SEC clears way for Bitcoin ETFs in milestone for crypto market

Ark Invest CEO Cathie Wood reacts to a hacker posting approval of Spot Bitcoin ETFs on ‘The Claman Countdown.’

They finally did it.

The Securities and Exchange Commission has paved the way for retail investors to gain access to the world’s largest digital asset, Bitcoin, by approving the first U.S. sale and distribution of 11 exchange traded funds that will track the daily or “spot” price of the asset.

SEC CHAIRMAN GENSLER’S STATEMENT ON SPOT BITCOIN ETFS

Late Wednesday afternoon, following a series of embarrassing technical missteps and a hack of the SEC’s social media account, the Commission voted 3-to-2 to greenlight the ETFs.

Until now, small investors wishing to trade digital assets would have to buy and sell them on unregulated crypto exchanges and, in some cases, fell victim to scams and fraud. The most notable example being the $8 billion of customer funds embezzled by convicted former crypto kingpin Sam Bankman-Fried on his now-defunct FTX exchange.

The U.S. Securities and Exchange Commission (SEC) said on Friday that it would delay enforcement of certain assets from a new disclosure rule for off-exchange securities until Jan. 3, 2022. Photographer: Andrew Harrer/Bloomberg via Getty Images (Photographer: Andrew Harrer/Bloomberg / Getty Images)

Starting Thursday, ETFs tracking the daily or spot price of Bitcoin will begin trading on the Nasdaq, New York Stock Exchange, and the CBOE, a key marker in the maturation and mainstreaming of the $1.7 trillion crypto market. Investors can purchase ETFs through some of the nation’s most venerable asset managers, such as BlackRock, Fidelity and Grayscale (which specializes in digital assets) and trade on the world’s most regulated stock exchanges.

SEC DUPED, X ACCOUNT HACKED, SPOT BITCOIN ETFS NOT APPROVED

In 2021, the SEC approved the sale of a Bitcoin ETF that tracks the futures market. The key difference is that futures products can only be sold to accredited investors, or those considered “sophisticated” and who have a high net worth.

The new spot Bitcoin ETFs can be sold to any investor. They can be purchased through brokers or on a discount-brokerage app, meaning potentially millions of new investors could soon be owning a piece of the crypto business.

“I am celebrating the right of American investors to express their thoughts on bitcoin by buying and selling spot bitcoin ETP,” said SEC Commissioner Hester Peirce. “And I am celebrating the perseverance of market participants in trying to bring to market a product they think investors want.”

Peirce was one of the 3 commissioners that voted to approve the ETFs.

The crypto industry’s journey to this point has not been a smooth one. The regulatory oversight of digital assets has been fraught since the SEC began to try to regulate them in 2017 when former SEC Chairman Jay Clayton brought enforcement actions against several companies like Telegram and Kik for holding unregistered so-called initial coin offerings, or ICOs.

One of Clayton’s first acts as Chair was to reject an application from the founders of crypto exchange Gemini, the Winklevoss brothers, for a Bitcoin spot ETF which it had applied for in 2013. The SEC’s reason for rejection was due to the fact the digital asset market was not yet mature enough. The agency rejected Gemini’s application again in 2018, citing that exchanges had a lack of internal controls to prevent market manipulation.

His final act as head of the SEC was to bring litigation against cross-border payments company Ripple for selling the token XRP to finance its platform, claiming that doing so without first registering the token sales with the commission put them in violation of securities laws.

However, courts have looked askance at the SEC’s attempts to bring the crypto market into compliance in recent months given the regulatory gray area around digital coins. Ripple spent around $200 million fighting the SEC action. In July, it won a mixed victory after three years in the courts when a U.S. district judge ruled that the company’s sales of XRP to institutional investors, like banks, did indeed violate securities laws, as the SEC claimed, but its sales to secondary market investors on crypto exchanges did not.

LIVE CRYPTOCURRENCY PRICES: HERE

The SEC has said it plans to appeal the ruling.

The seal of the U.S. Securities and Exchange Commission is being displayed on a smartphone, with Bitcoin visible on the screen in the background, in this photo illustration taken in Brussels, Belgium, on January 9, 2024. (Photo Illustration by Jonathan Raa/NurPhoto via Getty Images / Getty Images)

Current SEC Chair, Biden appointee Gary Gensler, has been even tougher than his predecessor on the crypto industry, filing more than two dozen enforcement actions against it in 2023 alone. Some of those actions included suing big exchanges like Coinbase and Binance, which both plan to follow Ripple’s example and battle the SEC in court, hoping the agency’s losing streak will bolster their chances of victory.

One legal loss in particular, experts say, paved the way for the Commission’s approval of the Bitcoin Spot ETFs. Grayscale’s August 2023 victory over the SEC when a DC appeals court ruled the agency could not outright deny the firm’s request to convert its Bitcoin Trust product into a spot ETF.

