Bitcoin: How will Jerome Powell’s ‘not in a hurry’ Fed rate cut outlook impact BTC?

- BTC stalled at $98K and plunged after Powell’s slow Fed rate cut outlook.

- Demand for BTC has slightly dropped amid macro uncertainty.

Bitcoin’s [BTC] early week recovery stalled at $98K and dumped to $95K following Fed’s chair Jerome Powell’s hawkish outlook on interest rate cuts.

During his semi-annual monetary report to the U.S. Congress on the 12th of February, Powell reinforced that the agency was not ‘in a hurry to change its policy stance.’ He said,

‘Our policy stance is now less restrictively than it had been, and the economy remains strong. We do not need to be in a hurry to adjust our policy stance.’

For context, a lower interest rate means cheaper capital, which is bullish for risk-on assets like Bitcoin and stocks.

However, after a hawkish hold in last month’s FOMC meeting, the slow Fed rate cut outlook and Trump’s tariffs have heightened bearish sentiment.

Will the January CPI report sway BTC?

U.S. labor markets and inflation status determine the Fed rate cuts. As a result, the markets will shift focus to key inflation data, the January CPI (Consumer Price Index) report scheduled for the 12th of February.

According to data tracked by Forex Factory, the forecasted target for monthly change for last month’s CPI is 0.3%.

If the actual CPI is higher, it could be considered bearish as it would prompt the Fed to keep the interest rate unchanged for longer. However, a lower CPI print could slightly boost the market and odds of a rate cut.

That said, interest traders were pricing a 95% chance of another rate pause, like in January, during the next FOMC meeting in mid-March.

Whether the CPI print will change the market pricing remains to be seen.

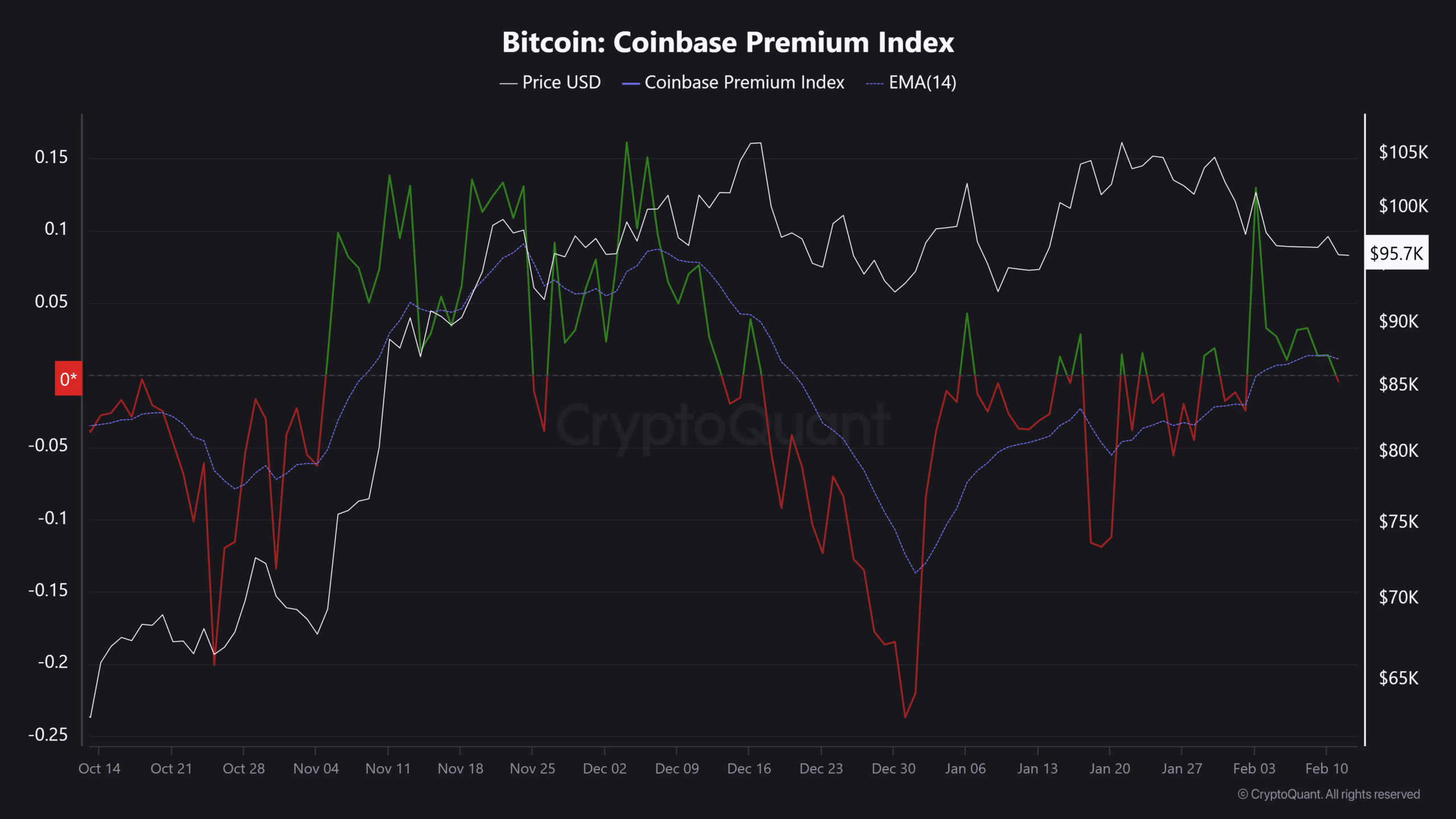

Note, however, that the above headline risk has kept overall demand muted, per Coinbase Premium Index. The indicator tracks U.S. investors’ appetite for the king coin and positively correlates with BTC price action.

