DeFi tokens UNI, AAVE, MKR gain, but the trends are changing

- AAVE’s price surged by 4% in the last seven days.

- UNI’s daily chart turned red as its value plummeted by over 13%.

During the last few weeks, AI tokens created a buzz in the crypto space as the values of several AI cryptos skyrocketed.

However, over the last few days, the narrative has shifted towards DeFi. This allowed multiple DeFi tokens like Uniswap [UNI] and AAVE to pump their prices substantially.

DeFi tokens are shining

A few days ago, AMBCrypto reported that AI tokens like Worldcoin [WLD] gained traction and surged by over 90% in a single week. The hype around AI tokens was driven by OpenAI’s Sora launch.

But over the next few days, DeFi tokens came into the limelight. Daan Crypto Trades, a popular crypto trader, recently posted a tweet highlighting the shift of capital flow from AI tokens to DeFi tokens.

The shift was evident in terms of price action too, as Uniswap showcased commendable performance.

AMBCrypto had earlier reported that the DeFi token’s price surged by more than 65% in just a single day, allowing it to enter the list of the top 20 cryptos by market capitalization.

To better understand how these DeFi tokens were performing, we checked their weekly performances.

The bigger picture

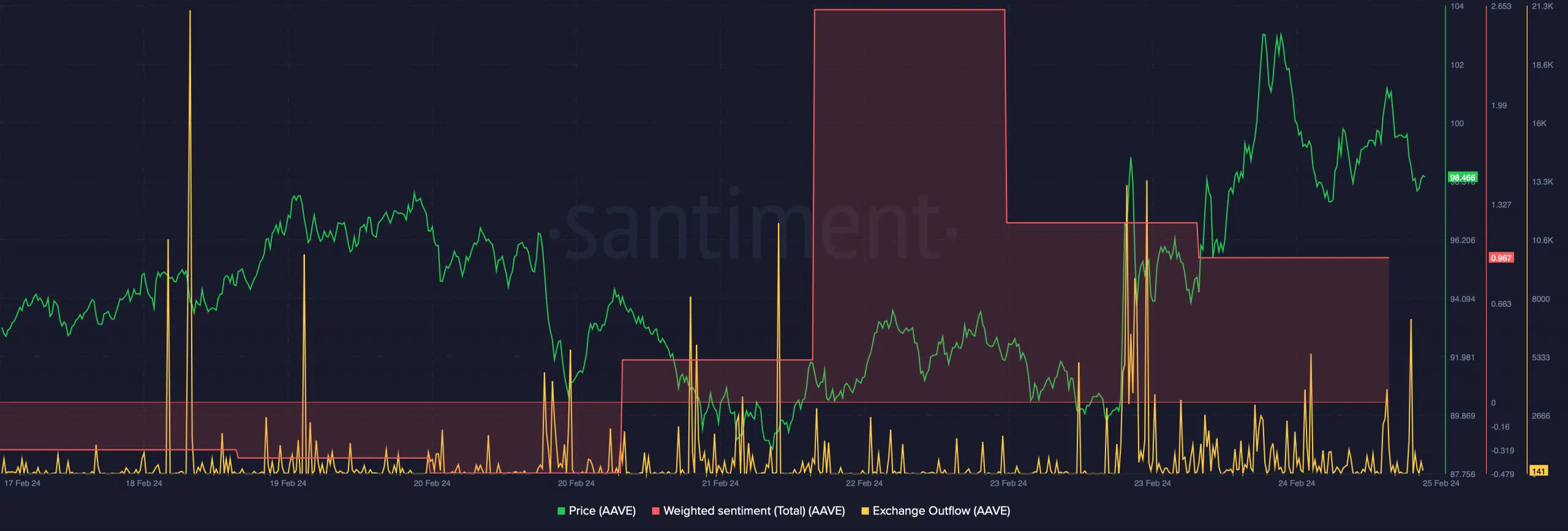

Apart from UNI, AAVE’s performance also looked promising, as its value shot up by more than 4% in the last seven days. At press time, it was trading at $98.14 with a market cap of over $1.4 billion.

It was surprising to note that despite the price rise, bearish sentiment around the token increased, as after a spike on the 22nd of February 2024, AAVE’s Weighted Sentiment dropped.

Its exchange outflow also dropped last week, signifying less buying pressure.

Though AAVE’s weekly chart was green, Maker’s [MKR] fate was different. The DeFi token’s value plummeted by more than 4.5% over the last seven days.

CoinMarketCap noted that MKR was trading at $2,030.17 with a market cap of over $1.8 billion at press time.

Read Uniswap’s [UNI] Price Prediction 2024–25

If the latest data is to be considered, UNI and AAVE’s bull rallies also came to an end. In the last 24 hours alone, UNI was down by more than 13%, while AAVE’s value dropped marginally.

It will thus be interesting to watch whether the hype around DeFi will help these tokens initiate another bull rally in the upcoming week.