After seven years of ups and downs, OpenSea, once the No. 1 NFT exchange, still chose to issue coins

OpenSea’s SEA token is not only the key to the platform’s self-rescue, but may also become the driving force to push the NFT market out of the downturn.

Author: Babywhale, Glendon, Techub News

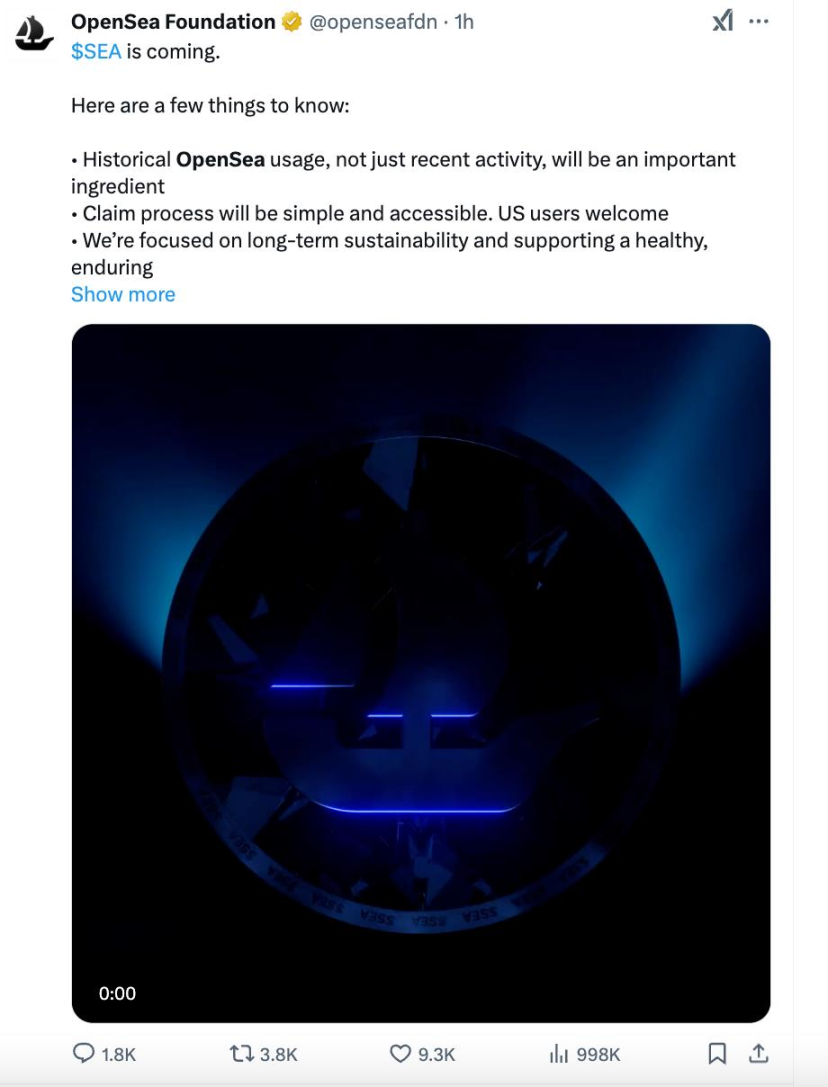

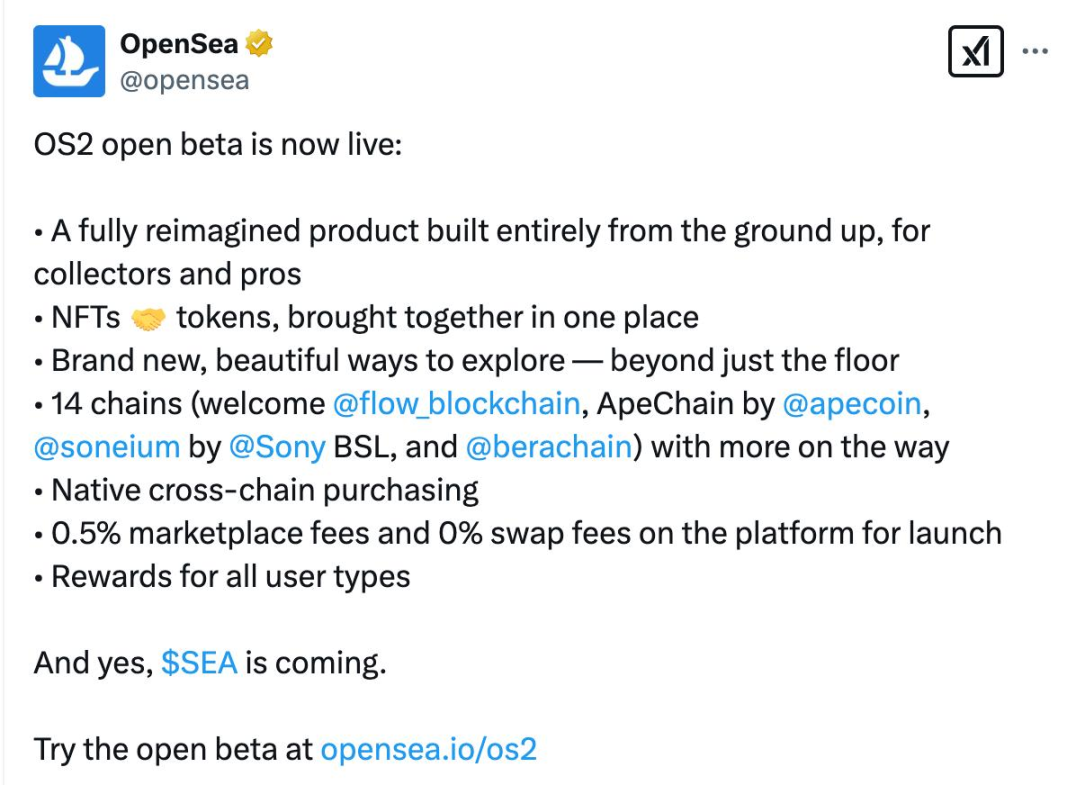

On the evening of February 13, OpenSea announced the launch of the OS2 public beta version on X, and will launch the platform token SEA, and hinted that it will conduct an airdrop. Although the specific timetable and details have not yet been announced, this announcement has undoubtedly touched the hearts of many old players in the cryptocurrency circle. In just one hour, the number of comments and reposts on the tweet has exceeded 1,000, and the community discussion has soared.

OpenSea CEO Devin Finzer also tweeted to emphasize that “OS2, which is being launched, is not just a new product, and SEA is not just a token, but a brand new OpenSea built from scratch.” There have also been some rumors that the new version of OpenSea will refer to Blur’s transaction-centric UI.

