Thorchain Dominates Cross-Chain Trading Volume: What’s Next for RUNE?

Thorchain, a cross-chain liquidity network, has emerged as a frontrunner in cross-chain transfers, surpassing its competitors in volume and transaction activity, on-chain data shows.

Thorchain Trading Volume Expands As Prominence Increases

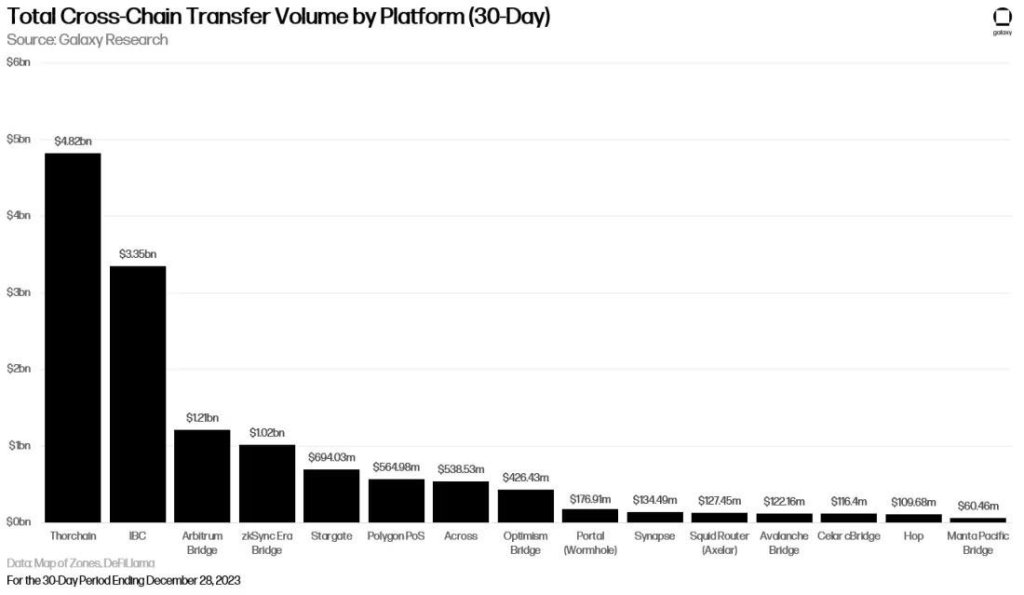

Citing Galaxy Research data, a user on X, Bullion, noted that Thorchain processed $4.82 billion in cross-chain transactions over the past 30 days, while Cosmos’ Inter-Blockchain Communication (IBC) protocol handled $3.35 billion worth of transactions during the same period.

Among layer-2 bridges, Arbitrum Bridge led the pack with $1.21 billion in cross-chain volume. Others, like Polygon POS and Stargate, processed $564 million and $694 million, respectively.

The spike in Thorchain’s trading volume and liquidity indicates the protocol’s increasing significance in the broader decentralized finance (DeFi) landscape. The protocol’s unique features and innovative solutions have made it a preferred destination for cross-chain asset transfers.

At the heart of Thorchain is its ability to facilitate cross-chain asset swapping in a trustless and non-custodial manner. In this arrangement, and like popular decentralized exchanges like Uniswap, Thorchain allows users to retain control of their funds without depending on intermediaries.

The stream swaps technology seems to be drawing user attention to Thorchain. This feature allows users to swap with near-slippage free even without high liquidity. Technically, and as expected in decentralized exchanges, the lower the liquidity, the higher the slippage. The offer for low or zero slippage gives Thorchain a significant advantage over other cross-chain swaps.

Beyond trading, Thorchain has incorporated other defi solutions, including lending. In this arrangement, Thorchain now supports the trustless lending of assets without liquidity risk or interest, a deviation from traditional lending protocols, including Aave.

As DeFi TVL Recovers, Will RUNE Break To New 2024 Highs?

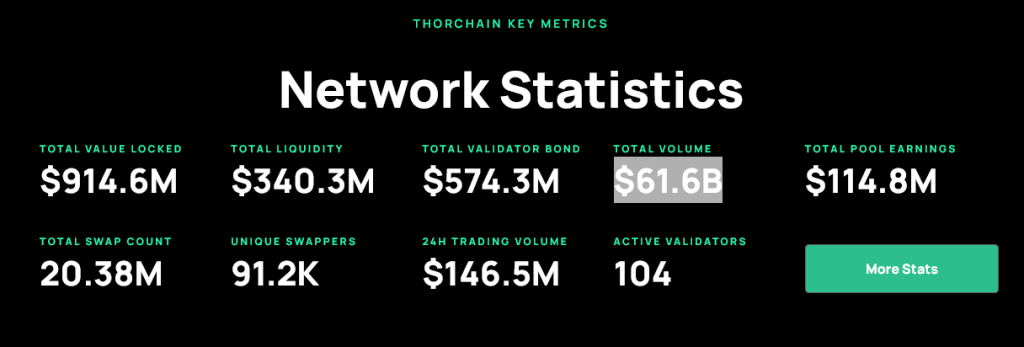

Together, these features have contributed to Thorchain’s growing trading volume, further cementing its position in the recovering DeFi scene. According to DeFiLlama, Thorchain has a total value locked (TVL) of around $322 million.

Meanwhile, Thorchain claims to have over 91,000 swappers. Cumulatively, the protocol has processed over $61 billion in trading volume.

As DeFi expands from 2022 pits, RUNE, the platform’s native token, has also benefited. Looking at the RUNE daily chart, it is up roughly 5X from 2023 lows.

Despite the re-pricing of asset prices on January 3, RUNE remains resilient. Prices are trending inside a bull flag. Any breakout above $6.5 and local resistances could catalyze demand, lifting the coin above $7.3 to new 2024 highs.

Feature image from Canva, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.