Analyst Warns Bitcoin Will Retrace Deep Enough To Convince Traders Bull Market Is Over – Here’s His Outlook

A closely followed crypto strategist believes that Bitcoin (BTC) will correct to a level that will make traders think a new bear market has begun.

Pseudonymous analyst Rekt Capital tells his 388,600 followers on the social media platform X that he believes the Bitcoin bull market is far from over.

But he thinks that Bitcoin is gearing up for a substantial correction that will make BTC bulls think twice about their current positions.

“Bitcoin will retrace deep enough to convince you that the bull market is over.

And then it will resume its uptrend.”

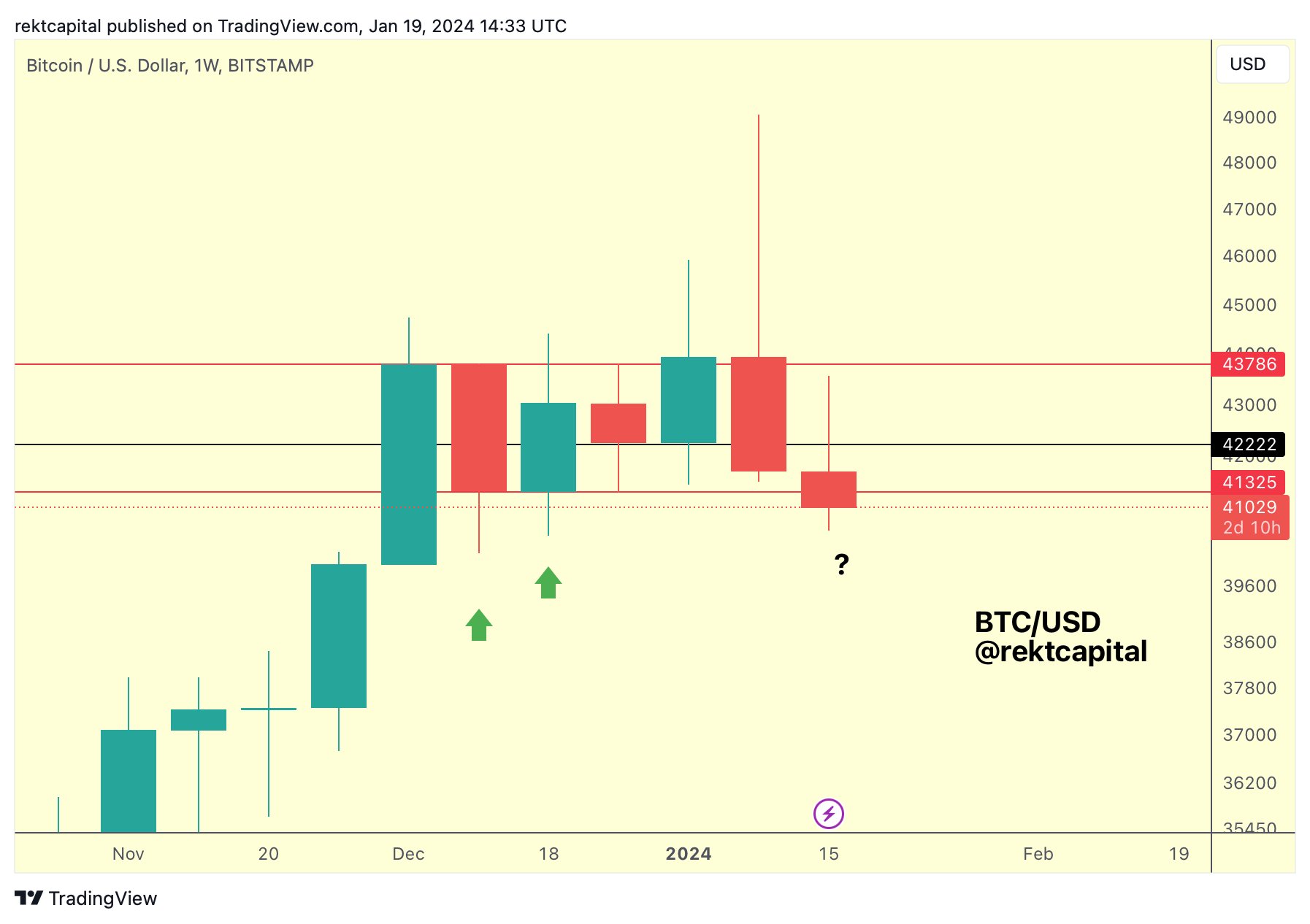

Looking at Bitcoin’s weekly chart, Rekt Capital says that the correction will likely gather momentum if BTC ends the week below $41,325.

“BTC is losing the range low as support.

This is not confirmed yet, however.

A weekly close below the range low is needed as previously price would downside wick here.

Weekly close below the range low would kickstart the breakdown process.”

The trader also shares a chart suggesting that BTC may correct to around $35,000 before its April 2024 halving when miners’ rewards get cut in half.

While the analyst is short to mid-term bearish on BTC, he remains optimistic about the long-term outlook of Bitcoin, saying that the crypto king has two key catalysts that can push its price higher in the coming months.

“The BTC ETF (exchange-traded fund) is similar to the halving in the sense that both tend to have a long-term impact on price

It takes months for these pivotal catalysts to impact price

The gold ETF is a great example of how an ETF can impact price in the long term.”

At time of writing, Bitcoin is worth $41,570.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney