XRP Gains, Trump Inauguration, AI Agents

Several big stories and developments have occurred in the crypto space this week, including Binance listing three AI agent tokens, Grayscale revealing 39 assets to be included in its investment products, and Donald Trump’s Inaugural Crypto Ball.

XRP also soared to a six-year high with cascading impacts on the crypto market, and JPMorgan predicted a $14 billion market from potential XRP and Solana ETFs.

Binance Lists Three AI Agent Tokens to Great Success

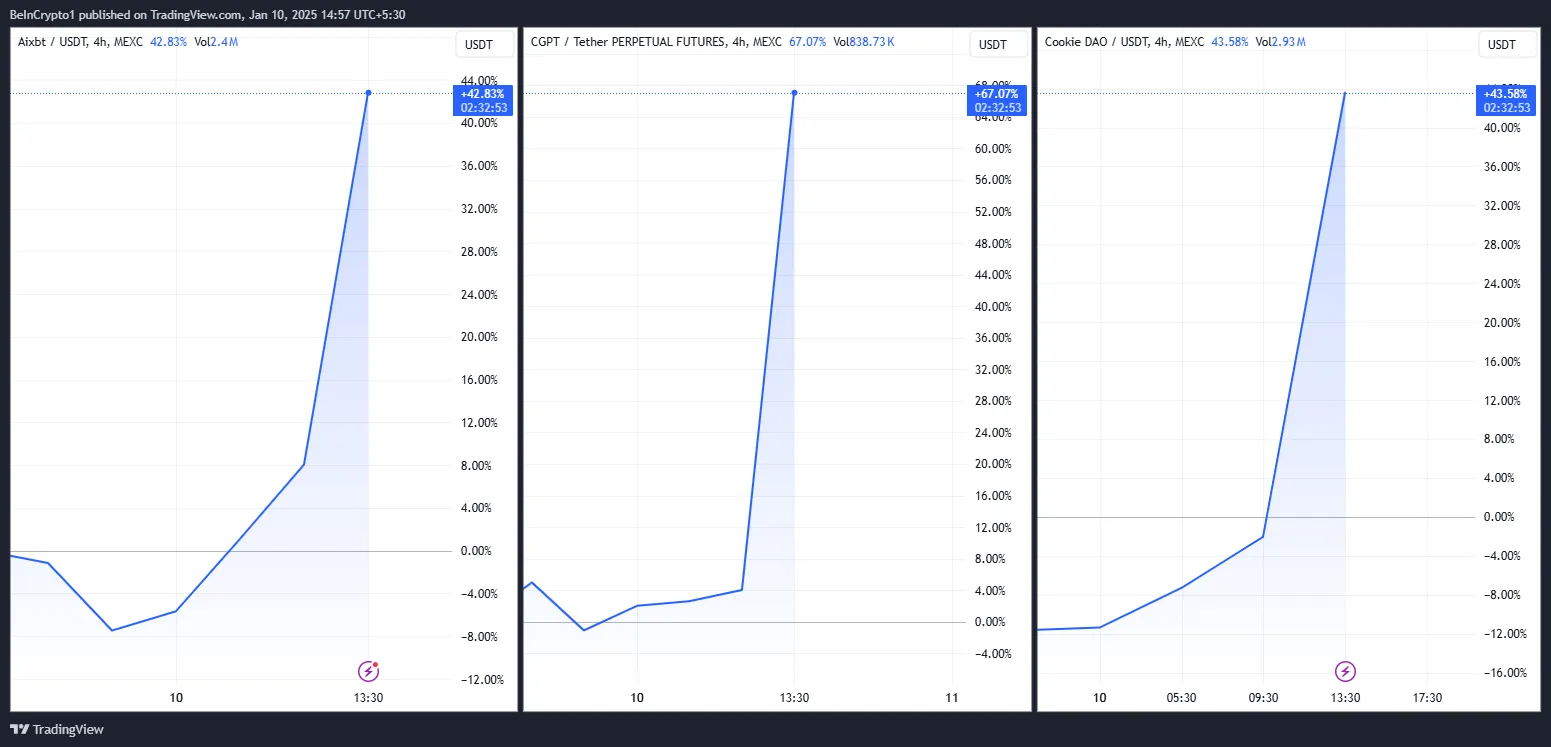

Binance, one of the world’s leading crypto exchanges, listed three new AI agent tokens on January 10. The firm also allowed zero-fee trading on the three tokens: aixbt by Virtuals (AIXBT), ChainGPT (CGPT), and Cookie DAO (COOKIE). Immediately after the listing took place, all three assets spiked over 40%.

