Bitcoin’s recovery: Is the White House Crypto Summit driving BTC ahead?

- Bitcoin forms a weekend CME gap, fueling speculation about potential post-summit volatility and regulatory outcomes.

- Regulatory clarity on stablecoins or Bitcoin reserves could spur bullish momentum, bridging key resistance near $87,000.

Recent weeks have seen Bitcoin [BTC] lose steam heading into weekends, but this time around, Bitcoin carried Friday’s momentum well into Saturday.

Crypto analyst Daan Crypto Trades highlighted an unusual move in Bitcoin’s price action that could impact the upcoming trading week.

It indicated a potential gap forming between Bitcoin’s Friday CME close of $84,258 and its current price, at the press time around $86,000—a roughly 2% increase over the weekend.

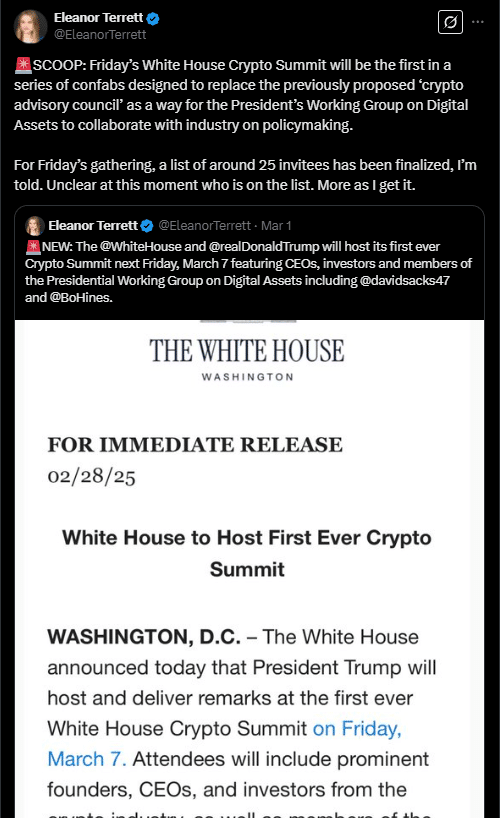

This shift comes just days before the first-ever White House Crypto Summit, set for the 7th of March, where President Donald Trump will host top crypto leaders and policymakers to discuss stablecoin regulation, Bitcoin reserves, and digital asset oversight.

While markets are always looking for catalysts, the question remains whether this event truly shapes Bitcoin’s trajectory, or is it just another policy meeting with little immediate impact?

Stablecoin & Bitcoin Reserve regulation take center stage

Although specific details about the summit’s agenda remain scarce, stablecoin regulation and a potential U.S. Bitcoin reserve are key policy themes.

According to Fox Business journalist Eleanor Terrett, the summit will not be a one-time event. Instead, it is the first in a series of meetings to replace the proposed ‘crypto advisory council’.

The White House event follows a call from Jeremy Allaire, CEO of Circle, who recently argued that stablecoin issuers should be required to register in the U.S.

His remarks came as Senator Bill Hagerty introduced legislation aimed at regulating stablecoins. A move that could have significant implications for USDT and USDC dominance in global markets.

Additionally, Paolo Ardoino, CEO of Tether, tweeted cryptically,

“Excited for next week. Something is about to change.”

Stablecoins are already central to Brazil’s crypto economy. Central Bank President Gabriel Galipolo states that 90% of the country’s crypto transactions involve stablecoins.

If the U.S. moves to tighten oversight, the market could see a shift in liquidity flows, especially as Tether (USDT) continues to dominate stablecoin volumes worldwide.

Meanwhile, the idea of a Bitcoin reserve is gaining traction at the state level. According to Miles Deutscher, 18 U.S. states are actively working on Bitcoin reserve proposals, with 13 already under legislative review.

The summit could signal whether the federal government will embrace similar policies—or leave Bitcoin adoption to state lawmakers.

Market speculation builds ahead of summit

Bitcoin’s price action leading into the event has been volatile.

From the 25th to the 27th of February, Bitcoin plummeted from a high of approximately $86,000 to a low of $78,000, representing a substantial 9.3% drop in just 48 hours.

This sudden downturn sparked concerns among investors and triggered a wave of selling pressure. However, the bearish sentiment was short-lived.

On the 28th of February, Bitcoin staged a remarkable comeback, surging from its $78,000 low back to the $86,000 range—a staggering 10.3% recovery in a single day.

As the calendar turned to March, Bitcoin entered a consolidation phase, trading in a narrower range between $84,000 and $86,000.

This period of relative calm saw trading volumes return to more normal levels, about 30-40% lower than during the volatile days of late February.

Now, with CME gaps forming and uncertainty over regulatory clarity, the market could react sharply depending on the summit’s outcomes.

If clearer stablecoin guidelines emerge or if the U.S. signals openness to Bitcoin reserves, sentiment could shift bullish.

Conversely, a lack of substantive action may reinforce the idea that markets move on real policy changes—not political meetings.

What’s next for Bitcoin?

Bitcoin traders now face two key scenarios. If momentum sustains, Bitcoin could break above $87,000, a key resistance level that has capped recent rallies.

A decisive move beyond this threshold could trigger further upside, potentially setting the stage for an extended rally as traders anticipate continued bullish momentum.

On the other hand, if market sentiment weakens, Bitcoin may struggle to maintain its current levels.

A failure to hold above $86,000 could increase the likelihood of a pullback toward the CME gap at $84,258, a level that traders often watch for retracements.

The crypto market is no stranger to hyped political events that fail to translate into immediate price action.

However, with Trump’s pro-crypto stance, state-led Bitcoin adoption, and ongoing regulatory shifts, this summit could mark the beginning of a broader policy shift that plays out in the months ahead.