NFTs Have Evolved, NFTs Endure

USV started playing with NFTs in 2017. First when Rare Pepes were starting to gain some niche popularity and then again when cryptokitties launched. Shortly after that exploration, we invested in the team behind cryptokitties and wrote:

We think digital collectibles are one of many amazing things that blockchains enable that literally could not be done before this technology emerged.

Since the inception of the internet, digital goods were synonymous with abundance, and the idea of ownership only existed within the confines of closed systems with centralized arbiters. Public blockchains came along and unlocked the ability to have a digital item that is unique and fully owned by an individual — a concept that is just as powerful today as it was six years ago. Ownership and verifiable provenance in a digital context are transformational, and we are just scratching the surface of the impact these ideas will have on our digital existence.

The Bubble

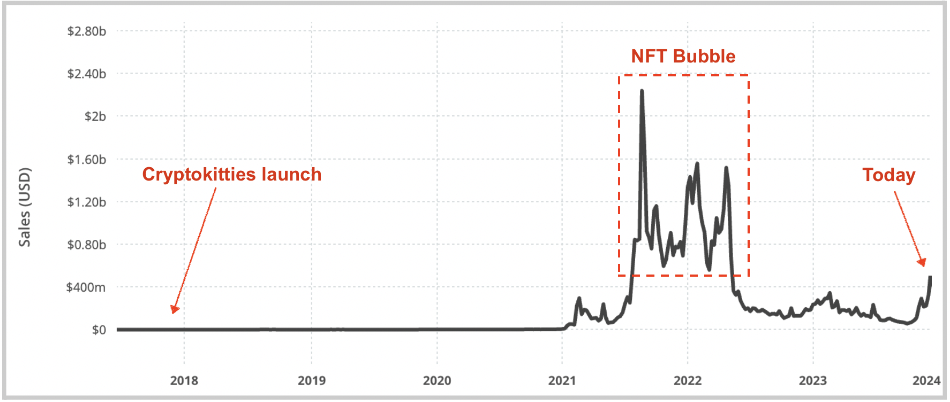

NFTs broke out onto the scene in 2017, and, as many of you have probably observed, a lot has happened in the intervening years. Here is a view of weekly secondary sales volume of NFTs across all public blockchains:

Monthly secondary transaction volumes across all chains peaked at ~$6B in Jan 2022, bottomed at ~$300M in October 2023 and have bounced back to ~$1.7B last month – with notable growth from the Bitcoin and Solana ecosystems.

NFTs, specifically NFTs as collectibles, experienced a massive hype cycle that was marked by an asset bubble. This bubble popped and asset prices and secondary marketplace volumes plummeted dramatically, drawing down over 85% and 95% respectively. With markets in an extremely risk-on, zero interest-rate environment in 2021, we were handed a particularly acute rise and fall.

If this story sounds familiar, it’s because it’s the story of virtually every nascent, innovative technology. NFTs are a microcosm of the larger crypto ecosystem and both have recently weathered periods of irrational exuberance. In the framing of Carlota Perez (whose seminal work we often lean on), we appear to be progressing through the installation phase of these technologies, wherein core infrastructure continues to be laid.

In spite of this period of “frenzy” and the asset-value collapse, the promise of NFTs remains unchanged. They are an innovative substrate, a novel vehicle for representing the non-fungible parts of our digital lives — tickets, memberships, collectibles, receipts, art, media, likes.

In our view, the kinds of bubbles we have seen in crypto, including this NFT mania, are a natural and inevitable part of how major technological shifts manifest and mature. They also offer a direct benefit: speculative market bubbles, in part, provide the capital needed to build out the next phase of enabling infrastructure.

The Innovation

Crypto’s ups and downs have helped illuminate the problems in the space, such as excessive transaction costs and poor usability for the average consumer, and the dramatic price oscillations have also helped fund solutions to these problems and have fed the relentless pace of building and innovation.

