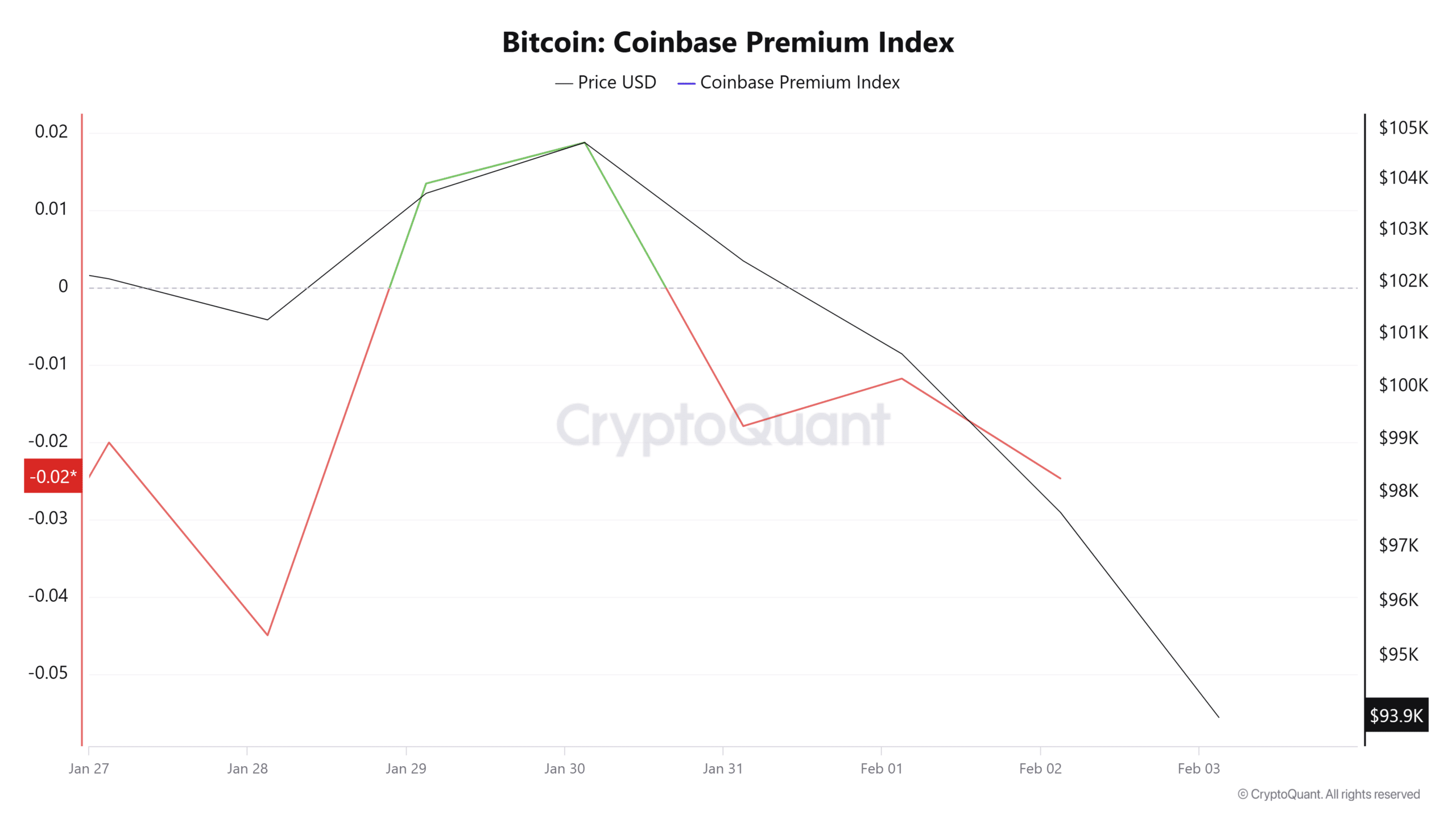

Bitcoin overheat as NVT golden cross surpass a critical level

- BTC has dropped by 6.54% over the past 24 hours.

