Here’s what whale’s $2.1M investment means for PEPE’s price action

- Whale investment and a cup-and-handle pattern hinted at potential bullish momentum for PEPE

- On-chain data and declining MVRV highlighted cautious optimism

A whale’s $2.1 million investment into PEPE has sparked speculation within the crypto community. Purchasing 107.89 billion PEPE tokens at an average price of $0.0000194, the move is a sign of growing confidence in the memecoin’s potential.

At press time, PEPE was trading at $0.00001884, following a modest 1.34% hike over the last 24 hours. However, could this significant buying pressure signal an impending rally for PEPE, or will the token face resistance that dampens its momentum?

Breaking resistance – Is a rally on the horizon?

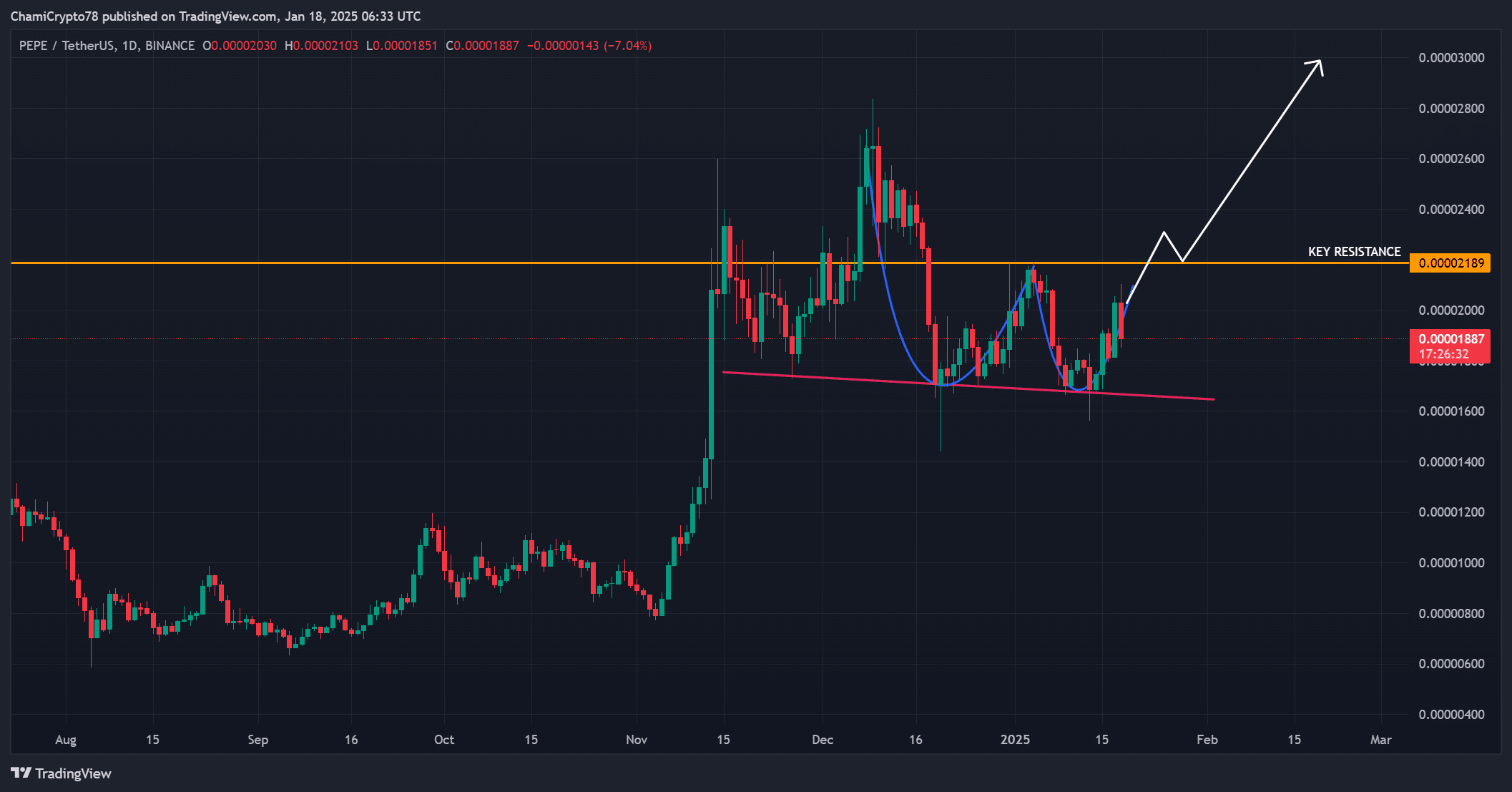

The memecoin’s price action hinted at a potential cup-and-handle pattern forming on the daily timeframe – Often a precursor to bullish price movements. In fact, the token seemed to be approaching its critical resistance near the $0.00002189-level, as highlighted on the charts.

