Bitlayer Expands Bitcoin Utility Through Blockchain Partnerships

Bitlayer, recognized as the first Bitcoin-centric layer-2 network, has unveiled a series of strategic partnerships aimed at expanding Bitcoin’s role beyond being a mere store of value. The announcement, made at ETH Denver 2025, highlighted collaborations with five prominent blockchain networks—Arbitrum, Starknet, Base, SonicSVM, and Plume Network. This initiative seeks to leverage Bitlayer’s BitVM technology to integrate Bitcoin with these ecosystems, effectively unlocking Bitcoin’s $1.9 trillion liquidity potential.

The newly formed alliances are expected to facilitate the adoption of Bitcoin-powered smart contracts, interoperability, and decentralized finance (DeFi), bringing functionalities similar to those seen on Ethereum. Traditionally, Bitcoin has maintained its position as the most decentralized and secure blockchain; however, its constrained scripting capabilities have hindered the development of sophisticated smart contracts. To address this limitation, Bitlayer has introduced the BitVM Bridge, an off-chain computation framework designed to enable Turing-complete smart contracts without necessitating changes to Bitcoin’s core protocol.

BitVM Bridge: Enabling Secure Bitcoin Transfers

The BitVM Bridge, a pivotal component of these partnerships, functions as a trust-minimized Bitcoin bridge that operates on the innovative BitVM smart contract framework. This technology ensures the seamless and secure transfer of Bitcoin (BTC) across different blockchain networks, granting BTC holders direct access to DeFi applications without the need for centralized intermediaries. By utilizing off-chain computation and fraud-proof mechanisms, the BitVM framework facilitates the development of Ethereum-like decentralized applications (dApps) on Bitcoin while maintaining security and efficiency.

Each blockchain partner plays a distinct role in advancing Bitcoin’s integration into the Web3 ecosystem. The integration with Base will enable BTC holders to utilize their assets across Ethereum Virtual Machine (EVM)-compatible chains, enhancing Bitcoin’s liquidity within DeFi platforms. Arbitrum, a leading Ethereum layer-2 network, will provide scalability and high-speed execution for BitVM-powered smart contracts and yBTC DeFi applications. Users on Arbitrum will be able to bridge assets between Bitcoin and Arbitrum through the BitVM Bridge, expanding opportunities within its DeFi ecosystem.

☑️ Bitlayer BitVM trust-minimized bridge

☑️ Yield-bearing BTC

☑️ Major chain integrationsWe’re teaming up with @arbitrum, @Starknet, @base, @SonicSVM, and @plumenetwork to bring BitVM and yBTC to major blockchain networks! pic.twitter.com/0fJrRQaXVT

— Bitlayer BitVM (@BitlayerLabs) March 1, 2025

Starknet’s involvement will allow Bitcoin users to execute transactions instantly with minimal fees while leveraging STARK proofs for enhanced security. The integration with SonicSVM, the first Solana Virtual Machine (SVM) chain, will facilitate Bitcoin’s liquidity within Web3 applications, including gaming and social media platforms. Meanwhile, the collaboration with Plume Network, a layer-1 blockchain focused on real-world assets (RWA), is designed to unlock Bitcoin’s liquidity for institutional financial products. This partnership will enable the seamless flow of native BTC into its ecosystem, allowing access to real-yield opportunities and RWA staking, bridging blockchain technology with traditional finance.

Expanding Bitcoin’s Utility Through yBTC

A crucial component of this initiative is the integration of yBTC (Yield Bitcoin), a wrapped Bitcoin asset that enables BTC holders to participate in DeFi applications, lending protocols, and yield-generating activities while maintaining exposure to Bitcoin’s value. With the introduction of yBTC across multiple blockchain networks, Bitcoin holders will be able to engage in lending, staking, and liquidity provision without relying on centralized intermediaries. This expansion is expected to increase Bitcoin’s utility and enhance liquidity across the DeFi landscape.

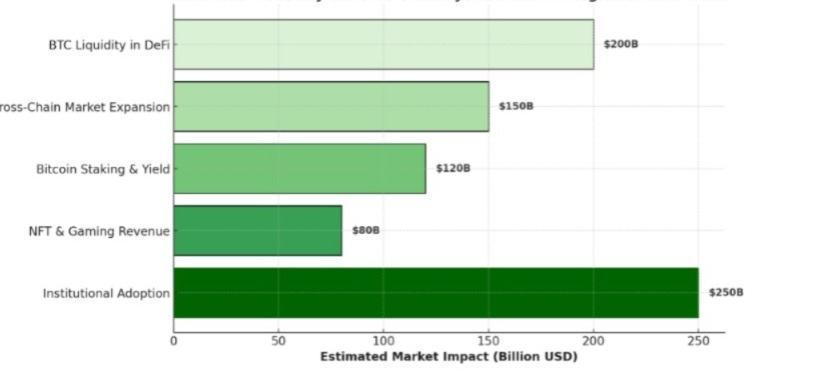

By establishing these partnerships, Bitlayer and its blockchain collaborators aim to unlock new use cases for Bitcoin while transforming it into an actively utilized asset. Given that over $1 trillion in Bitcoin remains idle in wallets, these efforts are poised to transition Bitcoin from a passive store of value to an integral component of the decentralized financial ecosystem.