- Bitcoin’s market could be overheated, although other indicators suggest a potential rebound.

Over the past 48 hours, as Trump trade wars escalate in North America, the crypto market has been hit the hardest. One of the most affected crypto assets is Bitcoin [BTC].

Over this period, Bitcoin has dropped to a low of $91k for the first time in 2025. The recent market crash has left key stakeholders talking over Bitcoin’s future trajectory.

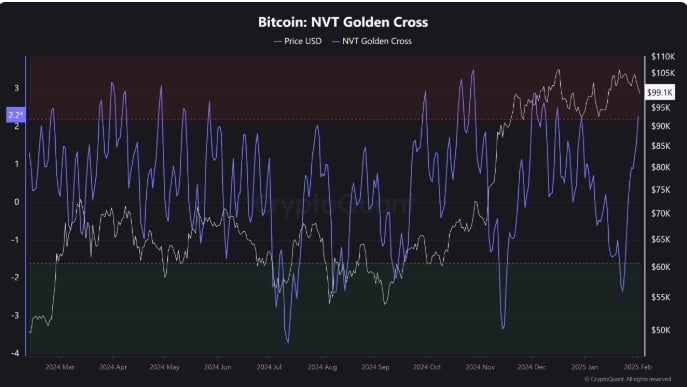

Bitcoin’s NVT Golden reaches a critical level

According to CryptoQuant, NVT Golden Cross shows that the Bitcoin market is currently overheated and risks a market bubble.

With the Golden Cross spiking to current levels to settle at 2, it implies that bears are attempting to take over the market.

When the Golden Cross reaches this level, it signals a potential sustained downward pressure. This phenomenon has been witnessed over the past two days as American investors turn bearish.

Surpassing the critical threshold implies that a downward momentum is building and bears are now emerging.

What do other indicators suggest?

While the recent price action is a cause for alarm, key indicators suggest that other regions excluding the U.S. remain optimistic.

As such, the recent correction could be a short-term drop before the market finds a way out of the current situation.