The judicial panel ruled the SEC must take a closer look at the application, which was the signal many would-be ETF issuers were waiting for.

Spot Bitcoin ETF applications from major asset managers like BlackRock and Fidelity along with other crypto outfits poured in during the summer. Cathie Wood’s Ark21Shares and crypto index fund manager Bitwise had already submitted their applications earlier in the year. By the end of 2023, the total number of applicants had grown to thirteen.

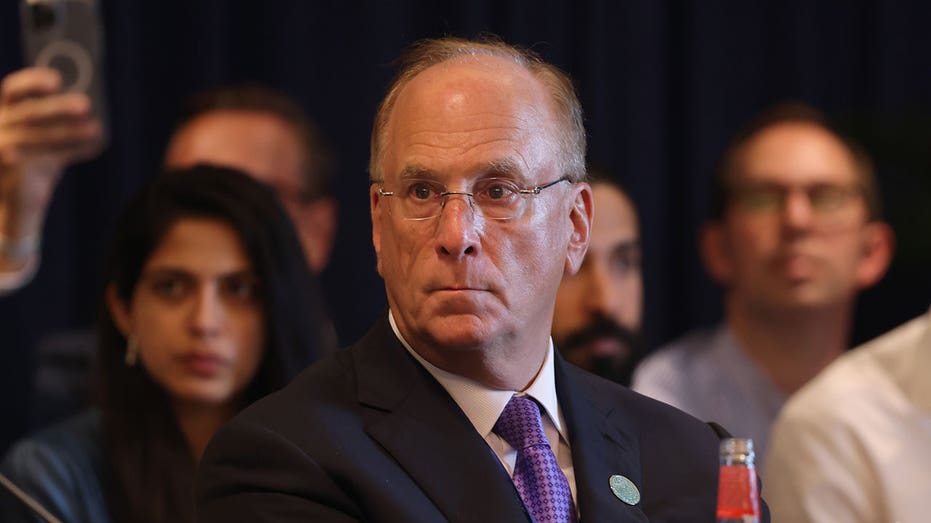

DUBAI, UNITED ARAB EMIRATES – DECEMBER 04: Larry Fink, CEO of Blackrock, attends a roundtable discussion titled: “Financing the New Climate Economy,” during which he described the urgent need for a “new financial landscape” for funding investments in (Sean Gallup/Getty Images / Getty Images)

BlackRock CEO Larry Fink, who was once a bitcoin bear, told FOX Business in July that he now sees Bitcoin as a store of value and an international asset. The change in tune from Wall Street, paired with pressure from the courts and the support of someone with Fink‘s gravitas (he runs the largest money manager in the world) made the approval of a Bitcoin spot product a matter of ‘if’, rather than ‘when’.

BITCOIN’S BOUNCE IN EARLY INNINGS

Securities lawyers say Gensler’s dislike of the asset class was apparent by the way in which the agency mandated the ETFs be structured – in cash only – meaning investors can only buy and redeem shares of the ETF using cash, not bitcoin. This is a deviation from the majority of traditional commodities-based ETFs which allow their customers to purchase shares using the underlying asset.

The SEC remains concerned that the cryptocurrency market is largely unregulated and susceptible to bad actors with malicious intentions.

In approving the ETFs, the SEC weighed those factors, FOX Business has learned, though it recently came to the conclusion that allowing investors to trade bitcoin in security-form on highly regulated exchanges is better than having small investors trading digital coins through opaque means, as has been the norm.

Adding to the myriad of hurdles the industry cleared leading up to Wednesday’s approval came from a series of flubs from the SEC itself including a hack on the agency’s official X (formerly Twitter) account on Tuesday, falsely announcing the ETFs were ready to begin trading.

A representation of bitcoin is seen in an illustration picture taken on June 23, 2017. (Benoit Tessier/File Photo / Reuters Photos)

Late Tuesday, the price of Bitcoin jumped close to $48,000 on the fake news before the SEC regained control of its account and Gensler had to retract the statement using his personal X account, informing the bewildered market that his agency’s account had been compromised. The SEC announced on Wednesday it would launch an investigation into the matter with the help of the FBI and the Office of the Inspector General.

The price of Bitcoin suffered a mini crash following Gensler’s clarification and remained trading around $45,000 on Wednesday. Following ETF approval, the digital asset is trading relatively flat at $46,500.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The mysterious circumstances and unprecedented nature of the SEC hack lead many industry watchers to believe the SEC would further delay approval beyond the January 10th deadline. Minutes before the close of trading Wednesday, the SEC fumbled again when it prematurely posted approvals of issuer’s 19b-4 forms, only to take them down again before making its official announcement after the 4pm closing bell.