Here’s What Could Get Them Dropped

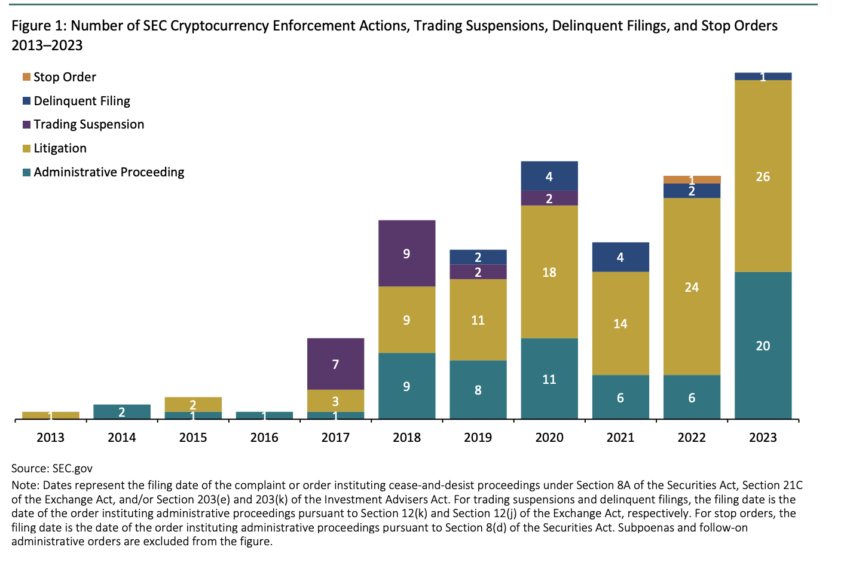

Under Gary Gensler, the US Securities and Exchange Commission (SEC) has been at the forefront of the crypto crackdown, launching numerous lawsuits against firms. However, Mike Novogratz, a well-known billionaire investor, suggests a potential shift in this trend.

The role of regulators such as the SEC is pivotal while the crypto industry matures.

Will Next SEC Chair Drop Gensler’s Lawsuits Against Crypto?

According to Novogratz, a change in SEC leadership could lead to many of these lawsuits being dropped. In a Forbes interview, he shared the perspective where Novogratz criticized the SEC’s inconsistent regulatory approach.

“Looking ahead, regardless of the political affiliation of the next SEC chairperson, there’s a likelihood that many of the lawsuits initiated under Gensler’s tenure will be dropped,” Novogratz said.

Specifically, the SEC’s decision to deny a Bitcoin ETF while approving futures ETFs has been controversial. This discrepancy was even questioned by the courts, highlighting the regulatory inconsistencies. Therefore, the next SEC chair might take a different approach. Consequently, markets could see a reduction in litigation against crypto entities.

Read more: Who Is Gary Gensler? Everything To Know About the SEC Chairman

Moreover, the regulatory framework for digital assets is currently mired in uncertainty. The Howey Test, used to determine what constitutes a security, seems outdated for blockchain technology. This ambiguity hampers industry growth and burdens businesses with navigating complex regulations.

Adding to the complexity, a security breach at the SEC led to a false announcement regarding a Bitcoin ETF. This incident has reignited debates about the SEC’s approach under Gensler, with some calling for his resignation. Critics, including Brad Garlinghouse of Ripple Labs, view Gensler as hindering economic growth. Ripple’s court victory against the SEC, where XRP sales were not deemed unregistered securities, further challenges the SEC’s stance on digital assets.

Read more: What Is the Howey Test and How Does It Impact Crypto?

In response to the SEC’s broad classification of digital assets as securities, Lejilex and the Crypto Freedom Alliance of Texas have filed a lawsuit. They argue that the SEC’s approach lacks legal clarity and imposes undue regulatory burdens. This case is part of a growing trend of legal challenges to the SEC’s authority in the crypto space.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.