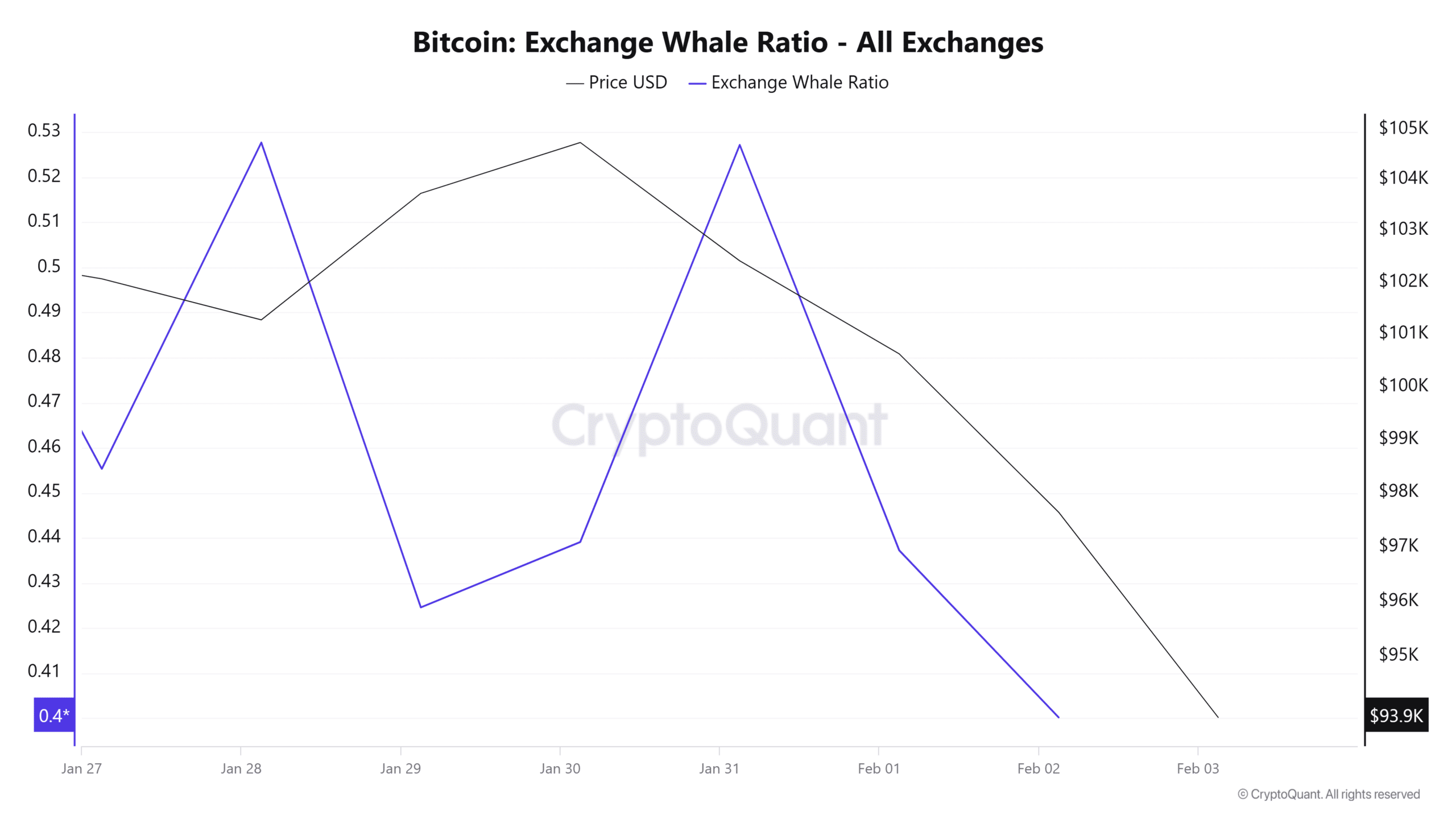

For example, Bitcoin whales are still bullish and continue to keep their assets off exchanges. As such, the Exchange Whale Ratio has dropped to reach a 10-day low.

This decline implies that whales are expecting prices to rebound and are not selling their BTC.

