Taylor Swift NFTs, Bitcoin all-time high among Bitwise’s 2024 predictions

Bitwise believes crypto is on the cusp of entering its “mainstream era” as we enter 2024 and outlined ten predictions of what’s to come in the year ahead.

Having outperformed major asset classes in 2023 — up over 150% year-to-date compared to 22% for the S&P, 40% for the Nasdaq and 12% for gold — Bitwise analysts expect bitcoin to continue that trend, reaching an all-time high above $80,000 in 2024, according to a report.

The analysts cite two main catalysts for this. Firstly, a wave of new capital following anticipated spot bitcoin ETF approvals on the demand side — potentially capturing 1% of the $7.2 trillion U.S. ETF market, or $72 billion, within five years. Secondly, on the supply side, the Bitcoin  BTC

BTC

+2.52%

halving event (when the block reward gets cut in half) is expected to fall in April. Bitwise said this was equivalent to a $6.2 billion reduction in new bitcoin entering the market each year.

The Securities and Exchange Commission has yet to approve a spot bitcoin ETF in the United States, having previously approved futures-based funds in 2021. The next deadlines for the SEC’s decision to approve, reject or delay applications from firms — including Bitwise, as well as VanEck, BlackRock, WisdomTree, Invesco, Fidelity and Valkyrie — fall in mid-January. Bloomberg analyst James Seyffart recently said the window for potential spot bitcoin ETF approval was looking like it would fall between Jan. 5 and Jan. 10, with a 90% probability of success.

Bitcoin currently trades at $42,409 — up 18% over the past month, according to The Block’s price data.

BTC/USD price chart. Image: The Block/TradingView.

Ethereum revenue to double and average transaction fees to fall below one cent

One criticism of blockchains is that they don’t generate cash flow in the traditional sense. Bitwise says that’s wrong, with Ethereum  ETH

ETH

+3.97%

hosting thousands of crypto applications generating fees.

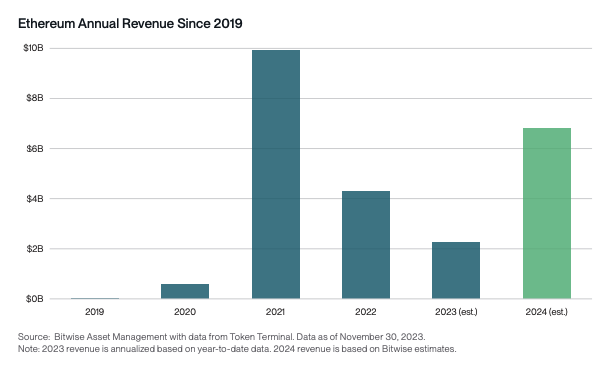

The analysts said Ethereum is on track to generate around $2.3 billion in fees this year and expects that to more than double in 2024 to over $5 billion as crypto apps go mainstream — making Ethereum one of the fastest-growing tech platforms in the world.

Ethereum Annual Revenue Since 2019. Image: Bitwise.

At the same time, Bitwise expects a major upgrade to Ethereum to significantly drive down the average fees paid by users. The analysts said the EIP-4844 upgrade, also known as Proto-Danksharding, could push fees paid on Ethereum’s Layer 2 chains (like Arbitrum, Base and Optimism) below $0.01 from around $0.14 — though fees on Ethereum’s base layer remain substantially higher.

Bitwise said this could open up additional use cases like micropayments, social media and large-scale gaming applications, paving the way for mainstream adoption.

Taylor Swift launching NFTs to connect with fans in new ways

Pop star Taylor Swift, whose Eras Tour recently became the first to gross over $1 billion, may also launch NFTs to connect with fans in new ways in 2024, according to Bitwise — claiming she has a reputation for uniquely engaging with fans and is a “staunch believer in artists owning and monetizing their music.”

The analysts said NFTs could provide a new medium for just that, from offering exclusive access to concerts, experiences and new music to providing fans partial ownership of their songs via royalties. “Major bands and artists, ranging from Snoop Dogg and Eminem to Kings of Leon and The Chainsmokers, have already embraced NFTs in one way or another,” they added.

Bitwise also highlighted Spotify — where Swift is the most streamed artist this year — experimenting with token-gated playlists that require certain NFTs to unlock access as one avenue for the singer.

Last year, Swift was one celebrity influencer who managed to dodge a bullet on partnering with the now-defunct crypto exchange FTX, though later reports suggested she was not the one to have shaken off a deal.

Bitwise’s other predictions for the year ahead

The Bitwise analysts anticipate crypto exchange Coinbase’s revenue to double next year from $2.8 billion to $5.7 billion — more than ten times average Wall Street expectations — as a bull market unfolds, Coinbase expands its products and the company positions itself to be the prime custodian for spot bitcoin ETFs.

The asset manager also expects stablecoins to settle more money than Visa next year, JPMorgan to tokenize a fund and launch it on-chain as Wall Street gears up to tokenize real-world assets, and one in four financial advisors to allocate to crypto in client accounts by the end of 2024.

Additionally, Bitwise sees AI assistants beginning to use crypto to pay for things online as it becomes the “native currency of the internet,” and more than $100 million staked in prediction markets as they become the next “killer apps” in crypto.

Last year, despite correctly predicting the crypto market recovery, Coinbase’s market cap doubling and the amount of staked ether rising over 50%, Bitwise was wrong in expecting USDC to surpass USDT as the world’s largest stablecoin and in predicting the U.S. Congress would pass at least one piece of significant crypto legislation in 2023.

Last week, fellow asset managers VanEck published its predictions for the year ahead. VanEck expects a long-awaited U.S. recession to finally arrive in 2024 but still anticipates spot bitcoin ETF approvals and the halving event to spur bitcoin to all-time highs by Q4.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.