Breaking this resistance could open the door for a rally towards $0.00003, significantly boosting its valuation. However, failing to surpass this level may lead to consolidation or retracement, making this a pivotal moment for the memecoin.

Additionally, the whale’s recent entry has strengthened optimism, but sustained momentum will depend on broader market conditions.

Are new addresses driving PEPE’s growth?

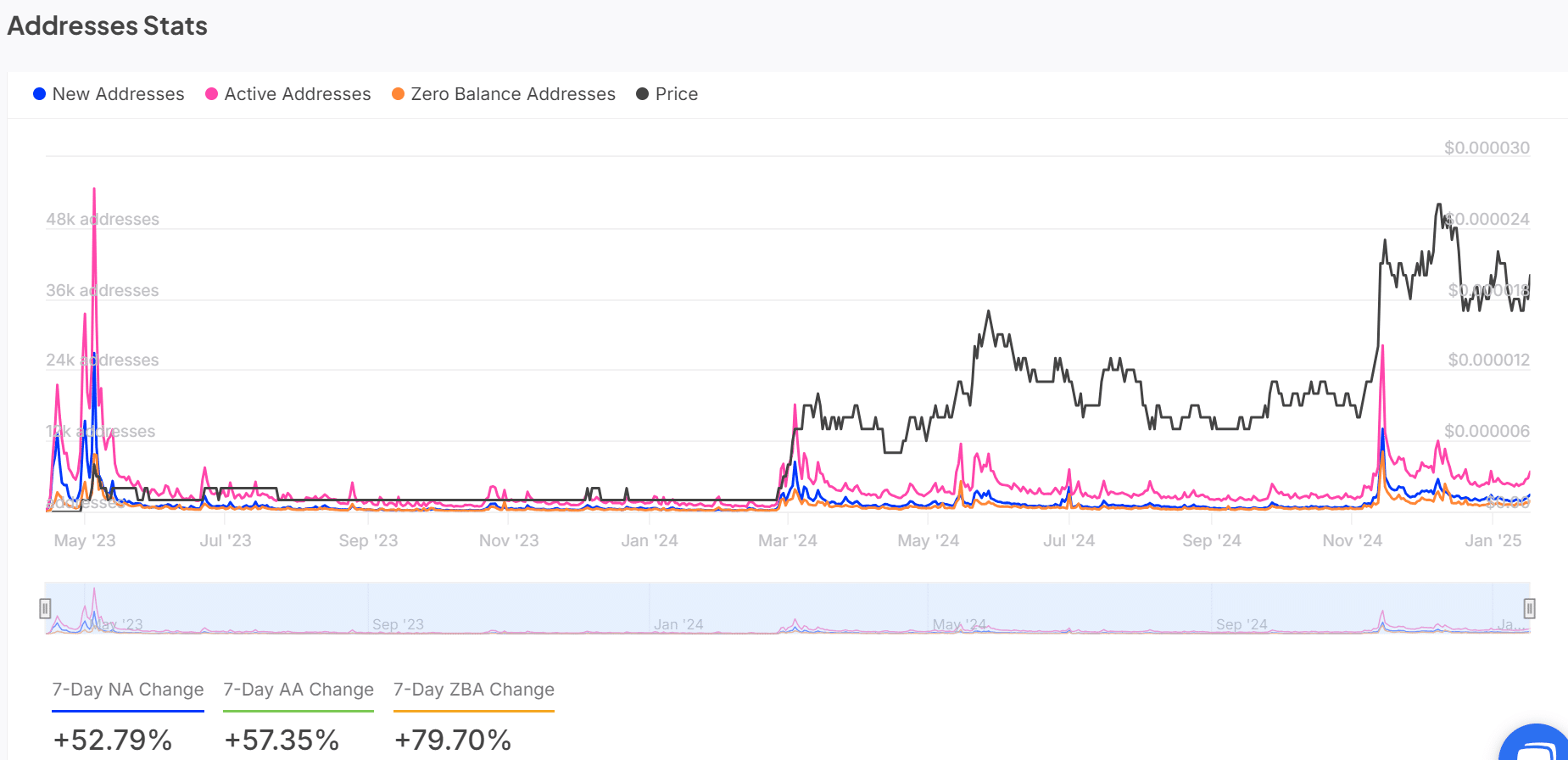

On-chain data indicated a surge in new and active addresses interacting with PEPE. Over the past week, new addresses have risen by 52.79%, while active addresses have climbed by 57.35%.

