7 Best Altcoins to Invest in Right Now December 13 – Injective, Render, OKB

Join Our Telegram channel to stay up to date on breaking news coverage

The global market cap stands at $1.55 trillion, indicating a 1.98% decrease in value over the past day. Over the same period, the total trading volume in the market recorded a notable decline of 14.67%, totaling $68 billion. Stablecoins have sustained a significant presence, with a combined volume of $61.03 billion, constituting 89.76% of the entire market’s 24-hour trading volume.

7 Best Altcoins to Invest in Right Now

KuCoin recently reached a settlement outlined in court documents filed in the State of New York County Supreme Court. According to these documents, KuCoin agreed to pay $22 million and discontinue access for users residing in New York state.

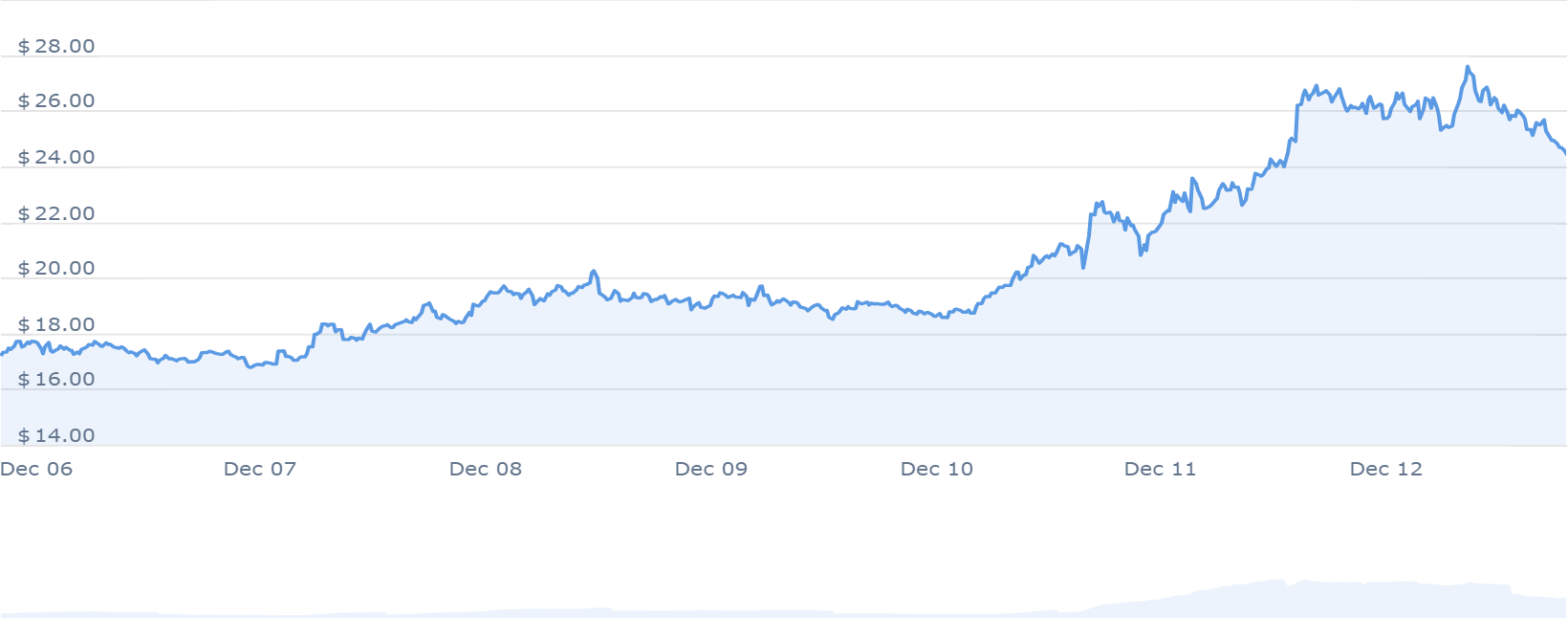

1. Injective (INJ)

Injective’s price has skyrocketed by 1,350%, making it a top-performing altcoin. It’s in the top 3% of cryptos, even outpacing big names like Bitcoin and Ethereum. Plus, it’s consistently traded above its 200-day moving average, indicating ongoing solid growth.

Over the last month, 15 days saw a 50% price surge, marking substantial growth from its initial sale price. Moreover, INJ boasts high liquidity based on its market cap.

Over $1 Billion worth of $INJ is now staked on chain.

