Ethereum Foundation Embraces DeFi With New Multisig Wallet

- Ethereum Foundation establishes a 3-of-5 wallet for DeFi participation.

- First funds tested on Aave, a top Ethereum DeFi protocol, indicated deeper involvement in decentralized finance.

- 50,000 ETH worth $166.45 Million was transferred to the wallet, marking the foundation’s entry into DeFi.

Vitalik Buterin, Ethereum co-founder, announced impending organizational changes inside the Ethereum Foundation (EF) on X on January 18, 2025. These changes aim to support app developers more actively and increase community transparency.

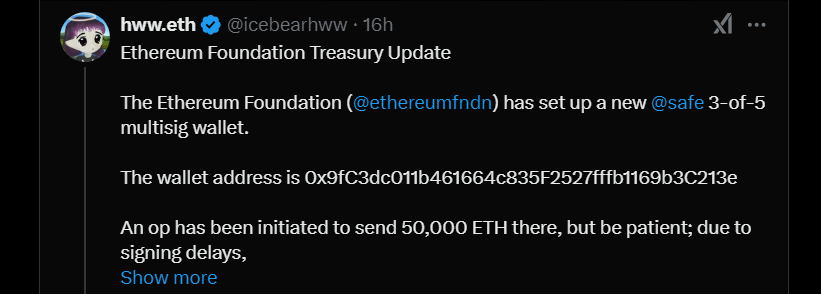

A few days later, the latest move by the Ethereum Foundation signaled its growing commitment to DeFi. On January 21, the team member hww.eth underlined the EF’s establishment of a new 3-of-5 multisig wallet. It has the address “0x9fC3…3C213e.”

This wallet will serve as a dedicated account for engaging in DeFi activities and expanding the Foundation’s treasury. The Ethereum Foundation has already executed a test transaction on the lending platform Aave through this new wallet.

EF plans to gradually migrate more funds into this secure, safe wallet. The foundation cites its strong track record and user-friendly interface as key factors in the decision.

Ethereum Foundation’s Strategic Move into DeFi: A $166 Million ETH Allocation to Fuel Ecosystem Growth

In a significant move, 50,000 ETH has been allocated to the Ethereum Foundation’s new multisig wallet. The same was revealed by staff member hww.eth. With Ethereum’s current price at $3,302.20, this allocation is worth approximately $165.11 Million.

The EF has already conducted a test transaction on Aave to kick off the initiative. It is one of the largest DeFi protocols in the Ethereum ecosystem.

As it was evident, the Ethereum Foundation’s treasury has faced a notable decline. It shrank by 39% in less than three years, dropping to $970.2 Million by October 31, 2024.

However, its newfound participation in DeFi could provide the much-needed catalyst for a treasury recovery. Most Ethereum Foundation holdings remain in ETH, and for years, it avoided staking.

Many people assumed they didn’t join in staking because they had no interest, but this was untrue. Instead, they avoided it due to regulatory concerns and the need to remain neutral.

Many within the Ethereum community have expressed hopes that the EF would engage more actively in staking, believing it would benefit the broader ecosystem.

Ethereum Foundation Takes Cautious Step Toward Staking Amid Diminishing Regulatory Concerns

The Ethereum Foundation, following the current CESR Composite Ether Staking Rate, could earn up to 3.31% yield on its ETH holdings. However, due to regulatory concerns, the organization had previously steered clear of staking.

Moreover, Vitalik Buterin, co-founder of Ethereum, explained that staking would force the EF into a position. There, it must choose the correct chain in case of a hard fork.

In such a situation, picking a chain would be vital to avoid the risk of slashing. That could potentially compromise the EF’s neutrality.

Similarly, Tim Beiko, who oversees core protocol meetings at the Foundation, echoed similar sentiments. He expressed support for staking when it made sense. However, he cautioned against relying too heavily on staking to fund the EF’s operations, particularly payroll.

He stressed that it would be reckless to leverage the ETH treasury for such purposes. With regulatory risks diminishing, the Ethereum Foundation is beginning to embrace staking. However, it is still exploring ways to mitigate other concerns tied to this move.

Institutional Confidence and Leadership Changes Signal Optimism

Despite the excitement surrounding Donald Trump’s inauguration, the price of Ethereum has seen a slight dip. At the time of writing, ETH was trading at $3,303.20, marking a 0.65% increase in the last 24 hours.

However, institutional confidence in Ethereum remains strong, with major players betting on its long-term value. On Monday, Trump’s World Liberty, an influential institutional entity, allocated millions to acquire ETH. As a result, token balance history skyrocketed this week.

Meanwhile, the Ethereum Foundation underwent leadership changes to enhance its technical expertise. Vitalik Buterin, co-founder of Ethereum, noted that these organizational changes have been in the works for almost a year.

With new leadership, the Foundation hopes to foster better communication and strengthen relationships with Ethereum stakeholders. This could bring a more optimistic outlook for Ethereum, potentially driving price growth in the long term.

Disclaimer

In this article, the views, and opinions stated by the author, or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.