This growth can be seen as a sign of heightened interest and activity within the memecoin ecosystem. Additionally, the spike in zero-balance addresses by 79.7% revealed that many traders have been exploring the token.

However, these traders may not yet fully commit to holding significant amounts. Therefore, sustained address growth will be crucial for translating this curiosity into long-term support for the memecoin.

Are transaction trends aligning with bullish sentiment?

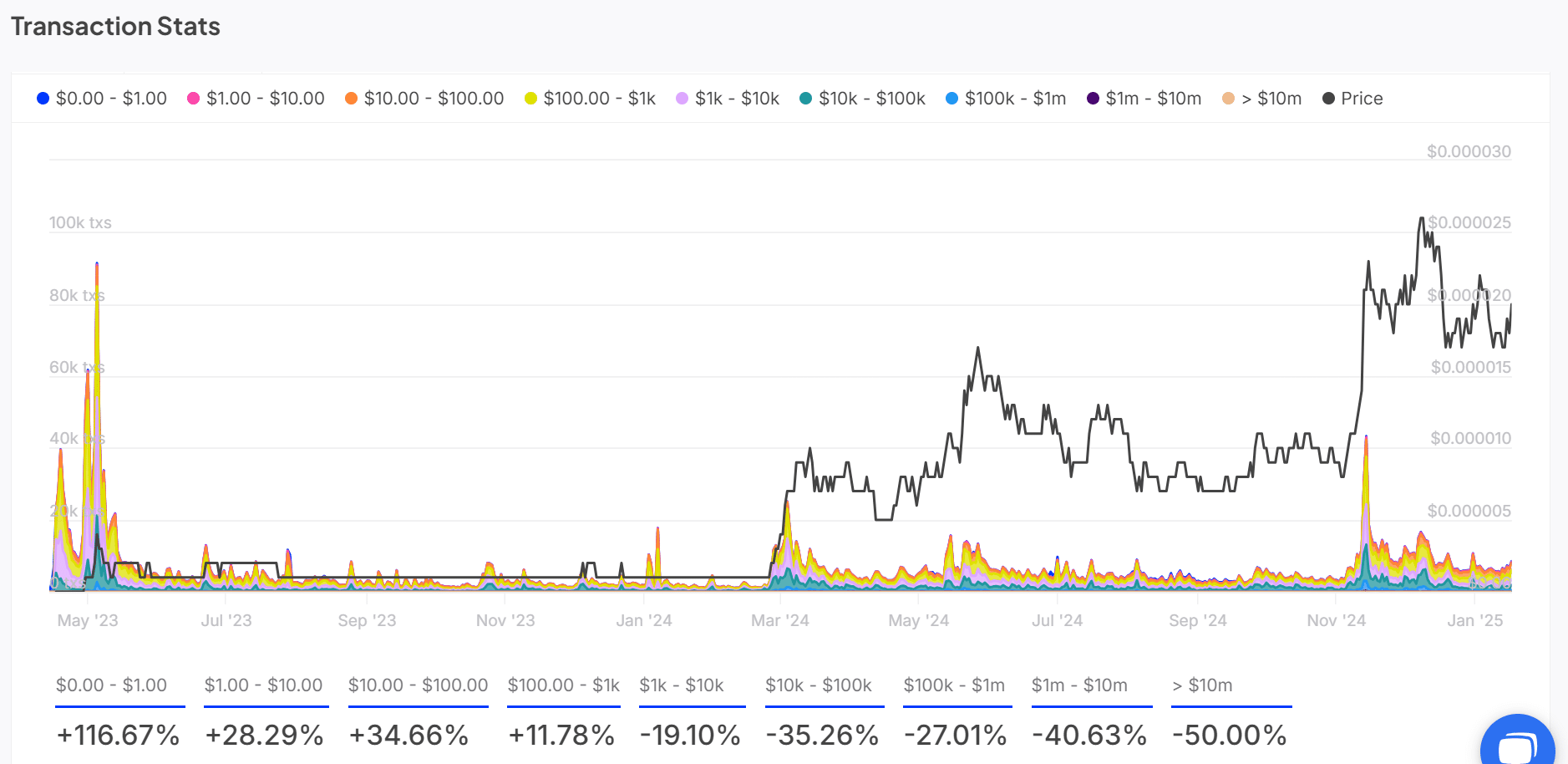

On the contrary, the transaction data painted a pretty mixed picture. Transactions below $10 surged by 28.29%, indicating growing retail participation. However, transactions exceeding $100,000 dropped by 35.26% – A sign of limited confidence from larger investors.

Therefore, while retail interest is building, balanced participation from both small-scale traders and institutions will be necessary for a sustained price rally. Additionally, the absence of more whale-sized transactions could allude to caution from major market players.