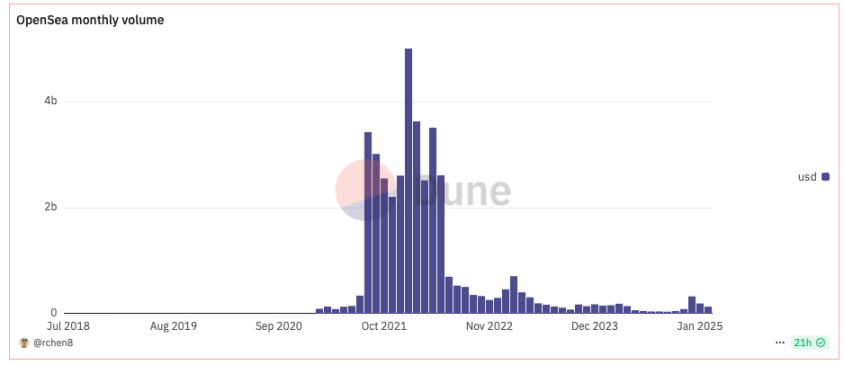

OpenSea is finally going to issue a coin. If it were three years ago, this would definitely be a much-anticipated carnival in the cryptocurrency circle. However, things are different now. Today’s cryptocurrency circle is dominated by MemeCoin, and NFT has long been “outdated”. What’s even more regrettable is that even if we limit our focus to the NFT field, OpenSea is no longer glorious. According to Dune data, OpenSea’s trading volume in January was only US$195 million, a 96% drop from the peak of US$5 billion in early 2022, and its annual revenue has shrunk to approximately US$33.26 million.

According to nftpulse data, as of press time, Opensea’s market share in the past 30 days has dropped sharply from 95% in December 2021 to 29%; on the other hand, OpenSea’s valuation has also fallen from its peak of US$13.3 billion in early 2023 to around US$1.5 billion, and it even fell to the point of being “sold”.