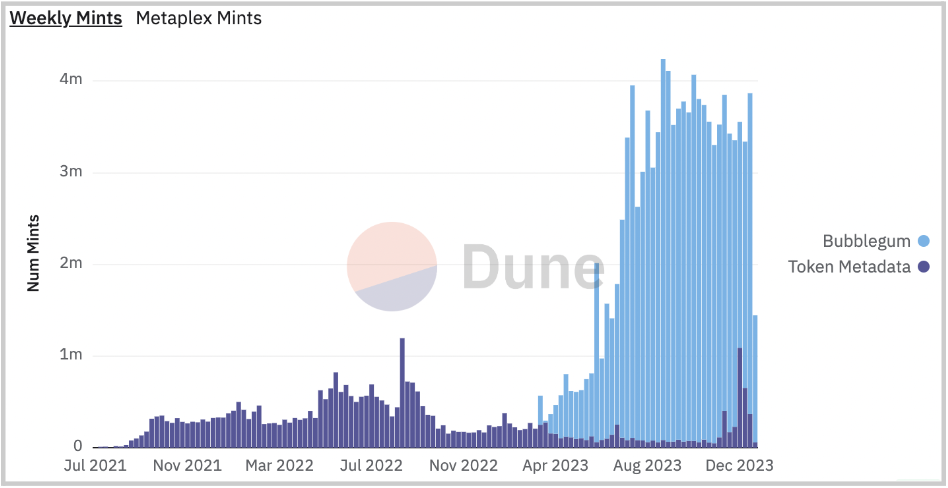

In the last 24 months and after years of development, numerous layer-2 blockchains came to market, opening up cheaper blockspace with faster finality while still retaining Ethereum’s strong security guarantees. Solana has rolled out compressed NFTs which allow developers and users to create NFTs at the cost of ~1/100th of a cent. Embedded wallets now offer a means of building low-friction crypto applications without sacrificing trustlessness. New standards like ERC-6551, which allows NFTs to themselves act as an account/wallet, are opening up the design space for NFTs. Networks like Arweave have matured and largely solved the problem of storing arbitrary content – not just metadata – onchain.

The net result of these improvements is that the aperture of what NFTs can practically represent is opening quickly and interacting with NFTs is becoming ever cheaper and easier. We now have the tools to, in many cases, abstract the technology altogether and have users engage with digital experiences that are silently backed by NFTs. Art and collectibles are just a piece of the puzzle, and any digital artifact in our lives can – and possibly eventually will – be represented by an NFT.

Art and Collectibles

Digital collectible goods – including art – were how NFTs first expressed themselves on blockchains and how they gained initial adoption. They are still the segment of NFTs that are responsible for virtually all of the sales volume and market capitalization of NFTs to date. And despite the asset bubble, they are not going anywhere.

NFTs have been a massive unlock for digital artists and creators who can now monetize their work and tap into the growing demand for digital creations. Collectors, speculators, and patrons alike can finally own – and permissionlessly transfer – digital items that are unique and scarce, which in turn has created vibrant markets for many of these assets. The internet-native financial rails that blockchains provide, have also made it much easier for creators to sell work to a global audience. Blockchains have also catalyzed newer forms of art and given rise to new elements while interacting with creative work, such as randomness.

Moreover, we live in a digital world with steadily growing pools of internet-native capital (thanks, crypto) and with increasingly ubiquitous digital creation (thanks, AI). The logical endpoint of these trends is having even more people storing even more value in an even wider array of digital objects.

