Introduction

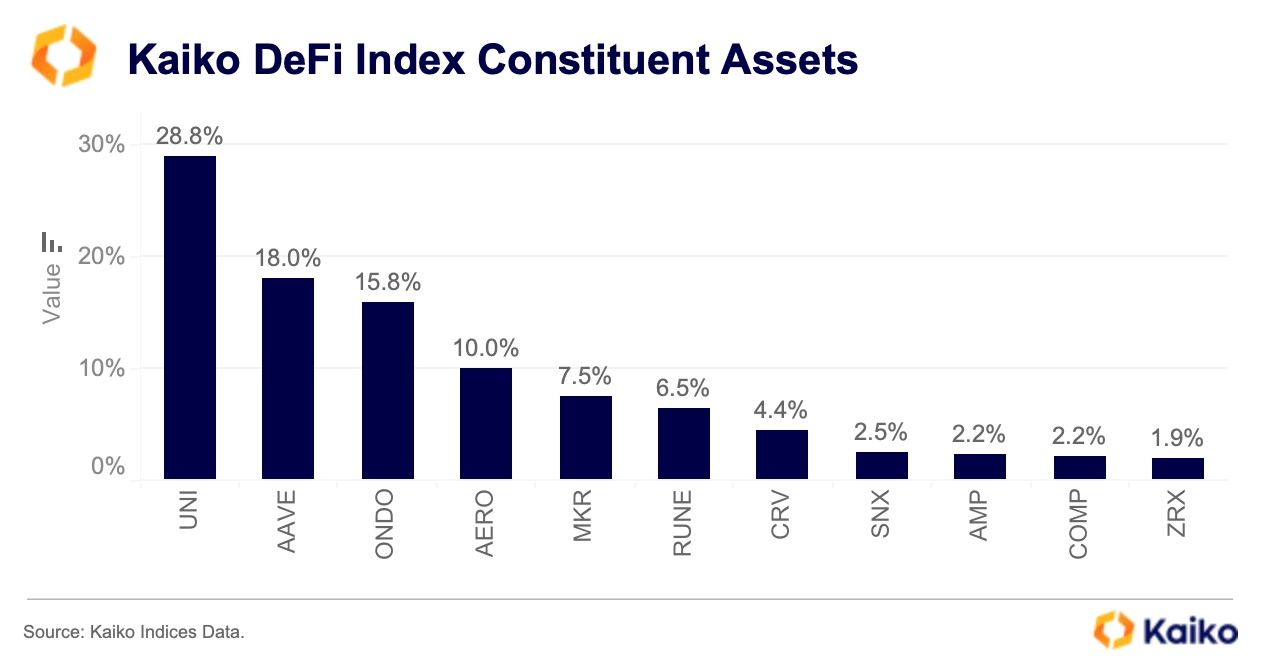

The Kaiko DeFi Index (KSDEFI) consists of 11 different digital assets. The index includes projects from across the sector, covering decentralized exchanges, tokenization, lending and borrowing, and other key components of DeFi.

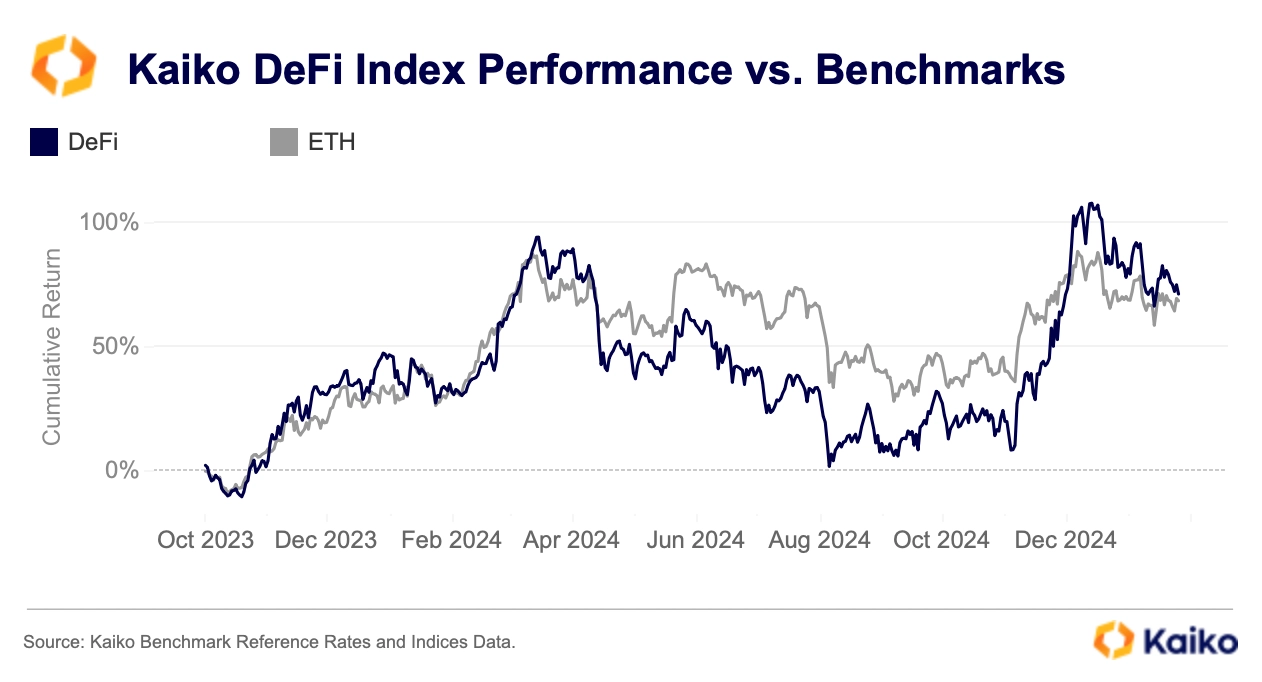

This index allows investors to track the sector’s growth over time. In this report, we analyze the index’s constituents, investment thesis, diversification benefits, and historical returns.

Although most protocols and projects in the index are built on Ethereum, its returns are not solely dependent on Ethereum’s performance.

Catalysts for growth

Any continued outperformance for the Kaiko DeFi index will be tied to individual catalysts for constituent assets. Projects that could drive returns in 2025 include UNI, AAVE, AERO, and ONDO. While these are some of the most likely to benefit from strong investment narratives in 2025, growth shouldn’t be limited to these four assets.

Learn more about these catalysts and explore the full report below.