Spot Bitcoin ETFs’ Trading Debut in 6 Charts

Almost all of the nine new spot bitcoin exchange-traded funds that started trading in January 2024 grabbed a significant chunk of assets in their first full month, by traditional standards.

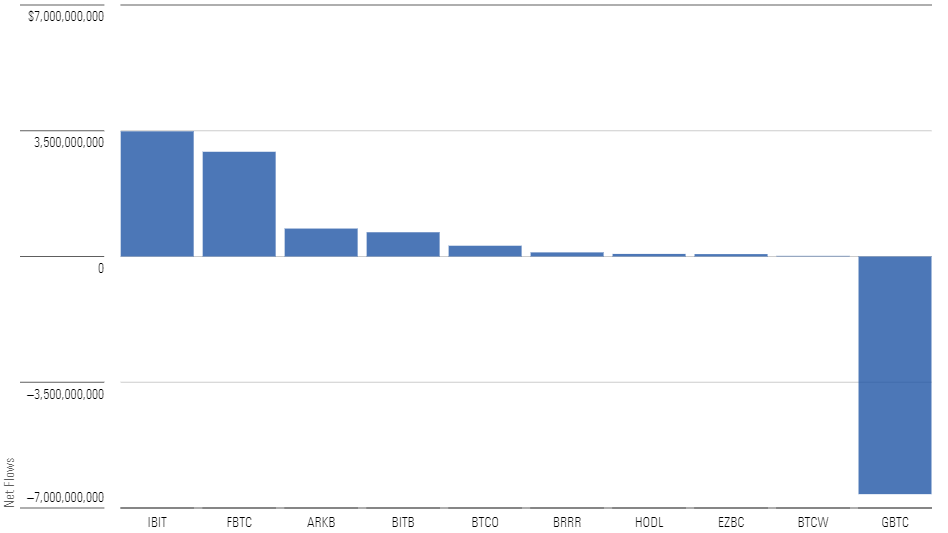

IShares Bitcoin Trust ETF IBIT and Fidelity Wise Origin Bitcoin ETF FBTC had the hottest start in gathering assets, while Grayscale Bitcoin Trust GBTC bled outflows after the new spot bitcoin ETFs began trading on Jan. 11. GBTC launched as a private trust in 2013 and held $29 billion in net assets before converting to an ETF.

Here’s how bitcoin ETFs’ long-awaited debut played out in six charts.

