Record highs, sharp drops, and rapid recovery trigger $1 billion market liquidation

Quick Take

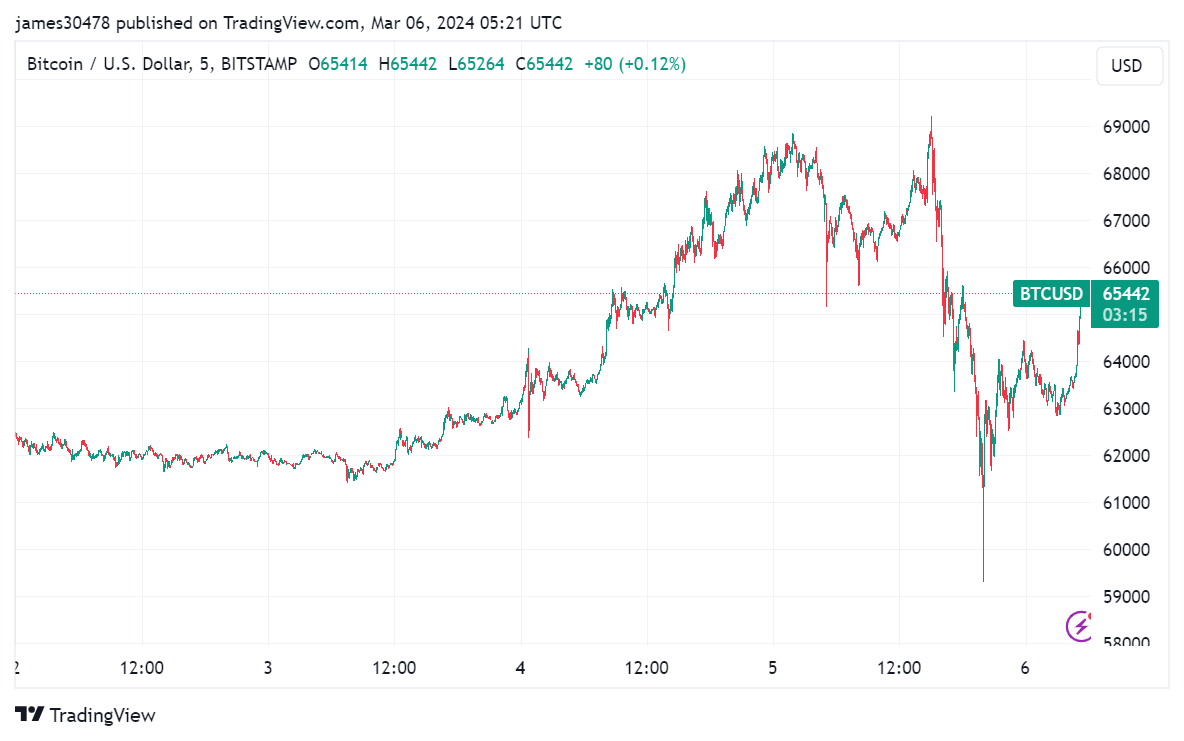

In an extraordinary 24-hour period, Bitcoin soared to a new all-time peak of around $69,200, then experienced a rapid sell-off, dropping the price to near $59,500. Following this tumultuous drop, Bitcoin has since rebounded and is now stabilizing at approximately $67,000.

