Bitcoin price dropping amid talks of largescale Texas investment

Most meme coins not under SEC jurisdiction: Peirce

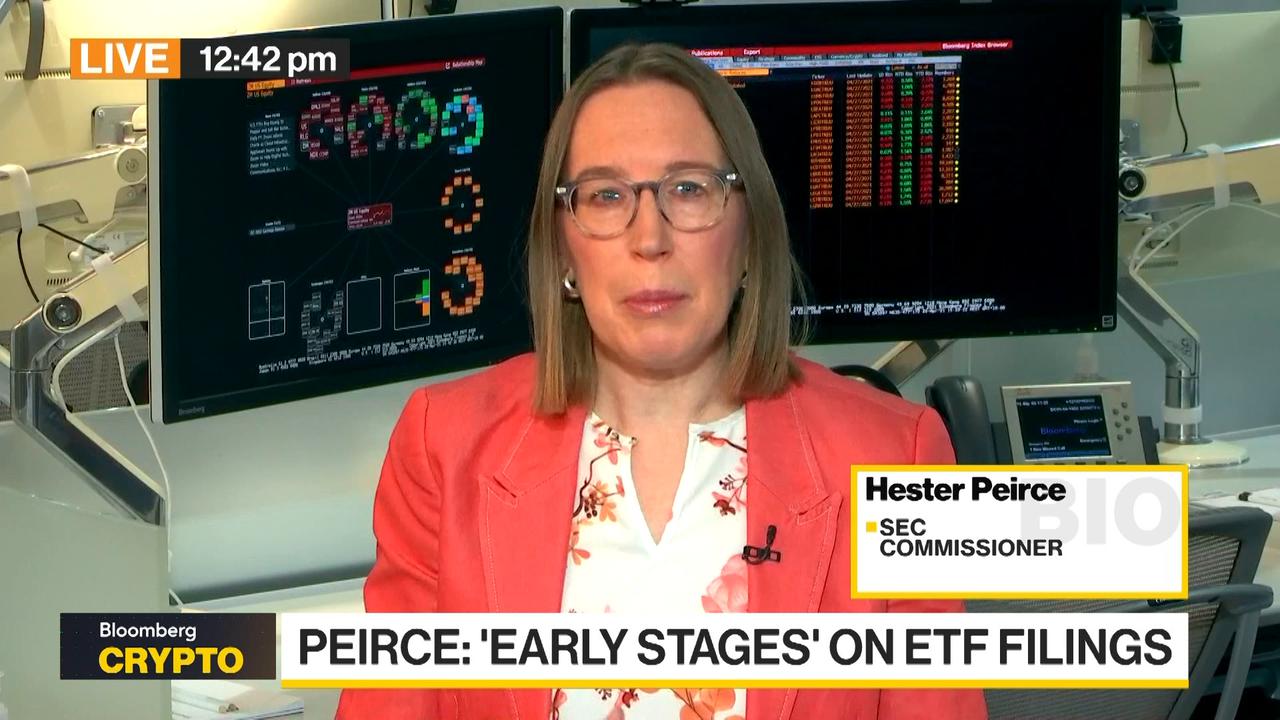

Head of the SEC Crypto Task Force and SEC Commissioner Hester Peirce gives her take on meme coins and says the SEC will look at the facts and circumstances, but says most meme coins probably don’t have a home in the current set of regulations.

Bloomberg

This story has been updated to add video.

A groundhog somewhere might just be indicating an elongated Bitcoin winter as the fortunes of the online currency continue to trend downward after a triumphant moment after the presidential election.

While the current downturn is far from the infamous Crypto Winter of 2022, the price of Bitcoin is down another five percent today as it struggles to rally. This downturn is only an exaggerated microcosm of how bitcoin has been trading in the last month.

In that timeframe, the coin, which is the poster child for cryptocurrency, has plunged more than 16% and is now priced at 87,234 USD per coin. While this number is still very impressive for the space it is a far cry from the 106,490 USD peak that the coin experienced in December of last year.

Why is the price of Bitcoin dropping?

The recent drop in the price of Bitcoin can be attributed to two main factors. First, its peak of over $100,000 in December led investors to fear overinflation, especially after the significant drop in 2022. This prompted some investors to cash out and sell for profit.

Second, floundering stocks have been a trend this week, with market favorites like Walmart, Tesla, Nvidia, and Palantir all experiencing drops amid fears of economic uncertainty.

These fears can be traced back to widespread tariffs, threats of tariffs, geopolitical tensions and cuts in federal spending.

Idea for Texas Bitcoin reserve has already been proposed

During the campaign trail and early into his second administration, marked by strategic chaos, Donald Trump floated the idea of a U.S. cryptocurrency stockpile. As a recent ally of the crypto industry, Trump has already ordered the creation of a crypto task force to explore new regulations and envision what a U.S. cryptocurrency stockpile would entail.

Since then, two Texas bills filed this session have sought to lead the conversation surrounding the establishment of a strategic Bitcoin reserve for the state.

The two bills, one filed by state Rep. Giovanni Capriglione, R-Southlake, and the other by Sen. Charles Schwertner, R-Georgetown, seek to establish a strategic reserve for the cryptocurrency in the state, allowing corporations and individuals to donate or use Bitcoin as a form of payment.

If the bills were to come to fruition, this would not result in the state outright buying Bitcoin using taxpayer funds. Rather, they would create the reserve to be used in emergency situations, for government philanthropic spending and more at the discretion of the Legislature and comptroller.

“The beauty of a Texas strategic Bitcoin reserve (through these bills) is it’s primarily driven by donations, and there’s really no risk to the Texas taxpayer. It’s only a net positive,” said Lee Bratcher, founder and president of Texas Blockchain Council told the American-Statesman in a previous report.

Karoline Leonard contributed to this report

Beck Andrew Salgado covers trending topics in the Austin business ecosystem for the American-Statesman. To share additional tips or insights with Salgado, email Bsalgado@gannett.com.