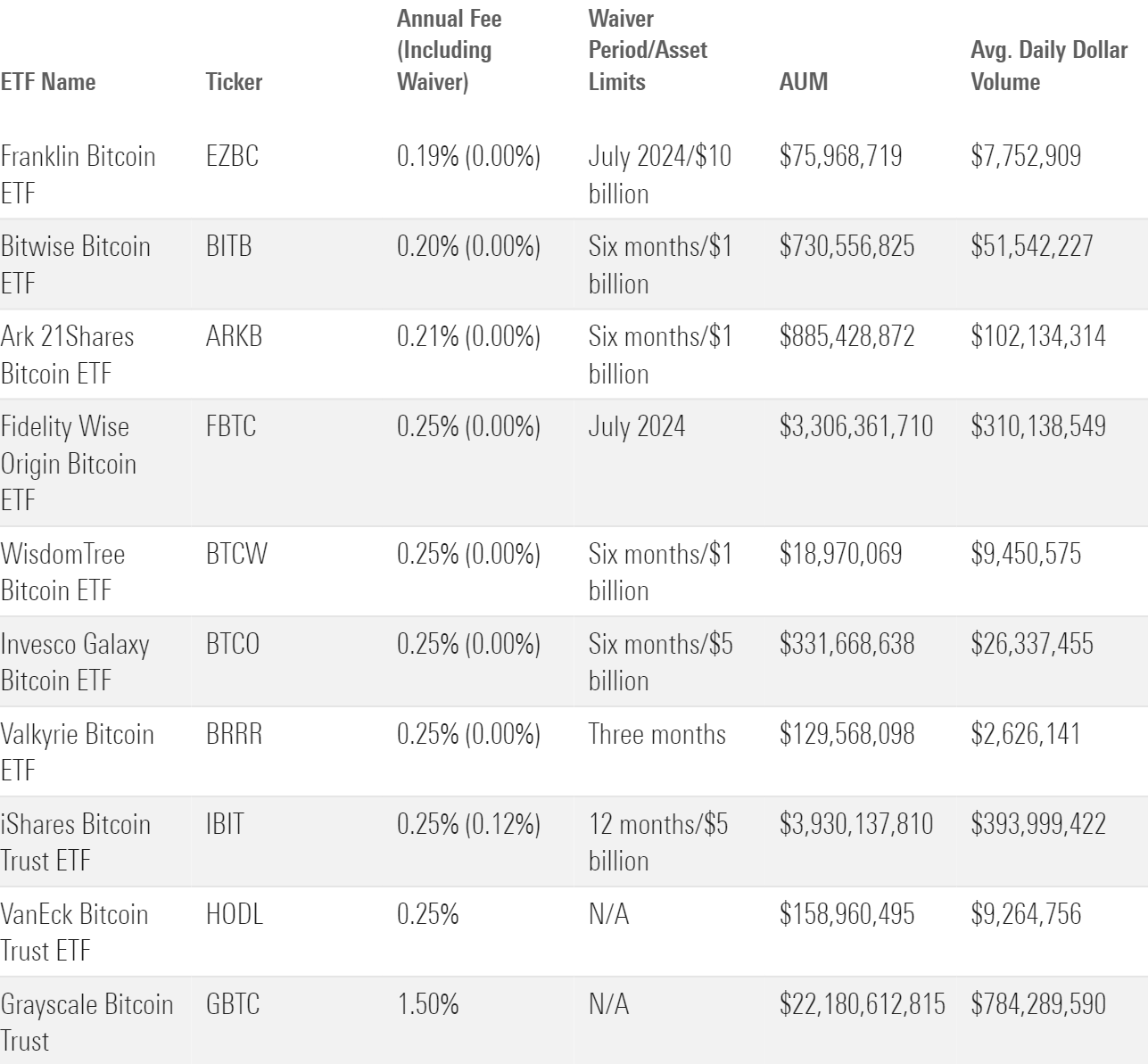

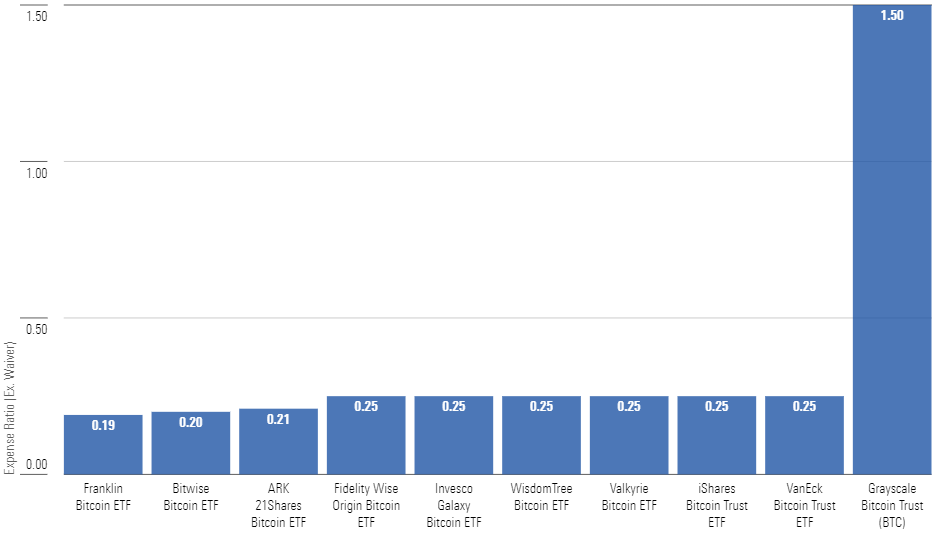

Bitcoin ETF Fees Locked In

A fee war broke out among bitcoin ETF issuers at the eleventh hour before SEC approval. Most notably, Franklin came out of left field to undercut Bitwise for the cheapest offering once its final prospectus was published.

The one outlier was Grayscale, who did no favors for their investors by charging an annual fee 1.25 percentage points higher than the next most expensive bitcoin ETF. As a reminder, all these ETFs hold the exact same thing. The only conceivable benefit of paying a higher fee is better liquidity, which we will touch on next.