That’s it. That’s the tweet.

— Injective 🥷 (@Injective_) December 12, 2023

Furthermore, market sentiment regarding INJ remains bullish, with a Fear & Greed Index score of 65 (Greed). Currently, about 83.76 million INJ are in circulation out of a total of 100 million INJ. In the past year, roughly 10.75 million new INJ were created due to a 14.72% yearly supply inflation rate.

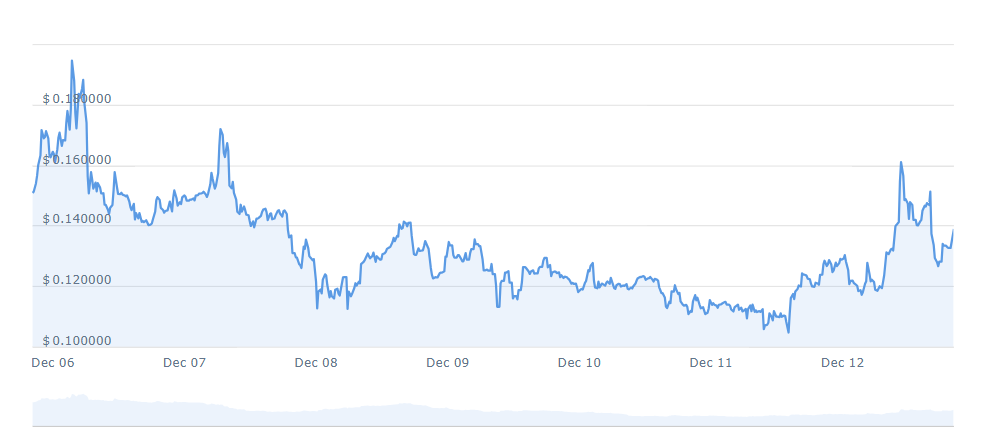

2. Beam (BEAM)

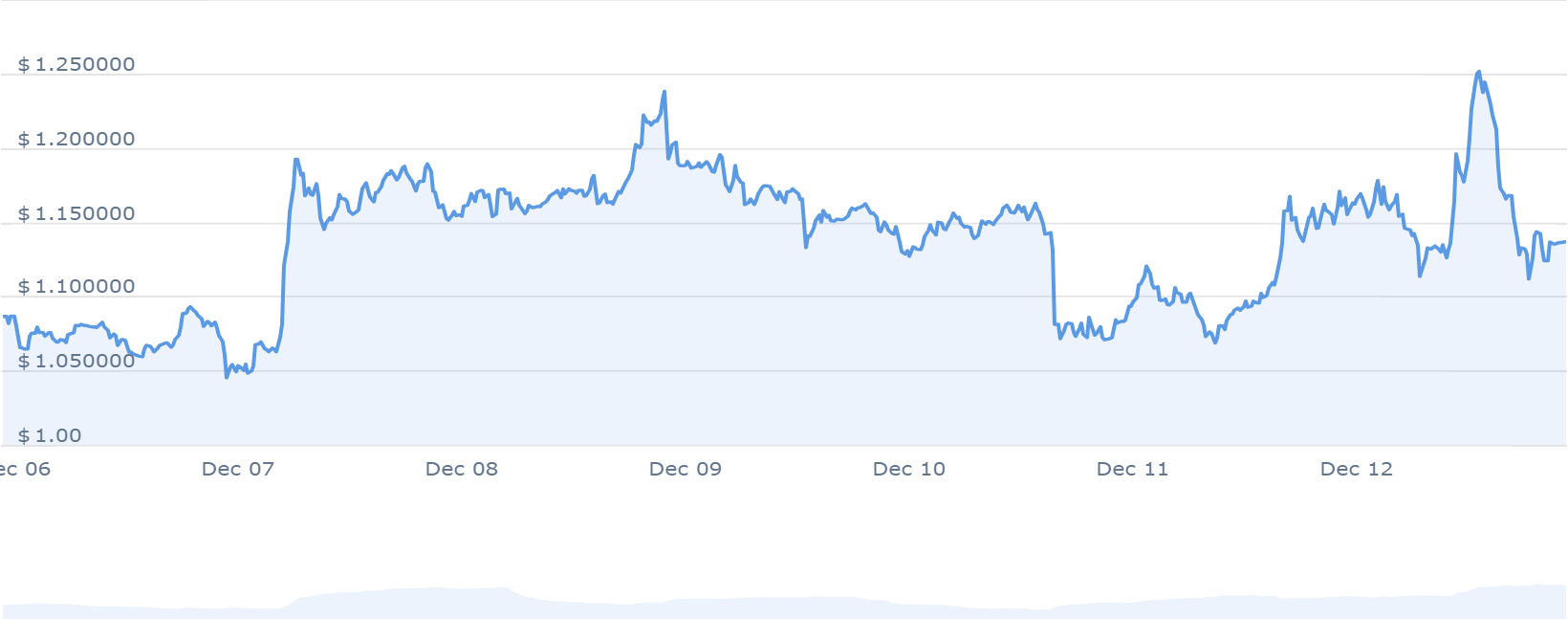

BEAM is showing some trends that are catching the market’s attention. It’s trading higher than its average price over the past 200 days, suggesting a potential uptrend. Also, it’s got a solid market presence due to its high liquidity and big market cap.

In the last year, BEAM’s price went up by 10%. And in the last day alone, it jumped by 7.53%. This growth makes BEAM one of the best altcoins to invest in. Moreover, predictions say the price might keep rising, and the Fear & Greed Index supports this with a score of 65 (Greed).

Interested to learn more about our recent partnership with @Immutable and @0xPolygon?@CoinDesk has you covered! 🗞️ https://t.co/ZHIk5D3Sif

— Merit Circle (@MeritCircle_IO) December 11, 2023

Understanding its supply dynamics, BEAM currently has a circulating supply of 148.15 million out of a maximum supply of 262.80 million BEAM. The yearly supply inflation rate is 15.74%, creating 20.15 million BEAM in the past year.

