Dogecoin’s new address surge – Will it trigger a price rally?

- Dogecoin’s network saw a sharp increase in new addresses, hinting at rising adoption and speculative interest.

- Despite address growth, DOGE’s price remains under pressure. Will this on-chain activity fuel a bullish breakout?

Dogecoin [DOGE] has seen major movements in one of its key on-chain metrics, New Addresses. The number has jumped to levels last seen in the previous year.

The move is also coming at a time when the price is struggling to reclaim key levels. What signal is the current trend showing?

A massive spike in new Dogecoin addresses

Dogecoin has experienced a significant increase in new wallet addresses, with the latest data showing a surge to nearly 200,000 new addresses in a single day.

This is a substantial jump compared to the relatively steady growth seen throughout the past few months.

Historically, such a rise in new addresses signals increased retail interest and potential incoming liquidity.

AMBCrypto’s analysis of the chart showed that the last time there was a similar surge was around November-December in the previous year. The surge at this time was around 1 million.

However, whether this will translate into sustained price growth remains uncertain.

Dogecoin’s price reaction to the surge

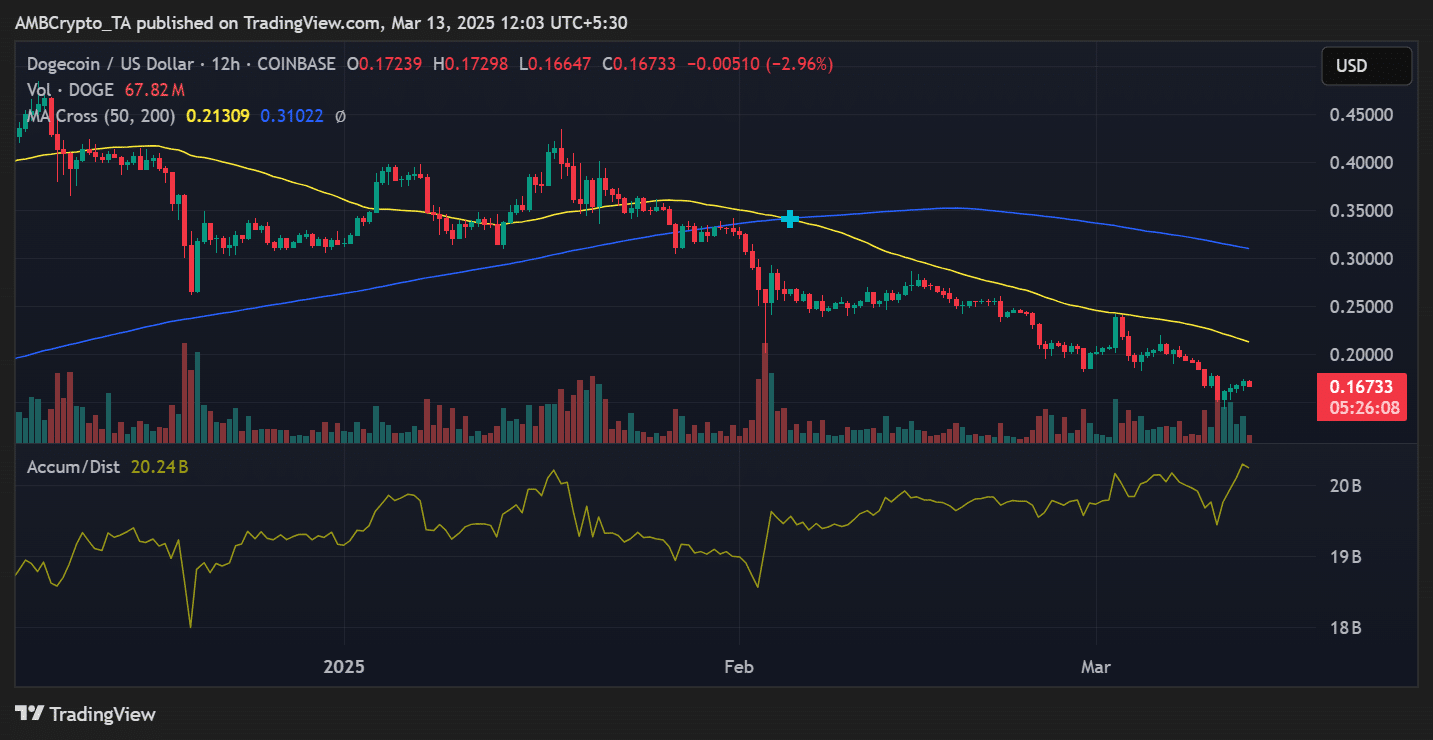

Despite the spike in new addresses, Dogecoin’s price has not reflected the same level of bullish enthusiasm. DOGE was trading at $0.167 as of this writing, marking a 2.96% decline in the last 24 hours.

The 50-day and 200-day moving averages remained above the current price, indicating that DOGE was still in a bearish trend.

However, there were signs of accumulation, as shown by the Accumulation/Distribution [A/D] indicator, which was trending upward as of press time.

What the address growth could mean

The increase in new DOGE addresses raises speculation about what is fueling the trend. Historically, a surge in new wallet addresses has correlated with speculative hype or anticipation of a major event.

While some traders see this as a bullish signal, it is essential to confirm whether these addresses belong to long-term holders or short-term speculators.

If the latter, it could result in price volatility rather than sustainable growth.

Is DOGE preparing for a reversal?

Although DOGE’s price has struggled to break above resistance levels, the influx of new addresses could hint at upcoming momentum.

If buying pressure continues to increase, DOGE may attempt to reclaim the $0.20 level, with further resistance near $0.25.

On the downside, failing to sustain the recent demand could push the price toward $0.15 or lower.

The surge in new addresses presents an intriguing development for Dogecoin. While this metric often precedes price action, other indicators suggest that caution is still warranted.

Traders should watch for confirmation in volume and price trends before assuming a breakout is imminent. If the momentum holds, DOGE may be gearing up for a much-needed reversal.