So, why did OpenSea, once the dominant player in the NFT trading market, come to this point?

Let’s review the brief history of OpenSea’s development and see how it rose rapidly and how it fell from the throne in the NFT market competition. Finally, let’s talk about what impact OpenSea’s decision to issue tokens at this time may have on the entire NFT market landscape.

The early days: surviving in the NFT wasteland

There is no doubt that among the startups in the Web3 field, OpenSea is undoubtedly a legendary company that started from scratch. Especially in the two years from 2021 to 2022, the company has leapt from obscurity to a super “unicorn” with a valuation of US$13.3 billion at an astonishing speed, and has firmly sat on the top spot in the NFT trading market. However, behind this glorious period is a dramatic history of market ups and downs. Therefore, the author believes that the rise and fall of OpenSea can also be seen as a microcosm of the NFT industry’s transition from wild growth to rational competition.

In September 2017, Devin Finzer and Alex Atallah won seed round financing from the well-known venture capital incubator Y Combinator with their innovative project “Wificoin”. This project aims to use cryptocurrency to pay for shared WiFi and has nothing to do with the NFT track.

However, in November 2017, Dapper Labs officially launched the Ethereum-based crypto cat game CryptoKitties, which triggered a wave of hype. The frenetic bidding once pushed the price of CryptoKitties’ NFT collections to 247 ETH, which was about US$118,000 at the time.

In the same year, CryptoKitties founder and CTO Dieter Shirley proposed the concept of NFT (Non-Fungible Token) and promoted the launch of EIP-721, which defines the NFT standard. (Techub News note: EIP-721 was later discussed and improved and officially passed in 2018, becoming the current ERC-721 protocol standard.)

It was the introduction of this standard that changed the entrepreneurial direction of Devin Finzer and his colleague. They decided to abandon the original “Wificoin” project and created the NFT trading platform Opensea in February 2018.

According to The Generalist, Devin Finzer said: “I see the potential of the NFT market because there is a standard for digital items, and everything that comes after CryptoKitties will abide by this standard.”

At that time, blockchain and cryptocurrency were in the early stages of development, the concept of NFT had not yet become popular, and the entire NFT market was almost a wasteland.

Despite this, Opensea was not the only NFT trading platform at the time. Rare Bits, which claimed to be a “zero-fee crypto asset market similar to eBay”, was released on Product Hunt almost on the same day. It was a competitor with more advantages than OpenSea. Interestingly, OpenSea also described itself as “Ebay for crypto goods.” (Techub News Note: Ebay is an online auction and shopping website that allows people around the world to buy and sell items online)

In May 2018, OpenSea raised $2 million from investors including 1confirmation, Founders Fund, Coinbase Ventures and Blockchain Capital. But Rare Bits received $6 million in funding a month earlier, with participation from Spark, First Round and Craft.

From the perspective of VC investment, although OpenSea is at a disadvantage, 1confirmation partner Richard Chen prefers OpenSea. He believes that “Rare Bits’ understanding of NFT is not as good as OpenSea’s. OpenSea’s team is more capable and more combative. Devin and Alex have also done a good job in discovering new NFT projects and promoting them to be listed on OpenSea. Moreover, when we invested in April 2018, OpenSea’s trading volume was already 4 times that of Rare Bits.”

In addition, the sales strategies of the two companies are also different. OpenSea insists on charging 1% transaction commission (later gradually increased to 2.5%) to maintain operations through stable income. Rare Bits adopted a “zero handling fee” strategy in 2018 and promised to refund the Gas fees generated by user transactions, trying to attract traffic by reducing user costs. This strategy attracted some attention in the early stage. It seemed to be more user-friendly, but it was not conducive to the long-term development of the platform. The high operating costs also doomed Rare Bits to be unsustainable, especially when the “cryptocurrency winter of 2018” was approaching.

During this period, in order to expand its user base and gain platform transaction volume, Rare Bits also tried to expand its business from NFT to a wider range of virtual goods transactions, such as cooperating with the animation platform Crunchyroll to launch “digital stickers” and exploring non-NFT asset transactions such as game props.

Unlike the diversification of Rare Bits, OpenSea remains focused, and its focus has always been on improving the NFT trading business.

But on the long road before dawn, OpenSea also had a hard time. The platform’s early trading volume continued to be sluggish, and early projects were limited to a few NFTs such as CryptoKitties and CryptoPunks.

