Why Ethereum Deserves a Spot ETF: Coinbase Makes Its Case

Coinbase, a prominent US crypto exchange, has thrown its weight behind Grayscale’s bid to turn Ethereum Trust into a spot Ethereum exchange-traded fund (ETF).

Meanwhile, there is high optimism amongst the Ethereum community regarding the US Securities and Exchange Commission’s (SEC) decision on spot Ethereum ETF.

Coinbase Explains Why The SEC Should Approve a Spot Ethereum ETF

On February 22, Coinbase’s chief legal officer, Paul Grewal, made a detailed 27-page letter public. It lays out the legal, technical, and economic grounds for the SEC to green-light an Ethereum-based ETF.

A key point in Coinbase’s argument is that Ethereum (ETH) should be seen as a commodity, not a security. This view finds support in the Commodity Futures Trading Commission’s (CFTC) approval of ETH futures. Additionally, statements from SEC officials and court decisions bolster this stance. Importantly, the SEC has not contested the CFTC’s treatment of ETH as a commodity.

Furthermore, Grewal highlighted the robust governance of Ethereum’s proof-of-stake consensus. This system, he argued, effectively reduces risks of fraud and manipulation.

Read more: How to Buy Ethereum (ETH) and Everything You Need to Know

Hence, Coinbase aims to clarify the Ethereum market’s dynamics and comprehensive surveillance. It believes these factors warrant the SEC’s approval of the proposed ETF.

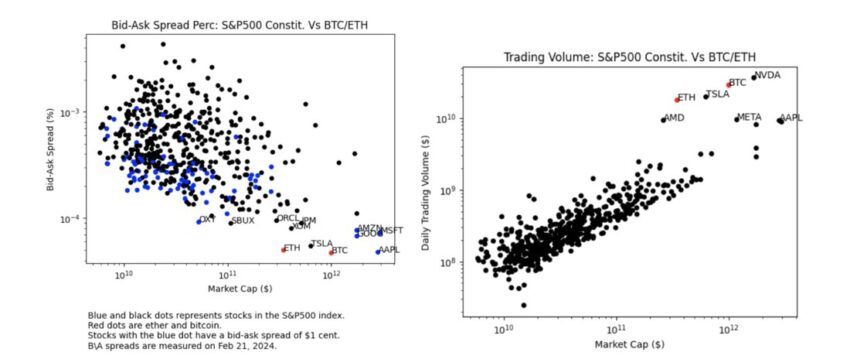

“The economics show that Ethereum is as resilient as Bitcoin in satisfying the Commission’s standard for ETP (exchange-traded product) approvals,” Grewal stated.

To demonstrate this, it provided charts showing that Ethereum was mostly on par with other ETF-approved assets and stocks in terms of trading volume and spreads.

However, in December 2023, the SEC delayed its decision on Grayscale’s spot Ethereum ETF proposal. Opting to extend its review period beyond the usual 45 days, the SEC seeks to evaluate the proposal thoroughly.

Meanwhile, Franklin Templeton, a well-regarded asset management firm, entered the fray with its application for a spot Ethereum ETF earlier this month. This move aligns with efforts by BlackRock, Grayscale, and VanEck, indicating a rising interest in Ethereum-based financial products.

Larry Fink, CEO of BlackRock, has expressed optimism about an Ethereum ETF. He sees it as a catalyst for the wider adoption of asset tokenization. This is a development he eagerly anticipates for the future.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

Amid these developments, Ethereum’s price has experienced a significant upturn, surpassing $3,000 for the first time since April 2022. This surge reflects the market’s growing enthusiasm for Ethereum and potential institutional adoption through ETFs.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.