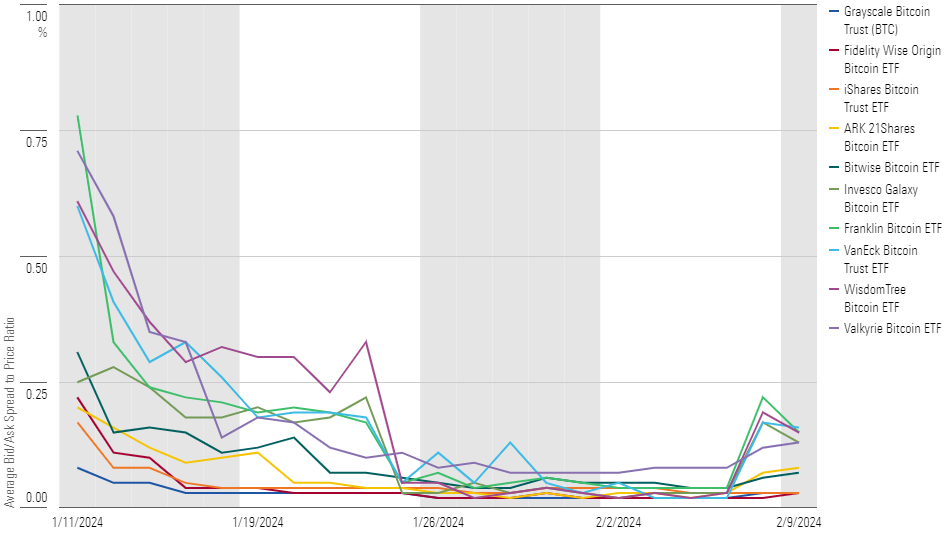

Bitcoin ETFs Were Liquid

The liquidity ecosystem for bitcoin ETFs operated extremely well for the new ETFs. The key to strong liquidity is plenty of hedging options for market makers, who are responsible for providing that liquidity. Market makers had nine new ETFs to contend with, but they could easily spread off new exposure by trading in the mature markets of GBTC and futures-based ProShares Bitcoin Strategy ETF BITO, let alone futures markets on the CME or spot bitcoin markets (though this is a bit trickier given that broker/dealers can’t hold bitcoin directly).

During the first month, over 1 billion shares of spot bitcoin ETFs traded. But perhaps the best sign for investors was the ETFs’ narrowing bid-ask spreads. The chart below shows that spreads started a bit wide but consistently narrowed to under 0.10% relative to the ETF’s price for all 10 ETFs by the end of January. Crossing the spread can be just as costly as annual fees, especially when trading often. Spreads spiked a bit in February, showing that investors still need to consider liquidity before selecting an ETF.

Net Flows Separate the Best From the Rest

In their first month, the nine new bitcoin ETFs brought in over $8.0 billion in new investment. How much of that came from the $6.6 billion that trickled out of GBTC is unknown. The week from Jan. 22-26 gave issuers a scare when the weekly net flows in aggregate were negative. But that trend reversed, and total spot bitcoin ETF flows have since been solidly in the black.