According to Titanium Media, in March 2020, the team had only five people and an average monthly transaction volume of about $1 million. Based on the 2.5% commission rate at the time, OpenSea’s monthly revenue was only $28,000. If it weren’t for the $2.1 million “life-saving funds” injected by strategic investors such as Animoca Brands at the end of 2019, the startup might have disappeared in the industry’s cold winter. As for Rare Bits, it was already in danger as early as 2019, and the platform completely withdrew from the market in 2020.

In hindsight, OpenSea’s rise to become the king of the NFT field is inseparable from its operational decisions to focus on core business and streamline operations. Devin Finzer once said in an interview, “We are willing to develop in this field for a long time, regardless of the current growth trajectory. We want to build a decentralized market for NFTs and hope that it can last for 3-4 years.”

Time quickly came to the second half of 2020, and dawn was approaching. This year can be said to be a watershed in the fate of OpenSea. With the gradual recovery of the Crypto market in the second half of the year, OpenSea took advantage of its NFT market pioneer advantage and was the first to reap the dividends. Its platform transaction volume began to rise rapidly. Dune data shows that in October 2020, OpenSea’s monthly transaction volume reached approximately US$4.18 million, an increase of approximately 66% from US$2.46 million in September.

In order to allow the platform to have a wider variety of NFT assets and attract wider liquidity, OpenSea began to fully implement the “open market” product strategy.

In December 2020, OpenSea launched a new feature “Collection Manager”, which allows users to mint NFTs without any handling fees (gas fees are borne by the buyer). The official also called this feature “Lazy Minting”, which separates on-chain issuance from metadata. Users can upload the metadata of the product to OpenSea for free, and only when the product is sold for the first time will it be minted as an on-chain ERC-1155 NFT.

This feature greatly reduces the threshold for creators, and based on the fact that OpenSea NFT listings do not require review, every user can directly mint and issue NFTs on OpenSea. Aside from this advantage, OpenSea also covers the widest range of transactions among similar platforms, including digital avatars, music, domain names, virtual worlds, trading cards, artworks and other NFT collections. Its strategy maximizes the supply of creators’ works and attracts more and more users in the primary and secondary markets.

Objectively speaking, the potential of the NFT market has contributed to OpenSea’s subsequent success, but the field’s rapid explosion is also inseparable from OpenSea’s contribution.

In 2021, the Crypto market ushered in a comprehensive “bull market”, and OpenSea, which had been dormant for two years, began to truly show its edge.

NFT is booming, and OpenSea is the king with billions of dollars in monthly trading volume

According to Dune data, in February 2021, OpenSea’s data experienced explosive growth for the first time. On February 2, OpenSea’s daily trading volume exceeded 5 million US dollars, while OpenSea’s trading volume for the whole month of January was just over 7.5 million US dollars. In the end, OpenSea’s trading volume for the whole month of February was close to 95 million US dollars, an increase of more than 10 times from the previous month.

Also from the beginning of 2021, a large number of commemorative NFTs began to be issued on OpenSea. Bands, entertainment stars, sports stars, and well-known artists have begun to launch their own NFTs. A large number of well-known brands have also begun to launch commemorative NFTs or use NFTs to launch user loyalty activities. It can be said that NFTs, which started with CryptoKitties, combined Web3 with traditional industries for the first time, and also allowed many people who did not know Crypto to come into contact with a new “species” for the first time.

Budweiser launches NFT series

As the largest NFT trading platform, OpenSea has finally waited for the arrival of the trend. Data shows that in March 2021, the transaction volume on OpenSea exceeded the $100 million mark for the first time, exceeded $300 million in July, and in August the figure increased by more than 10 times month-on-month to $3.44 billion. It was also in March that OpenSea completed a round of financing of $23 million led by a16z, and many angel investors including Mark Cuban also participated in this round of investment.

Although NFT has actually started to develop rapidly since the beginning of 2021, the floor price of the CryptoPunks series of NFTs has also increased from single-digit ETH at the beginning of the year to more than 10 to 20 ETH in the middle of the year. However, the main narrative of the market in the first half of 2021 was still centered around DeFi, and everyone’s attention had not yet completely shifted to NFT. The reason for this is that in addition to the rising popularity of DeFi, there are no targets and concepts in the NFT field that can be hyped.

