Ethereum price retreats amidst strategic whale moves

- Two Ethereum whales sold off over 28,000 tokens.

- ETH trades around $1,900 as the bull trend weakens further.

The price of Ethereum [ETH] has been undergoing a reversal over the last few days. Nevertheless, recent observations of whale activities suggest that these large wallets may be exploiting the current price range.

Ethereum on the move

As reported by LookonChain, an Ethereum whale sold off a substantial volume of ETH on 17th November, selling over 10,000 ETH.

The total value of this transaction amounted to $19.33 million, at $1,933 per token. Further analysis of the whale’s activity revealed this was not an isolated occurrence.

Previous reports indicated the sale of over 6,000 tokens, resulting in a $12 million transaction, took place some days ago. These actions have created an impression that the whale is selling off its holdings.

Additionally, another whale, initially holding a long position on ETH, has recently sold off its ETH holdings.

This particular whale acquired 12,048 ETH in October for $21.3 million, entering into long positions on Aave and Compound.

At the time of writing, the whale had sold its ETH for $23.4 million, using the proceeds to settle its debt. Is this a strategic profit-taking move, a market dump, or a combination?

Impact on the Ethereum netflow?

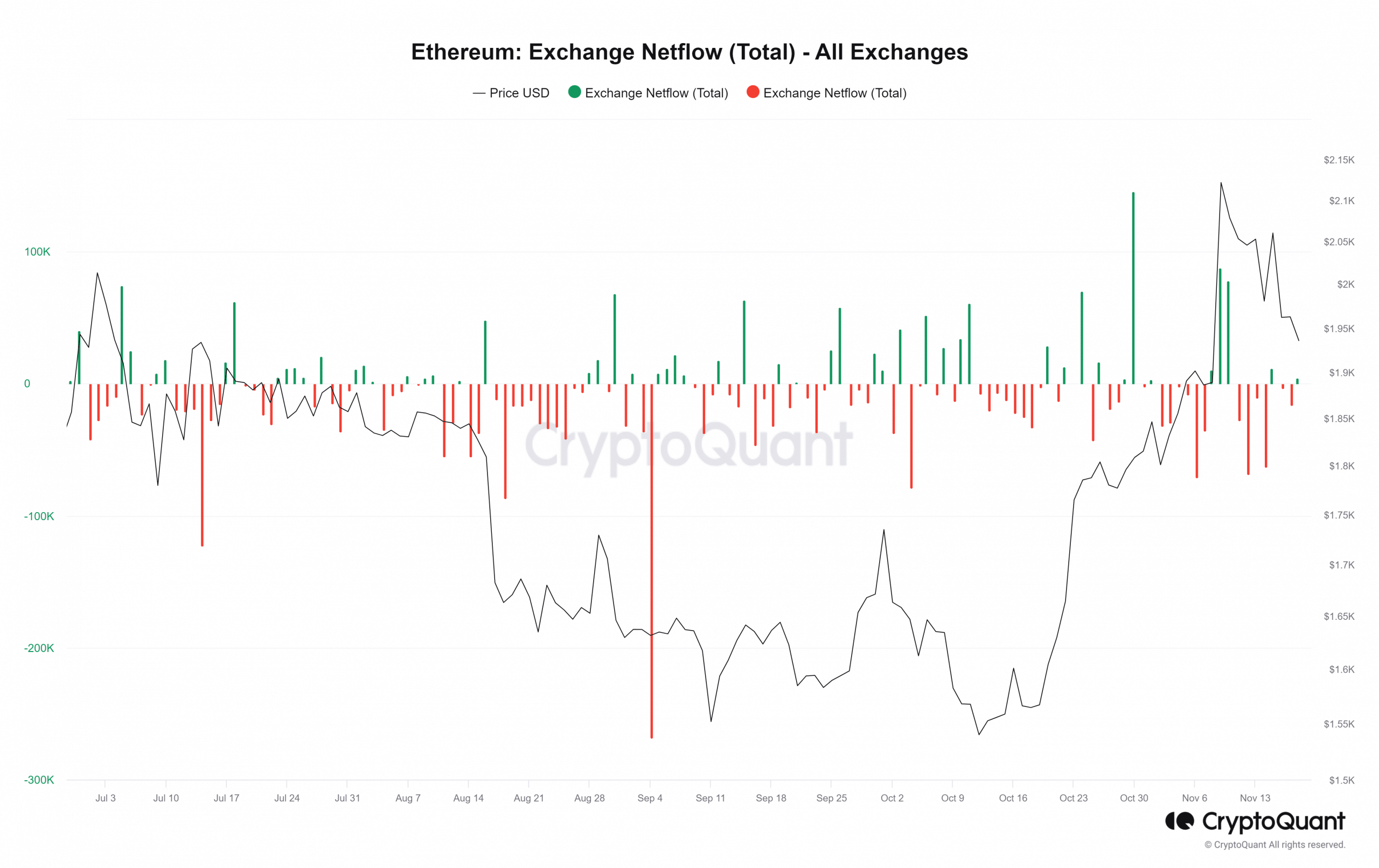

AMBCrypto’s examination of Ethereum movements across various exchanges revealed an interesting trend.

Despite the moves from these whales, as mentioned earlier, there was a net outflow of ETH on 17th November. The netflow chart, as analyzed on CryptoQuant, showed that over 16,000 ETH left the exchanges, indicating a negative netflow during that period.

However, as of this writing, there was a reversal in the netflow, with over 10,000 ETH flowing into exchanges.

This shift suggests that there is now an increase in the amount of ETH being deposited into exchanges, potentially for selling.

Whales tapping into profit

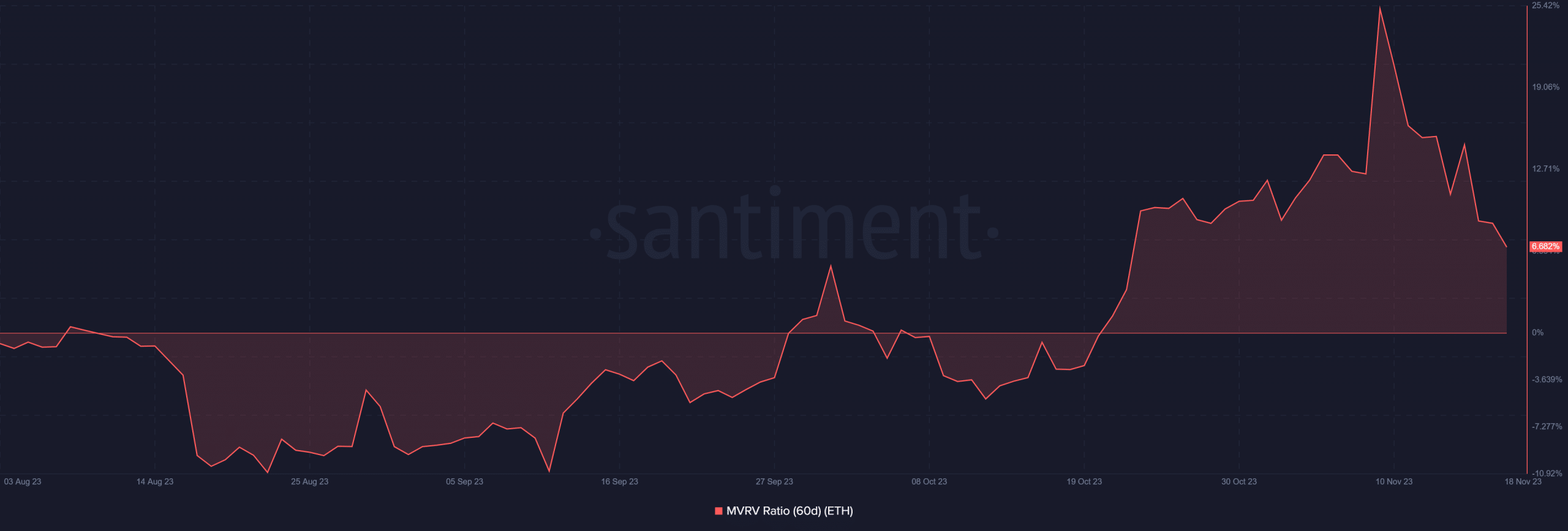

AMBCrypto analyzed the 60-day Market Value to Realized Value Ratio (MVRV) of Ethereum.

The analysis revealed potential motivations behind the observed market movements from the whales.

An initial examination of the Santiment chart indicated a rapid decline in MVRV attributed to the changing price trends. Around 9th November, the 60-day MVRV stood at over 25%.

