Historic exchange withdrawal prices in profit for BTC as upward cost basis trend begins

Quick Take

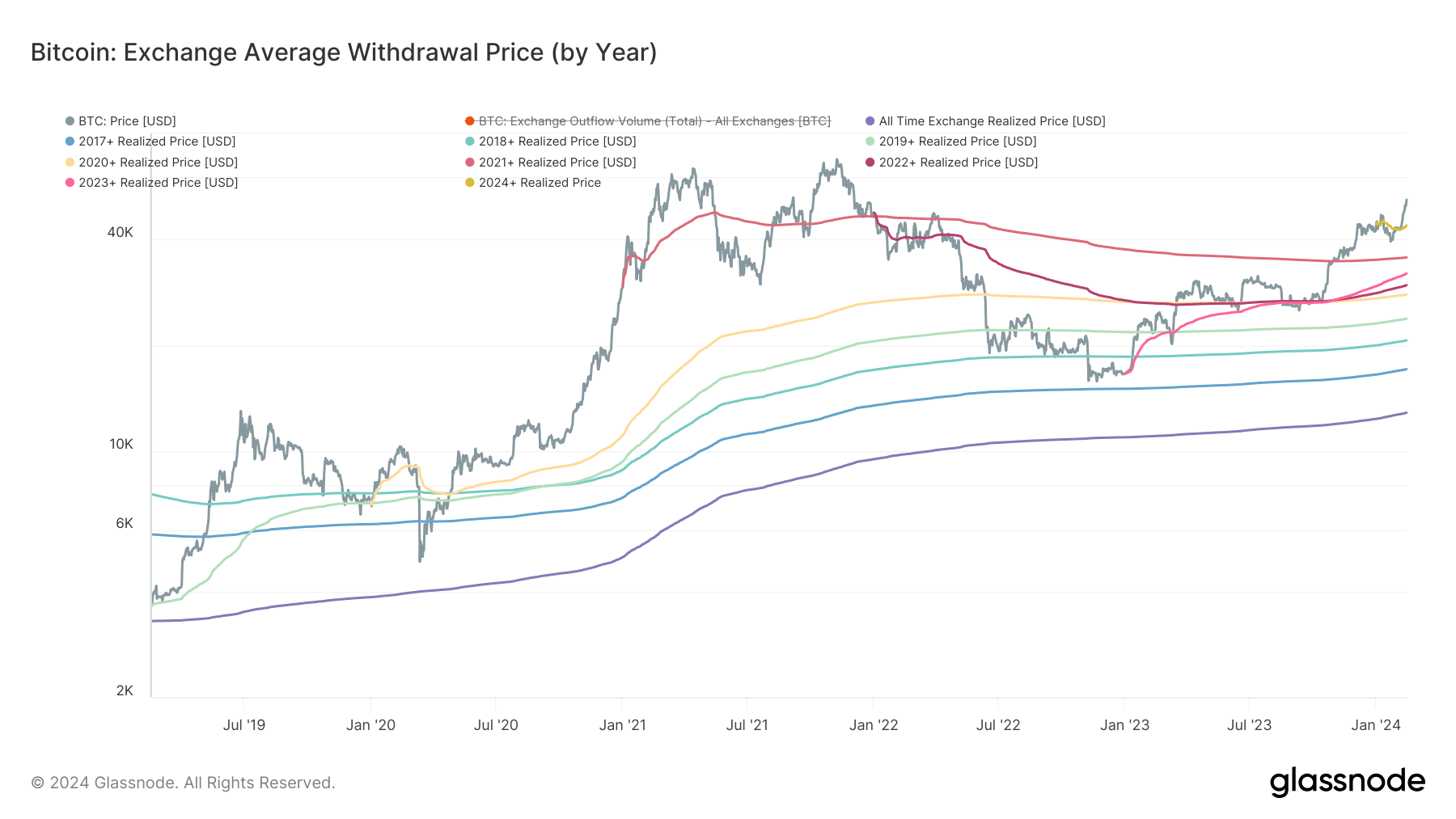

Tracking the average withdrawal prices from digital asset exchanges provides a viable method to estimate a market-wide cost basis.

A deep-dive into the cohorts’ performance reveals an interesting narrative. The most notable cohort is 2021, which had an initial realized price of approximately $47,000 back in 2021. Since then, continuous purchases have brought their cost basis down to $35,553, marking their entry into a profitable phase in November 2023 when Bitcoin exceeded the $40,000 mark.

| Year | Price ($) |

|---|---|

| 2017+ | 17,115 |

| 2018+ | 20,658 |

| 2019+ | 23,800 |

| 2020+ | 27,897 |

| 2021+ | 35,553 |

| 2022+ | 29,646 |

| 2023+ | 32,007 |

| 2024+ | 43,780 |

Contrastingly, the 2024 cohort, with a realized price of $43,780, experienced a brief period of loss in January following the ETF’s launch, as Bitcoin retraced 20%. However, they quickly bounced back to a favorable profit position, aligning with the overall optimistic trend of all cohorts.

For the first time since November 2021, all cohorts are experiencing profitability due to Bitcoin’s rise above the $50,000 mark. The all-time exchange cost basis remains steady, averaging around $12,800.

Intriguingly, a recent trend is emerging across all cohorts. Their cost basis has been on an upswing in the past few weeks, indicating that they are purchasing Bitcoin at a price higher than their existing cost basis.

The post Historic exchange withdrawal prices in profit for BTC as upward cost basis trend begins appeared first on CryptoSlate.