Ethereum leads altcoins north as Bitcoin halts amid bull trap fears

- Ethereum price is on a tear, up almost 5% in the last 24 hours while Bitcoin price drops 2%.

- Altcoins, however, are rallying alongside ETH amid capital inflow into the sector against FUD-infused BTC.

- Santiment says while traders fear crypto markets may be in a bull trap, FUD could drive BTC to $50,000.

Ethereum (ETH) price remains northbound, unrelenting despite the king of cryptocurrency, Bitcoin, showing weakness. Behavior analytics tool Santiment observes that Ether and altcoins are on a tear even as BTC momentum fades.

Also Read: Ethereum Price Prediction: ETH attempts to flip $2,300 into support

Ethereum and altcoins blast off

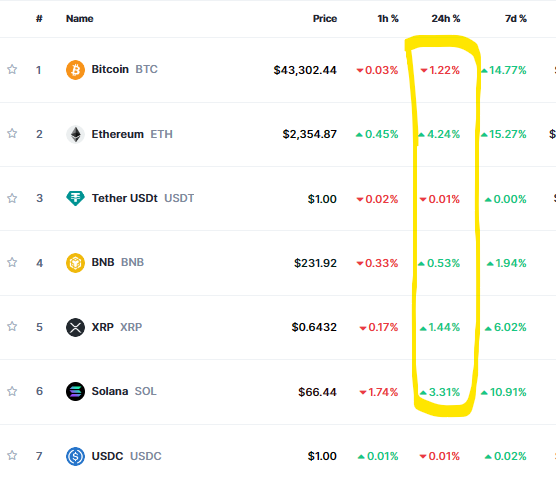

Ethereum (ETH) price is up almost 5%, with the daily price updates flashing green alongside its peers in the altcoin category against Bitcoin (BTC) price, which is showing red.

BTC versus ETH and altcoins

According to Santiment, the capital is flowing away from Bitcoin and into Ethereum and altcoins amid fears that “the market may be in a bull trap at the moment.”

For the layperson, a bull trap in crypto trading refers to a false signal indicating a market in a temporary uptrend is going to continue upward. However, the trend quickly reverses, leading to a decline. Oftentimes, this decline leads to lower prices compared to when the bull trap commenced.

Nevertheless, the on-chain behavior analytics tool acknowledges that if the fear, uncertainty and doubt (FUD) continues, it could in fact be the driving force for Bitcoin price hitting the desirable $50,000 psychological level.

It is the same FUD, however, that has the likes of Senator Elizabeth Warren saying, “there is a new threat out there, it is crypto and we cannot allow that to continue.”

Similarly, JPMorgan CEO Jamie Dimon recently said, “I have always been deeply opposed to crypto and Bitcoin [in particular],” adding, “If I were the government I would close it down.”

The assertions by the two renowned personalities only serve to inspire more enthusiasm among crypto proponents.

It should be noted that in the absence of a spot Bitcoin exchange-traded fund (ETF) approval just yet, and the fact that the BTC halving event is months away, there is no driving force in the market as of now, save for speculation.

This speculation has metamorphosed into FOMO, the fear of missing out, as investors continue to front run the approvals. With this perspective, Bitcoin price is bullish on a big-picture perspective, with the capital overflows benefiting altcoins.

To put this in perspective, apart from BTC and Ethereum, the total market capitalization of other altcoins is likely to breach through an 19-month-long downtrend that prompted a decline in market capitalization since May 2022.

Total altcoins market capitalization, excluding Ethereum

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.