What Coinbase Trading Volume Jump Means for COIN Stock

Coinbase trading volume surged month-on-month following Binance’s recent regulatory issues. The increasing trading volume also coincided with a notable rise in COIN’s stock price.

In November, Binance and former CEO Changpeng Zhao pled guilty to multiple financial law violations and agreed to a $4.3 million settlement with the US authorities, including the Commodity Futures Trading Commission.

Coinbase Emerges as the Winner

Following the resolution of the Binance case, Coinbase, one of its rivals, emerged as one of the biggest winners. The Brian Armstrong-led exchange’s trading volume increased by around 62% month-on-month to $50.4 billion from the $31.16 billion recorded in October.

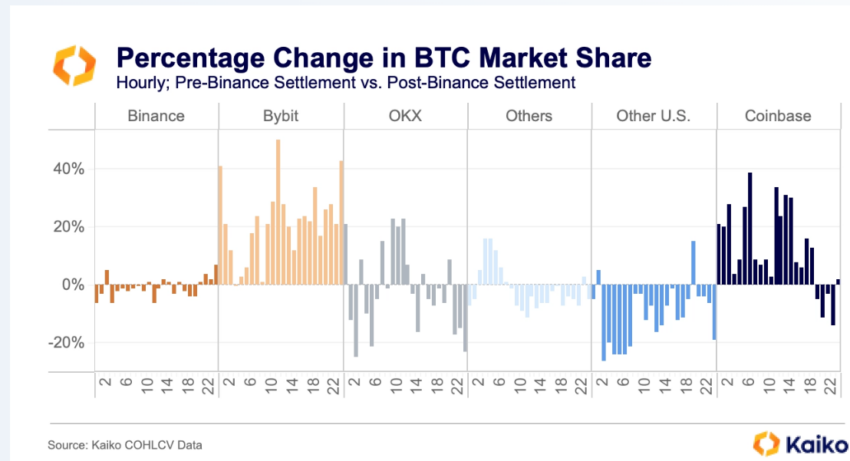

Prominent blockchain analytical firm Kaiko corroborated the surging volume in a recent report. It stated that Coinbase and Bybit have emerged as the main beneficiaries of the issues with Binance.

According to Kaiko, Binance has ceded some market share to Coinbase in non-US hours and Bybit across the board.

“Coinbase’s share grew the most outside of U.S. trading hours (14-22 UTC), instead surging in the middle of the trading day in Europe and the beginning of the trading day in eastern Asia,” analysts at Kaiko said.

Observers have suggested that this trend would likely continue as Coinbase’s compliance-first approach has won its adoption from several applicants for a spot Bitcoin ETF (exchange-traded fund). Coinbase is named the surveillance partner for many asset managers, including BlackRock, per filings with the US Securities and Exchange Commission (SEC).

COIN Stock Rallies Past $130

Amid these developments, Coinbase’s COIN stock rallied by approximately 73% over the past month. The stock’s value surged from roughly $80 at the beginning of November to around $137 as of the market closing on December 1.

The rally continues a year-long trend of COIN’s price performance outperforming flagship assets, Bitcoin and Ethereum. The stock’s value has increased by over 100% in the last six months and by 260% year-to-date.

Read more: Coinbase Review 2023: The Best Crypto Exchange for Beginners?

It is worth noting that COIN shares remain approximately 60% below the all-time high of $343.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.