Shifting Behaviors

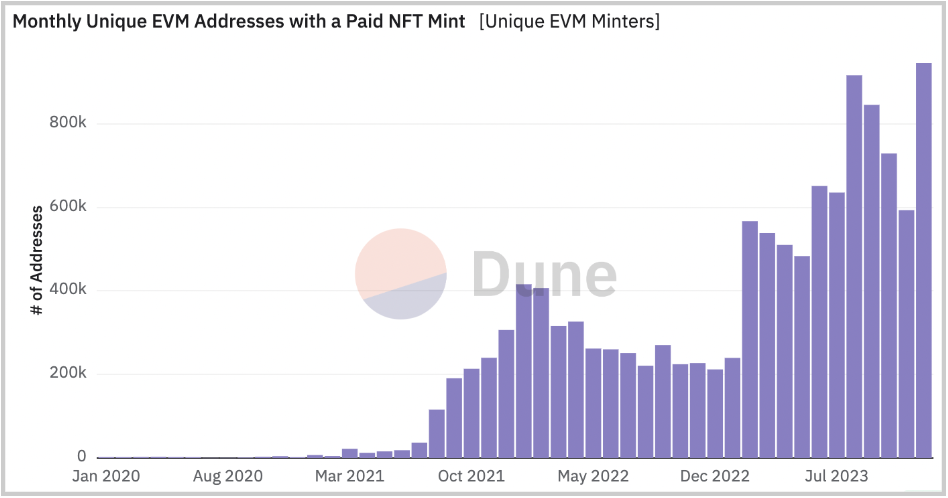

Despite severe declines in trading activity and market cap, the pace of creation in crypto remains strong. Every month thousands of creators are still producing digital art, generative art, or AI art. And every month, new (and existing) crypto users come into the fold to mint pieces from these collections.

We are also seeing new NFT behaviors emerge. Open edition style mints, often offered at zero cost, became increasingly popular throughout 2023. One example usage is that projects will release an open edition collection for a fixed time window when they launch their product. Consumers opt to mint the NFT not as a speculative action but as a way to plant an indelible flag and express support – an act of patronage that the consumer can potentially benefit from. In some settings, low/no-cost minting is gradually becoming a new social primitive akin to a “like” or a “repost”.

These new behaviors have led to continued growth in lower-cost minting. We can see that even as secondary transaction volumes dried up in 2023, more users are minting more NFTs than ever before. A couple representative views of these trends:

NFTs as Everything

Most of this post has focused on a specific segment of NFTs and their resurgence and evolution, but the reality is that NFTs are simply a substrate that can represent virtually anything.

The Ethereum Name System uses NFTs to represent identity. Uniswap uses NFTs to represent the liquidity provided to a pool. Blackbird represents each relationship a user has with a restaurant as an NFT. Paragraph represents reader subscriptions as NFTs. Helium represents eligibility to receive network rewards (i.e. hotspot operators) as an NFT. And the list goes on.

We are also excited to see even more actions and artifacts represented as NFTs. Tickets for everything from concerts to movies to airlines should be NFTs. Anything that can benefit from true ownership and the compounding value of open, permanent systems.

It’s worth nothing that NFTs don’t always have to be transferable — for example, many reusable-KYC providers issue Soulbound Tokens instead. And, NFTs don’t always have to represent digital objects — as non-fungible real-world assets seek to leverage blockchains, NFTs can often serve as a digital twin representing everything from trading cards to luxury handbags.

NFTs, like other blockchain standards, benefit both from the openness of the blockchain and the consistency of being a standard. They are portable and can move with a user to any application — an application which in turn is guaranteed to be able to understand what the NFT is, take actions on it, and thereby further extend its utility. This also means that for any NFT issued, it instantly has access to all the pre-existing tooling built for this standard. Popularly, this means any NFT created can immediately be swapped on an exchange, borrowed against, or donated.

The composability and openness of blockchain data, and by extension NFTs, hold immense potential but are not without problems. They can allow for novel experiences and for apps to have a richer view of users, but we are still early in the journey of architecting these systems in ways that preserve privacy. They can allow for value transfers such as mint fees or royalties that are transparent and programmatic, but they can also allow for applications to route around these rules (royalties were a boon for creators until they weren’t but we are now seeing a revival as newer ecosystems are choosing to enforce royalties at the NFT standard level).

Parting Thoughts

As with many other technologies before it, we are witnessing the continued evolution and improvement of crypto broadly and NFTs specifically. We believe that NFTs are an incredibly simple but also an incredibly powerful primitive that blockchains uniquely enable, and we are deeply excited by the experimentation and new experiences that will emerge. If you are building something that leverages this primitive to build novel experiences, we would love to chat!