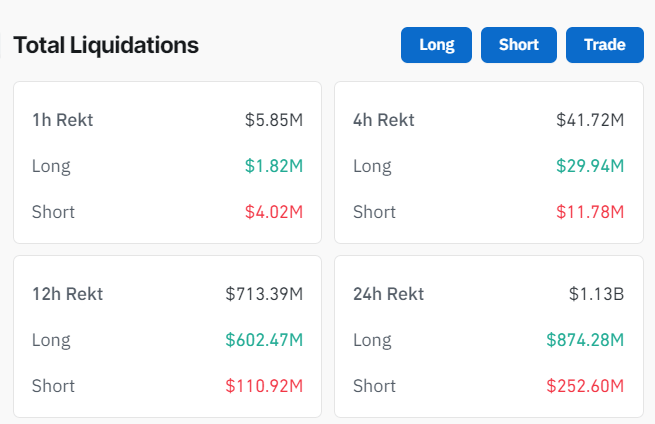

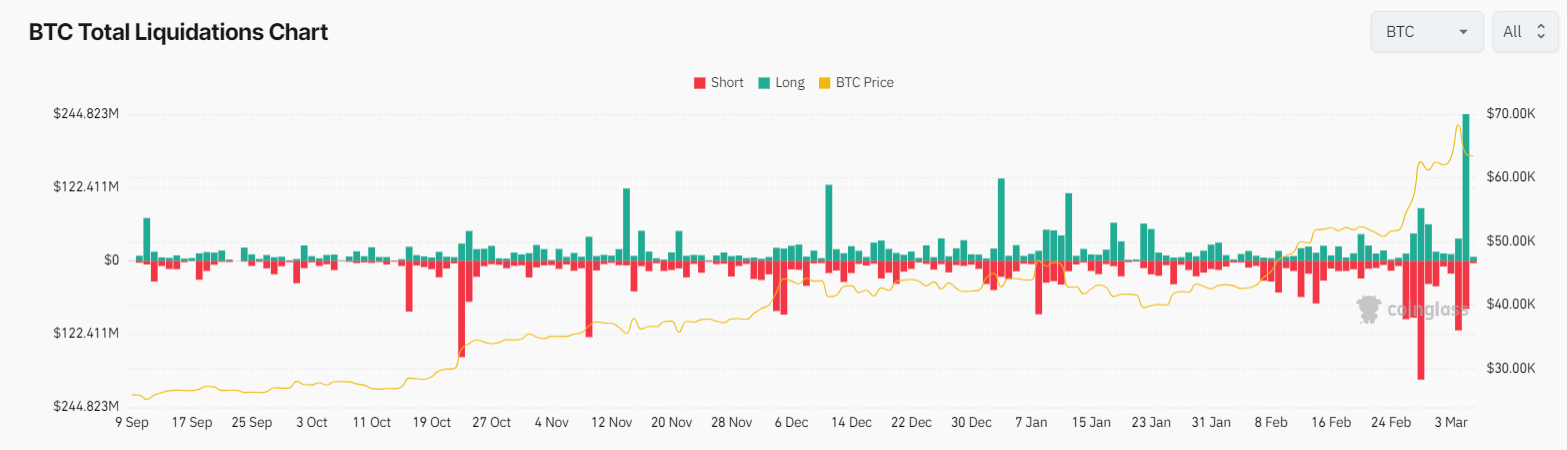

This precarious and sudden market volatility triggered a widespread liquidation event within the digital asset ecosystem, amounting to nearly $1.15 billion, according to CoinGlass.

CoinGlass data shows the liquidations hit harder on longs, with approximately $875 million liquidated, in comparison to $250 million of shorts. Bitcoin, the leading digital asset, was at the center of this financial storm, witnessing liquidations of roughly $320 million; the majority ($245 million) of this figure represented longs. This incident marks the most significant long liquidation event in Bitcoin in the last half year.

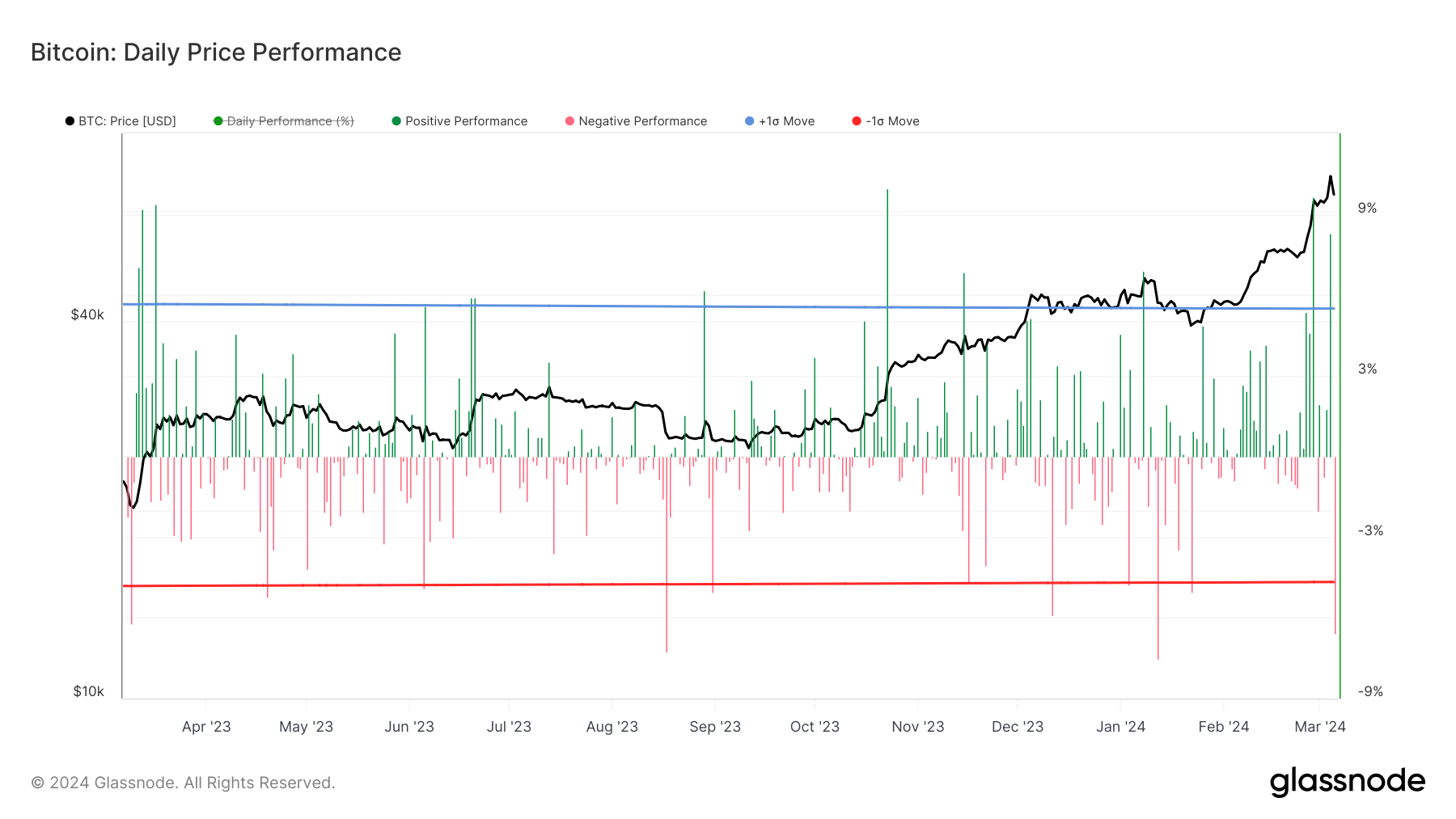

By the end of the turbulent day, Bitcoin had suffered a roughly 6.5% loss, its steepest one-day decline since Jan. 13 and the third most significant daily loss in the past 12 months.

The post Record highs, sharp drops, and rapid recovery trigger $1 billion market liquidation appeared first on CryptoSlate.