Declining MVRV – What does it mean for PEPE?

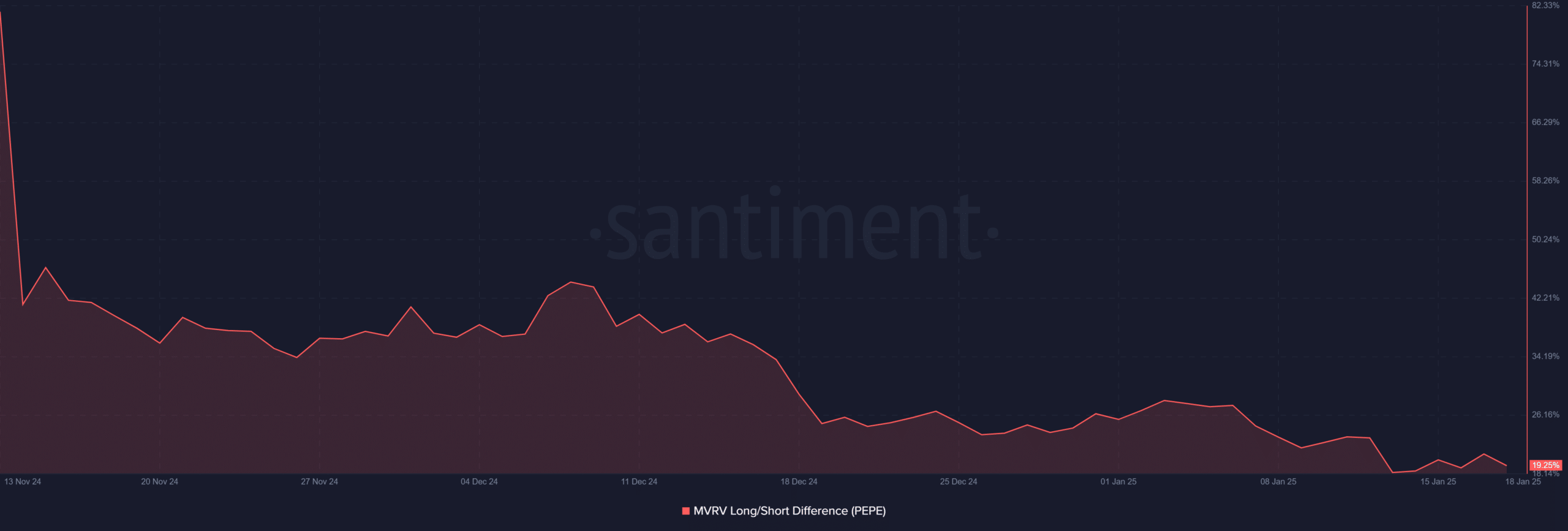

The MVRV (Market Value to Realized Value) long/short difference fell to 19.25%, indicating reduced profitability among holders. Such a decline often means that traders are less likely to sell at press time levels, potentially reducing selling pressure.

However, the downward trajectory in MVRV also underlined waning speculative enthusiasm, which could hinder any immediate rally. Additionally, this metric highlighted the delicate balance between maintaining investor interest and avoiding overselling.

Read Pepe’s [PEPE] Price Prediction 2025–2026

Can PEPE deliver on investor expectations?

The combination of whale activity, a cup-and-handle pattern, and rising address engagement provides reasons for optimism about PEPE’s future.

However, breaking the $0.00002189 resistance is crucial for any sustained upward movement. If PEPE can leverage its current momentum and overcome these challenges, it may achieve a significant rally.