After entering the second half of the year, the advent of a series of PFPs represented by BAYC completely ignited the passion of the market, and NFT is also considered to be another phenomenal concept after DeFi. As the popularity of NFT transactions rises, the monthly transaction volume on OpenSea has always remained at a high level of billions of US dollars. In January 2022, the number even exceeded 5 billion US dollars. Nate Chastain, head of product at OpenSea, tweeted at the end of August 21 that the company had only 37 people, and that month OpenSea’s fee income alone exceeded 80 million US dollars. The contribution of more than 2 million US dollars per capita is extremely terrifying in any industry.

Before the end of 2021, OpenSea spent most of its time accelerating non-stop. During this period, apart from the resignation of Nate Chastain due to an insider trading scandal, there was almost no other negative news about OpenSea. Even if other NFT trading platforms obtained large amounts of financing, they had no way to shake OpenSea’s position. In fact, almost all NFT trading platform products have more or less referred to OpenSea.

Challengers are eyeing it, but OpenSea “betrays” Web3 and plans to go public?

Amidst the prosperity, a turning point came quietly, and it all started with the rumor of OpenSea’s listing…

In early December 2021, Bloomberg reported that Brian Roberts, CFO of Lyft, an American online car-hailing company, would join OpenSea as CFO. At the same time, Roberts said that he was planning an IPO for OpenSea. This was originally a very ordinary news, but it sparked some discussions in the Web3 industry. Many people believed that OpenSea should issue tokens to give back to OpenSea users, and this is what Web3 projects should do.

Perhaps feeling some pressure, two days later, Brian Roberts personally came out to clarify that there is no IPO plan at present, and said, “There is a big gap between thinking about what the IPO will eventually look like and actively planning an IPO. We have no plans for an IPO. If we do, we will seek community participation.”

This somewhat ambiguous statement not only failed to dispel the community’s concerns, but instead made everyone more confident that OpenSea would eventually go public, because it did not mention the issuance of coins at all.

If OpenSea had decided to issue coins at that time, there might not have been any subsequent exciting stories in the NFT trading platform track. It was the “selfish” decision of choosing an IPO that tore a hole in the originally unbreakable wall.

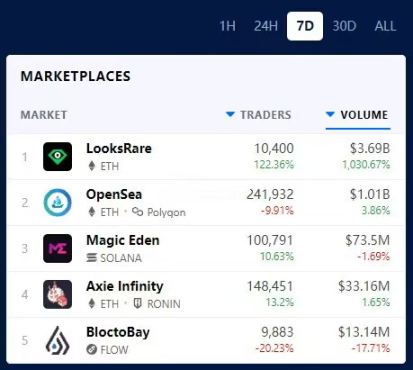

At that time, OpenSea occupied more than 90% of the NFT trading market on Ethereum. After its attitude of not issuing tokens spread, some entrepreneurs found opportunities and quickly launched NFT trading platforms that issued tokens. LooksRare is one of them. Although it was not the first project to launch a “vampire attack” on OpenSea, it obviously had a great influence after OpenSea was ready to go public.

On January 10, 2022, LooksRare was officially launched. The team said that users with a trading volume of 3 ETH or more on OpenSea can get airdrops by placing an order for an NFT on LooksRare. In addition, users can pledge the LOOKS airdrops they received to share all the transaction fees of the platform. Two days after LooksRare went online, its daily trading volume exceeded OpenSea, and based on the 7-day trading volume data as of January 19, 2022, LooksRare was more than three times that of OpenSea.

When the rift was torn open and the market found that OpenSea was not completely invincible, everyone began to show their skills. X2Y2, which was launched in February 2022, Element, which focuses on BNB Chain, Zora, which focuses on art NFTs and takes a high-end route, and Magic Eden, which focuses on the Solana NFT market, are constantly eroding OpenSea’s existing market and the market that may be expanded. Perhaps it is a bit too arrogant, but at least it was a major strategic mistake for OpenSea not to take precautions at the peak of its prosperity.

Despite this, OpenSea’s market influence remains unshakable. As we enter the second quarter of 2022, Yuga Labs is about to issue APE tokens, and on the other hand, transactions of “blue-chip NFTs” such as Moonbirds and Doodles are still active. As the NFT trading market with the best liquidity, OpenSea still holds the lifeline of the NFT market.

The person mainly responsible for changing the entire NFT track or the collapse of NFT was quietly born at this time. Its appearance fundamentally changed everyone’s stereotype of what the NFT market should look like.

