Shiba Inu price prediction – Flipping THIS level could change market bias

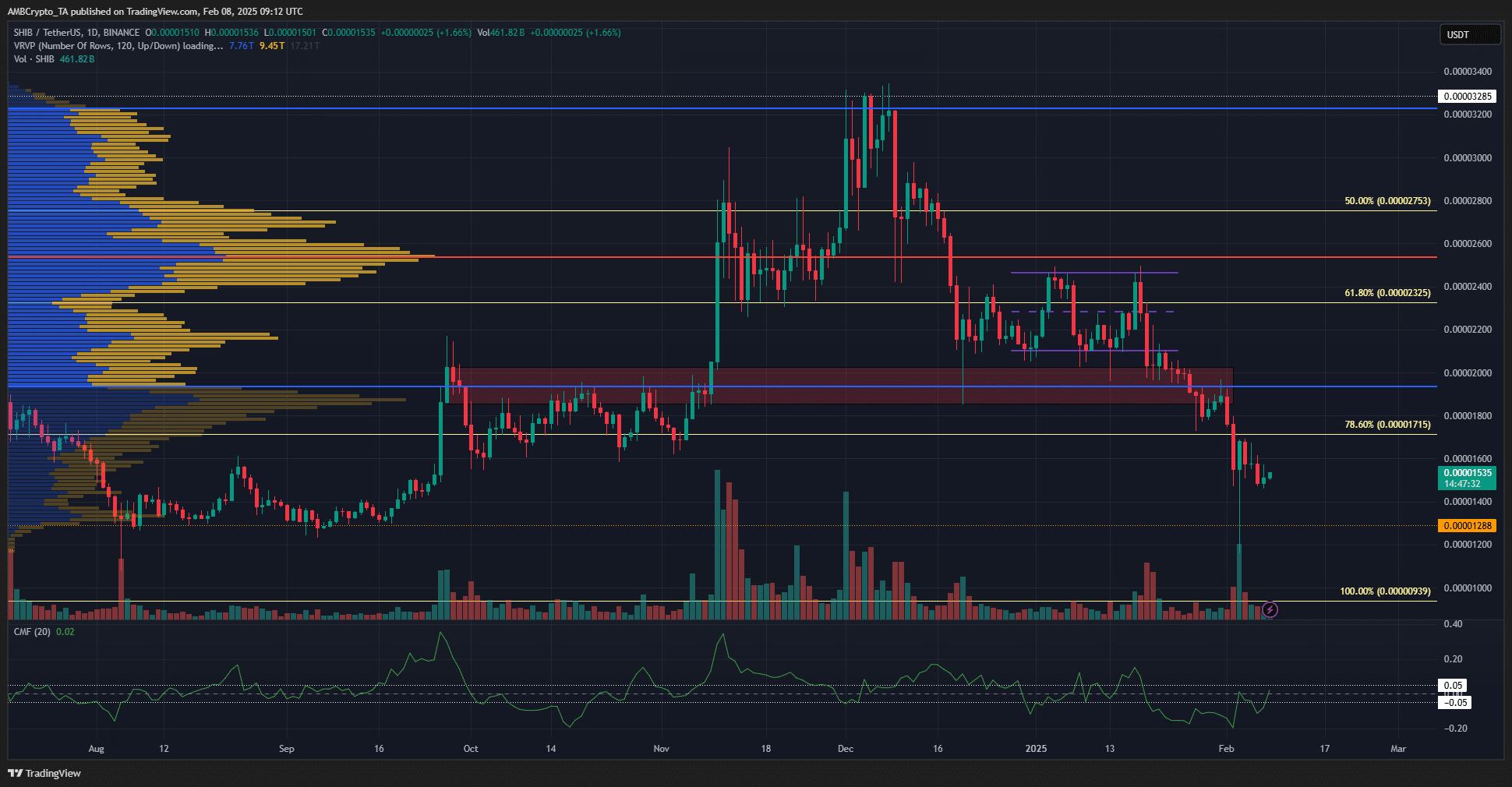

- Shiba Inu has fallen below the VRVP’s value area

- The $0.00002 level is a key resistance zone, and bulls need to reclaim it before the longer-term bias can be flipped

The second-largest memecoin by market cap, Shiba Inu [SHIB] has shed nearly 30% of its value over the past month. It was unable to hold on to the range formation from early January and at press time, its downtrend continued apace.

