Bitcoin price sustains above $42,000 while wallets holding less than 1 BTC drop

- Bitcoin ETF race continues as Bloomberg ETF analyst speculates Charles Schwab’s entry.

- Bitcoin exchange balances have nosedived by over one million BTC since 2020.

- BTC price sustained above the $42,000 level as Bitcoin eyes a recovery.

Bitcoin ETF race likely to intensify as Bloomberg ETF specialist Eric Balchunas speculates $8.5 trillion asset manager Charles Schwab’s entry into the race. BTC exchange balances are on a decline and a recovery in Bitcoin price is likely in the short term.

Also read: Lido price sustains above $3 despite massive surge in profit-taking by LDO traders

Daily Digest Market Movers: Bitcoin balance on exchanges in a downtrend

- Bloomberg ETF specialist Eric Balchunas has predicted multi-trillion dollar asset manager, Charles Schwab’s entry in the Bitcoin ETF race with a competitively priced product.

- Balchunas believes that the investment giant’s entry could intensify the ETF race. According to sources, the giant is yet to develop its spot Bitcoin ETF.

- Crypto analyst Joe Burnett reports that Bitcoin exchange balances have declined by over a million since 2020. This is a significant on-chain development since BTC has a limited supply of 21 million. One million BTC leaving exchange wallets adds to the bullish thesis for the asset.

- The Bitcoin halving event where the reward for mining a BTC block will be slashed in half, from 6.25 to 3.125 is nearly 80 days away.

- The BTC halving is considered a catalyst for the asset, as Bitcoin price hit a new all-time high post halving in previous instances.

- Another key on-chain metric that supports the bullish thesis for BTC is addresses with less than 1 BTC.

- According to Glassnode data, wallet addresses with less than 1 BTC have been in a downward trend since the asset hit its $49,000 local top. This seems to have bottomed out with more signs of consolidation around the $40,000 level.

Bitcoin wallet addresses with less than 1 BTC. Source: Glassnode

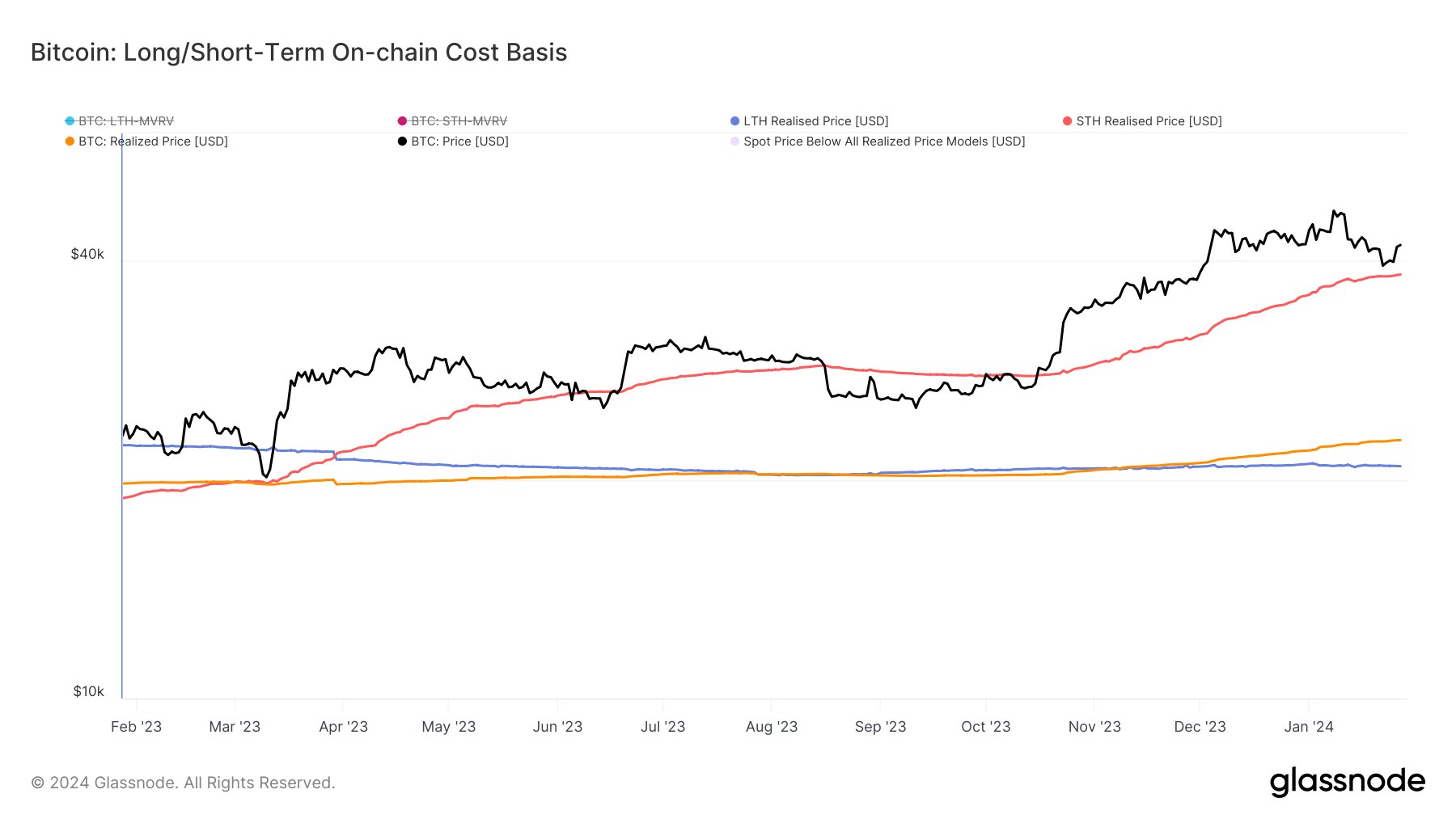

- Bitcoin’s ongoing bull run is likely sustainable as Glassnode data reveals that Bitcoin’s short-term holder realized price continues to climb. This indicates BTC is getting acquired at a higher price, supporting Bitcoin’s uptrend and the thesis for BTC recovery.

Bitcoin: Long/Short-term on-chain cost basis. Source: Glassnode

- Bitcoin’s Spot ETF product is gaining popularity among traders. On January 26, Harvest Hong Kong, one of China’s largest fund companies, filed an application for a BTC Spot ETF, the first application of its kind, submitted to the Hong Kong Securities and Futures Commission.

Technical Analysis: Bitcoin price likely to recover from slump

Bitcoin price sustained above the $42,000 level on Monday, recovering from its weekend slump. BTC price climbed above the $40,000 psychological level. BTC price is likely to face resistance at $43,600 and $45,589, two key levels in its uptrend.

Bitcoin price recovery to the $45,000 level becomes increasingly likely as the asset breaks out of its slump and rebounds from the psychologically important level of $40,000.

BTC/USDT 1-day chart

A daily candlestick close below $40,000 could invalidate the bullish thesis and BTC price could decline to support zone between $38,155 and $38,555.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Bitcoin spot ETF has been approved outside the US, but the SEC is yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, the interest surrounding crypto ETFs has been renewed. Grayscale – whose application for a Bitcoin spot ETF was initially rejected by the SEC – got a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF might be approved by the end of the year.

-638421048576263911.jpeg)