Exploring the Mechanism Advantages and 5 Disadvantages of DeFi Platform Infinex

As a portfolio management platform, Infinex aims to achieve the security and usability of CEX and on-chain wallets.

Author: c4lvin , ChainLight Analyst

Compiled by: Felix, PANews

Perhaps most people learned about Infinex through the Kaito Connect poll. It has been nearly a month since the Infinex dashboard was added to Kaito AI, and I haven’t seen many research articles about Infinex. This article aims to analyze the structure of Infinex and its project vision.

What is Infinex ?

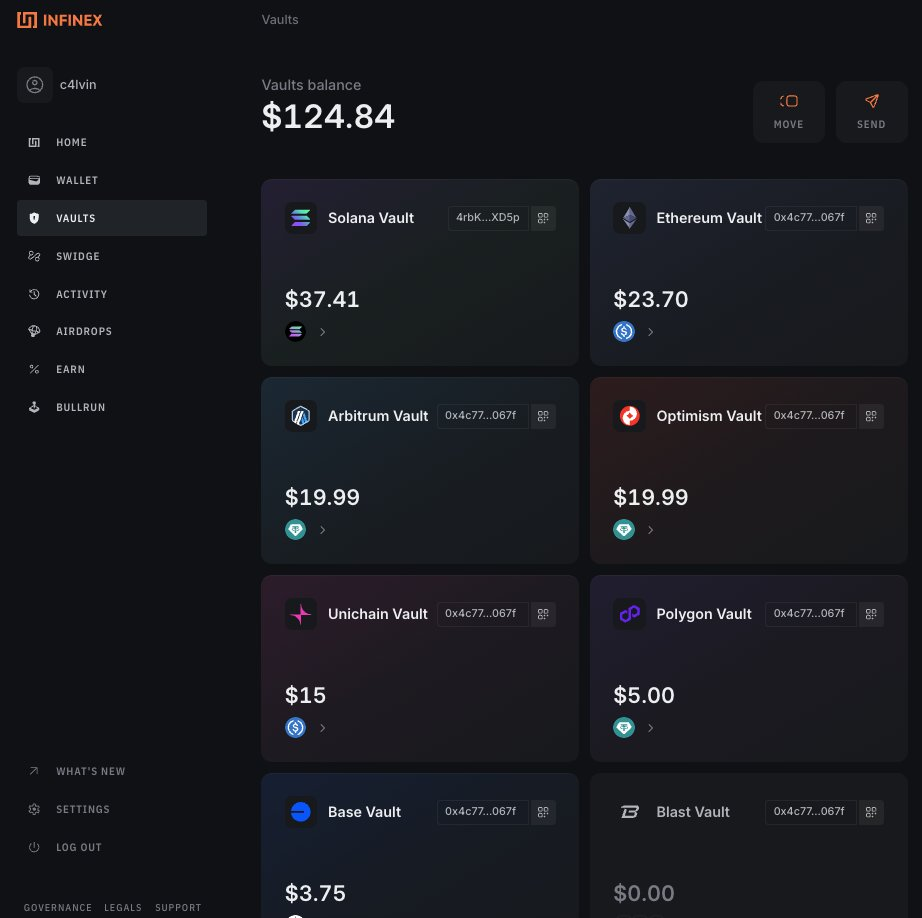

Infinex is a wallet (or portfolio management) platform that aims to provide excellent user experience (UX) and focuses on achieving seamless cross-chain in various computing environments, but the number of chains supported is not very large at present. For EVM chains, Ethereum, Arbitrum, Optimism, Polygon, Unichain, Base, Blast and Berachain are supported, while for non-EVM chains, only Solana is currently supported.

Infinex can be roughly divided into two parts: Wallet and Vault. Wallet is often referred to as a one-time wallet “Burner Wallet”. (Note: Burner wallets are only used to store enough cryptocurrency for one or a few interactions, i.e. a temporary place for liquid funds). On the other hand, Vault can be considered a wallet where funds can be passively deposited without the need for operations such as exchange.

Infinex is implemented as a web application and is optimized for the PC environment. As can be seen from the menu on the left side of the screenshot, in addition to basic wallet functions such as wallet, vault, and activities (such as trading), it also includes Swidge (multi-chain exchange), separate airdrops for Infinex users, and Earn functions for checking deposit points/interest.

Why choose Infinex ?

If you look at Infinex as a wallet property, it’s hard to find standout features compared to other wallets. Multi-chain wallets like Phantom and OKX Wallet are considered very useful for both EVM and non-EVM chains, and they already come equipped with airdrop checkers, Earn checkers, and multi-chain swap features. CEXs like Binance and Bybit also offer these features, as well as additional benefits like separate Earn plans. So, what advantages does using Infinex actually provide?

Security

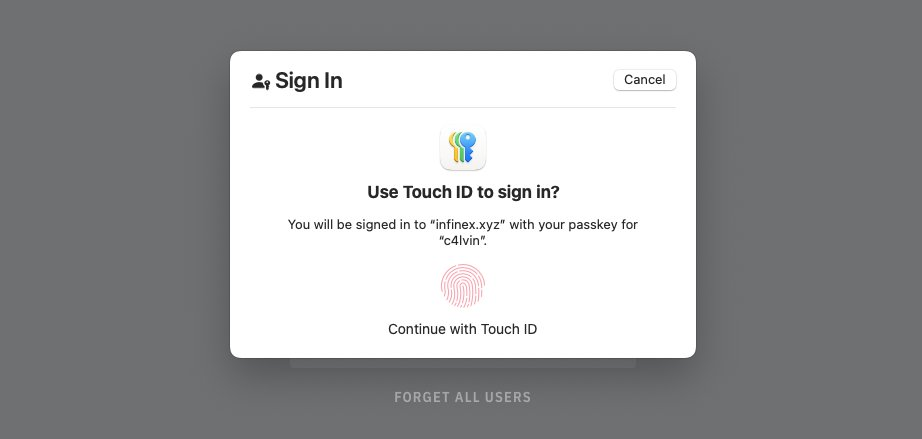

For users who rely on CEXs as a liquidity hub, it is not uncommon to have their funds stolen due to SIM swap attacks or email hacks. Similarly, for on-chain non-custodial wallets, there have been many wallets stolen due to mnemonic/private key leaks. Infinex appears to have invested a lot of effort in its structure to reduce these risks. By limiting logins to keys, it brings wallet security to the same level as the security of user biometric data and physical devices. As shown in the screenshot below, attempting to log in on a Mac prompts a Touch ID request. On top of that, it supports 2FA through authenticator apps, which makes it difficult for attackers to gain control.

Additionally, Vaults can be restored via Smart Accounts.

Since Vault is implemented through custom smart accounts, it can be recovered through pre-registered on-chain addresses and emails. Each Vault is initially deployed on Base and Solana. For example:

https://basescan.org/address/0x4c77dD4e616FaDF448a8D3F22D5FeC81402A067f

https://solscan.io/account/4rbKc2pMpQeFw1QupJ8f7VRJda9WkFmRsqFmBC8DXD5p

For other chains, when your Vault needs to be traded or restored, it will be deployed to the requested chain. For restores, it will not be directly displayed in the dashboard, but the team will provide a link with an interface to do this, or by user request to go directly to the chain. Compared with CEX and other non-custodial wallets, it provides better security from the user perspective.

