Crypto market’s weekly winners and losers – BOME, JUP, SHIB, BSV

- Book of Meme, ZRK, and Jupiter had the week’s biggest gains.

- Shiba Inu, Bitcoin SV, and BitTorrent were the biggest losers for the week.

At the end of another trading week, Solana [SOL]-based coins emerged as some of the crypto assets that saw the most gains during the seven-day period.

Here’s AMBCrypto’s list of the biggest winners and losers from the 10th to 17th of March.

Biggest winners

Book of Meme [BOME]

The newly launched Solana-based meme coin Book of Meme [BOME] led the cryptocurrency market as the asset with the most gains in the last week.

Exchanging hands at $0.019 at press time, the token’s value rose by over 2000% over the last seven days.

Developed by Darkfarms, the creator of Pepe [PEPE], BOME was launched on the 10th of March and was offered for pre-sale on the 13th of March.

It’s listing on Binance on the 16th of March caused its price to skyrocket to an all-time high of $0.028 on the same day before witnessing a 29% price correction.

0x Protocol [ZRX]

Per CoinMarketCap’s data, 0x Protocol [ZRX] witnessed an impressive weekly gain of 106%, securing its position as the asset with the second-highest gains last week.

According to the data provider, the token started the week at a value of $0.65.

While the rest of the market trended sideways, with leading coins such as Bitcoin [BTC] and Ethereum [ETH] recording losses of 5% and 10%, ZRX saw its value climb by triple digits.

As of this writing, the altcoin exchanged hands at $1.36, with a 60% uptick in its trading volume in the past 24 hours.

Jupiter [JUP]

Jupiter [JUP], the token that powers Jupiter, the Solana-based decentralized exchange (DEX), secured the third spot on the list of assets with the highest gains over the past week.

Trading at $1.34 at press time, the token’s value rose by 77% during the period under review.

During the week, the token climbed to a 30-day high of $1.5 on the 16th of March before witnessing a correction below the $1.4 price mark.

As of this writing, the token’s market capitalization was $1.81 billion.

Biggest losers

Shiba Inu [SHIB]

Following an extended period of rally, Shiba Inu [SHIB] emerged as the crypto asset with the highest losses in the last week.

With a 27% decline in its value in the past seven days, it traded at $0.00002556 at press time.

At the beginning of the week, it exchanged hands at $0.000035. However, as SHIB’s daily trading volume plummeted, its value also declined.

Per Santiment’s data, SHIB’s daily trading volume dropped by over 25% during the period under review.

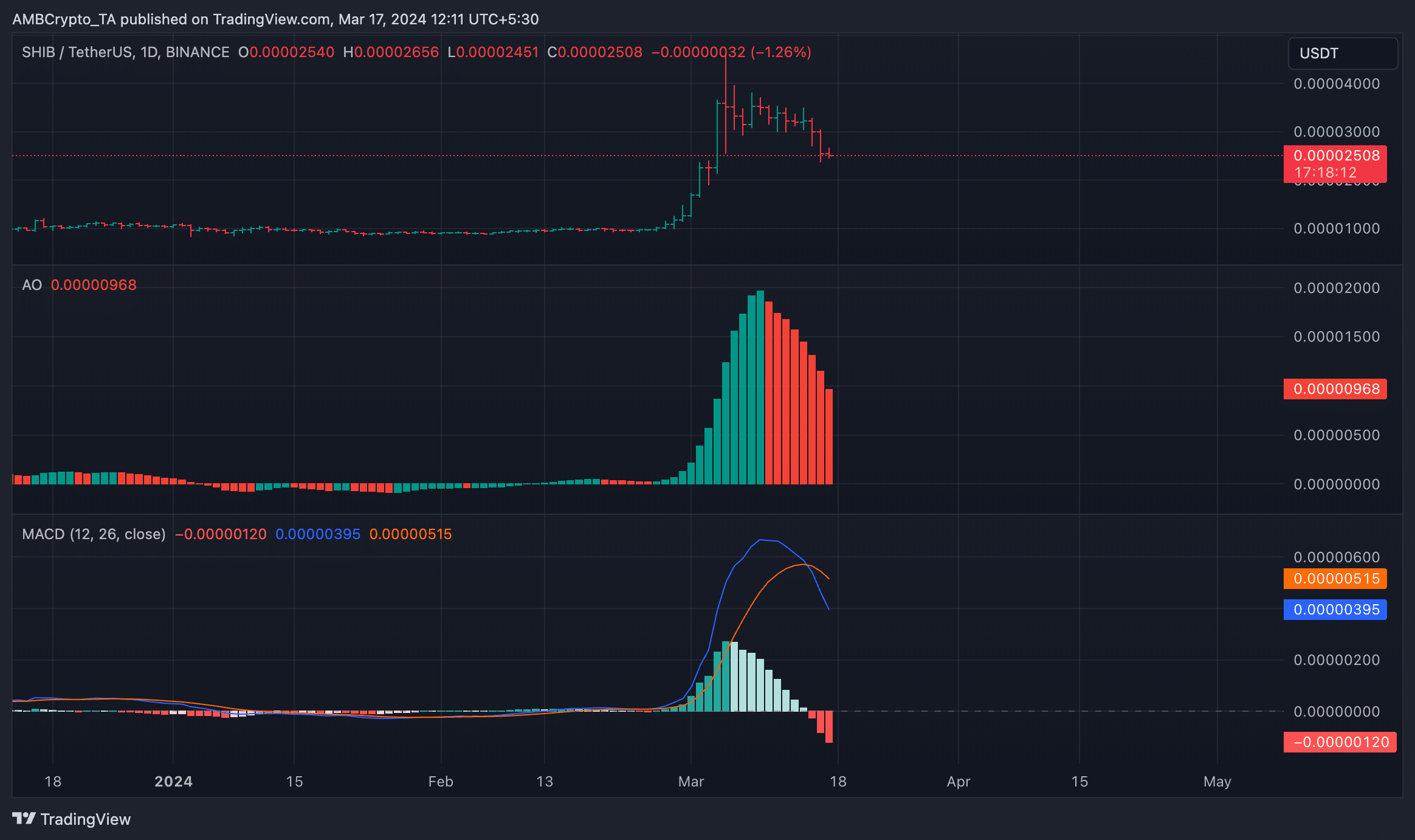

An assessment of the price performance on a daily chart revealed a downward intersection of its MACD line with its signal line on the 15th of March, signaling that the bears had regained market control.

Likewise, in the past seven days, SHIB’s Awesome Oscillator has posted red upward-facing histogram bars. This suggested a significant shift in momentum from bullish to bearish and a surge in coin sell-offs.

Bitcoin SV [BSV]

AMBCrypto found that BSV started the week at an impressive $112.

However, BSV’s statistically positive correlation with BTC, which experienced a sharp decline below the $70,000 price level on the 14th of March, caused its price to initiate a downtrend on the same day.

Due to increased coin sell-offs, BSV’s value had dropped below $85 by the end of the week. Exchanging hands at $81 at press time, the altcoin traded at its lowest level since the beginning of March.

BitTorrent [BTT]

According to CoinMarketCap, BTT, the token that powers the popular peer-to-peer (P2P) file-sharing and torrent platform BitTorrent, ranked as the asset with the third-highest weekly loss.

Between 10th and 17th of March, the altcoin’s value fell by 27%. With no attempts at recovery during the week, BTT spent the past seven days trending downwards.

BTT extended its losses at the time of writing, plummeting by 14% in the past 24 hours. During that period, its trading volume dropped by 5%.