Blur emerges, NFT market No. 1 changes hands

At the end of March 2022, Blur announced that it had completed US$11 million in financing. At that time, I believe many people would still wonder why a new NFT trading platform would emerge at this point, but after Blur was officially launched at the end of October, it gave everyone a blow.

A completely different UI, which clearly states that there will be airdrops for placing orders, bidding, and buying and selling, and the airdrops are just “treasure boxes” with unknown number of tokens. Blur has achieved the ultimate in product and gameplay design, with a UI designed purely for trading and clear but unclear airdrops. Although many people criticized Blur’s UI for being very difficult to use at the beginning, after getting used to it, everyone found that such a design is indeed much easier to use than OpenSea in terms of buying and selling. To make an analogy, if OpenSea is an e-commerce platform for NFT, then Blur is an exchange for NFT.

Prices are listed from low to high, and real-time transactions and the distribution of transaction prices are displayed on the right. With such a convenient UI design and the expectation of airdrops, a large amount of funds began to flow into Blur. Previously, many NFT trading platforms relied on tokens to attract traffic in the short term, but OpenSea’s market share in transaction volume has not been challenged in monthly or quarterly data. However, the emergence of Blur has brought OpenSea’s share of transaction volume back to more than 50% until a week ago.

But it is also because of this that big funds have gained the ability to manipulate the market, buying and selling frantically. In addition, the Crypto market had entered a deep bear market at that time. Seeing that big funds were airdropping at all costs, the prices of a large number of NFTs were almost smashed. Retail investors lost interest in NFTs. After Bitcoin fell to around $20,000, the “last goalkeeper” of crypto assets also left the market. The collapse of the NFT market and the ascension of the new king Blur made OpenSea a cannon fodder.

In early 2022, it completed a $300 million Series C financing at a valuation of $13.3 billion. Two years later, in early 2024, OpenSea CEO admitted that he was considering being acquired. In this round of Bitcoin’s “one-person bull market”, in addition to Pudgy Penguins, which is expected to be airdropped, the floor prices of a large number of former blue-chip NFTs have fallen to a terrible level. For OpenSea, if they don’t make changes, they may end up giving away years of hard work, which is definitely not what they want to see.

Therefore, OpenSea decided to launch the platform token SEA at this moment. On the one hand, it is a self-help measure to cope with the continuous decline of the platform business; on the other hand, this former king may also have a little resignation and ambition to return to the top. So the question is, after OpenSea issues the token, is it possible to change the competitive landscape of the NFT market?

With the recent surge in trading volume, is OpenSea expected to reshape the competitive landscape of the NFT market?

There is no doubt that the most likely to be impacted by OpenSea’s coin issuance and the launch of the OS2 public beta version is Blur. As a powerful rival that subverts OpenSea’s position, Blur has also shown a downward trend with the downward trend of the Crypto market. However, as of writing, its trading market share in the past 30 days is still over 44%, firmly sitting in the top spot in the NFT market.

In addition to the unique product UI and gameplay design mentioned above, Blur also attracted a large number of users with its Bid Airdrop (bid reward tokens) and zero-fee model. It conducted airdrops several times in 2023 to seize market share, which can be seen from the data:

On February 15, 2023, Blur airdropped 360 million BLUR in the first quarter, accounting for 12% of the total initial supply and released immediately. According to Glassnode, after the BLUR token airdrop, Blur’s market share surged, and its NFT transaction volume market share jumped from 48% to 78%, while OpenSea fell by 21%.

On February 23, 2023, Blur launched the second quarter airdrop of 300 million BLUR. This airdrop directly pushed Blur’s trading volume to surpass OpenSea by a large margin. DappRadar data showed that on February 22, 23, BLUR’s trading volume reached approximately US$108 million, while OpenSea’s was only US$19.27 million during the same period.

To a certain extent, Blur’s two large token airdrops have played an indispensable role in breaking through OpenSea’s “moat”. As the saying goes, give someone a taste of their own medicine. At a time when the current NFT market has not yet recovered, if OpenSea’s SEA token attracts users through airdrops or staking rewards, it is very likely to copy this strategy, and even follow the example of “OpenSea killers” such as LooksRare and x2y2 in the past to launch a “vampire attack” on Blur to compete for its core users.