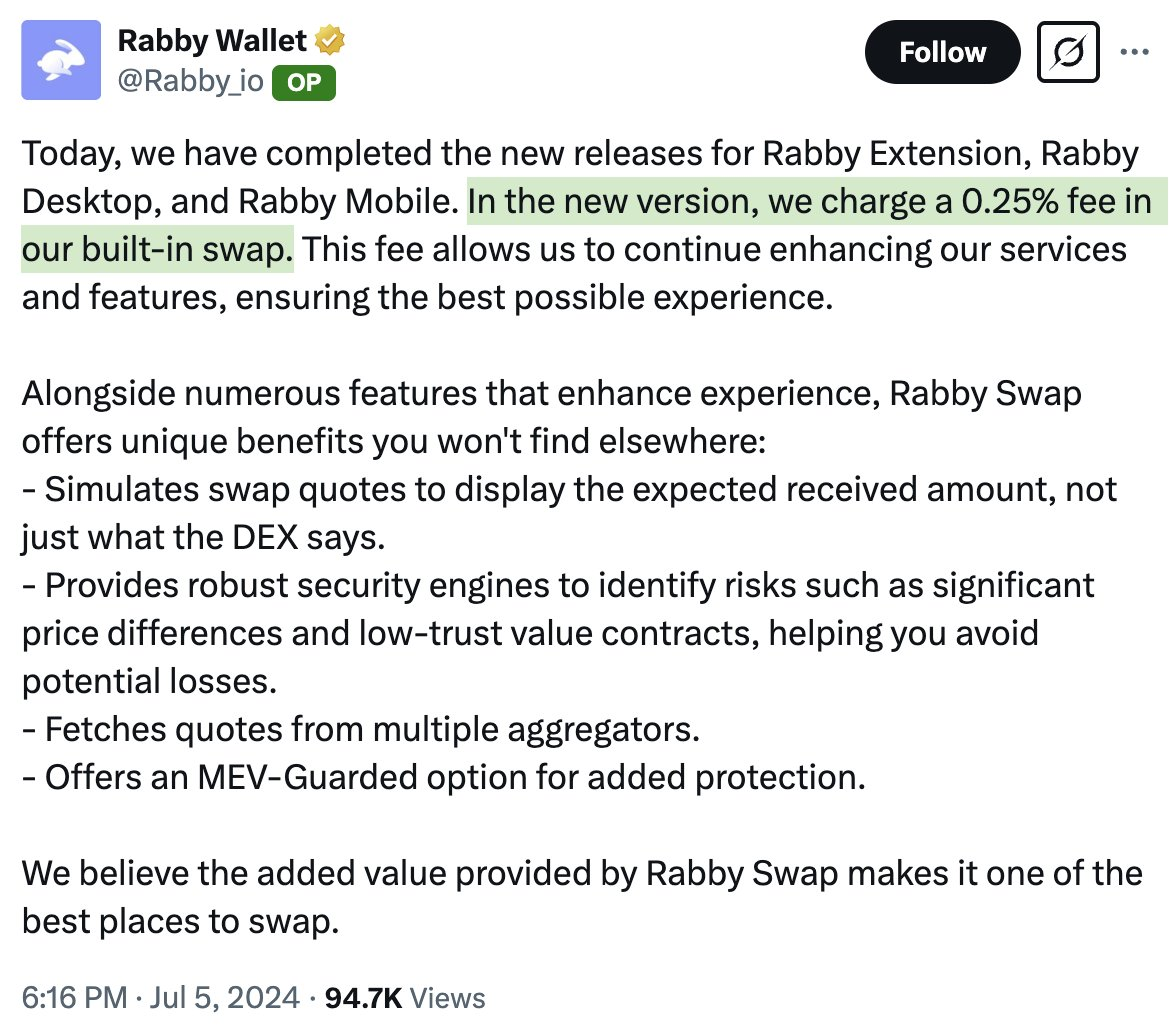

No transaction fees

Some people may not know that using the built-in Swap/Bridge function in an on-chain wallet usually requires high fees. For example, Metamask charges 0.875%, Phantom charges 0.85%, and Rabby charges 0.25% in its built-in Swap/Bridge function. However, Infinex does not charge fees for Swap/Bridge, making it as attractive as depositing funds into a CEX or using a wallet supported by a CEX.