At the time of writing, volume indicators showed that the $0.00002 resistance zone would be key to its bullish efforts. While the momentum was severely against SHIB bulls, market-wide sentiment was weak as well.

Key to solving Shiba Inu’s woes

The drop below the 61.8% Fibonacci retracement level in mid-December was the domino that started the downtrend. Memecoins had run rampant in November but by December, their mini-altseason had ended.

The $0.00002 region, a bullish order block from September, was retested as resistance on 31 January. Since then, SHIB has slumped by another 23% on the charts. However, the CMF flashed a slightly hopeful signal. It had a reading of +0.02 at press time, after spending the second half of January below -0.05.

The CMF’s uptick can be a sign that capital outflows from the market have been slowing down, although they aren’t strongly bullish yet.

The Visible Range Volume Profile also highlighted the importance of the $0.00002-zone, forming the lower bound of the value area.

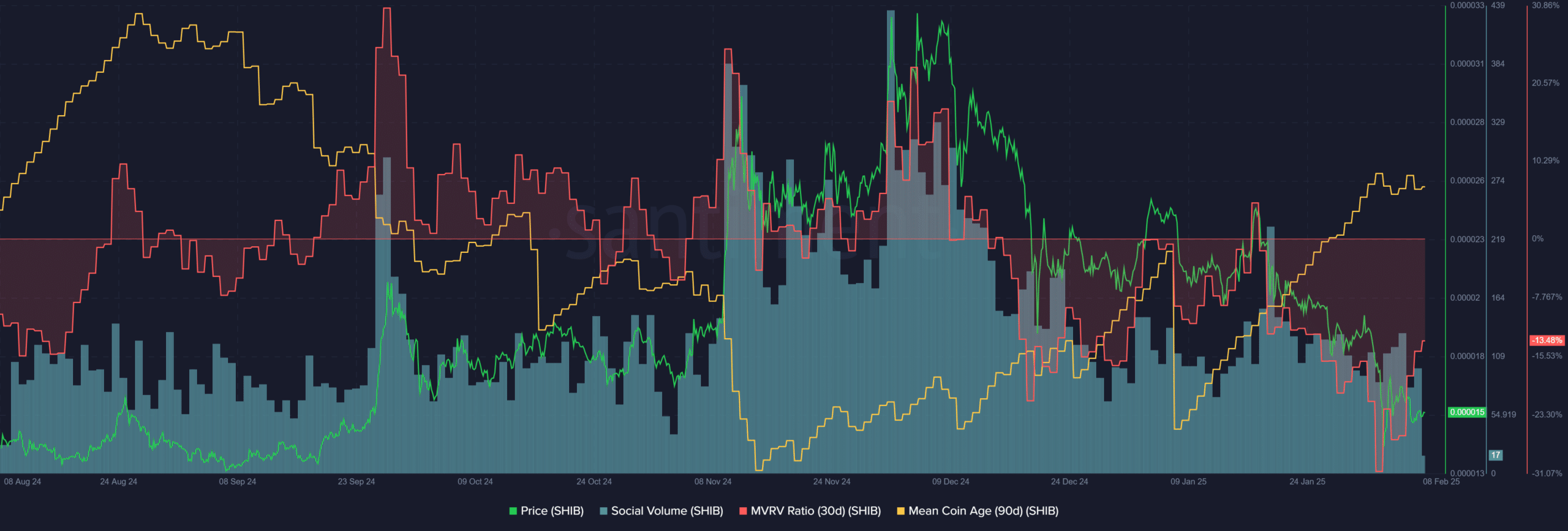

Source: Santiment

Usually in the crypto market, where attention goes, money flows. The social volume has been falling since early December when memecoin euphoria lost its grip. The sustained losses pushed the short-term MVRV into negative territory.

Realistic or not, here’s SHIB’s market cap in BTC’s terms

On the other hand, the Mean Coin Age has trended higher over the past month. Together with the MVRV, it underlined a buying opportunity- Increased accumulation while short-term holders were facing losses.

Technical analysis showed that a retest of $0.0000128 would be a buying opportunity. Alternatively, the $0.00002 zone being flipped to support would also offer bulls some hope.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion