Ethereum price could crumble under rising selling pressure

- Ethereum supply on exchanges increased rapidly in the past three days.

- ETH token inflow to exchange platforms climbed 62% last week.

- Ethereum price could face selling pressure from the rising token reserves, pushing ETH lower.

Ethereum supply on exchanges noted a considerable increase between December 21 and Saturday. As ETH reserves in exchange wallets climb, there is more Ether available to sell, typically increasing the selling pressure on the altcoin.

ETH price could suffer a pullback in response to the selling pressure. At the time of writing, ETH price sustains above $2,200 on Binance.

Also read: Four altcoins most likely to bounce during Christmas holidays: LTC, STORJ, ILV, DYDX

Ethereum tokens flood exchange platforms

Based on on-chain data from Santiment, Ethereum supply on exchanges as a percentage of Ether’s total supply climbed from 8.07% to 8.16%. The increase in ETH tokens on the exchange platform is significant in comparison to the past three months, seen in the chart below. Mounting selling pressure could push ETH price lower.

Ethereum supply on exchanges. Source: Santiment

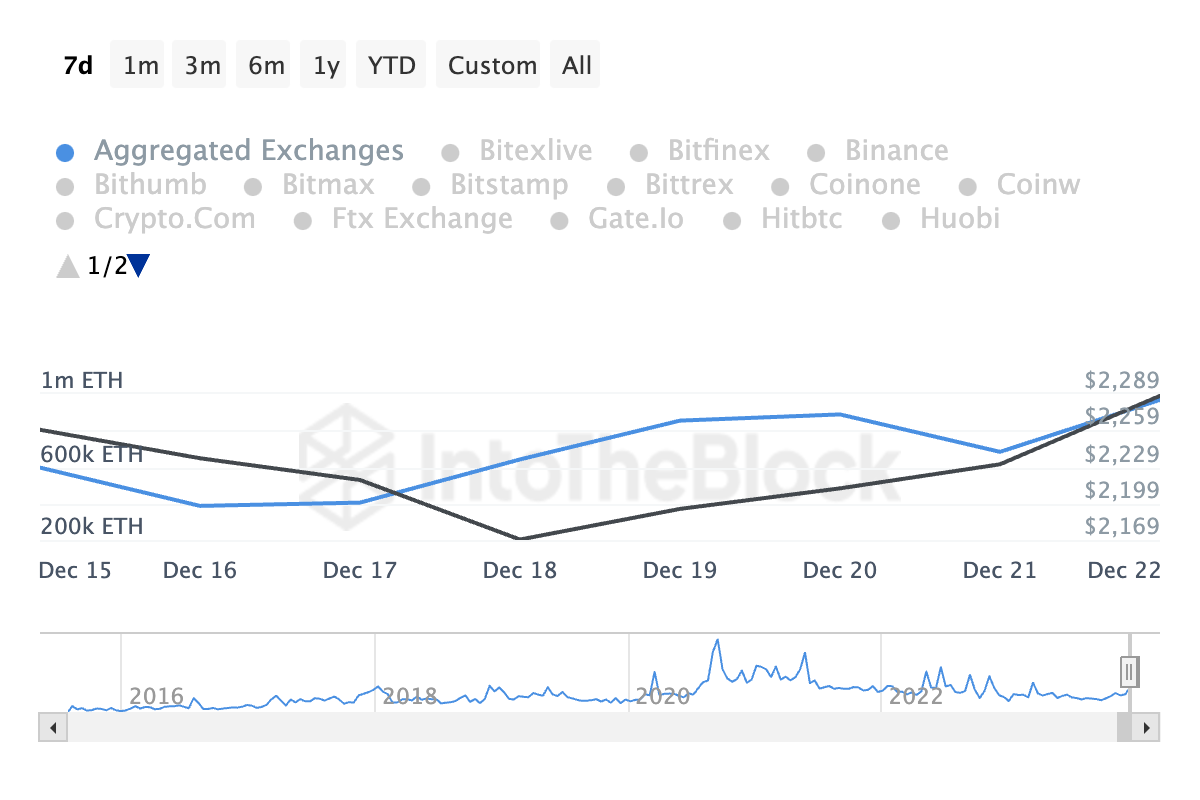

IntoTheBlock data reveals that in the past week, Ethereum inflow to exchanges (aggregated exchanges) climbed 62% in the past week.

Ethereum inflow to exchanges. Source: IntoTheBlock

Network Realized Profit/Loss shows spikes in profit-taking by ETH traders between October 31 and December 23. Large volume of profit-taking could result a pullback in ETH price.

Ethereum Network Realized Profit/Loss. Source: Santiment

Ethereum developers recently set tentative dates for activating the Cancun/Deneb upgrade on public Ethereum test networks.

The schedule for upgrades is as follows:

- Goerli fork on January 17

- Sepolia fork on January 31

- Holesky fork on February 7

The dates are subject to change if any unexpected bugs are discovered by developers. In the recent All Core Developers Consensus (ACDC) call, devs agreed to reconvene to discuss progress in the next meeting on January 4.

%20[16.29.25,%2023%20Dec,%202023]-638389279123274485.png)

%20[16.51.44,%2023%20Dec,%202023]-638389279792813264.png)