XRP Jumps 4,586% in Liquidations in Sudden Rally Against Bulls

Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

In an astonishing twist of events, the cryptocurrency market embarked on a tumultuous journey as XRP, a heavyweight in the realm of digital assets, underwent a period of intense volatility over the past few days. A palpable tension spread throughout the landscape as assets, traders and enthusiasts found themselves maneuvering through a landscape dominated by red.

Falling short of surpassing the crucial dynamic price support level, consistently emphasized in earlier analyses by U.Today, XRP suffered a substantial blow, recording an almost 3% decline in its valuation. This abrupt downturn triggered a chain reaction, leading to the automatic liquidation of a significant number of traders’ XRP positions.

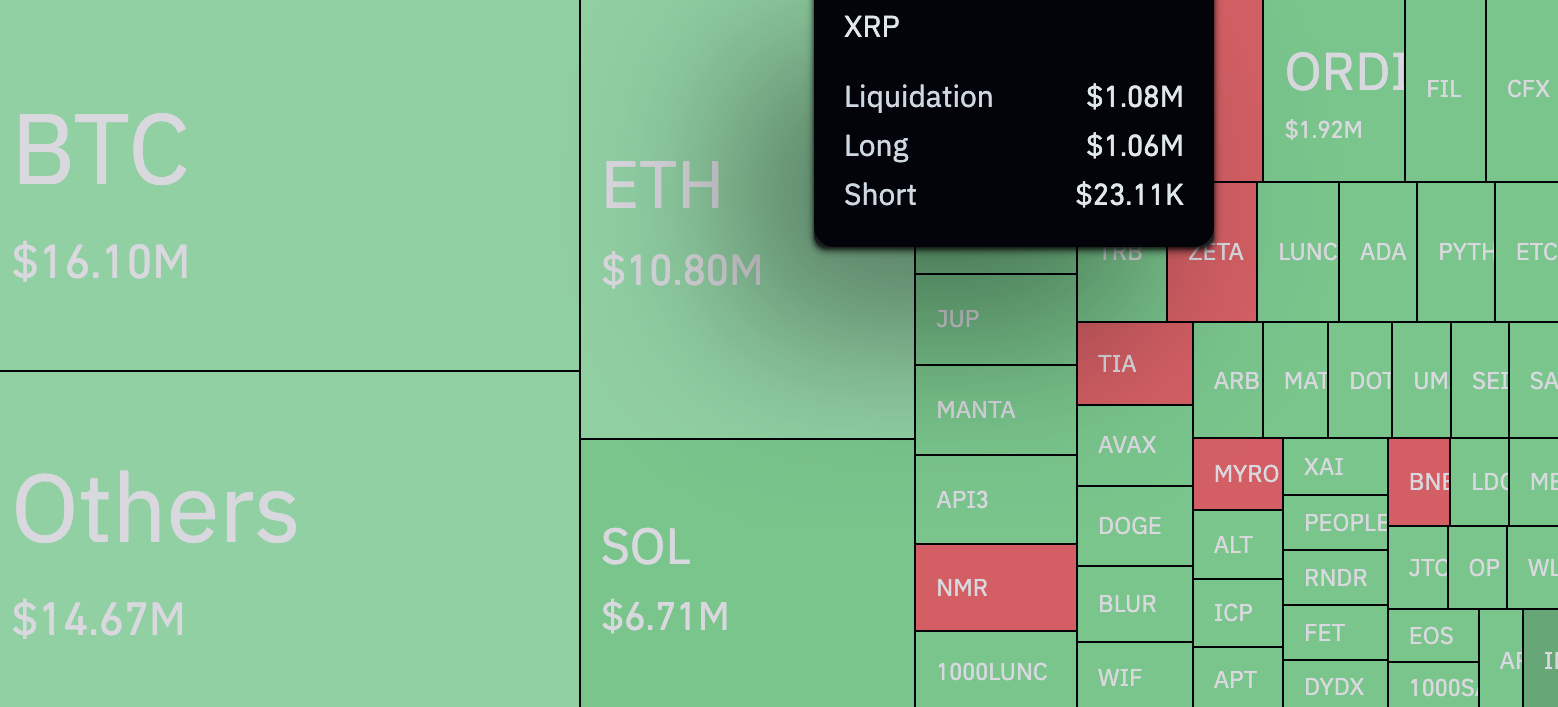

According to data from CoinGlass, the past 24 hours alone witnessed an astounding $1.08 million in liquidations in XRP trading. What is particularly striking is that $1.06 million of this total represents long positions – optimistic bets on the token’s growth. This marks an astonishing 4,586% surge when compared to the liquidations of short positions in dollar terms.

Amid this financial upheaval, XRP secured a notable position on the list of liquidated assets, trailing behind only crypto giants like Bitcoin (BTC), Ethereum (ETH), Solana (SOL) and Chainlink (LINK).

As the dust settles, the pivotal question remains: what does the future hold for the price of XRP? The recent closure of the weekly candle below the major support level sends a bearish signal, leaving analysts and enthusiasts alike contemplating the potential trajectory.

To maintain a positive outlook, exercising caution is paramount. The recent liquidation data underscores the significance of minimizing risk and steering clear of high leverage, emphasizing that such strategies may not be suitable for weathering the volatile storms within the crypto market.