Winners and Losers in a Fractured Market Week

- Story (IP) surged 205% after breaking $2.50 resistance, triggering a short squeeze fueled by $18M daily DEX volumes and whale accumulation.

- Raydium (RAY) fell 16% post-exploit, with a death cross signaling bear control as volumes dropped 44% and open interest declined $2.1M.

The crypto market closed the week with sharp divergences: niche altcoins posted explosive rallies, while tokens in established ecosystems faced aggressive corrections. Story (IP), Sonic (S), and Maker (MKR) led gains, contrasting with steep declines for Raydium (RAY), Jupiter (JUP), and meme token Official Trump (TRUMP). Price swings aligned with capital rotations, liquidity events, and on-chain metrics.

Story (IP) surged 205% after breaking a four-month accumulation pattern on daily charts. The token, tied to decentralized storytelling platforms, triggered a short squeeze on February 20 by breaching resistance at $2.50.

Spot volumes on decentralized exchanges (DEXs) hit $18 million daily, per Santiment data, while whale addresses increased holdings by 32%. Technical analysis suggests a $6.40 target if support holds at $4.20, where aggressive buy orders appeared on Binance’s order books.

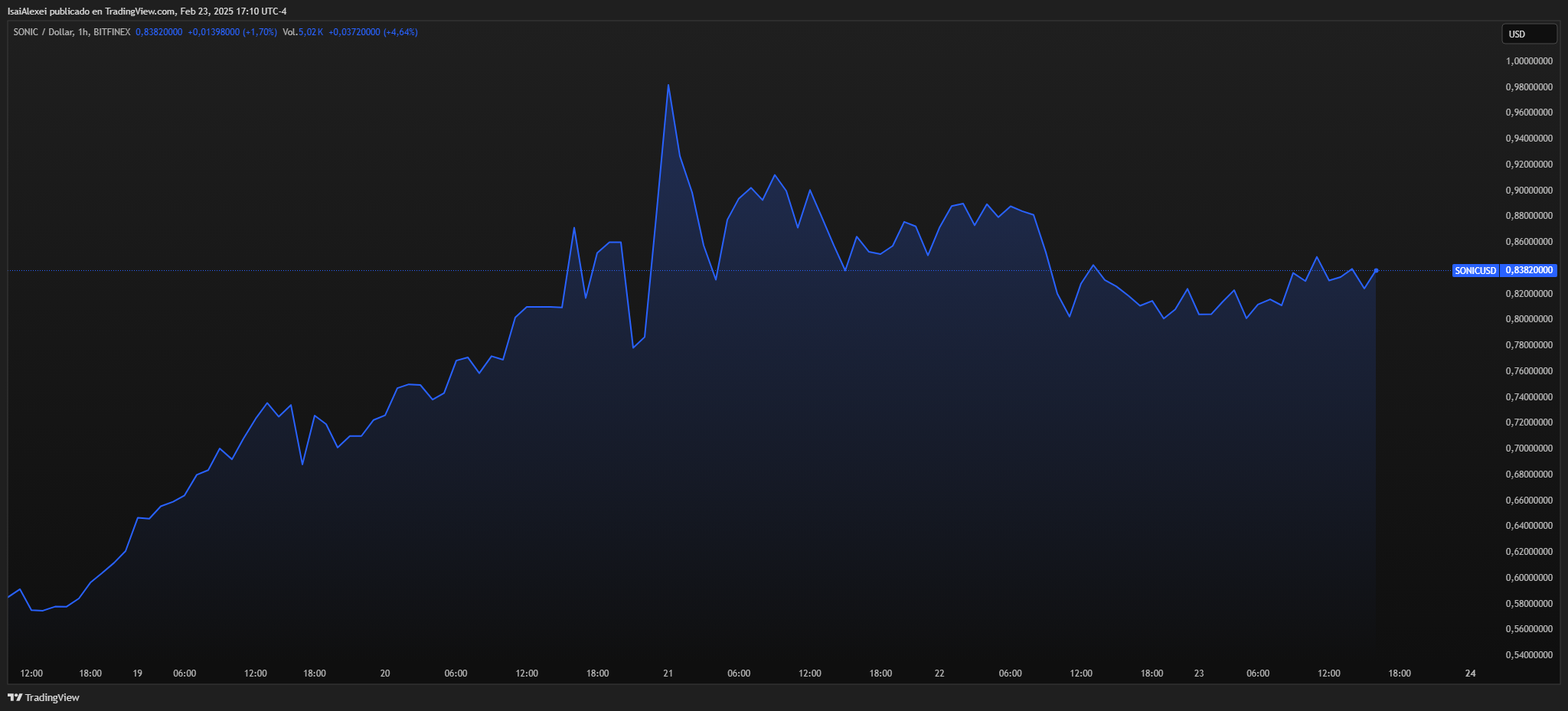

Sonic (S), rebranded from Fantom (FTM), climbed 60% after integrating with liquidity providers like Wintermute. The rally included an 82% pump within six hours on February 21, coinciding with a spike in futures open interest ($4.7 million). However, negative funding rates on Bybit (-0.12%) signal skepticism about sustainability.

Maker (MKR), the governance token of its namesake DeFi protocol, rose 58% after a proposal passed to raise the DAI savings rate to 8%. Increased vault collateralization (+$240 million in ETH deposits) and the burning of 1,200 MKR reduced circulating supply. The price cleared the 200-day moving average ($1,487), but weekly RSI (78) flags overbought conditions.