In fact, since OpenSea confirmed that it would conduct an airdrop, it has aroused the expectations and heated discussions of many Twitter users. Many people believe that this will be one of the largest airdrops this year.

In addition, in terms of transaction fees, the OS2 beta version recently launched by OpenSea reduces market fees to 0.5% and transaction fees to 0%, which directly targets Blur’s zero transaction fee model. When SEA goes online, OS2 will most likely build a very flexible competitive strategy with its combination of “low transaction fees + token incentives”.

Objectively speaking, most users are profit-seeking in nature. If the reward mechanism of SEA tokens is more attractive, and some of Blur’s existing users originally came from OpenSea, it may not necessarily cause these users to return to OpenSea. However, Blur’s “moat” lies in its faster transaction speed and higher gas efficiency than OpenSea, and it still has a technical advantage in the short term.

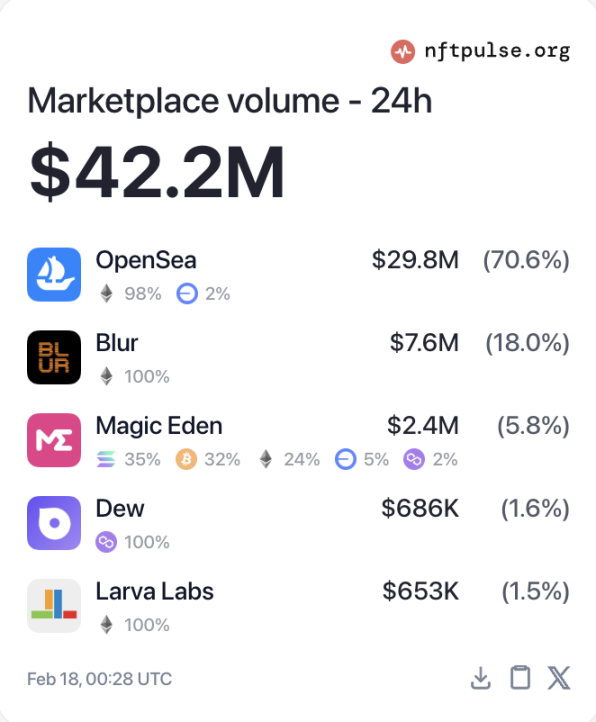

The market has already reacted to the news of the coin issuance. According to nftpulse data, as of the time of writing, OpenSea’s daily trading volume has reached approximately US$29.8 million, and the transaction share has soared to 70.6% of the total daily trading volume.

For the entire NFT market, OpenSea’s launch of SEA tokens is undoubtedly a good thing. In addition to stimulating a sharp increase in NFT trading volume in the short term, OpenSea also tweeted that OS2 already supports cross-chain transactions of 14 chains such as Flow, ApeChain, and Soneium. So, is it possible for SEA tokens to become a universal token for the multi-chain NFT ecosystem, thereby promoting the development of the NFT market on Ethereum external chains (such as Solana)? This is worth looking forward to.

However, from another perspective, the upcoming fierce competition between OpenSea and Blur will once again squeeze the living space of second-tier platforms such as LooksRare and X2Y2, and Blur will surely not sit back and watch its former rivals make a comeback. Blur may launch more token application scenarios, or token rewards may further motivate user loyalty. In addition, Magic Eden, also a latecomer, should not be underestimated. With its dominant dominance on Bitcoin and Solana chains, its market transaction volume on the entire platform once reached US$3.2 billion in the past year, accounting for more than 30%, second only to Blur’s US$3.8 billion (accounting for about 36%), while OpenSea’s transaction volume in the past year was only US$1.2 billion, accounting for less than 12%.

In short, I believe that OpenSea’s SEA token is not only the key to the platform’s self-rescue, but may also become the driving force to push the NFT market out of the downturn. In the long run, the competition between OpenSea and Blur will also prompt the NFT field to develop in a more complex financial and multi-chain direction. As for whether OpenSea can regain its dominant position, whether the future pattern will be a two-strong confrontation, or whether Blur will continue to be the king, it depends on the performance of the SEA token after it goes online. Let’s let the bullets fly for a while!

Author :Techub News

This article reflects the opinions of PANews’s columnist and does not represent the stance of PANews. PANews does not assume legal responsibility. The article and opinions do not constitute investment advice.

Image Source :

Techub News

If there is any infringement, please contact the author to remove it.