Messari Founder’s Tips for Handling Crypto Profits in Bull Market

On social media, Messari founder Ryan Selkis declares his recommended strategy for crypto investors seeking to maximize profits in the upcoming year.

Selkis advises against selling during the initial four months of 2024.

Messari Founder Urges Investors to Hold, Avoid Selling Crypto Profits

Messari founder Ryan Selkis advises his 340,600 X (formerly Twitter) followers to retain their assets for the upcoming months. He suggests making strategic moves when the market-value-to-realized-value surges two to three times, indicating potential overvaluation of prices:

“Your job right now should be to hold on for dear life to BTC for the next couple of months, then take some gains as MVRV crosses 2-3.”

“Set aside half for taxes and use the other half to play the hot ball of money game if you must,” he stated.

Read more: 4 Best Crypto Learn and Earn Platforms in 2024

Crypto Influencers’ Profit Tips in Today’s Market

In a recent X (formerly Twitter) post, Neuner advised his 736,400 followers against hastily entering the crypto market as prices continue to experience an upward trend across the board:

““Treat this bull market like a marathon (42km). We have done about 10km already, there are 32km left.”

He declared, “there are 32km of opportunities ahead of us,” to his following. Furthermore, he reminds them that they don’t need to catch every trade or have to time every trade perfectly:

“Most people will get REKT before the end because they rush to make their fortunes!”

However, the market constantly evolves, with new coins emerging; what gained popularity in the last cycle might differ in this one.

In October 2023, BeInCrypto reported that Neuner highlighted PEPE as one to closely monitor.

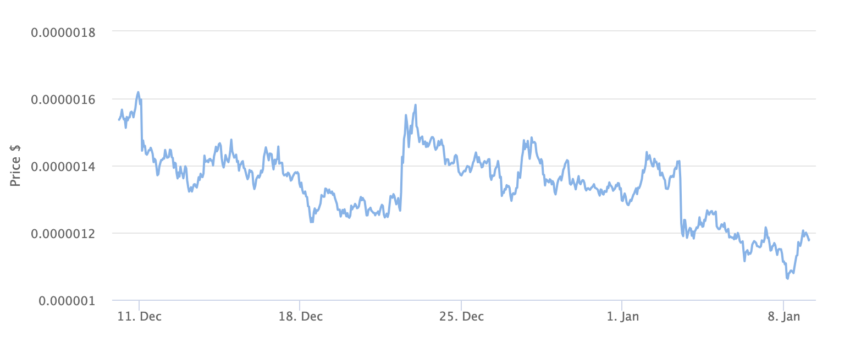

At the time of publication, PEPE’s price stands at $0.00000117.

He explains that it is a good market indicator, for knowing when the market is getting to oversaturated.

“It’s literally an index for when the market is getting overheated. When people are confident enough to go there and it pumps, that’s your sign to exit. Works every time,” Neuner stated.

Read more: How To Make Money With Cryptocurrency: Top 4 Ways In 2024

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.