Bitcoin ETF newcomers surpass Microstrategy in BTC holdings

Quick Take

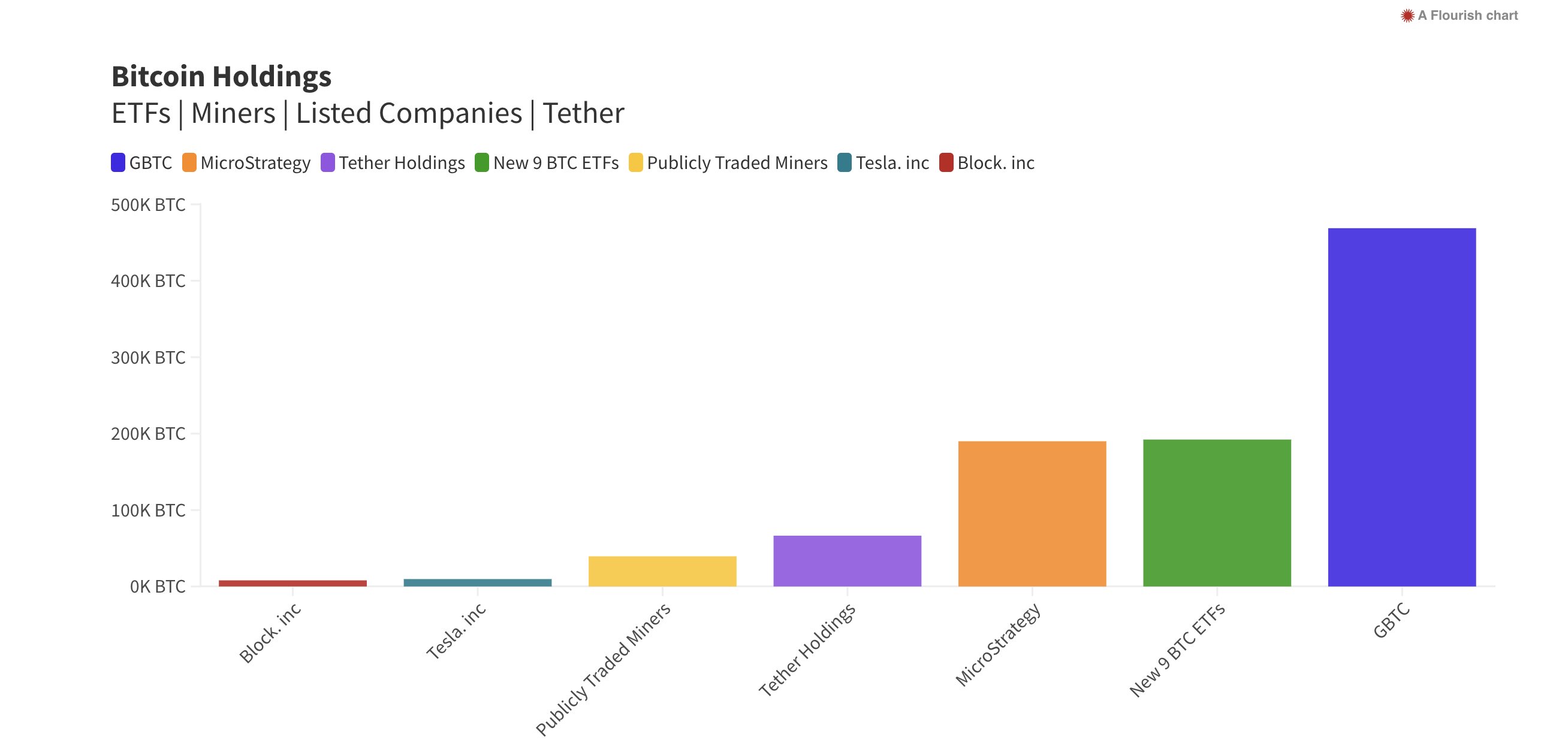

The rapid growth and success of Bitcoin ETFs, specifically the group termed the ‘Newborn Nine,’ excluding GBTC, is reshaping the dynamics of Bitcoin holdings. In just one month since their inception, according to Bitcoin website Apollo, these ETFs have outpaced MicroStrategy by acquiring 192,000 Bitcoins compared to MicroStrategy’s 190,000 in its corporate treasury. This remarkable growth signifies a shift in Bitcoin ownership from individual entities to ETFs.

Data from Applo shows that the new challenge for the ‘Newborn Nine’ is GBTC, holding 469,000 Bitcoins. Furthermore, BlackRock’s IBIT, with 78,000 Bitcoins, indicates potential competition for MicroStrategy in the upcoming months. These trends underscore the strong performance of Bitcoin ETFs.

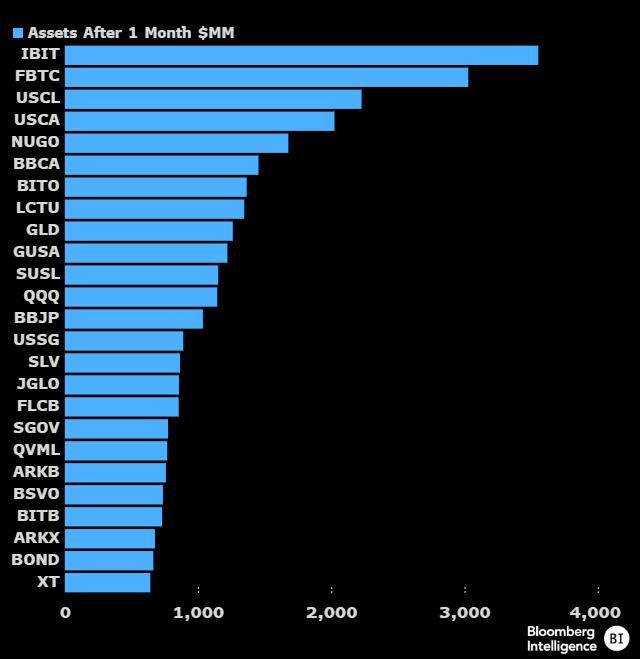

In addition, Bloomberg Analyst Eric Blachunas highlighted the impressive standing of these ETFs, with IBIT and FBTC leading the ETF pack with assets of around $3 billion each within a month of their launch. This places them at the top of the league of the top 25 ETFs by assets, among 5,535 launches in 30 years. ARKB and BITB also made the list, Balchunas goes on further to say.

The post Bitcoin ETF newcomers surpass Microstrategy in BTC holdings appeared first on CryptoSlate.