circulating supply and enhance token value over time. Binance has committed to gradually burning 100 million BNB (50% of total supply) until the circulating supply decreases to 100 million BNB.

BNB Release Schedule

Binance releases BNB tokens according to the following plan:

- ICO: No lock-up period. Investors received BNB five days after the ICO concluded.

- Angel Investors: No lock-up period. Investors received the full allocation upon ICO completion.

- Binance Team: The Binance team’s allocation was locked and released gradually over five years at a rate of 20% per year (16 million BNB annually).

BNB Price Prediction

Fundamental Analysis of BNB

Weekly Update (App Revenue, Market Share, Weekly Change) from several notable blockchain:

- Solana: $27.9M, 50%, -16%

- Ethereum: $12.9M, 23%, -12%

- BNB: $8.4M, 15%, +2%

- Base: $4.4M, 8%, -23%

Source: Dan Smith’s Post on X

BNB Chain currently holds a TVL of $5.346 billion, ranking 4th globally. It surpasses:

- Base ($2.87B, ranked 6th)

- Arbitrum ($2.46B, ranked 8th)

- Sui ($1.17B, ranked 9th)

Source: CoinGecko

24-hour DEX volume on BNB Chain

BNB Chain’s dominance in DEX volume highlights its role as the leading decentralized trading hub, driving demand for BNB in transaction fees.

- According to CoinGecko, BNB Chain currently holds a TVL of $5.339 billion, ranking 4th globally. It surpasses:

- Base ($3.042B, ranked 6th)

- Arbitrum ($2.509B, ranked 8th)

- Sui ($1.152B, ranked 9th)

Source: Defillama

- 24-hour DEX volume on BNB Chain:

- $2.586 billion (highest among all blockchains)

- Compared to:

- Ethereum: $1.348 billion

- Base: $426.26 million

- Arbitrum: $385.81 million

- Sui: $159.94 million

Source: Defillama

BNB Chain’s dominance in DEX volume highlights its role as the leading decentralized trading hub, driving demand for BNB in transaction fees.

Memecoin and Low-Cap Token Activity

- Memecoin activity on BNB Chain is booming, with tokens like:

- $TUT surging 5x after being mentioned by CZ in a video.

This 7 minute video from a year ago should be one prompt to an AI bot now. I think there are a couple of them already on BNB chain. Let’s see some videos of those? https://t.co/YOHQmmEnDi

— CZ 🔶 BNB (@cz_binance) March 17, 2025

- Other active tokens: $CHEEMS, $TST, $BMT, $SHELL.

- $TUT surging 5x after being mentioned by CZ in a video.

- Memecoins have historically driven trading waves, as seen on Solana and Sui.

- Their presence on BNB Chain brings liquidity and new users, indirectly supporting BNB.

- The decline of Pump.fun creates an opportunity for Four.meme, which is gaining strong community traction and fueling further BNB Chain activity.

Binance’s Actions and CZ’s Influence

- Binance has listed tokens from Binance Alpha and conducted TGE for $BMT and $SHELL, attracting investors and projects into the ecosystem.

- CZ has influenced the market through:

- Test trades with $TST.

- Promoting $MUBARAK on Binance Square.

These actions drive trading volume, increase market attention, and enhance BNB Chain’s ecosystem, supporting BNB price growth.

Network Upgrades and Growth Potential

- Upcoming hard forks will improve network efficiency:

- Pascal (March 2025), Lorentz (April 2025), Maxwell.

- Benefits include reduced block time, higher TPS, and lower fees. (Source: X post by BNB Chain)

These upgrades will attract more developers and users, increasing demand for BNB while enhancing competitiveness against Ethereum and Solana.

Recent Price Performance and Market Comparison

- BNB 24-hour performance:

- +1.84% increase

- 38.70% rise in trading volume

- Comparison with major assets:

- Bitcoin: -0.12% (Price: ~$83,696)

- Ethereum: +1.73% (Price: ~$1,925)

- 30-day performance:

- BNB: -8%, yet still demonstrates relative strength compared to Bitcoin and Ethereum, reflecting investor confidence.

Despite short-term fluctuations, BNB continues to be a preferred asset, maintaining resilience in the crypto market.

Comparison Table of Key Metrics

Below is a comparison table of key metrics between BNB Chain and other blockchains:

Overview of the BNB Chart

Recent Price Trend Analysis:

CoinGecko currently ranks BNB 5th by market capitalization. As of March 18, 2025, BNB is trading at approximately $629.95, with a market cap of around $91,816,295,746 and a 24-hour trading volume of $1,769,078,204. This price reflects a healthy level of liquidity and trader interest.

Historically, BNB has seen significant price volatility:

- All-Time High: $788.84, indicating its peak performance.

- All-Time Low: $0.03982, marking its starting point.

- Current Position: Trading 20.40% below its all-time high but substantially above its all-time low, suggesting a strong recovery from its early days, though it has yet to reclaim its previous peak.

The chart reflects a coin that has experienced both sharp rallies and corrections, with its price movements closely tied to the success of the Binance ecosystem and broader cryptocurrency market trends.

Technical Analysis: BNB Price Action

Source: TradingView

Source: TradingView

- BNB price is currently consolidating within a Wyckoff accumulation range, signaling potential breakout opportunities.

- Short-term entry is identified at $618.xx, but NFTevening does not recommend trading at this level due to potential volatility.

- Preferred medium-term entry is at $500 – $501.9, offering a better risk-to-reward ratio.

- Key price levels to monitor:

Conclusion

BNB continues to solidify its position as a leading asset in the crypto ecosystem, backed by strong market fundamentals and technical resilience. The chain’s dominance in DEX volume, increasing TVL, and expanding ecosystem provide a strong foundation for long-term growth. Additionally, Binance’s ongoing development efforts, including network upgrades and new project listings, further reinforce its adoption.

From a technical perspective, BNB’s current consolidation within a Wyckoff accumulation pattern presents both short-term and medium-term trading opportunities.