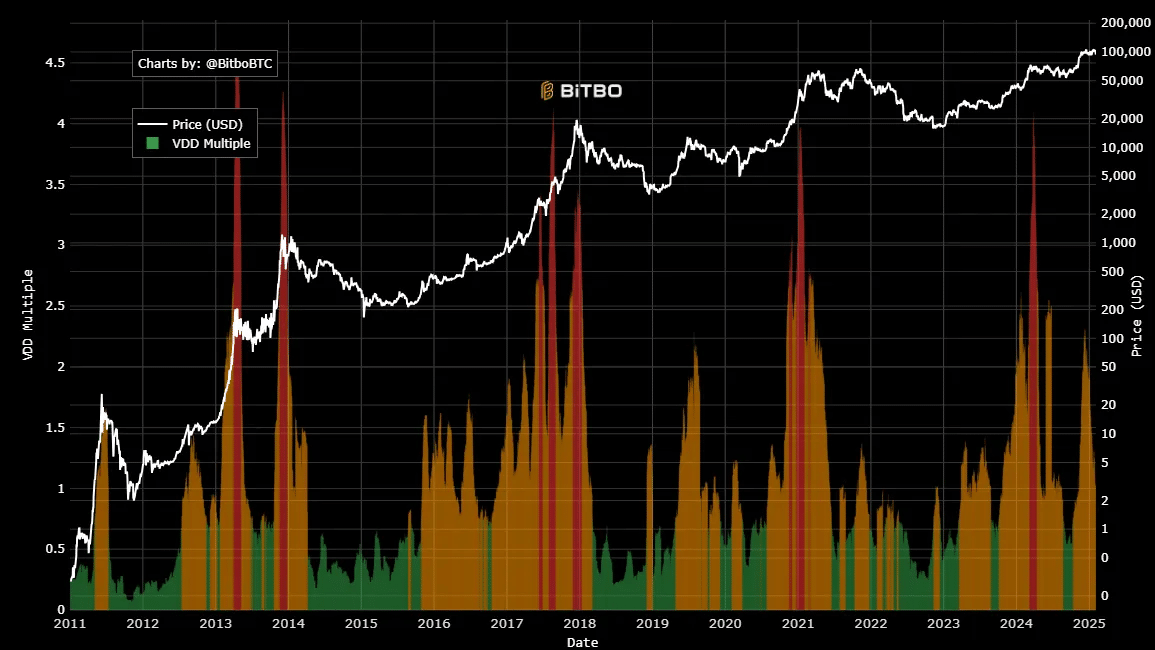

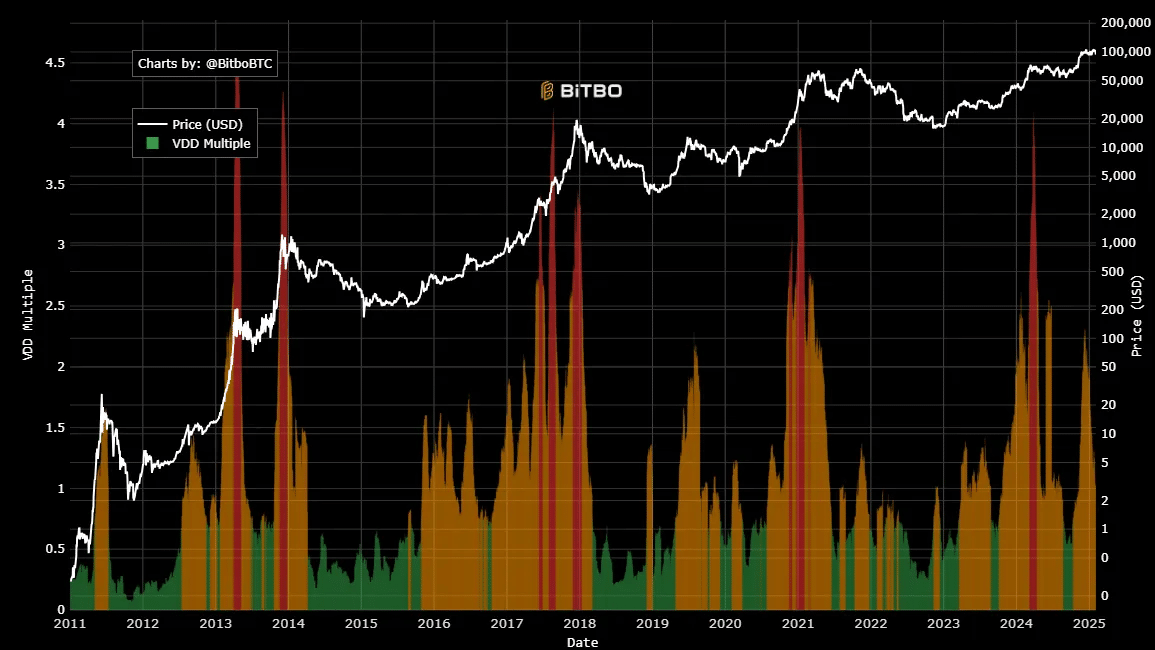

Source: Bitbo

Additionally, Bitcoin’s VDD Multiple has remained above 1, settling at 1.05 at the time of writing. When this remains above 1, it implies that long-term holders are not panic selling, indicating market stability.

There’s low selling pressure from long-term holders, and the current drop is largely led by short-term holders. With long-term holders still bullish, the market could recover soon, and the drop is unlikely to continue.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

Simply put, although Bitcoin has dropped over the past few days as the North American market turns bearish, other indicators suggest the drop is led by short-term holders.

The market is likely to rebound as long-term holders and whales remain bullish.

A rebound here will see BTC reclaim $96,370 and attempt to reach $98,000. However, further correction could see a dip to $92,103.