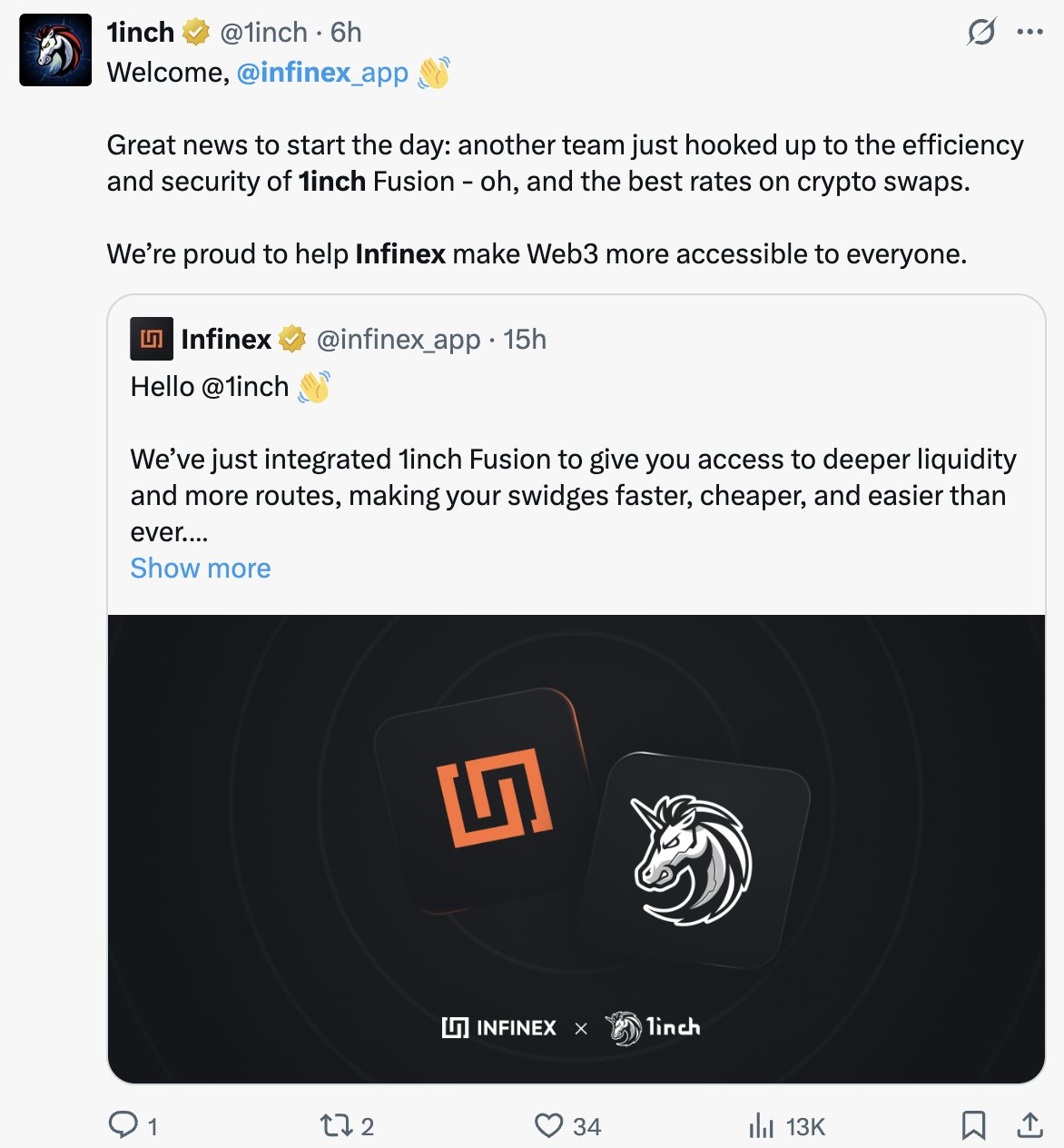

Infinex seems to be positioning its Swidge (Swap + Bridge) functionality as a major highlight. To this end, it recently integrated 1inch Fusion as an aggregator, demonstrating its commitment to providing users with the best Swidge experience.