After a surge in early February, the indicator has returned to a neutral level. Similarly, BTC retraced from $101K to $95K over the same period.

Any further dip in the Coinbase Premium Index to negative territory could limit BTC’s short-term rebound, despite the pending supply shock as the OTC balance shrinks.

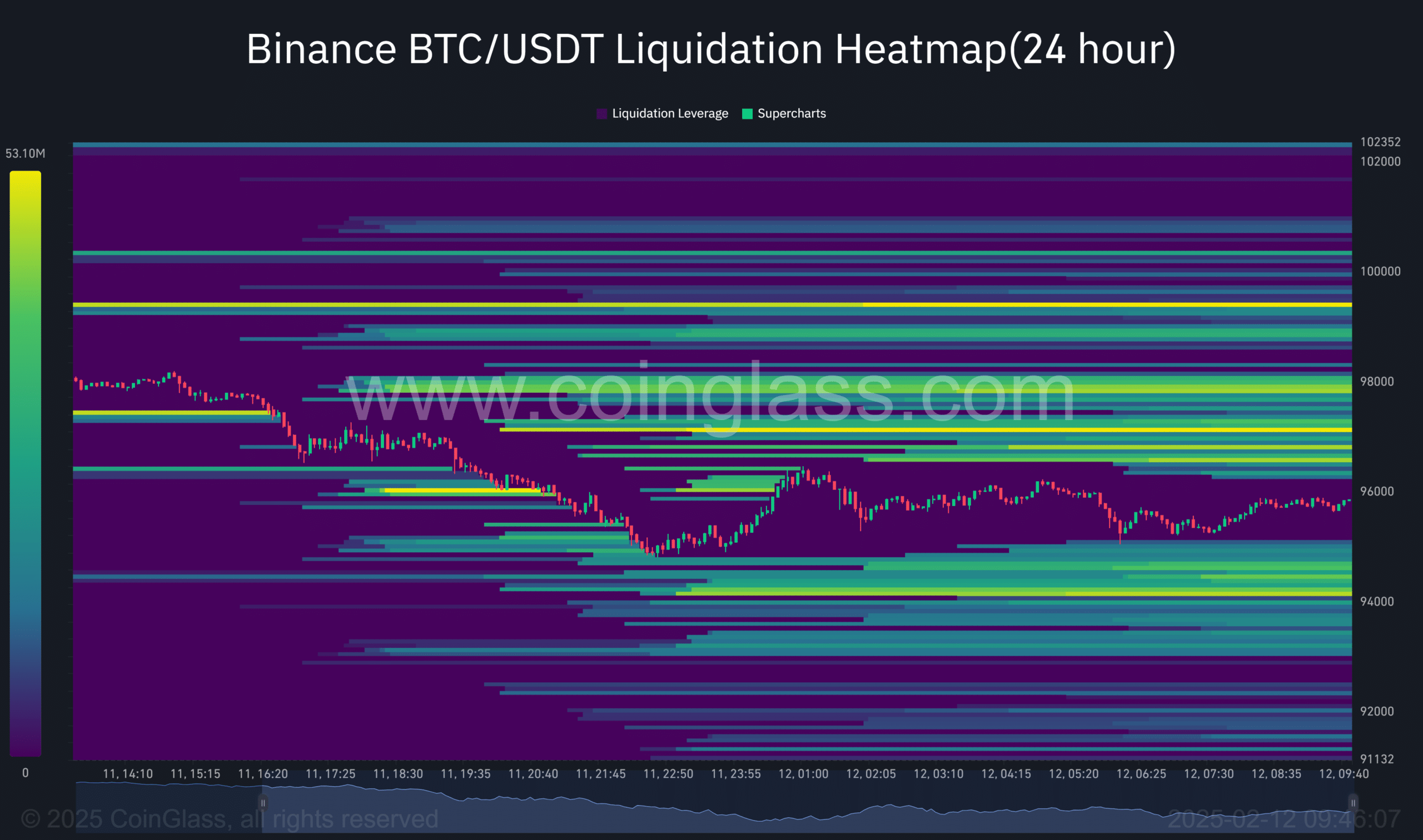

In the meantime, the cryptocurrency’s choppy market could persist according to the Coinglass liquidation heatmap. Pockets of liquidity (bright levels) are on either side of price action.

Simply put, BTC could continue fluctuating between $94K and $100K in the short term.