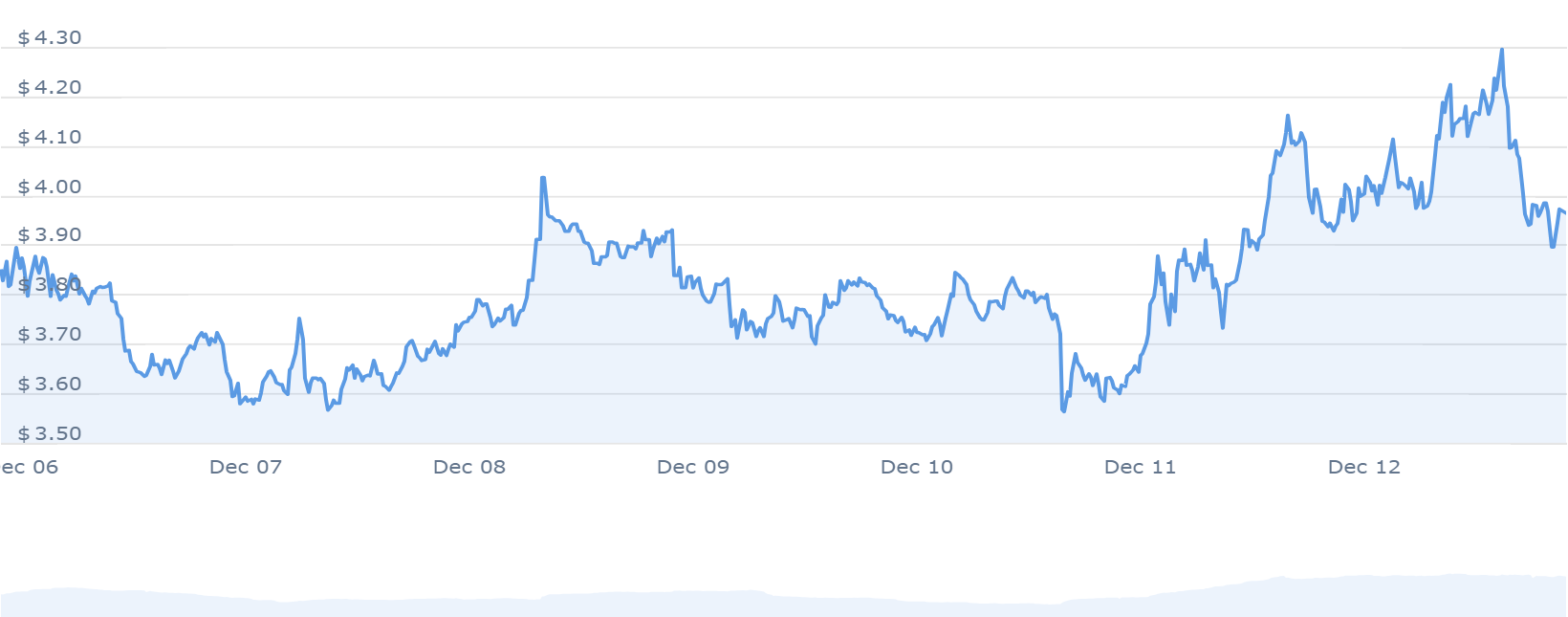

3. Render (RNDR)

Over the past year, Render has surged by an impressive 701%, topping 96% of the top 100 crypto assets. It’s consistent trading above the 200-day moving average and 18 positive trading days in the last 30 (60%) indicate a strong upward momentum. Market sentiment remains bullish, aligning with a Fear & Greed Index at 65 (Greed).

Regarding its supply, 369.61M RNDR is circulating out of a maximum supply of 536.87M RNDR. With a yearly supply inflation rate of 45.63%, 115.82M RNDR was created last year. Ranking-wise, Render Token holds 13th place in the Ethereum (ERC20) tokens sector and stands at #3 in the AI crypto sector based on market cap.

[1/4] Here’s an update for @rendernetwork community members who upgraded from RNDR ERC-20 to RENDER SPL tokens during the ongoing three month gas fee refund window. ⬇️

— The Render Network (@rendernetwork) December 12, 2023

Furthermore, Render has shown substantial growth, robust liquidity, and prevailing bullish sentiment. Its performance has cemented its position among notable players in the Ethereum Tokens and AI Crypto sectors.

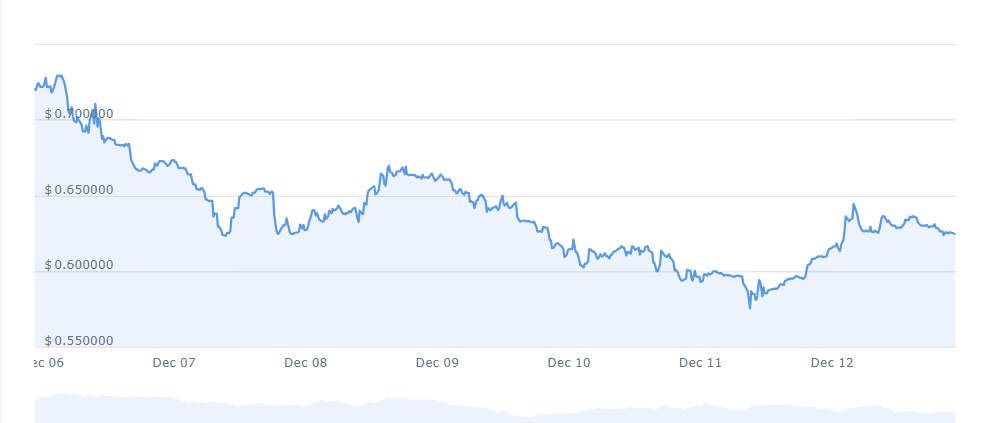

4. Centrifuge (CFG)

Centrifuge (CFG) has witnessed substantial price shifts over the past year. Its current value is $0.625009, reflecting a 217% increase from its valuation a year ago. This surge in price performance has positioned Centrifuge as a standout among the top 100 cryptocurrencies, outpacing 87% of these assets.

