XRP May End December in Profit for First Time in Six Years

Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

In a recent development, renowned cryptocurrency XRP is poised to conclude December in the profit zone for the first time in the six years, marking a significant departure from its historical trends.

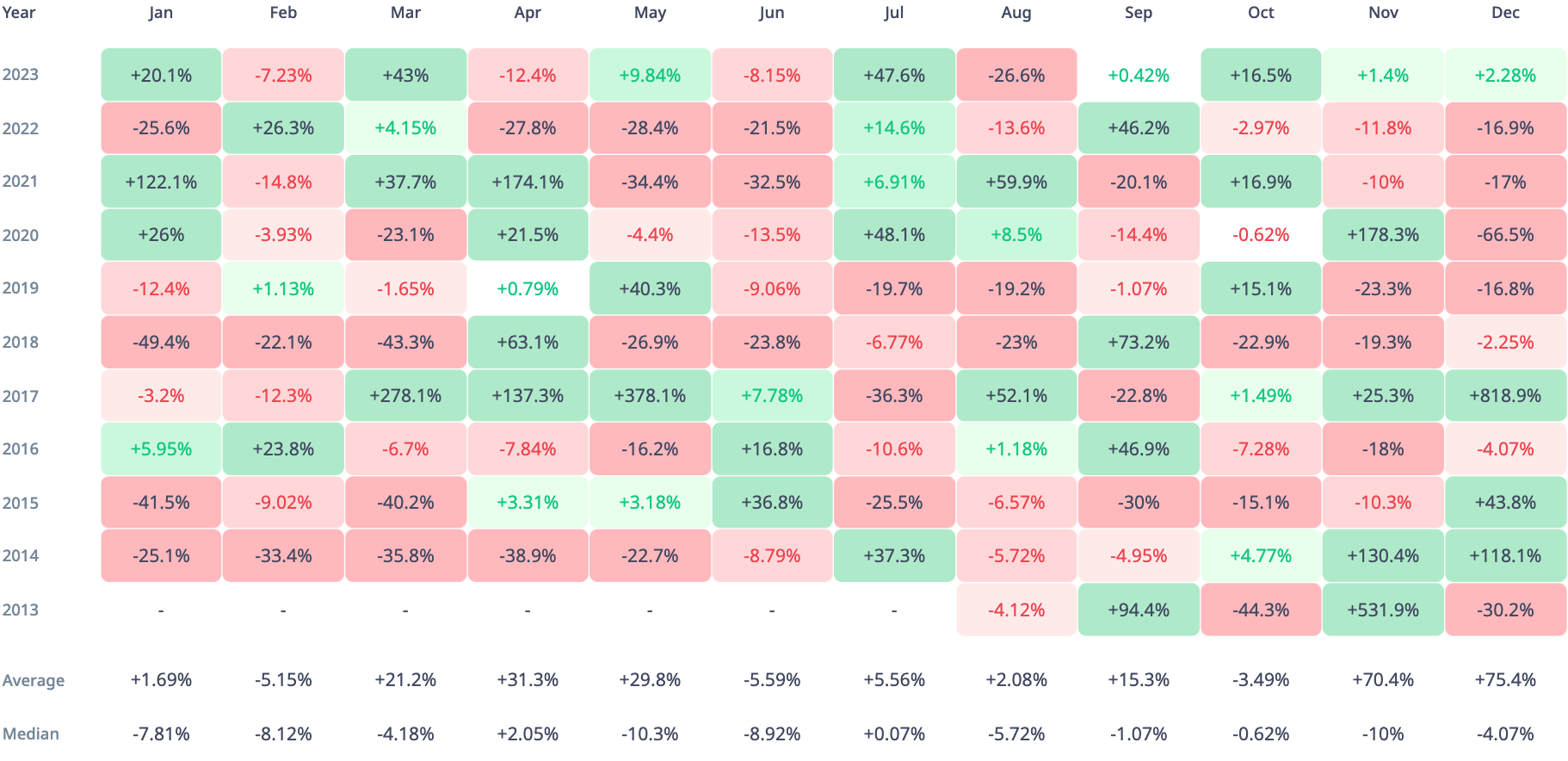

According to CryptoRank‘s price history data, XRP has consistently closed out December with losses since 2018, with the most notable dip occurring in 2020, when the token plummeted by over 66%.

The last instance of XRP finishing the twelfth month on a positive note dates back to 2017, a remarkable period that witnessed an unprecedented 818.9% surge in the token’s value. This staggering gain remains the highest monthly result in XRP’s decade-long history.

December holds particular significance for XRP, as reflected in its average and median returns, which currently stand at a remarkable +75.4% and -4.07%, respectively. This striking contrast underscores the volatile nature of XRP during the final month of the year.

XRP ends Q4, 2023, on high note

The latest figures for December 2023 indicate a modest but noteworthy gain of 1.9%, painting the month in a positive light for the popular token.

Even if the XRP price fails to maintain profitability by the end of December, the broader picture remains optimistic. The final quarter of 2023 has proven to be favorable for XRP, positioning it to conclude the quarter with a commendable 20.4% gain.

This marks the second most profitable quarter for the token this year and a notable deviation from the trend of negative fourth quarters since 2017.