Arbitrum [ARB] falls 14% after 1.1B token unlock, but is a rise coming?

- ARB deposits to exchanges rose sharply after the unlock.

- Wallets holding between 100,00 to 100 million coins continued to accumulate.

Layer-2 (L2) token Arbitrum [ARB] crashed 14% shortly after more than a billion of its tokens were released into the market as part of the cliff unlock.

Fears come true

ARB was exchanging hands at $1.9 at 11 am UTC on the 16th of March, according to CoinMarketCap. However, prices started plunging dramatically after the scheduled supply unfreeze at 1 pm.

As of this writing, ARB was exchanging hands at $1.65.

About 76% of ARB’s total circulating supply, worth over $2 billion, was distributed to the team, future team, and investors, as per AMBCrypto’s analysis of Token Unlocks’ data.

Many of these recipients acted quickly to profit from these tokens.

According to Spot On Chain, six beneficiary wallets transferred 8.95 million ARBs to Binance within hours of the unlock.

These wallets still held over 32 million tokens and could likely deposit more tokens in the days to come, causing further downsides.

Large whales are bullish though

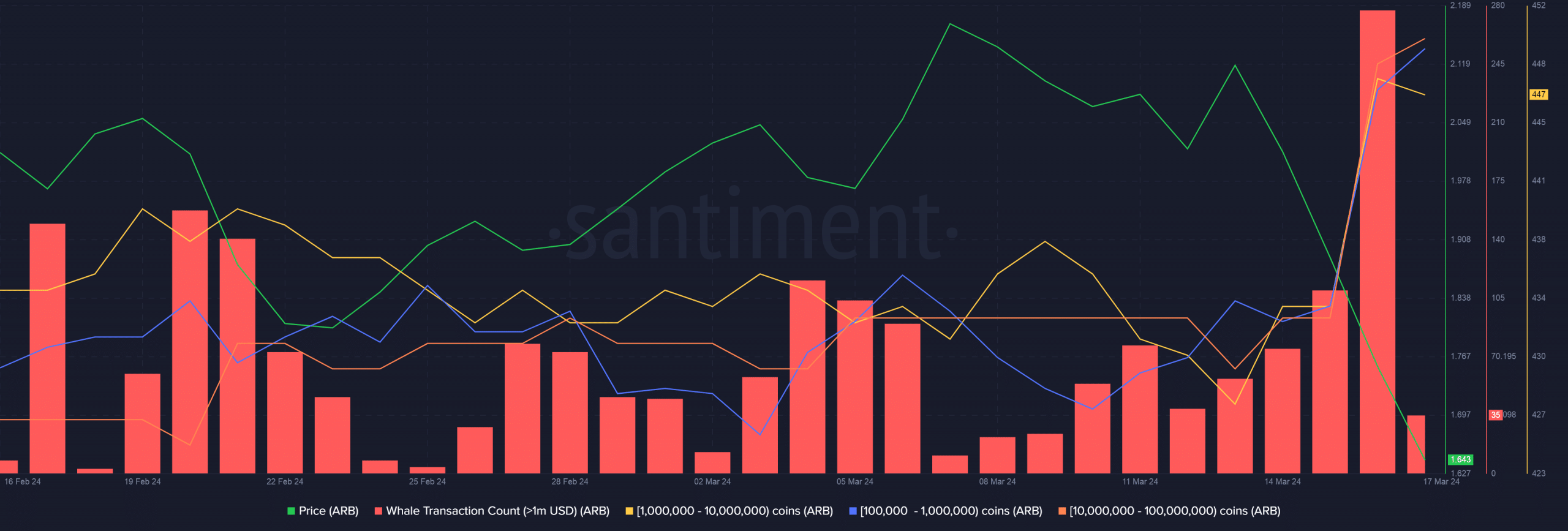

To gain additional insights, AMBCrypto investigated ARB whales’ behavior using Santiment data. Notably, transactions worth over $1 million spiked to their highest value ever on the 16th of March.

However, most large whales were seen to be accumulating ARBs as opposed to selling. As evident above, wallets holding between 100,00 to 100 million coins rose sharply on the same day.

Interestingly, these user cohorts started amassing tokens in the days leading to the unlock, suggesting that they were bullish on ARB’s prospects.

Now that the prices have plunged, it remains to be seen if these whales will continue to accumulate or dump their holdings.

Realistic or not, here’s ARB’s market cap in BTC’s terms

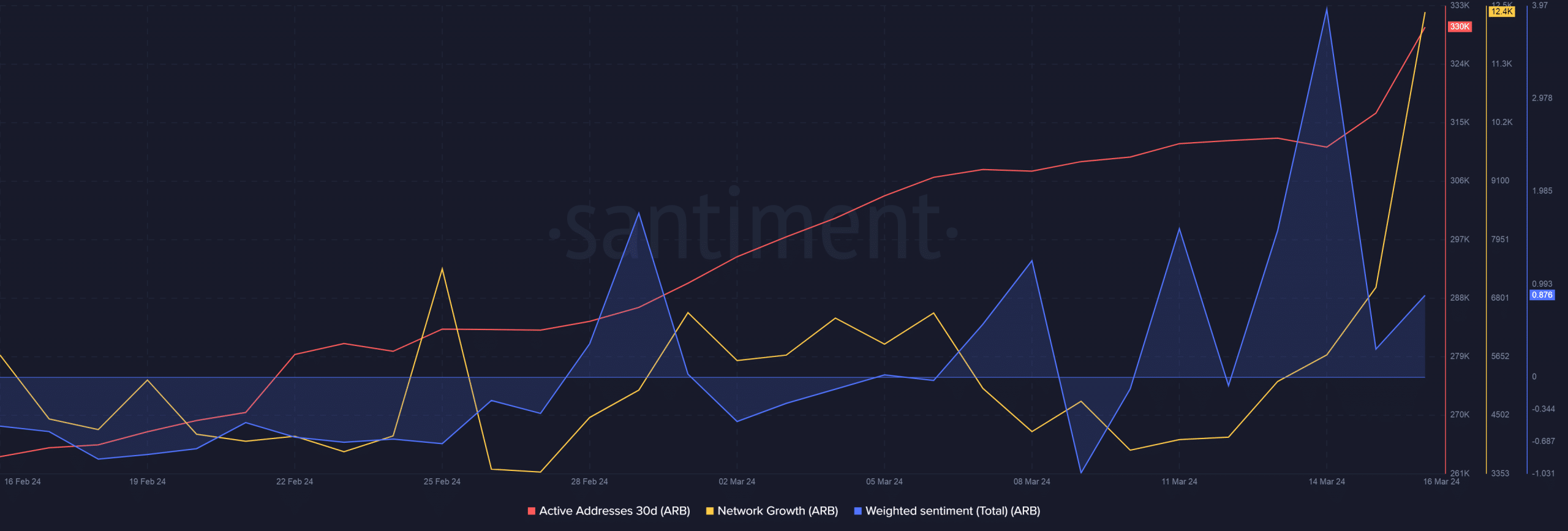

Meanwhile, ARB’s on-chain activity increased significantly due to the unlock. About 330k unique addresses were active on the 16th of March, 13k more than the previous day.

Moreover, the number of new addresses on the network jumped 77%, indicating retail excitement and mainstream adoption of the token.