From a technical standpoint, Centrifuge’s market position appears robust, trading above the 200-day simple moving average. The current market capitalization is $225.17 million, with a 24-hour trading volume of $946,211, signifying consistent investor interest.

Despite fluctuations, the project’s current circulating supply is at 360.26 million CFG out of a maximum supply of 430.01 million CFG. Centrifuge’s yearly supply inflation rate is 3.94%, creating 13.65 million CFG over the past year.

Congrats @BoysClubWorld — our media partner at the Real-World Asset Summit — on the release of their latest zine!

In the thread below: read their interview with @cassidydaly on all things Centrifuge. Plus: all the recordings from their podcast popup at the Summit 🎙 ⚡️ pic.twitter.com/06NcJ6AgWO

— Centrifuge (@centrifuge) December 8, 2023

Based on sentiment indicators, the current Centrifuge price prediction sentiment remains neutral. Moreover, the Fear & Greed Index registers at 65, indicating a phase of greed within the market.

5. Meme Kombat

Meme Kombat, a recently emerging cryptocurrency, has experienced a substantial surge in its market value today. This sudden rise had a noticeable impact on the wider cryptocurrency market. This has positioned MK as one of the promising alternative coins for potential investment. The project has raised $2,931,473 out of its targeted goal of $3,500,000, garnering initial interest within the community.