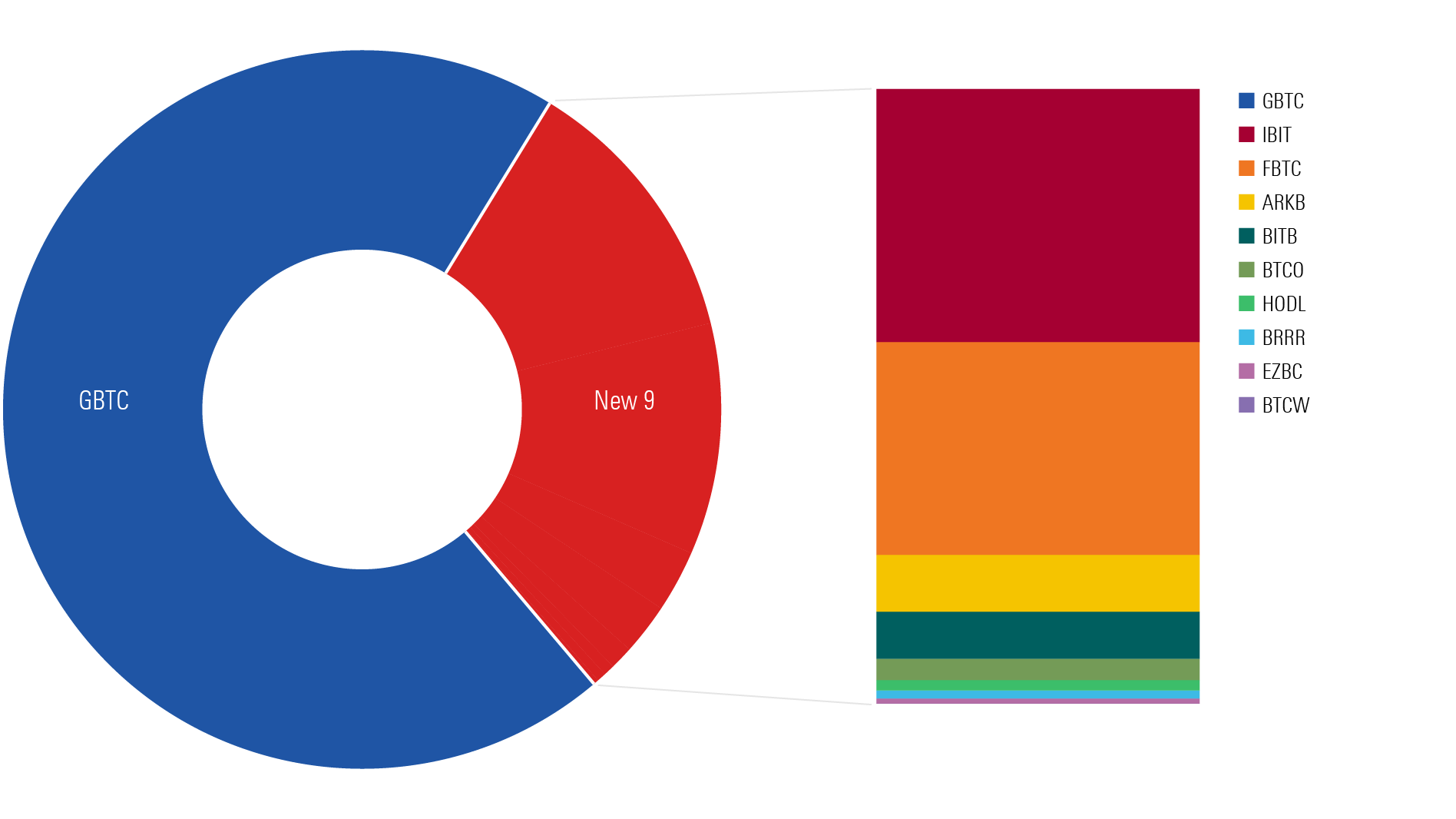

Bitcoin ETFs’ Market Share Should Continue to Change

GBTC still holds the majority of bitcoin ETF assets by virtue of a 10-year head start. What started at about 100% of spot bitcoin ETF net assets has shrunk to 70% after the first month. GBTC should continue to yield market share as investors flee its high fees and IBIT and FBTC replace it as the top liquidity vehicles for market makers.

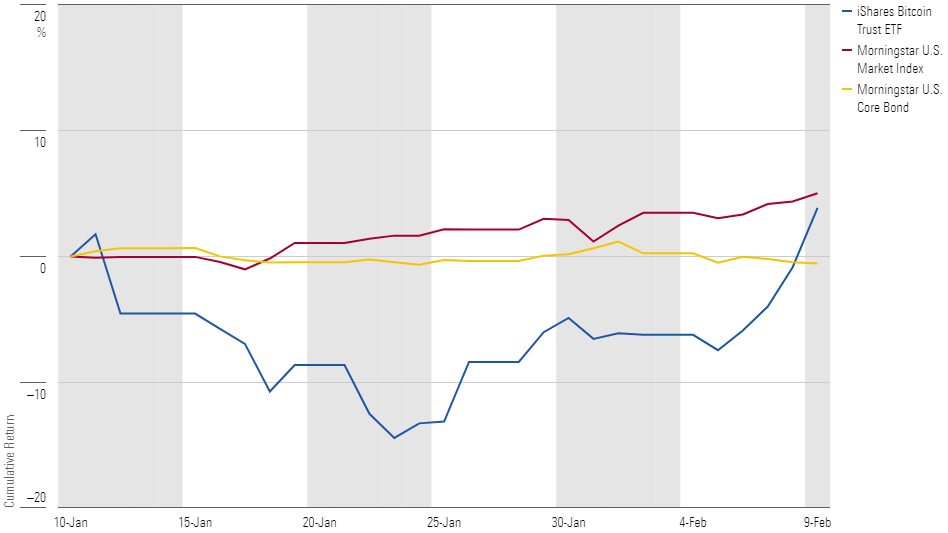

Bitcoin’s Volatility Created a Roller Coaster for ETF Investors

Bitcoin is not for the faint of heart. Day-one investors in spot bitcoin ETFs were quickly dealt a 15% drawdown as a welcome gift. But the ETFs, as proxied by IBIT, ended up roughly in line with the U.S. stock market in terms of absolute return. From here, I don’t know whether these ETFs will go up, down, or sideways, but you can bet the farm that performance will continue to be turbulent.

So, Is There a Best Bitcoin ETF?

I’ve written about whether you should invest in bitcoin, along with some guidelines around how to minimize costs when selecting a bitcoin ETF (if you were to buy one). Fees and the cost of crossing the bid-ask spread were the two main considerations. Now the guesswork is gone.

We have hard numbers to rely on for those looking for the best bitcoin ETF: IBIT and FBTC currently possess the best combination of low fees and strong liquidity. The next-best tier includes Bitwise Bitcoin ETF BITB, Ark 21Shares Bitcoin ETF ARKB, and Invesco Galaxy Bitcoin ETF BTCO.

That said, spectating may be better than speculating for most investors.

Fear of missing out is not a sound investment strategy. There’s a lot of volatility and risk in bitcoin that may not be compensated for—only time will tell.

Here’s an updated table on where bitcoin ETFs stand in terms of fees, assets, and volume.