Losers: Sell Pressure and Technical Failures

Raydium (RAY) dropped 16% following reports of an exploit in its Solana-based DEX liquidity pools. Volumes fell 44% weekly, while futures open interest shed $2.1 million. A death cross on the 50/200-day EMA signals prolonged bearish momentum.

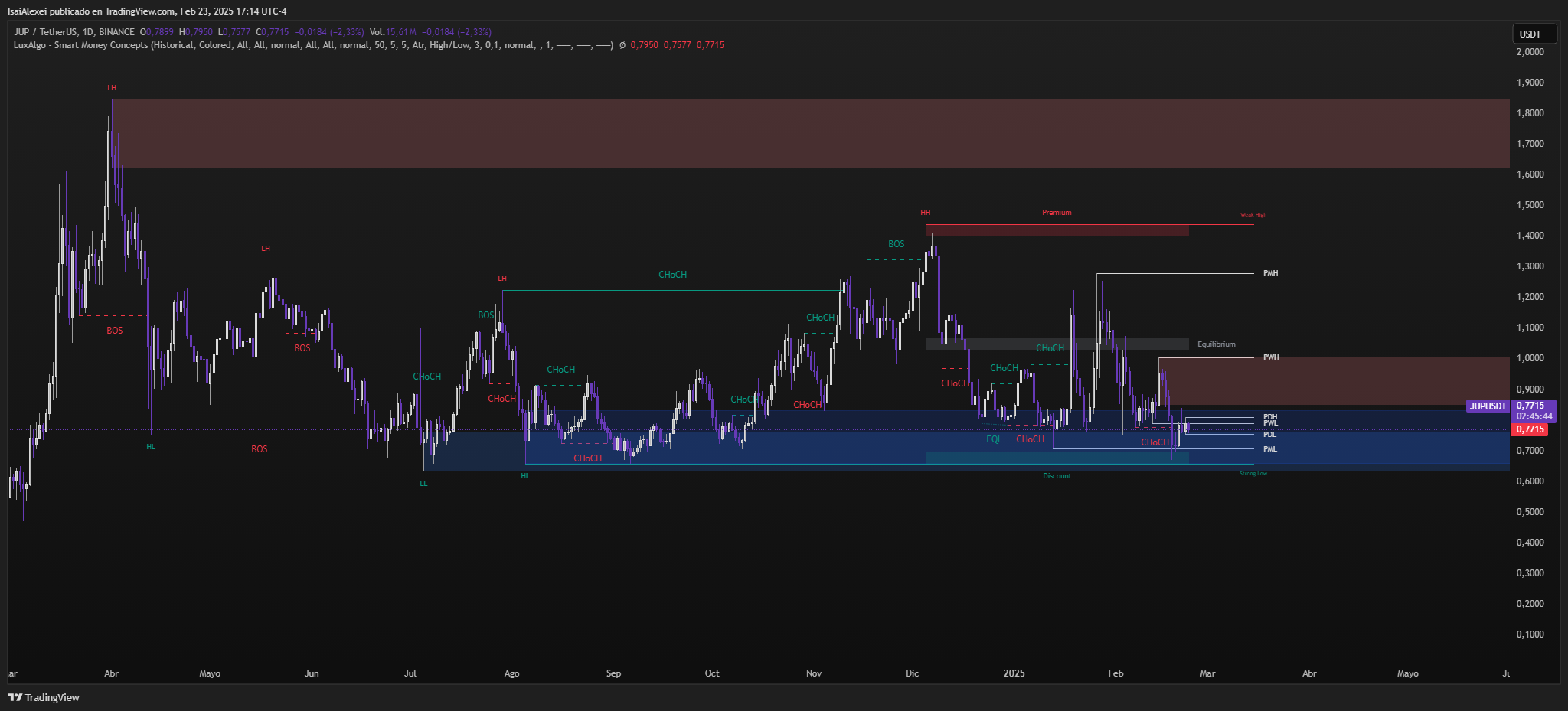

Jupiter (JUP), a Solana liquidity aggregator, lost 14% as capital rotated into new launches. Daily active addresses fell 31%, per Nansen, and stakers withdrew 18 million JUP from yield pools. The critical $0.75 support level, last defended in January, is under pressure.

Official Trump (TRUMP), a politically themed meme token, slid 12% after margin liquidations. Hyblock data shows $480,000 in longs liquidated on Bitget, while top 10 holders sold 8.2% of their supply.

Mid-Caps: Speculative Opportunities and Risks

Scotcoin (SCOT), a regional Scottish token, jumped 742% after announcing integration with 120 Edinburgh merchants. Undeads Games (UDS) rose 295% on hype for its Solana-based play-to-earn game, despite a 12% sell tax.

Among losers, Unchain X (UNX) collapsed 62% after a staking bug locked withdrawals. Griffain (GRIFFAIN), an AI project on BNB Chain, fell 44% following the cancellation of a key partnership.

Technical Analysis and On-Chain Flows

IP’s 4-hour chart shows a bull flag pattern with a measured target of $5.20. MKR displays bullish divergence on the weekly MACD, but declining volume (+18% vs. +58% price gain) raises caution. For RAY, the Average Directional Index (ADX) hit 47, confirming bearish strength.

Glassnode data reveals addresses holding over 10,000 JUP increased accumulation by 7%, suggesting a potential reversal if $0.75 holds. TRUMP’s Spent Output Profit Ratio (SOPR) at 1.02 indicates most holders remain profitable, risking further sell-offs.