Crypto Venture Capital Exits and Funding Remains at 3-Year Low

Crypto venture capital markets are still in the doldrums despite a resurgence in spot markets for digital assets. Moreover, startups are staying private longer, and low mergers and acquisitions and IPO activity keep things depressed and ‘exits’ low.

According to findings in PitchBook’s Q4 2023 Crypto Report, the broader startup market is suffering from an exit drought, and crypto startups are possibly even more parched.

Crypto Venture Funding Drought

Exits refer to liquidity events that allow venture firms to realize returns. This enables them to exit out of their investments in crypto startups after they have appreciated over time.

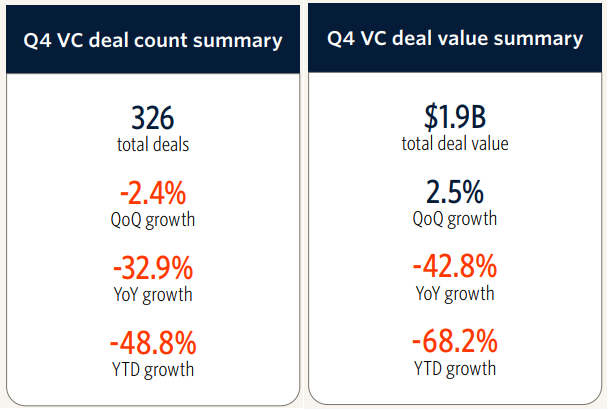

Deal value increased, hitting $1.9 billion across 326 deals in Q4 2023, the firm reported. However, the fourth quarter was consistent with the “low-level activity seen throughout 2023,” it added.

There were also just 12 exits during the period, the lowest number since Q4 2020. Additionally, crypto venture exits remain low, at just $1 billion in 2023.

The outlier was 2021, with $88 billion in crypto exits, noted the report. This was largely driven by Coinbase’s public listing demonstrating the impact of a single major liquidity event.

Read more: What’s the Relation Between Venture Capital Investment and Crypto Market Prices?

However, in crypto, exits also happen through token launches, which are harder to quantify but represent a lot of VC liquidity events. Several major crypto projects have been labeled as being “VC controlled” through their tokenomics.

Co-founder of Framework Ventures, Vance Spencer, commented:

“The vast majority of liquidity events in crypto VC will come from tokens, and that’s likely much harder to gauge holistically. I wouldn’t see a decline in these metrics as a proof point that VCs are having more difficulty achieving liquidity.”

Nevertheless, some crypto venture capital investors remain optimistic. They are doubling down on early-stage investments, taking a long-term view for their portfolio companies. Spencer continued:

“Smart VCs did their buying in 2022 and 2023, and now the more competent class of investors are waiting for new all-time highs before even thinking about exit opportunities,”

Funding Flat

Earlier this month, BeInCrypto reported that crypto venture funding declined almost 30% in January from the previous month.

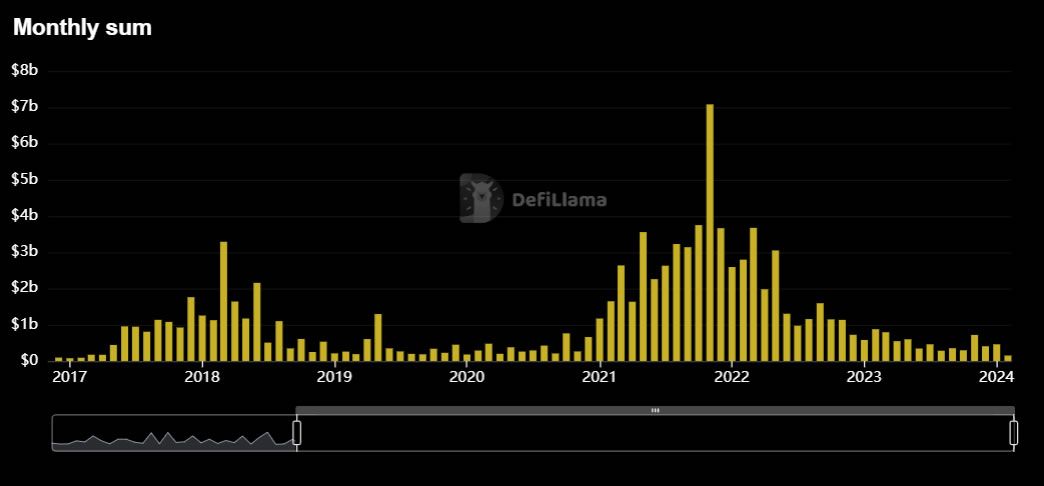

Crypto venture capital remains relatively flat compared to the multi-billion-dollar monthly highs in 2021 and 2022.

Read more: How To Make Money With Crypto: Top 4 Ways In 2024

Despite spot markets moving to within 33% of their all-time highs, VC funding is still at bear market lows.

This could be another signal that this bull market cycle has yet to really take off despite total capitalization topping $2 trillion again.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.