Just sliding past $2.8 million💪

Good start to the week! pic.twitter.com/1OJfgQzWxr

— Meme Kombat (@Meme_Kombat) December 11, 2023

One key distinguishing factor of Meme Kombat is its emphasis on delivering an innovative gaming platform designed for enthusiasts. The project focuses on staking and betting as primary means of user engagement, offering opportunities to earn rewards.

Half of the MK token supply was available at $1.667 per token during its presale phase, with a specified hard cap set at $10 million. Moreover, the project has articulated its commitment to enabling decentralized MK token trading in its whitepaper, positioning this move as a crucial part of its future roadmap.

6. Arbitrum (ARB)

Arbitrum has consistently traded above its 200-day simple moving average, indicating a sustained upward movement in its price. It also boasts high liquidity, reflected in its market cap.

Examining its price history, Arbitrum reached its peak value on March 23, 2023, trading at an all-time high of $8.67. Conversely, its lowest recorded price occurred on September 11, 2023, hitting an all-time low of $0.741867.

GM Arbinauts! 💙

#ArbitrumDAODay is happening on Thursday from 10:00am – 4:00pm EST!

We have an exciting line of panels with DAO members leading discussions like navigating DAO as a newcomer, grants, learnings from OGs, and DAO incentives.

Register 👇… pic.twitter.com/zWD1w5Yrw7

— Arbitrum (💙,🧡) (@arbitrum) December 13, 2023

As for the current market sentiment, the prediction for Arbitrum’s price stands neutral, without a clear bias towards a bullish or bearish trend. The Fear & Greed Index, reflecting market sentiment, currently sits at 65, indicating a level of greed among investors.

7. OKB (OKB)

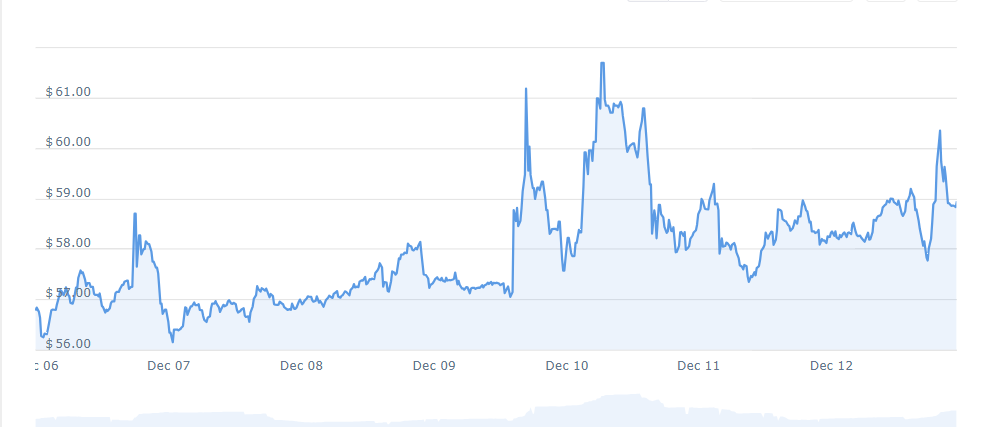

OKB has shown significant price movement over the past year. With a staggering 175% increase in price within the last 12 months, OKB has outperformed 82% of the top 100 crypto assets during this period. This price surge has led OKB to trade above its 200-day simple moving average, indicating sustained upward momentum.

Despite this remarkable performance, OKB is trading close to its cycle high, having experienced 15 positive trading days out of the last 30, accounting for a 50% increase. Notably, the yearly inflation rate for OKB stands at a negative -78.79%. This indicates a reduction in the circulating supply by 222.84 million OKB in the past year.

Regarding its market position, OKB currently holds the third position in the Exchange Tokens sector based on market cap. The sentiment surrounding OKB’s price prediction leans towards a bullish outlook. This sentiment is complemented by a Fear & Greed Index reading of 65, indicating investor greed in the market.

Read More

New Crypto Mining Platform – Bitcoin Minetrix

- Audited By Coinsult

- Decentralized, Secure Cloud Mining

- Earn Free Bitcoin Daily

- Native Token On Presale Now – BTCMTX

- Staking Rewards – Over 100% APY

Join Our Telegram channel to stay up to date on breaking news coverage