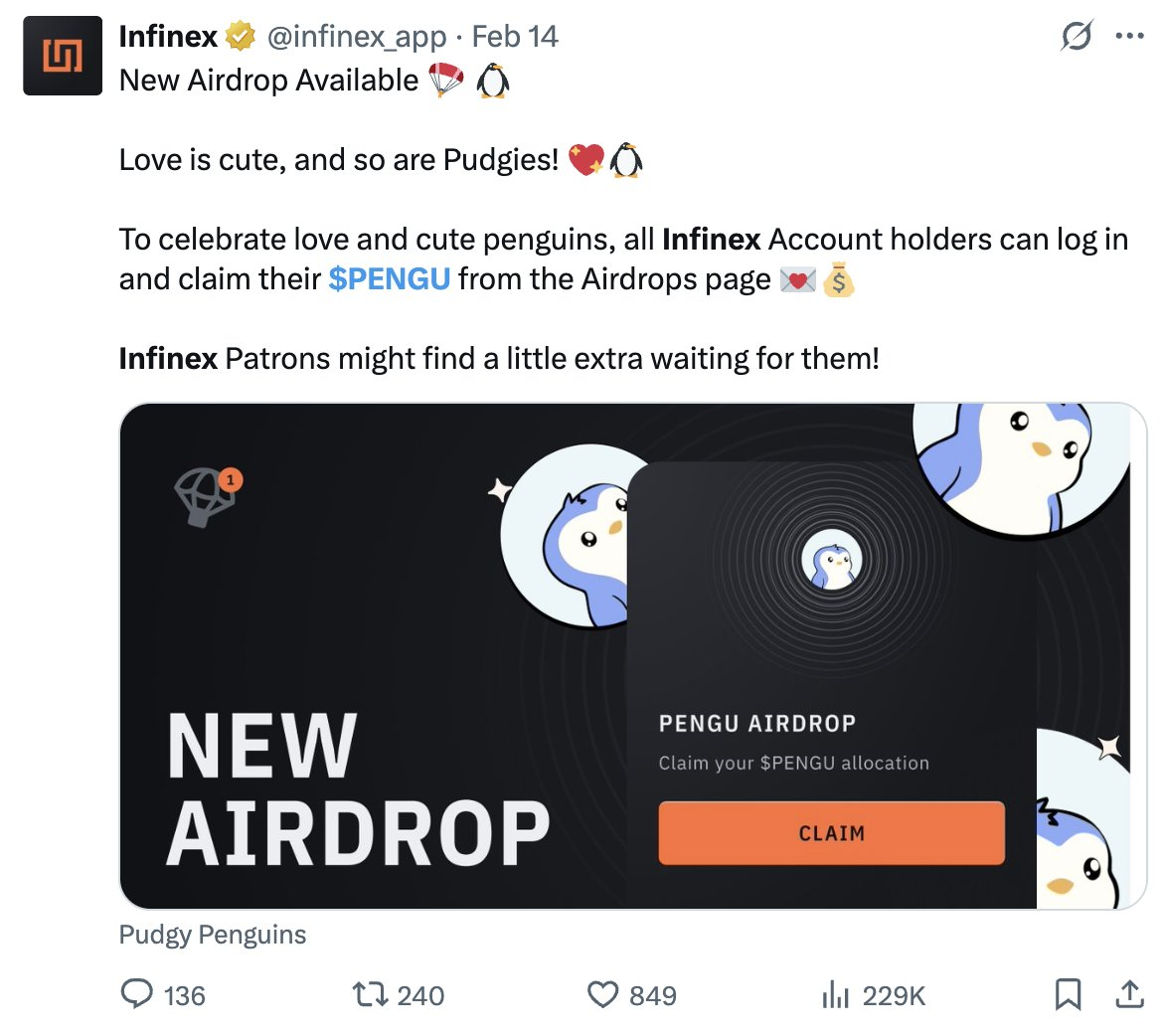

Provide passive airdrops for users

Getting airdrops is perhaps one of the most important reasons to use Infinex. Infinex recently airdropped $PENGU tokens to all users, and given how actively it is integrating with the ecosystem, more passive airdrops are very likely to occur in the future.

It is worth noting that Infinex’s vision is to achieve and replace the user experience provided by CEX. As shown in the tweet below, the Infinex team constantly compares the platform’s user experience with that of CEX, emphasizing its advantages.

Besides simple deposits, why deposit funds into CEX? Perhaps mainly because CEX has Earn programs like Launchpool and Launchpad – deposit stablecoins or specific tokens to get newly listed tokens. This can be said to be the key to using CEX.

Since Infinex has advantages that are “better” than CEX, Infinex may also launch similar or even better airdrop or Earn programs. This is something that requires long-term attention, and it would be great if the official team could provide some information on this.

Improvement Suggestions

After using Infinex for a short time, I noticed that there are still several areas that need improvement:

More chains should be supported

The number of supported chains is still very limited. Especially as new L1 chains are launched more and more frequently, rapid integration with various L1 and non-EVM chains beyond EVM L2s seems necessary. Support for DeFi-focused chains like Sui and Mantle may help to quickly increase users. In addition, support for Bitcoin and Ordinals should also be added.

Should support whitelisted addresses

There is a “Move” function in Wallet/Vault, which is a separate function that supports asset transfers between Wallet and Vault. But whitelist transfers should also be supported in “send”, not only for Wallet <-> Vault interactions, but also for other known wallets owned by the user.

Swidge User Experience

Currently, Swidge only supports exchanges between addresses in the user’s wallet, and does not allow the recipient’s address to be specified. The ability to specify the recipient’s address in cross-chain transactions is a powerful feature, and its absence will cause inconvenience in transferring funds from wallets to Vault.

Lack of incentives

As mentioned above, Infinex may soon offer an attractive Earn plan, but currently, the incentive plan does not fully match its usability. Although the official team is investing a lot of effort to attract users, I hope Infinex can provide users with a more attractive environment as soon as possible.

Limited availability

Infinex still lacks the versatility to fully replace on-chain wallets. For example, it cannot be used with external web services through the WalletConnect API, which limits its practicality. A proposal for this issue was made in June 2024, but it still seems to be unresolved due to some issues.

in conclusion

Infinex is a new integrated portfolio management platform that aims to achieve the security and usability of CEX and on-chain wallets. Since the project is still in its early stages, it has some shortcomings in community building and user experience, but it is still a potential project worthy of attention.

Related reading: BTC wallet battle: From the competition for a trillion-dollar market to ecological reconstruction, who will dominate the next decade?

Author :Felix

This article reflects the opinions of PANews’s columnist and does not represent the stance of PANews. PANews does not assume legal responsibility. The article and opinions do not constitute investment advice.

Image Source :

Felix

If there is any infringement, please contact the author to remove it.