Many influential voices within the crypto industry are becoming increasingly bullish on AI agents. Yesterday, for example, OKX Ventues identified them as a key investment area for 2025, and Nvidia’s CEO claimed it will become a multi-trillion-dollar industry.

The performance of these three tokens showcases the growing hype of AI agents throughout the crypto community.

Grayscale Reveals 39 Altcoins For Investment Consideration

Grayscale, one of the leading ETF issuers, revealed an extensive list of potential new crypto investment options, including meme coins and AI tokens.

In total, the firm is considering adding 39 altcoins to its lineup of investible digital assets. They fall into five categories: currencies, Smart Contract Platforms, Financials, Consumer and culture, and Utilities and services.

“The list is subject to change intra-quarter as some multi-asset funds reconstitute and we launch new single-asset products,” Grayscale claimed.

Grayscale has previously added a blitz of new crypto offerings in this manner. For example, it posted 35 tokens last October, but not all of them made it to an official listing.

Several of these assets, such as KAS, APT, ARB, and TIA, were on both lists. Other discrepancies between these two rosters reveal Grayscale’s changing priorities.

In the past few months, Grayscale has evidently placed a higher priority on AI agents, but a few sectors, such as meme coins, RWAs, and DePINs, are also growing in prominence.

The First-Ever “Crypto Ball” Will Take Place Ahead of Trump’s Inauguration

David Sacks, Trump’s newly appointed AI and Crypto Czar, will be hosting the first-ever Crypto Ball. This black-tie event sold out its lower-tier $2,500 tickets, highlighting the strong enthusiasm for the event.

Several prominent firms have backed it, including Coinbase, Sui, Mysten Labs, Metamask, Galaxy, Ondo, Solana, and MicroStrategy.

“This exclusive event features $100,000 VIP tickets and $1 million private dinner packages with Trump. Major sponsors like Coinbase, MicroStrategy, and Galaxy Digital are backing the event, signaling a shift toward a pro-crypto US administration,” Mario Nawfal wrote on X (formerly Twitter).

Since his election victory in November, Trump has promised a sweeping array of pro-crypto reforms in the US. Currently, the President-Elect is not expected to personally attend, but other pro-industry officials will make an appearance. Trump is also expected to sign a pro-crypto executive order on his first day in office.

XRP Surged to an All-Time High at $3.39

Ripple’s altcoin, XRP, soared to its highest price in over seven years, prompting a number of changes in the broader crypto ecosystem. Several XRP-based meme coins, such as ARMY, PHNIX, and LIHUA, posted impressive gains due to XRP’s dedicated base of supporters.

XRP also outperformed other cryptoassets in the past week, contributing to this sense of optimism. Earlier today, its trading volume topped $20 billion, fueled by speculation that Trump may support a US reserve of several assets, not just Bitcoin.

JPMorgan Predicts XRP, SOL ETF Market at $14 Billion

Analysts from major investment bank JPMorgan claimed that the ETF market for XRP and SOL could reach $14 billion. These analysts predicted that an XRP ETF would be the more profitable of the two but concluded that both are likely to win SEC approval in 2025.

“The key question here remains the uncertainty of investor demand for additional products and whether new crypto ETP launches will matter,” JPMorgan analysts including Kenneth Worthington claimed.

Earlier this year, Ripple CEO Brad Garlinghouse claimed that an XRP ETF is inevitable, and this prediction is looking increasingly likely.

SEC Chair Gary Gensler is about to resign from his position alongside the CFTC chair, and both positions will be replaced by industry advocates. Financial regulation in the US is about to get a lot more pro-crypto.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.