However, as of this writing, the MVRV had decreased significantly to around 7%.

This shift in MVRV suggests that the profit derived from the sales of ETH has experienced a substantial reduction, dropping from over 25% to the current 7%.

Read Ethereum (ETH) Price Prediction 2023-24

ETH weakening bull run

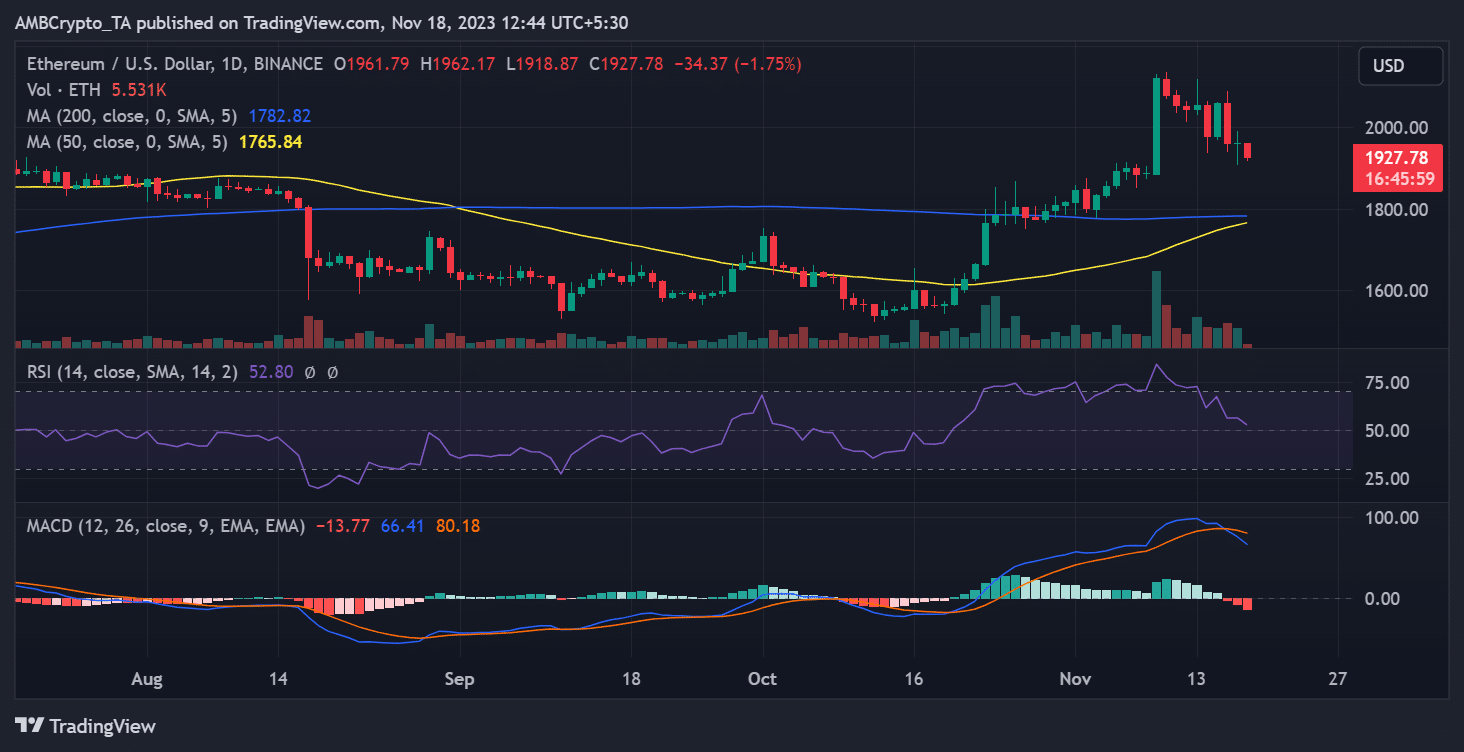

A review of the daily timeframe chart indicated that Ethereum continued to trend downward. At the time of this analysis, it reflected a 1.7% decrease in value, trading at around $1,920. This decline is underscored by the movement of its Relative Strength Index (RSI) line.

The RSI was situated in the overbought zone in the previous period, signifying a strong bull run. However, the current trend shows the RSI approaching the point of crossing below the neutral line, suggesting a weakening of the initial bull run.