Total Value Locked in the Decentralized Finance Sector Surges in January to Highest Point Since 2022: DappRadar

Crypto intelligence platform DappRadar says the total value locked (TVL) in the decentralized finance (DeFi) sector surged to a level not seen in over a year.

DappRadar notes in a new analysis that total DeFi TVL increased by 7% in January and reached $110 billion, the highest since 2022.

TVL refers to the amount of capital deposited within a protocol’s smart contracts and is often used to gauge the health of a crypto ecosystem.

DappRadar radar says the jump in overall TVL indicates a “resurgence in the market.”

“This surge in DeFi’s TVL is partly attributed to growing optimism about the onset of a new bull market, which has sparked an uptick in overall token prices. A continuing trend from 2023, which persists into 2024, is the launch of new chains offering airdrops, fueling the narrative around airdrop hunting in the X ecosystem. This phenomenon contributes significantly to the heightened activity in the DeFi landscape.”

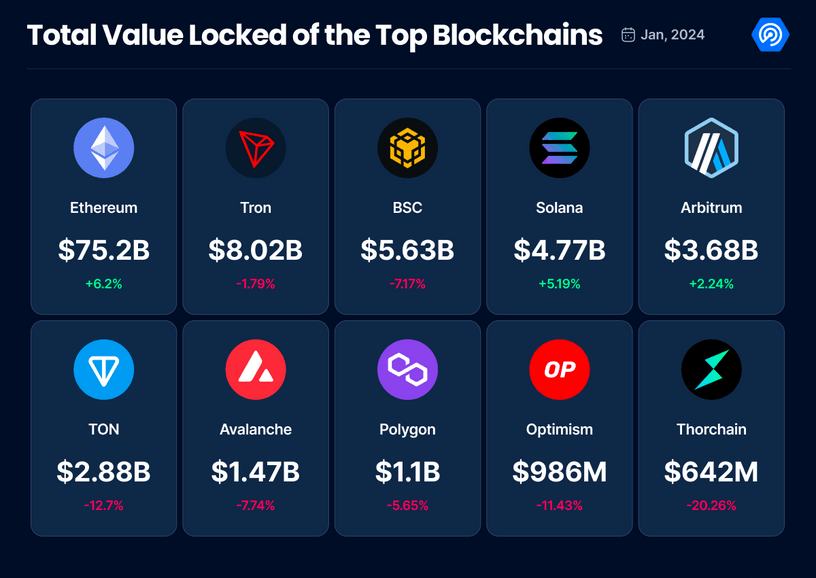

Despite the sector’s overall increase, only three of the top ten chains witnessed jumps in TVL in January: the smart control protocol Ethereum (ETH), the Ethereum competitor Solana (SOL) and the scaling solution Arbitrum (ARB).

In January, Ethereum’s TVL jumped by 6.2%, Solana’s rose by 5.19% and Arbitrum’s increased by 2.24%. Of the top 10 chains, the decentralized liquidity protocol THORChain (RUNE) witnessed the largest TVL slump, decreasing by more than 20%.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney